|

市场调查报告书

商品编码

1443998

金属罐 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

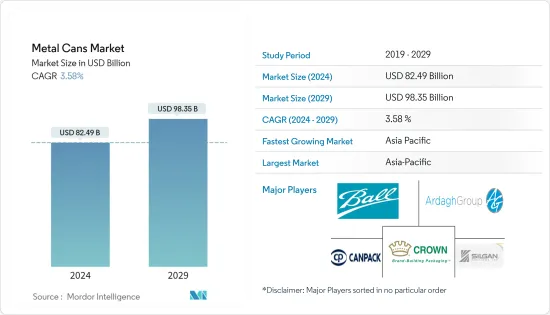

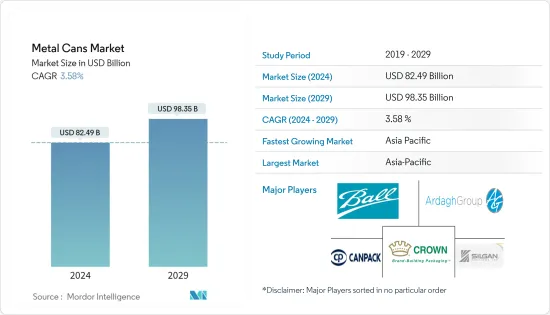

金属罐市场规模预计到2024年为824.9亿美元,预计到2029年将达到983.5亿美元,在预测期内(2024-2029年)CAGR为3.58%。

该产品因其独特的特点而受到关注,如耐运输、密封盖、粗暴搬运和易于回收。

主要亮点

- 金属罐的高可回收性是市场的重要驱动力之一。铝罐几乎可以提供防潮保护。这些罐子不生锈、耐腐蚀,并且是任何包装中保质期最长的罐子之一。它还具有许多优点,例如刚性、稳定性和高阻隔性。

- 由于欧洲地区啤酒和碳酸饮料等酒精和非酒精饮料的消费量不断增加,对金属罐的需求量很大。根据Barth-Haas Group的数据,2021年德国是欧洲最大的啤酒生产国。德国的啤酒产品产量超过8,500万公升,是英国产量的两倍多。俄罗斯产量为 8,200 万公升,位居欧洲第二。

- 铝罐短缺继续影响食品和饮料行业,因为与餐厅相比,家庭消费和杂货的饮料需求增加。许多知名市场参与者已宣布投资建立新的製造基础设施,以满足增加的订单并解决铝罐短缺。例如,2021年9月,鲍尔公司宣布计划在美国内华达州新建一座美国铝製饮料包装工厂。该多线工厂计划于 2022 年底开始生产。该公司计划在未来几年内对该工厂投资约 2.9 亿美元。即使进行了调整并提高了製造能力,波尔公司预计,到 2023 年,需求仍将继续超过供应。

- 消费者对在包装中应用非致癌材料的意识的提高以及对轻质包装的需求增加正在为金属罐市场带来高成长前景。然而,由于聚乙烯和聚对苯二甲酸乙二醇酯 (PET) 等聚合物包装材料的替代可能性,金属罐的使用具有挑战性。

- 为了因应COVID-19大流行对需求的影响,欧洲钢铁製造商迅速减少供应,第一季产量较去年同期下降10%。此外,有色金属产业是食品包装等重要价值链的重要供应商。由于关键价值链需求大幅减少、供应中断和运输困难,COVID-19 正在对欧洲有色金属产业造成重大且日益严重的经济影响。

金属罐市场趋势

罐头食品消费推动市场成长

- 全球生活方式的变化导致消费者选择易于烹饪的食物。年轻人口和个体消费者消费更多的罐头食品。这些使用者时间较少,预算有限,因此会选择成本较低、便利性较高的产品。

- 许多罐头食品的普通消费者选择该产品是因为其方便且成本较低。罐头食品食用较方便,烹调所需的能量和时间较少。大多数罐头食品的准备时间比一般餐点少 40%。

- 此外,大流行后市场对植物性食品的需求显着增加。由于英国是越南植物性产品的主要市场,越南素食食品出口商正在探索充足的机会。例如,2022年8月,在英国最大的越南商品进口国伦敦的支持下,位于同塔省的Binh Loan素食工厂向英国出口了2吨罐头素食食品。

- 现代便利商店和超市在全国范围内的扩张已经加速,这可能会增加所研究市场的成长。例如,2022年7月,零售巨头WinCommerce计划在年底前在越南开设数百家新超市和便利商店,以满足方便食品日益增长的需求,并加速扩大其市场份额在国内。

- 此外,2021 年 10 月,北美食品和家居用品钢罐製造商 Ball Metalpack 在其密尔瓦基製造工厂新增了一条两片式食品罐生产线。这条新鲜、高速两片式食品罐生产线将支援每年数百万个食品罐的生产,并使 Ball Metalpack 能够满足食品和营养行业客户不断增长的需求。这是密尔瓦基工厂的第二条高速两件式生产线,使其能够拥有更快的投产时间和更低的总成本结构。 Ball Metalpack 在其北美八家工厂拥有四种高速两片罐。

- 此外,根据 StatCan 的数据,过去十年中新鲜和加工水果和蔬菜的供应量有所下降。因此,人们正在转向罐头食品。

- 第三大生活支出是食品。罐头食品通常比新鲜或冷冻食品便宜,成本大约是冷冻食品的一半,是冷冻新鲜食品的五分之一。此外,加拿大人口的成长速度超过了这些成长速度,导致人均罐头食品的供应量较低。例如,根据 StatCan 的数据,加拿大人均可消费的烘焙豆和罐装豆量已从 2013 年的 1.13 公斤下降到 2021 年的 0.92 公斤。

北美将在市场中占据重要份额

- 由于对不同健康饮料、碳酸软性饮料、保健饮料和三氯蔗糖果汁的需求不断增长,预计北美将在整个预测期内对金属罐的需求产生积极影响。此外,一些重要的参与者透过广泛的促销活动和新的研究影响着业务的发展。

- 食品和零售业是影响美国产品需求的主要因素。该国的杂货店和超市比以往任何时候都多,该国食品和零售业的扩张主要是由于小型住宅数量的增加。因此,它推动了对较小包装单位的需求。

- 由于美国的生活方式,对金属罐的需求更大。人们选择即食且可以快速製作的有益健康的食物,因为他们的日程繁忙,几乎没有时间做饭。透过提供简单的包装和即用食品,罐头食品实现了这一目标。由于金属罐可以长时间保持食物新鲜和高品质,因此将推动市场成长。

- 此外,该地区的参与者正在关注垂直和水平整合。例如,2021年11月,Ardagh集团子公司Ardagh Metal Packaging (AMP)收购了加拿大数位印刷罐供应商Hart Print。 Hart Print 成立于 2018 年,总部位于魁北克,为饮料市场客户提供灵活的数位印刷解决方案。 Hart Print 声称是北美市场第一家提供数位印刷罐的公司。

金属罐产业概况

由于全球和本地行业参与者的存在,金属罐市场适度分散。该市场的供应商根据产品组合、差异化和定价参与。市场主要参与者有 SKS Bottle & Packaging, Inc.、Silgan Containers LLC、Ball Corporation 等。

2022 年3 月,德国马口铁製造商ThyssenKrupp Rasselstein 与瑞士公司Hoffmann Neopac 和Ricola 合作,推出了世界上第一个由减少二氧化碳排放的蓝薄荷钢製成的食品罐,后者将销售罐装草药滴剂。

2022 年 1 月,Ardagh Metal Packaging Europe 推出了 HIGHEND,这是其客製化系列的新成员,为客户提供提升品牌的创意机会。该技术可以在整个外壳表面上进行 CMYK 颜色的高品质装饰,这意味着品牌可以以最大的视觉衝击力突出、定制和区分他们的罐子。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 由于能源使用量较少,包装的可回收性高

- 酒精和非酒精饮料的消费量增加

- 市场限制

- 替代包装解决方案如聚对聚对苯二甲酸乙二酯的存在

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场的影响

第 5 章:市场细分

- 依材料类型

- 铝

- 钢

- 依罐头类型

- 食物

- 饮料

- 化妆品和个人护理

- 药品

- 画

- 其他最终用户产业

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 亚太其他地区

- 澳洲

- 拉丁美洲

- 中东和非洲

- 北美洲

第 6 章:竞争情报

- 公司简介

- Ball Corporation

- Ardagh Group

- Mauser Packaging Solutions

- Silgan Containers LLC

- Crown Holdings Inc.

- DS Containers Inc.

- CCL Container Inc.

- Toyo Seikan Group Holdings Ltd

- Pacific Can China Holdings Limited

- Universal Can Corporation

- CPMC HOLDINGS Limited (COFCO Group)

- Showa Denko KK

- Independent Can Company

- Hindustan Tin Works Ltd

- Saudi Arabian Packaging Industry WLL (SAPIN)

第 7 章:投资分析

第 8 章:市场机会与未来趋势

The Metal Cans Market size is estimated at USD 82.49 billion in 2024, and is expected to reach USD 98.35 billion by 2029, growing at a CAGR of 3.58% during the forecast period (2024-2029).

The product is gaining prominence because of its distinct features, like transportation resistance, hermetically sealed cover, rough handling, and easy recyclability.

Key Highlights

- The high recyclability of metal cans is one of the significant drivers of the market. Aluminum cans deliver nearly protection against moisture. The cans do not rust and are resistant to corrosion, as well as provide one of the most extended shelf lives considering any packaging. It also offers many benefits, such as rigidity, stability, and high barrier properties.

- Due to the increasing consumption of alcoholic and non-alcoholic beverages, such as beer and carbonated drinks, in the European region, there is significant demand for metal cans. According to Barth-Haas Group, Germany was Europe's top beer producer in 2021. The beer products in Germany were over 85 million hl which was more than twice as much as produced in the UK. With 82 million hl, Russian output was the second-largest in Europe.

- The aluminum can shortage continues to affect the food and beverage industry, as the beverage demand for home consumption and grocery increased compared to restaurants. Many prominent market players have announced investments to set up new manufacturing infrastructures to fulfill the increased order and tackle the shortage of aluminum cans. For instance, in September 2021, Ball Corporation announced plans to build a new US aluminum beverage packaging plant in Nevada, US. This multi-line plant has been scheduled to begin production in late 2022. The company plans to invest around USD 290 million in this facility over the next few years. Even with the adjustments and increased manufacturing capacity, Ball Corporation anticipated that the demand would continue to outstrip supply well into 2023.

- The rise in consumer awareness concerning the application of non-carcinogenic materials in packaging and increased demand for lightweight packing is generating high growth prospects for the metal cans market. However, metal cans are challenging to use due to the replacement possibility of polymer-based packaging materials, including polyethylene and polyethylene terephthalate (PET).

- In response to the COVID-19 pandemic's impact on demand, European steelmakers have swiftly reduced supply, with first-quarter production falling 10% yearly. Also, the non-ferrous metals industry is a crucial supplier of essential value chains, including food packaging. COVID-19 is causing significant and growing economic impacts on the European non-ferrous metals sector, driven by substantial demand reduction in key-value chains, supply disruptions, and transport difficulties.

Metal Cans Market Trends

Canned Food Consumption to Drive the Market Growth

- The changing lifestyles at a global level are resulting in consumers opting for easy-to-cook food. The younger population and individually living consumers are consuming more canned food. These users have less time and are budget restrained, thus, opting for products with lower costs and higher convenience.

- Many regular consumers of canned foods choose the products due to the convenience offered and lower cost of the products. Canned foods are more convenient to consume and require less energy and time to cook. Most canned foods take 40% less time to prepare than regular meals.

- Also, the demand for plant-based foods has significantly increased in the market post-pandemic. Vietnam's vegetarian food exporters are exploring ample opportunities as the UK is the primary market for Vietnam for its plant-based products. For instance, in August 2022, Dong Thap Province-based Binh Loan vegetarian food factory exported two tonnes of canned vegetarian food to the UK with the support of London, the biggest importer of Vietnamese goods in the UK.

- The expansion of modern convenience stores and supermarkets across the country has geared up, which will likely add growth to the market studied. For instance, in July 2022, WinCommerce, a retail giant, plans to open hundreds of new supermarkets and convenience stores in Vietnam by the end of the year to cater to the increased demand for convenience food products and to accelerate the expansion of its market share in the country.

- Also, in October 2021, Ball Metalpack, a North American manufacturer of steel cans for food and household products, added a new two-piece food cans production line at its Milwaukee manufacturing plant. The fresh, high-speed two-piece food can production line will support the production of millions of food cans per year and allow Ball Metalpack to meet growing demand from customers in the food and nutrition industries. It is the second high-speed two-piece production line at the Milwaukee plant, enabling it to have a quicker ramp-up time and a lower total cost structure. Ball Metalpack has four high-speed two-piece cans across its eight North American plants.

- Additionally, according to StatCan, there has been a decline in fresh and processed fruit and vegetable availability over the past ten years. Therefore people are shifting to canned food.

- The third-largest living expenditure is food. Canned food is frequently less expensive than fresh or frozen food, costing approximately half as much as frozen and a fifth as much as frozen fresh. Also, the population of Canada's growth outpaced these increases, yielding lower per capita availability of canned food. For instance, according to StatCan, the baked and canned beans volume available for consumption per person in Canada has declined from 1.13 kg in 2013 to 0.92 kg in 2021.

North America to Hold a Significant Share in the Market

- North America is anticipated to positively influence the demand for metal cans throughout the forecast period due to the growing demand for different healthy beverages, carbonated soft drinks, health drinks, and sucralose juices. Additionally, several significant players impact the business's development through extensive promotional efforts and new research.

- The food and retail industries are the primary factors influencing the demand for products in the United States. The country has more grocery shops and superstores than ever before, and the expansion of the country's food and retail industries is primarily due to the rise in the number of smaller homes. Consequently, it is driving demand for smaller packing units.

- Because of the way of life in the United States, there is a greater need for metal cans. People choose wholesome food that is ready to eat and can make it quickly since they have hectic schedules that leave them with little time for cooking. By offering easy packaging and foods that are ready to use, canned food accomplishes this goal. Because they can keep food fresh and high-quality for an extended period, metal cans will boost the market growth.

- Additionally, players in the region are focusing on vertical and horizontal integration. For instance, in November 2021, Ardagh Metal Packaging (AMP), a subsidiary of Ardagh Group, acquired Canada-based digital printed cans provider Hart Print. Hart Print was established in 2018 and is based in Quebec, offering flexible digital printing solutions to customers serving the beverage market. Hart Print claims to be the first company to provide digitally printed cans in the North-American market.

Metal Cans Industry Overview

The metal cans market is moderately fragmented, owing to the presence of various global and local industry players. Vendors in this market participate based on product portfolio, differentiation, and pricing. Key players in the market are SKS Bottle & Packaging, Inc., Silgan Containers LLC, Ball Corporation, etc.

In March 2022, the German tinplate manufacturer ThyssenKrupp Rasselstein had the world's first food can made of CO2-reduced blue mint Steel, in collaboration with the Swiss companies Hoffmann Neopac and Ricola, the latter of which will sell its herbal drops in the cans.

In January 2022, Ardagh Metal Packaging Europe launched HIGHEND, a new addition to its customization range, which offers customers brand-enhancing creative opportunities. The technology allows high-quality decoration in CMYK colors on the entire shell surface, meaning brands can highlight, customize and differentiate their cans with maximum visual impact.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Recyclability of the Packaging Due to Less Usage of Energy

- 4.2.2 Increasing Consumption of both Alcoholic and Non-Alcoholic Beverages

- 4.3 Market Restraints

- 4.3.1 Presence of Alternate Packaging Solutions as Polyethylene Terephthalate

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Aluminum

- 5.1.2 Steel

- 5.2 By Can Type

- 5.2.1 Food

- 5.2.2 Beverage

- 5.2.3 Cosmetics and Personal Care

- 5.2.4 Pharmaceuticals

- 5.2.5 Paint

- 5.2.6 Other End user Industry

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.3.5 Australia

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE INTELLIGENCE

- 6.1 Company Profiles

- 6.1.1 Ball Corporation

- 6.1.2 Ardagh Group

- 6.1.3 Mauser Packaging Solutions

- 6.1.4 Silgan Containers LLC

- 6.1.5 Crown Holdings Inc.

- 6.1.6 DS Containers Inc.

- 6.1.7 CCL Container Inc.

- 6.1.8 Toyo Seikan Group Holdings Ltd

- 6.1.9 Pacific Can China Holdings Limited

- 6.1.10 Universal Can Corporation

- 6.1.11 CPMC HOLDINGS Limited (COFCO Group)

- 6.1.12 Showa Denko KK

- 6.1.13 Independent Can Company

- 6.1.14 Hindustan Tin Works Ltd

- 6.1.15 Saudi Arabian Packaging Industry WLL (SAPIN)