|

市场调查报告书

商品编码

1443910

润滑脂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Grease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

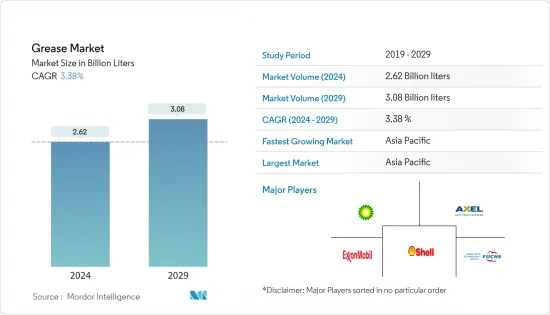

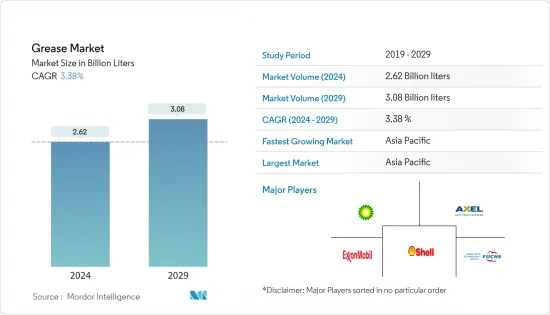

润滑脂市场规模预计到2024年为26.2亿公升,预计到2029年将达到30.8亿公升,在预测期内(2024-2029年)复合年增长率为3.38%。

主要亮点

- 汽车、工业加工(主要是钢厂)、航太以及食品和饮料等消耗油脂的主要行业受到了 COVID-19 的严重感染疾病。疫情严重扰乱了供应链,减少了许多国家之间的贸易量。

- 短期内,亚太地区工业部门的成长以及风力发电和电动车产业越来越多地采用高性能润滑脂等因素预计将推动市场成长。

- 每个国家关于润滑脂使用的环境法规可能会减缓市场的发展。

- 技术进步和产品创新以及聚脲润滑脂使用的增加是推动未来市场的机会。

润滑脂市场趋势

汽车和其他运输系统主导市场

- 汽车产业的需求对润滑脂市场做出了重大贡献。汽车产业OEM和RMO市场的成长预计将对预测期内的润滑脂需求产生直接影响。

- 根据国际工业组织(OICA)的数据,2021年汽车产量较2020年成长3%,达8,015万辆。亚太地区是最大的汽车製造中心,2021年整体成长约6%。

- 中国是最大的汽车生产国,2021年生产汽车2,600万辆,比2020年成长3%。同时,印度汽车产业出现显着成长,2020年至2021年汽车产量成长30%,达到440万辆。

- 电池在汽车领域的应用日益广泛,带动了电动车产量的快速成长。截至 2021 年,挪威电动车在持有中所占比例最大。

- 未来 20 年,乘客成长预计需要购买 44,040 架新喷射机(价值 6.8 兆美元)。到 2038 年,全球商业机队预计将达到 50,660 架,其中包括将继续投入使用的全新飞机和喷射机。

- 据波音民航机称,随着航空公司用更省油的设计替换旧式喷射机,并在已开发市场和新兴市场扩张,商用飞机市场的价值预计到2028 年将达到3.1 兆美元。因为我们正在开发机队以促进稳定成长跨市场的航空旅行。

- 因此,所有上述因素都可能增加预测期内的润滑脂消耗量。

亚太地区主导市场

- 亚太地区是润滑脂消费的主要市场,其次是北美和欧洲。预计中国、印度和印尼将成为预测期内对油脂消费表现出强劲需求的主要国家。

- 目前,中国已成为最大的润滑油和润滑脂消费国。涉及各个行业的大规模製造活动以及工业和汽车行业的快速增长使该国成为该形势领先的消费国和油脂生产国。

- 中国工业和资讯化部(工信部)报告称,2021年中国食品工业利润总额为6,187.1亿元人民币(约874.1亿美元)。随着国内加工和食品需求的不断增长,该行业的规模可能会进一步扩大。

- 根据OICA和印度汽车製造商协会(SIAM)的数据,2021年汽车总产量为4,399,112辆,与前一年同期比较去年同期成长30%。

- IBEF报告显示,预计2022年印度国内化工产业的中小企业收益将成长18-23%。 2021年11月,印度石油公司(IOCL)投资368.1亿卢比(约4.9522亿美元)建设印度首座大型顺丁烯二酸酐装置,用于製造高价值特种化学品,并宣布计划在哈里亚纳邦建立帕尼帕特炼油厂。

- 根据 Gaikindo &AAF 的报告,在印尼,2021 年汽车产量比 2020 年增加了 63%。 2021年总产量为1,121,967辆。随着最终用户行业需求的增加,产量可能会增加。上述因素可能会增加亚太地区应用产业对润滑脂的需求。

润滑脂行业概况

润滑脂市场本质上是分散的。市场主要企业包括壳牌公司、埃克森美孚公司、BP公司(嘉实多)、福斯、Axel Christiernsson等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区不断成长的工业领域

- 风力发电和电动车产业越来越多地采用高性能润滑脂

- 抑制因素

- 有关润滑脂使用的环境法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 增稠剂

- 锂基

- 钙基

- 铝基

- 聚脲

- 其他增稠剂

- 最终用户产业

- 发电

- 汽车及其他交通工具

- 重型设备

- 食品和饮料

- 冶金和金属加工

- 化学製造

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 菲律宾

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 智利

- 南美洲其他地区

- 中东

- 沙乌地阿拉伯

- 伊朗

- 土耳其

- 阿拉伯聯合大公国

- 卡达

- 其他中东地区

- 非洲

- 埃及

- 南非

- 奈及利亚

- 阿尔及利亚

- 摩洛哥

- 其他非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Axel Christiernsson International AB

- BECHEM Lubrication Technology LLC

- BP PLC

- Calumet Speciality Products Partners LP

- China Petrochemical &Chemical Corporation(Sinopec)

- Chevron Corporation

- ENEOS Corporation

- ETS

- Exxon Mobil Corporation

- FUCHS

- Gazpromneft-Lubricants Ltd

- Kluber Lubrication Munchen SE &Co. KG

- LUKOIL

- PKN Orlen

- Penrite Oil

- Petroliam Nasional Berhad(PETRONAS)

- Petromin

- Shell PLC

- Totalenergies-Lubricants Ltd

第七章市场机会与未来趋势

- 技术进步与产品创新

- 扩大聚脲润滑脂的用途

简介目录

Product Code: 48925

The Grease Market size is estimated at 2.62 Billion liters in 2024, and is expected to reach 3.08 Billion liters by 2029, growing at a CAGR of 3.38% during the forecast period (2024-2029).

Key Highlights

- The major grease-consuming industries, like automotive, industrial processing (majorly steel mills), aerospace, and food and beverage, were greatly impacted by COVID-19. The pandemic led to severe supply chain disruptions, which in turn dampened the trade volumes between many countries.

- In the short term, factors such as the growing industrial sector in Asia-Pacific and increasing adoption of higher-performance greases in the wind power and electric vehicle industries are likely to drive market growth.

- Environmental regulations across countries concerning the usage of grease are likely to slow down the market.

- Technological advancements and product innovations, and the growing usage of polyurea greases are the opportunities that are likely to drive the market in the future.

Grease Market Trends

Automotive and Other Transportation to Dominate the Market

- The demand from the automotive sector contributes significantly to the grease market. The growing OEM and RMO markets in the automotive industry are expected to have a direct impact on the demand for greases during the forecast period.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), automotive production in 2021 increased by 3%, with 80.15 million vehicles in comparison to 2020. Asia-Pacific, the largest hub for automotive manufacturing, witnessed an overall increase of about 6% in 2021.

- China was the largest producer of motor vehicles, with 26 million units in 2021, a 3% rise from 2020. On the other hand, the Indian automobile sector saw immense growth, with a production of 4.4 million vehicles in 2021, a 30% increase from 2020.

- The growing application of batteries in the automotive sector has led to a surge in the production of electric vehicles. As of 2021, Norway had the largest share of electric vehicles in its fleet.

- Over the next two decades, rising passenger volumes are expected to necessitate the purchase of 44,040 new jets (worth USD 6.8 trillion). The global commercial fleet is expected to reach 50,660 planes by 2038, including all-new airplanes and jets that will remain in service.

- According to Boeing, the commercial airplane market will be worth USD 3.1 trillion by 2028 as operators replace older jets with more fuel-efficient designs and develop their fleets to facilitate the steady rise in air travel across developed and emerging markets.

- Therefore, all the aforementioned factors are likely to drive grease consumption over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is the major market in the consumption of grease, followed by North America and Europe. China, India, and Indonesia are expected to be leading countries witnessing strong demand for grease consumption during the forecast period.

- China is the largest consumer of lubricants and greases in the current scenario. The vast manufacturing activities pertaining to different sectors and the rapid growth in the industrial and automotive sectors have pushed the country to stand among the major consumers and grease producers in the global landscape.

- The Ministry of Industry and Information Technology (MIIT), China, reported that in 2021, the total profits of the food industry in China were CNY 618.71 billion (~ USD 87.41 billion). The industry is likely to upscale with the growing demand for processed and packaged food items in the country.

- As per OICA and the Society of Indian Automobile Manufacturers (SIAM), the total automobile production in 2021 stood at 4,399,112 units, an increase of 30% compared to the previous year.

- The Indian domestic chemicals sector's small and medium enterprises are expected to showcase 18-23% revenue growth in 2022, as per the reports by IBEF. In November 2021, Indian Oil Corporation (IOCL) announced plans to invest INR 3,681 crore (~ USD 495.22 million) to set up India's first mega-scale maleic anhydride unit for manufacturing high-value specialty chemicals at its Panipat Refinery in Haryana.

- In Indonesia, as per the reports by Gaikindo & AAF, automobile production accounted for 63% growth in 2021 as compared to the numbers in 2020. The total production in 2021 was 1,121,967 units. Production is likely to increase with the growing demand from end-consumer industries.

- The above-mentioned factors are likely to ascend the demand for grease across the application industries in Asia-Pacific.

Grease Industry Overview

The grease market is fragmented in nature. Some of the major players in the market include Shell PLC, Exxon Mobil Corporation, BP PLC (Castrol), FUCHS, and Axel Christiernsson.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Industrial Sector in Asia-Pacific

- 4.1.2 Increasing Adoption of Higher Performance Greases in the Wind Power and Electric Vehicle Industries

- 4.2 Restraints

- 4.2.1 Environmental Regulations Concerning Usage of Grease

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Thickeners

- 5.1.1 Lithium-based

- 5.1.2 Calcium-based

- 5.1.3 Aluminium-based

- 5.1.4 Polyurea

- 5.1.5 Other Thickeners

- 5.2 End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Automotive and Other Transportation

- 5.2.3 Heavy Equipment

- 5.2.4 Food and Beverage

- 5.2.5 Metallurgy and Metalworking

- 5.2.6 Chemical Manufacturing

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Philippines

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Spain

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Chile

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Iran

- 5.3.5.3 Turkey

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Qatar

- 5.3.5.6 Rest of the Middle East

- 5.3.6 Africa

- 5.3.6.1 Egypt

- 5.3.6.2 South Africa

- 5.3.6.3 Nigeria

- 5.3.6.4 Algeria

- 5.3.6.5 Morocco

- 5.3.6.6 Rest of Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Axel Christiernsson International AB

- 6.4.2 BECHEM Lubrication Technology LLC

- 6.4.3 BP PLC

- 6.4.4 Calumet Speciality Products Partners LP

- 6.4.5 China Petrochemical & Chemical Corporation (Sinopec)

- 6.4.6 Chevron Corporation

- 6.4.7 ENEOS Corporation

- 6.4.8 ETS

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 FUCHS

- 6.4.11 Gazpromneft - Lubricants Ltd

- 6.4.12 Kluber Lubrication Munchen SE & Co. KG

- 6.4.13 LUKOIL

- 6.4.14 PKN Orlen

- 6.4.15 Penrite Oil

- 6.4.16 Petroliam Nasional Berhad (PETRONAS)

- 6.4.17 Petromin

- 6.4.18 Shell PLC

- 6.4.19 Totalenergies - Lubricants Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements and Product Innovation

- 7.2 Gaining Usage of Polyurea Greases

02-2729-4219

+886-2-2729-4219