|

市场调查报告书

商品编码

1443996

农业熏蒸剂 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Agricultural Fumigants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

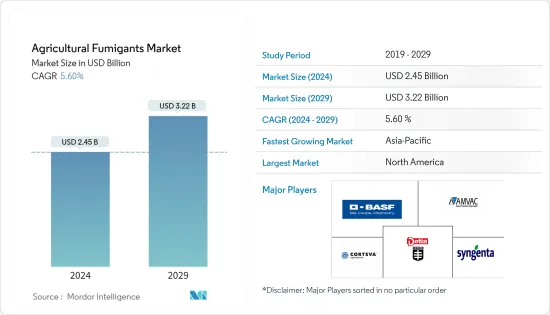

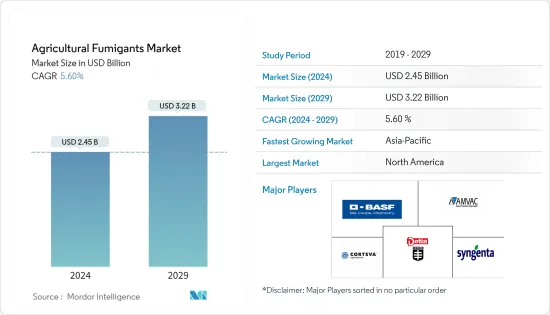

2024年农业熏蒸剂市场规模估计为24.5亿美元,预计2029年将达32.2亿美元,在预测期内(2024-2029年)CAGR为5.60%。

COVID-19 大流行扰乱了作物保护化学品市场的运营,包括熏蒸剂。疫情影响了供应链网络,造成企业和农民损失。从供给来看,分配瓶颈导致移工短期短缺,生产所需劳动力缺口较大。其他一些限制包括清关、出口许可证、进口许可证和植物检疫证明。

农业熏蒸剂市场受到多种因素的推动,例如农业领域技术的快速进步、对收穫后损失的日益担忧以及先进农业实践的转变,这些因素导致了产量的增加。储存期间使用熏蒸剂有助于减少储存损失。因此,由于使用熏蒸剂是减少收穫后损失的有效且经济的方法,因此预计对熏蒸剂的需求将会增加。

磷化氢熏蒸剂是一种广泛使用的熏蒸剂,用于储存农产品,同时提供防虫和囓齿动物保护,并已成为全球所有类型熏蒸剂中最大的一部分。北美主导市场。随着技术和研发的快速投资,许多毒性更低、效率更高的新产品品种正在开发中。农业熏蒸剂市场的成长可归因于多种因素,例如消费者对提高农产品品质的兴趣增加、耕作方式的改变以及先进的储存技术。然而,熏蒸剂会引起一些问题,包括可能的植物毒性,这取决于作物的类型及其品种、季节条件、湿度、温度、熏蒸剂浓度和处理持续时间。因此,由于其作为呼吸道毒物的毒性较高,建议仅由专业熏蒸人员使用。

农业熏蒸剂市场趋势

农业生产不断成长

随着农业产量的增加,熏蒸剂的需求多年来一直呈上升趋势。熏蒸技术在谷物和油籽供应链各个层面的使用增加,成为农场一级主要的昆虫管理选择。对于农场级储存和筒仓,熏蒸是防止昆虫侵扰同时避免害虫产生抗性的最佳选择方法之一。然而,由于立法限制,可用的活性物质仅限于数量有限的熏蒸剂和储存杀虫剂。溴甲烷 (MB) 熏蒸是一种有效的处理方法,可确保产品造成的植物检疫风险降至最低。儘管欧盟已禁止使用甲基溴,但加拿大仍要求将其作为某些产品检疫和装运前应用的唯一批准处理方法。

联合国粮食及农业组织(FAO)预测,到2050年,农业生产力可能提高70%,以满足日益增长的粮食需求。预计到 2050 年,农作物需求将增加至 67.59 亿吨左右。全球谷物产量从 2018 年的 29.065 亿吨增加到 2020 年的 29.961 亿吨。因此,对农业仓库、储存技术和相关产品的需求,例如熏蒸剂,预计从长远来看将会增长。在仓库中,害虫危害大部分农作物,熏蒸剂的使用减少了农产品的损失。因此,预计这将增加全球农业熏蒸剂市场的需求。

北美引领全球市场

北美是最大的农业熏蒸剂市场,其主要国家有超过 250 种授权产品。储藏昆虫的管理是食品和谷物加工和储藏行业中一个重要的关注点和广泛研究的课题。

该地区储存和土壤应用消耗熏蒸剂的主要商品是玉米、水稻、大麦、马铃薯、番茄、小麦、草莓、捲心菜等。在北美,美国是最大的市场,占一半以上的区域市场份额。美国市场的主要熏蒸剂包括三氯硝基甲烷、硫酰氟、磷化铝、环氧乙烷等。在加拿大註册的熏蒸剂产品有90多种,由25家公司生产。一些主要参与者包括 AMVAC Chemicals、Degesch America Inc.、Syngenta Canada Inc.、United Phosphorus Inc. 等。

农业熏蒸剂产业概况

全球农业熏蒸剂市场整合,少数公司占最大市场。北美和欧洲市场集中度较高,少数主要厂商占较大市场份额,竞争激烈。透过研发实现产品组合多元化是推出新产品的支柱,也是应用于成熟市场进一步强化的重要策略之一。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 溴甲烷

- 氯化苦

- 膦

- 威百亩钠

- 1,3-二氯丙烯

- 其他农业熏蒸剂

- 申请方法

- 土壤

- 仓库

- 形式

- 坚硬的

- 液体

- 气体

- 作物应用

- 以作物为主

- 非农作物为主

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第 6 章:竞争格局

- 最常用的策略

- 市占率分析

- 公司简介

- DowDuPont

- Amvac Chemical Corporation

- Syngenta AG

- UPL Group

- Detia Degesch GmbH

- ADAMA Agricultural Solution Ltd

- BASF SE

- Cytec Solvay Group

- FMC Corporation

- Fumigation Services

- Ikeda Kogyo Co. Ltd

- Industrial Fumigation Company

- Isagro SpA

- Lanxess

- Reddick Fumigants LLC

- Trical Inc.

- TriEst Ag Group Inc.

- VFC

- Industrial Fumigation Company

第 7 章:市场机会与未来趋势

第 8 章:评估 COVID-19 对市场的影响

The Agricultural Fumigants Market size is estimated at USD 2.45 billion in 2024, and is expected to reach USD 3.22 billion by 2029, growing at a CAGR of 5.60% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the operations of the crop protection chemicals market, including fumigants. The pandemic affected supply chain networks, resulting in losses for companies and farmers. In terms of supply, a short-term shortage of migrant laborers amid distribution bottlenecks created a wide gap between the number of workers required for production. Some other restraints included customs clearances, export permits, import permits, and phytosanitary certificates.

The agricultural fumigants market is driven by factors, like rapid technological advancements in the agricultural sector, growing concerns over post-harvest losses, and a shift in the advanced farming practices, which have led to increased yields. The use of fumigants during storage helps in the reduction of storage loss. Thus, the demand for fumigants is expected to increase as the use of fumigants is an effective and economical method to reduce post-harvest losses.

A widely used fumigant for storing agricultural commodities while offering protection against insects and rodents, phosphine-based fumigants have emerged as the largest segment among all types of global fumigants. North America dominates the market. With rapid investments in technology and R&D, many new varieties of products are being developed with less toxicity and more efficiency. The growth of the agricultural fumigants market can be attributed to several factors, such as the increased inclination of consumers for improving the quality of agricultural output, changing farming practices, and advanced storage technology. However, fumigants cause several problems, including possible phytotoxicity, depending on the type of crop and its variety, seasonal conditions, humidity, temperature, fumigant concentration, and duration of treatment. Therefore, it is recommended to be used by professional fumigators only due to its high toxicity as a respiratory poison.

Agricultural Fumigants Market Trends

Growing Agricultural Production

In line with increasing agricultural production, the demand for fumigants has been witnessing an upward trend over the years. The use of fumigation has increased at all levels of the grain and oilseeds supply chain, emerging as the main insect management option at the farm level. For farm-level storage and in silos, fumigation is among the most preferred methods to prevent the build-up of insect infestations while avoiding pest resistance. However, the available active substances are constrained to a limited number of fumigants and storage insecticides due to legislative restrictions. Methyl bromide (MB) fumigation is an effective treatment to ensure that products pose a minimal phytosanitary risk. While the European Union has banned the use of MB, Canada still requires it as the only approved treatment for the quarantine and pre-shipment applications of some products.

The Food and Agriculture Organization (FAO) of the United Nations has predicted that agricultural productivity is likely to increase by 70% by 2050 in order to meet the growing demand for food. The demand for agricultural crops is expected to rise to around 6,759 million ton by 2050. Global cereal production increased from 2906.5 million ton in 2018 to 2996.1 million ton in 2020. Thus, the demand for agricultural warehouses, storage technologies, and associated products, like fumigants, is anticipated to grow in the long run. In warehouses, pests damage most crops, and the use of fumigants decrease the loss of agricultural products. Therefore, this is expected to boost demand for the agricultural fumigants market across the world.

North America Leading the Global Market

North America is the largest market for agricultural fumigants, with over 250 authorized products available in its major countries. Management of stored product insects is a major concern and widely researched topic in the food and grain processing and storage industry.

The major commodities consuming fumigants for both storage and soil applications in the region are corn, rice, barley, potato, tomato, wheat, strawberry, cabbage, etc. In North America, the United States is the largest market, accounting for more than half of the regional market's share. The major fumigants in the US market include chloropicrin, sulfuryl fluoride, aluminum phosphide, ethylene oxide, etc. Over 90 fumigant-based products are registered in Canada, manufactured by 25 companies. A few key players are AMVAC Chemicals, Degesch America Inc., Syngenta Canada Inc., United Phosphorus Inc., etc.

Agricultural Fumigants Industry Overview

The global agricultural fumigants market is consolidated, with a few companies occupying the largest market share. The markets in North America and Europe are highly consolidated, with a few major players occupying large market shares and having a high level of competition. Diversification of portfolios through R&D, which is the backbone of the introduction of new products, is one of the prominent strategies being applied to the matured markets for further intensification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Methyl Bromide

- 5.1.2 Chloropicrin

- 5.1.3 Phosphine

- 5.1.4 Metam Sodium

- 5.1.5 1,3-Dichloropropene

- 5.1.6 Other Agricultural Fumigants

- 5.2 Method of Application

- 5.2.1 Soil

- 5.2.2 Warehouse

- 5.3 Form

- 5.3.1 Solid

- 5.3.2 Liquid

- 5.3.3 Gas

- 5.4 Crop Application

- 5.4.1 Crop-based

- 5.4.2 Non-crop-based

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Italy

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 DowDuPont

- 6.3.2 Amvac Chemical Corporation

- 6.3.3 Syngenta AG

- 6.3.4 UPL Group

- 6.3.5 Detia Degesch GmbH

- 6.3.6 ADAMA Agricultural Solution Ltd

- 6.3.7 BASF SE

- 6.3.8 Cytec Solvay Group

- 6.3.9 FMC Corporation

- 6.3.10 Fumigation Services

- 6.3.11 Ikeda Kogyo Co. Ltd

- 6.3.12 Industrial Fumigation Company

- 6.3.13 Isagro SpA

- 6.3.14 Lanxess

- 6.3.15 Reddick Fumigants LLC

- 6.3.16 Trical Inc.

- 6.3.17 TriEst Ag Group Inc.

- 6.3.18 VFC

- 6.3.19 Industrial Fumigation Company