|

市场调查报告书

商品编码

1441654

滑石:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Talc - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

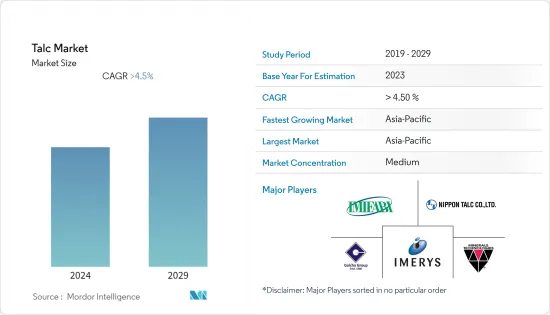

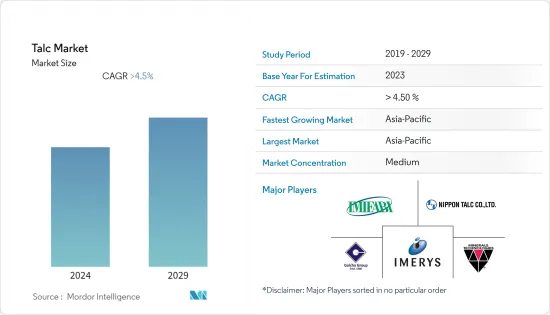

预计2024年滑石市场规模为766万吨,预计2029年将达到1,009万吨,在预测期间(2024-2029年)复合年增长率为4.5%。

过去几年,COVID-19 大流行影响了全球市场,迫使陶瓷製造商、纸浆和造纸製造商以及涂料製造商暂停经营,从而减少了 2022 年对滑石粉的需求。预计这将在预测期下半年恢復受调查市场的成长轨迹。

主要亮点

- 短期内,工业和船舶涂料需求的增加正在推动对滑石粉的需求,因为滑石粉具有防腐蚀、减少溶剂使用和良好附着力等优点。

- 另一方面,与滑石粉化妆品相关的健康问题预计将阻碍市场成长。

- 航太对热塑性塑胶的需求不断增长可能代表着未来的机会。

- 由于中国塑胶市场的崛起以及印度等国家白色滑石蕴藏量的存在,亚太地区主导了全球滑石市场。

滑石粉市场趋势

塑胶和橡胶产业主导市场

- 滑石粉为聚丙烯提供了多种好处,包括增加刚性和尺寸稳定性。

- 它主要用作塑胶中的填料,并在製造过程中充当吸收剂和抗结块剂。滑石颗粒的片状形状增加了聚乙烯、聚丙烯、尼龙、乙烯基和聚酯等产品的硬度。它还可以提高耐热性并减少收缩。

- 滑石粉是化学品、塑胶和橡胶等各行业中最常用的添加剂、改质剂或填充物。可显着提高塑胶製品的拉伸强度、衝击性能、耐热性、抗蠕变性、抗撕裂性等。

- 根据欧洲塑胶协会统计,欧洲约三分之二的塑胶需求集中在五个国家,其中德国25.4%、义大利14.3%、法国9.7%、英国7.6%和西班牙7.5%。

- 在欧洲塑胶市场运营的领先公司正在倾向于策略性业务发展,以扩大其地理影响力。例如,2022年6月,林德工程被MOL集团成员公司Slovnaft选中,维修斯洛伐克一家聚丙烯工厂。这使得该工厂的聚丙烯年产能增加了 18%,达到约 300 吨,并将储存设施从 45 个筒仓扩大到 61 个。

- 2022年12月,埃克森美孚公司在路易斯安那州首府巴吞鲁日运作了一家新的聚丙烯製造工厂。该厂每年可生产45万吨聚丙烯。此外,我们正在美国Point Comfort 建造一座新的聚丙烯製造工厂。 2024 年完工后,该厂将生产 10 万吨 α 烯烃,用于生产高密度聚苯乙烯(HDPE)。该公司将使用63,000吨α-烯烃,其余37,000吨将销往国际。

- 由于电子商务行业对包装的需求,印尼塑胶的使用量正在增加。丰益集团、Mayora 和 Indofood 等日常消费品公司正在印尼建立综合包装生产工厂。埃克森美孚也投资印尼的塑胶产业。该公司于2022年11月与PT Indomobile Prima Energi(IPE)签署谅解备忘录,在印尼大规模应用先进塑胶回收再利用技术。

- 因此,业内各公司所进行的此类扩张计划可能会推动预测期内的市场成长。

亚太地区主导市场

- 由于中国、印度和日本等国家的需求不断增长,亚太地区主导了全球市场占有率。

- 中国是亚太地区滑石粉的主要消费国之一。滑石粉在该国广泛用于各个行业,包括陶瓷、食品和饮料、纸浆和造纸。工业信部资料显示,2023年第一季全国饮料产量与前一年同期比较增6%,达4,435万吨。

- 中国也是世界陶瓷生产和消费大国。该公司是全球最大的瓷砖生产商之一,迄今已生产了约84.7亿平方公尺的瓷砖。国内和出口市场的激烈竞争迫使陶瓷生产商改进其生产流程和该地区的产品品质。

- 印度是少数拥有白色滑石蕴藏量的国家之一。滑石矿床遍布全国各地。生产的大部分白色滑石粉在国内消费。

- 在印度,滑石粉的大部分商业生产发生在拉贾斯坦邦。该国两家领先的滑石生产公司(Golcha Group 和 Golcha Associated)总部位于拉贾斯坦邦斋浦尔,为餐饮化妆品和聚合物产业生产优质滑石。

- 印度的塑胶工业市场是该国最重要的经济部门之一。印度品牌股权基金会的数据显示,2022 年 4 月至 9 月塑胶出口总额为 63.8 亿美元。

- 此外,中国拥有庞大的塑胶市场,需要大量滑石粉才能发挥作用。在我国,滑石粉分布于15个省份,特别是辽宁、山东、广西、江西、青海,占总蕴藏量的90%以上。

- 所有这些因素预计将在预测期内推动该地区对滑石粉的需求。

滑石粉行业概况

滑石市场本质上是适度整合的,有几家公司在全球和区域层面运作。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 塑胶需求增加

- 对工业和船舶涂料的需求增加

- 抑制因素

- 化妆品的健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 沉积

- 绿土石

- 碳酸盐

- 最终用户产业

- 陶瓷製品

- 食品与饮品

- 油漆/涂料

- 个人护理

- 塑胶/橡胶

- 纸浆/纸

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)/排名分析

- 主要企业采取的策略

- 公司简介

- AKJ MinChem

- ANAND TALC

- Chanda Minerals

- ELEMENTIS PLC

- Eurominerals Gmbh

- Golcha Group

- Imerys

- IMI Fabi SpA

- LITHOS Industrial Minerals GmbH

- Magris Performance Materials

- Minerals Technologies Inc.

- Nippon Talc Co. Ltd

第七章市场机会与未来趋势

The Talc Market size is estimated at 7.66 Million tons in 2024, and is expected to reach 10.09 Million tons by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

The COVID-19 pandemic affected the market in the past years on a global scale and forced ceramic makers, pulp and paper manufacturers, and paints and coatings manufacturers to shut down their operations, lowering the demand for talc in 2022. However, the condition is expected to recover, which will restore the growth trajectory of the market studied during the latter half of the forecast period.

Key Highlights

- Over the short term, increasing demand for industrial and marine coatings is driving the demand for talc, as it provides benefits such as corrosion protection, solvent reduction, and good adhesion.

- On the flip side, health issues pertaining to talc-based cosmetic products are expected to hamper the market's growth.

- The growing demand for thermoplastics in the aerospace industry is likely to act as an opportunity in the future.

- Asia-Pacific dominated the talc market globally, owing to the rising plastics market in China and the presence of white talc reserves in countries like India.

Talc Market Trends

Plastic and Rubber Industry to Dominate the Market

- Talc imparts a variety of benefits to polypropylene, such as higher stiffness and improved dimensional stability.

- It is mainly used as a filler in plastics and acts as an absorbent and anti-caking agent during production. The plate shape of talc particles increases the hardness of products such as polyethylene, polypropylene, nylon, vinyl, and polyester. It also increases heat resistance and reduces shrinkage.

- Talc is the most commonly used additive, modifier, or filler in a variety of industries, including chemicals, plastics, and rubber. It can significantly improve the tensile strength of plastic products, impact properties, heat resistance, creep resistance, tear resistance, etc.

- According to Plastics Europe, about two-thirds of Europe's plastics demand is concentrated in five countries, including 25.4% in Germany, 14.3% in Italy, 9.7% in France, 7.6% in the United Kingdom, and 7.5% in Spain, according to Plastics Europe.

- The major companies operating in the European plastic market are more inclined towards strategic business development to expand their geographical presence. For instance, in June 2022, Linde Engineering was selected by Slovnaft - a member company of MOL Group, to conduct a revamp of a polypropylene plant in Slovakia. This revamped the plant capacity of polypropylene per year by 18% to around 300 kilotons, and the storage facility expanded from 45 to 61 silos.

- In December 2022, Exxon Mobil Corporation started a new manufacturing facility for polypropylene in Baton Rouge, the capital of Louisiana. This plant can produce 450,000 MT/year of polypropylene. Further, Formosa Plastics Corporation, in the United States, is constructing a new manufacturing facility for polypropylene in Point Comfort, Texas in the United States. Upon completion in 2024, this plant will produce 100,000 tonnes of Alpha olefins to manufacture high-density polyethylene (HDPE). 63,000 tonnes of Alpha olefins would be used by the company while the remaining 37,000 tonnes would be sold internationally.

- The usage of plastic in Indonesia is increasing since the e-commerce industry requires packaging. FMCG companies, including Wilmar Group, Mayora, and Indofood, have established integrated packaging production units in Indonesia. Exxon Mobil is also investing in the Indonesian plastic industry. It signed a memorandum of understanding with PT Indomobil Prima Energi (IPE), in November 2022, regarding the application of advanced plastic recycling technology on a large scale in Indonesia.

- Hence, such expansion projects carried out by various companies in the industry are likely to drive the market growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share with the growing demand from the countries such as China, India, and Japan.

- China is one of the major consumers of talc in the Asia-Pacific region. The country uses talc in a wide range of industries, such as ceramics, food and beverage, pulp and paper, and others. According to the data from the Ministry of Industry and Information Technology, the country witnessed increase in its beverage production by 6 percent year-on-year, reaching 44.35 million tons during Q1 2023.

- Also, China is the leading producer and consumer of ceramics worldwide. It is one of the largest producers of ceramic tiles in the world and has produced around 8.47 billion square meters of ceramic tiles. The fierce competition in the domestic and export markets forces ceramic producers to improve their production process and product quality in the region.

- India is one of the few countries with white talc reserves. The deposits of talc are found throughout the country. Most of the white talc produced is consumed in the country itself.

- In India, most of the commercial production of talc comes from Rajasthan. The two leading talc producers in the country (Golcha Group and Golcha Associated) are based in Jaipur, Rajasthan, catering cosmetics and polymer industry with talc of superior grades.

- The Indian plastic industry market is one of the country's most important economic sectors. According to the India Brand Equity Foundation, the total value of plastics exported between April and September 2022 was USD 6.38 billion.

- Furthermore, China has a huge plastics market that requires a high supply of talc to function. In China, talc is found in 15 provinces, with Liaoning, Shandong, Guangxi, Jiangxi, and Qinghai as the prominent areas that account for more than 90% of the total reserves.

- All these factors, in turn, are expected to drive the demand for talc in the region during the forecast period.

Talc Industry Overview

The talc market is moderately consolidated in nature, with several companies operating on both global and regional levels. Some of the major players in the market (not in any particular order) include ELEMENTIS PLC, Imerys, IMI Fabi SpA, Nippon Talc Co. Ltd, and Minerals Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Plastics

- 4.1.2 Increasing Demand for Industrial and Marine Coatings

- 4.2 Restraints

- 4.2.1 Health Issues in Cosmetic Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Deposit

- 5.1.1 Talc Chlorite

- 5.1.2 Talc Carbonate

- 5.2 End-user Industry

- 5.2.1 Ceramic

- 5.2.2 Food and Beverage

- 5.2.3 Paints and Coatings

- 5.2.4 Personal Care

- 5.2.5 Plastics and Rubber

- 5.2.6 Pulp and Paper

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AKJ MinChem

- 6.4.2 ANAND TALC

- 6.4.3 Chanda Minerals

- 6.4.4 ELEMENTIS PLC

- 6.4.5 Eurominerals Gmbh

- 6.4.6 Golcha Group

- 6.4.7 Imerys

- 6.4.8 IMI Fabi SpA

- 6.4.9 LITHOS Industrial Minerals GmbH

- 6.4.10 Magris Performance Materials

- 6.4.11 Minerals Technologies Inc.

- 6.4.12 Nippon Talc Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Thermoplastics in the Aerospace Industry