|

市场调查报告书

商品编码

1686175

变频驱动器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Variable Frequency Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

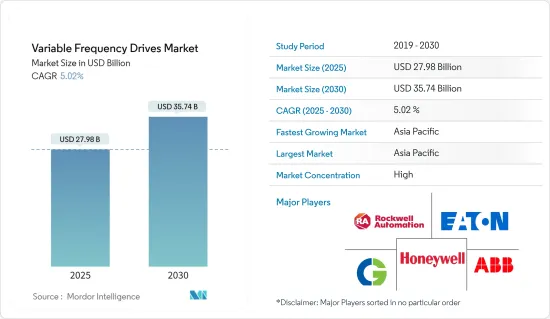

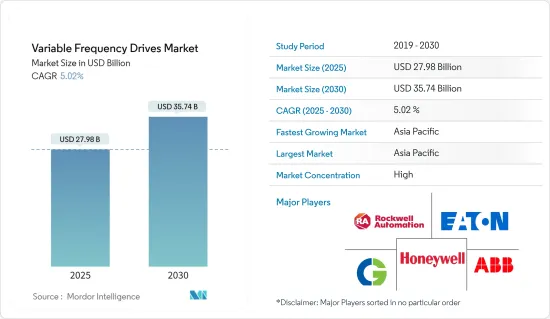

变频驱动器市场规模预计在 2025 年为 279.8 亿美元,预计到 2030 年将达到 357.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.02%。

主要亮点

- 快速工业化推动 VFD 跨产业渗透:由于快速工业化,尤其是在新兴国家,变频驱动器 (VFD) 市场正在以更快的速度成长。例如,中国预计2021年工业产值将成长9.6%,到2025年中国的目标是生产3,500万辆汽车。这一扩张为VFD在各个领域的部署创造了巨大的机会。国际机器人联合会预测,2024年全球工业机器人安装量将成长到51.8万台。

- 自动化推动成长:印度的 SAMARTH Udyog Bharat 4.0 等智慧製造倡议正在提高人们对工业 4.0 的认识,从而促进自动化的采用。

- 新兴产业:VFD 越来越多地用于碳捕获和氢气生成等新应用,其应用范围正在扩大。

- 政府支持:VFD 製造商和政府机构之间的合作正在加速市场扩张,例如与加尔各答和清奈地铁计划的伙伴关係。

- 能源效率:VFD 市场成长的关键驱动力:越来越关注能源效率也是 VFD 市场成长的关键驱动力。根据国际能源总署统计,马达消耗了电力产业所用能源的近40%。 VFD 可提高能源效率,尤其是与泵浦和风扇等变扭矩负载应用中的马达结合使用时。透过调节马达速度,VFD 可以显着降低能耗。

- 节能潜力 根据 ABB 白皮书,节能马达和变频器可以将全球电力消耗减少 10%。

- 监管支持:欧盟(EU)能源效率指令的目标是到 2030 年将能源效率提高 30%,高于 2020 年的 20%。

- 减少碳排放:欧盟委员会的「Fit for 55」倡议正在推动减少二氧化碳排放,从而鼓励在註重节能的地区采用变频器。

- 技术进步正在提高 VFD 的能力:技术进步正在加速各行各业对 VFD 的应用。现代驱动器配备了先进的网路和诊断功能,以提高生产力并降低营运成本。例如,将马达驱动系统与 VFD 整合可以将商业建筑每平方英尺的消费量降低高达 40%。

- 产品创新罗克韦尔自动化将于 2022 年升级其 PowerFlex 6000T VFD,以增强高速马达应用的性能。

- 新品:艾默生 Copeland VFD 系列 (2021) 和 ABB 的紧凑型 ACS1000i (2022) 分别为工业冷冻和空间受限的环境而设计。

- 产业特定应用这些进步使得 VFD 在水和电力管理等领域更加可靠。

- 市场细分与区域洞察:VFD 市场根据电压类型、最终用户产业和地区进行细分。低电压变频器在 2021 年占据 61.02% 的市场占有率,预计到 2027 年将成长到 185.2 亿美元,复合年增长率为 5.1%。能源和电力产业仍将是最大的终端用户,2021 年约占市场的 29%,预计到 2027 年将成长到 86.8 亿美元。

- 亚太地区处于领先地位:该地区将在 2021 年占据 42.18% 的份额,预计到 2027 年将增长至 136.7 亿美元,复合年增长率为 6.2%。

- 产业优势低压变频器在食品和饮料、石油和天然气以及采矿等行业占主导地位。

- 暖通空调中的能源效率:暖通空调产业越来越多地采用变频器,这可以将泵浦应用中的能耗降低 25%,伯明翰竞技场剧院等计划证明了这一点。

- VFD 市场的投资和创新:市场领导正在积极投资研发、生产能力和分销网络,以扩大市场占有率。技术创新专注于开发节能、经济的变频器,使其更易于在所有行业中使用。

- 新产品 Bison Gear & Engineering Corp. 将于 2022 年推出一款针对工业和户外应用的新型多功能 VFD。

- 市场扩展:WEG 于 2022 年推出了 CFW900 VFD,将更高的功率密度与简单的设计相结合。

- 扩大产品组合:丹佛斯传动于 2021 年透过 VACON 1000 变频器扩展了其中压产品阵容。

变频驱动市场趋势

低压部分占据市场主导地位

低压部分是 VFD 市场中最大的部分,占 2021 年总市场占有率的 61.02%。该部分预计将从 2022 年的 144.5 亿美元成长到 2029 年的 200.4 亿美元,复合年增长率为 5.1%。

- 能源效率备受关注低压变频器有助于优化各行各业的能源使用,其中包括商业建筑,而商业建筑占美国能源消耗的 40%。

- 监管推动:欧盟的 Tier-2 生态设计指令 (2021) 和欧洲绿色交易等政府政策正在推动能源密集型产业采用 VFD。

- 技术创新:先进的 VFD 现在包括煞车策略、加速期间的功率提升和减速期间的高级控制等功能。

- 工业应用:Invertek 的 Optidrive E3 安装在吉隆坡的朝圣者集合点终点站,用于气流管理。

亚太地区是成长最快的区域

亚太地区是 VFD 应用成长最快的地区,预计将从 2022 年的 101 亿美元成长到 2029 年的 153.9 亿美元,复合年增长率为 6.2%。

- 工业发展:中国快速的自动化和工业成长是该地区对 VFD 需求的主要驱动力。

- 能源法规:政府严格的能源效率政策为中国和印度等国家创造了成长机会。

- 战略伙伴关係:罗克韦尔自动化将于 2021 年与新加坡 CAD-IT 合作,为东南亚提供智慧製造解决方案。

- 暖通空调领域的扩张:都市化地区暖通空调系统市场的不断扩大正在推动对变频器的需求,正如格兰富与 BBP 合作在 2021 年实现东南亚永续製冷一样。

变频驱动器产业概况

变频驱动器市场竞争格局分析

全球企业主导综合市场

VFD 市场由全球企业集团主导,其中少数大型公司占据相当大的份额。预计 2021 年市场规模为 218.2 亿美元,到 2027 年将达到 301.7 亿美元,复合年增长率为 5.0%。主要成长动力包括工业化和变频器在 HVAC 等能源密集型领域的广泛应用,这可以减少商业建筑 30-40% 的能源使用。

市场领导者ABB、西门子、施耐德电机、丹佛斯和罗克韦尔自动化等公司引领 VFD 市场。

产品重点:这些公司正在大力投资研发节能解决方案,例如 ABB 的 ACS1000i 和西门子的再生能源驱动器。

技术创新:西门子和Schneider Electric专注于具有增强通讯功能的变频器,用于远端监控和诊断。

VFD 市场未来成功的策略:

技术创新、扩大应用和能源效率将继续成为 VFD 市场成功的关键策略。人工智慧和机器学习的整合简化了 VFD试运行并优化了效能。

新兴机会:变频器在交通运输、氢气生产和碳捕获领域的应用不断扩大,为其提供了新的成长途径。

分散化趋势:公司正在开发直接整合到马达中的分散式变频器,以降低安装成本和复杂性。

IIoT 整合:在采用工业物联网 (IIoT) 的行业中,联网的 VFD 变得至关重要,以提供即时资料分析并提高营运效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介

- 按类型

- 交流变频器

- 直流驱动

- 按类型

- 评估宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 工业化进程加快,变频器在重点产业的应用日益广泛

- 自动化推动成长

- 技术进步提高了 VFD 能力

- 市场限制

- 对设备的技术担忧

- 设备高成本

- 网路安全问题

第六章 市场细分

- 按电压类型

- 低电压

- 中高压

- 按最终用户产业

- 基础设施

- 食品加工

- 能源和电力

- 矿业与金属

- 纸浆和造纸

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Eaton Corporation

- ABB Ltd

- Crompton Greaves Ltd

- Honeywell International Inc.

- Rockwell Automations Inc.

- Hitachi Group

- Siemens AG

- Mitsubishi Corporation

- Toshiba Corporation

- Schneider Electric SE

- Johnson Controls Inc.

- Nidec Corporation

- Danfoss AS

第八章投资分析

第九章:市场的未来

The Variable Frequency Drives Market size is estimated at USD 27.98 billion in 2025, and is expected to reach USD 35.74 billion by 2030, at a CAGR of 5.02% during the forecast period (2025-2030).

Key Highlights

- Rapid Industrialization Driving VFD Adoption Across Industries:The Variable Frequency Drives (VFD) market is witnessing accelerated growth due to rapid industrialization, especially in emerging economies. For example, China's industrial production surged by 9.6% in 2021, and the country aims to produce 35 million automotive units by 2025. This expansion is creating significant opportunities for VFD deployment across various sectors. The rise of automation in manufacturing is further boosting the market, with the International Federation of Robotics predicting that global industrial robot installations will increase to 518,000 units by 2024.

- Automation driving growth: Smart manufacturing initiatives such as India's SAMARTH Udyog Bharat 4.0 are raising awareness of Industry 4.0, which in turn is increasing automation adoption.

- Emerging industries: VFDs are increasingly being used in new applications, such as carbon capture and hydrogen generation, broadening their reach.

- Government support: Collaborations between VFD manufacturers and government agencies are accelerating market expansion, as seen in Danfoss' partnership with Kolkata and Chennai Metro Rail projects.

- Energy Efficiency: A Key Driver for VFD Market Growth:The growing emphasis on energy efficiency is another critical driver of VFD market growth. According to the International Energy Agency, electric motors consume nearly 40% of the energy used in power industries. VFDs enhance energy efficiency, particularly when paired with motors in variable torque load applications like pumps and fans. By adjusting motor speed, VFDs can significantly reduce energy consumption.

- Energy-saving potential: ABB's whitepaper suggests that energy-efficient motors and VFDs could cut global electricity consumption by 10%.

- Regulatory support: The European Union's updated Energy Efficiency Directive targets a 30% improvement in energy efficiency by 2030, up from 20% in 2020.

- Carbon reduction: The European Commission's 'Fit for 55' initiative is pushing for lower carbon emissions, which is driving VFD deployment in energy-conscious sectors.

- Technological Advancements Enhancing VFD Capabilities: Technological progress is accelerating the adoption of VFDs across industries. Modern drives come equipped with advanced networking and diagnostic capabilities, which enhance productivity and reduce operational costs. For instance, integrating motor-driven systems with VFDs can cut per-square-foot energy consumption by up to 40% in commercial buildings.

- Product innovation: Rockwell Automation introduced upgraded PowerFlex 6000T VFDs in 2022, enhancing performance for high-speed motor applications.

- New releases: Emerson's 2021 Copeland VFD line and ABB's compact ACS1000i (2022) are designed for industrial refrigeration and space-constrained environments, respectively.

- Industry-specific applications: These advancements are increasing the reliability of VFDs in sectors like water and power management.

- Market Segmentation and Regional Insights: The VFD market is divided by voltage type, end-user industry, and geography. Low voltage VFDs held a 61.02% market share in 2021 and are expected to grow to USD 18.52 billion by 2027 at a CAGR of 5.1%. The energy and power sector remains the largest end-user, accounting for nearly 29% of the market in 2021, with projected growth to USD 8.68 billion by 2027.

- Asia-Pacific leads the way: The region held a 42.18% share in 2021 and is expected to grow to USD 13.67 billion by 2027, at a 6.2% CAGR.

- Sector dominance: Low-voltage VFDs dominate sectors such as food and beverage, oil and gas, and mining.

- Energy efficiency in HVAC: The HVAC industry is a notable adopter, where VFDs are capable of cutting energy use by 25% in pump applications, demonstrated in projects like the Birmingham Hippodrome theater.

- Investment and Innovation in the VFD Market: Market leaders are actively investing in R&D, production capabilities, and distribution networks to increase market share. Innovation is focused on developing energy-efficient, cost-effective VFDs to enhance their usability across industries.

- New products: Bison Gear & Engineering Corp. released a versatile new VFD in 2022, targeting industrial and outdoor applications.

- Market expansion: WEG introduced the CFW900 VFD in 2022, combining increased power density with simplified design.

- Portfolio expansion: Danfoss Drives expanded its medium-voltage offerings with the VACON 1000 drive in 2021.

Variable Frequency Drives Market Trends

Low Voltage Segment to Dominate the Market

The low-voltage segment is the largest in the VFD market, accounting for 61.02% of the total market share in 2021. This segment is forecasted to grow from USD 14.45 billion in 2022 to USD 20.04 billion by 2029, with a CAGR of 5.1%.

- Energy efficiency in focus: Low-voltage VFDs help optimize energy use across multiple industries, including commercial buildings, which account for 40% of U.S. energy consumption.

- Regulatory push: Government policies like the EU's Tier-2 Ecodesign Directive (2021) and the European Green Deal are driving adoption of VFDs in energy-intensive industries.

- Technological innovations: Advanced VFDs now come with features like braking methods, power boost during ramp-up, and advanced controls during ramp-down.

- Industry application: The food processing industry is a major adopter, with Invertek's Optidrive E3 being installed for airflow management at Kuala Lumpur's Pilgrim Assembly Point Terminal.

Asia Pacific The Fastest-Growing Regional Segment

Asia-Pacific is the fastest-growing region for VFD adoption, with projected growth from USD 10.10 billion in 2022 to USD 15.39 billion by 2029 at a CAGR of 6.2%.

- Industrial development: Rapid automation and industrial growth in China are driving significant VFD demand in the region.

- Energy regulations: Strict government policies around energy efficiency are creating growth opportunities in countries like China and India.

- Strategic partnerships: Companies are expanding in the region, with Rockwell Automation partnering with Singapore-based CAD-IT in 2021 to provide smart manufacturing solutions in Southeast Asia.

- HVAC sector expansion: The growing market for HVAC systems in urbanizing regions is driving VFD demand, as seen in Grundfos' 2021 partnership with BBP for sustainable cooling in Southeast Asia.

Variable Frequency Drives Industry Overview

Variable Frequency Drives Market: Competitive Landscape Analysis

Global players dominate a consolidated market:

The VFD market is dominated by global conglomerates, with a few major players controlling a significant share. Valued at USD 21.82 billion in 2021, the market is expected to reach USD 30.17 billion by 2027, growing at a CAGR of 5.0%. The primary growth drivers include industrialization and increased VFD adoption in energy-intensive sectors such as HVAC, which can reduce energy usage by 30-40% in commercial buildings.

Market leaders: Companies like ABB, Siemens, Schneider Electric, Danfoss, and Rockwell Automation lead the VFD market.

Product focus: These firms invest heavily in R&D to develop energy-efficient solutions, such as ABB's ACS1000i and Siemens' regenerative energy drives.

Technological innovation: Siemens and Schneider Electric focus on VFDs with enhanced communication capabilities for remote monitoring and diagnostics.

Strategies for future success in the VFD market:

Technological innovation, expanding applications, and energy efficiency remain key strategies for success in the VFD market. The integration of AI and machine learning is simplifying VFD commissioning and optimizing performance.

Emerging opportunities: VFD applications in transportation, hydrogen production, and carbon capture are expanding, offering new avenues for growth.

Decentralization trend: Companies are developing decentralized VFDs built directly into motors, reducing installation costs and complexity.

IIoT integration: Connected VFDs are becoming essential, providing real-time data analytics and enhancing operational efficiency in industries adopting the Industrial Internet of Things (IIoT).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Technology Snapshot

- 4.4.1 By Type

- 4.4.1.1 AC Drives

- 4.4.1.2 DC Drives

- 4.4.1 By Type

- 4.5 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization and Increased Use of VFDs across Major Vertical Industries

- 5.1.2 Automation driving growth

- 5.1.3 Technological Advancements Enhancing VFD Capabilities

- 5.2 Market Restraints

- 5.2.1 Technical Concerns of the Equipment

- 5.2.2 High Cost of the Equipment

- 5.2.3 Cybersecurity Apprehensions

6 MARKET SEGMENTATION

- 6.1 By Voltage Type

- 6.1.1 Low Voltage

- 6.1.2 Medium and High Voltage

- 6.2 By End-user Industry

- 6.2.1 Infrastructure

- 6.2.2 Food Processing

- 6.2.3 Energy and Power

- 6.2.4 Mining and Metals

- 6.2.5 Pulp and Paper

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of the Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton Corporation

- 7.1.2 ABB Ltd

- 7.1.3 Crompton Greaves Ltd

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automations Inc.

- 7.1.6 Hitachi Group

- 7.1.7 Siemens AG

- 7.1.8 Mitsubishi Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Schneider Electric SE

- 7.1.11 Johnson Controls Inc.

- 7.1.12 Nidec Corporation

- 7.1.13 Danfoss AS