|

市场调查报告书

商品编码

1443999

列印标籤 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

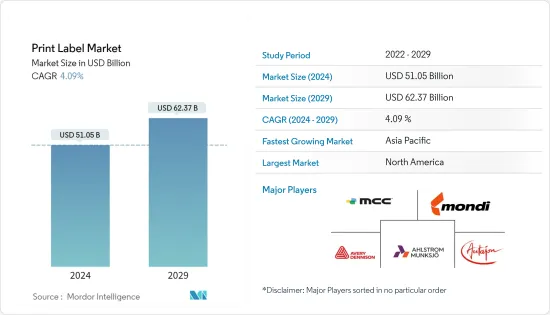

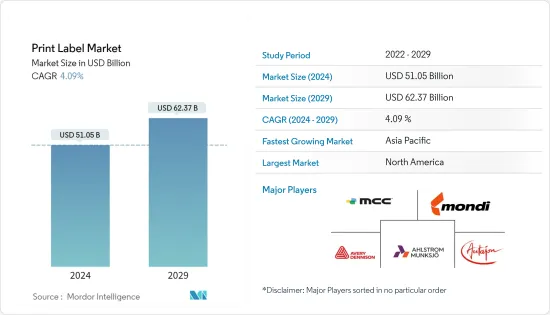

列印标籤市场规模预计到 2024 年为 510.5 亿美元,预计到 2029 年将达到 623.7 亿美元,在预测期内(2024-2029 年)CAGR为 4.09%。

随着 SKU 数量的不断增加、批量生产产品的平均工作长度和生命週期的缩短以及标籤上监管内容的增加,列印标籤客户对更具吸引力的品牌的需求不断增加。此外,对製成品的需求不断增加以及人们可支配收入的激增预计也将在预测期内推动列印标籤市场。

主要亮点

- Nilpeter、Xeikon 和 Bobst Firenze 等许多组织都认为数位印刷标籤适合满足市场需求,并且比传统印刷技术具有更多优势。

- 数位技术满足了各个最终用户产业在製作有吸引力的标籤设计以鼓励潜在消费者购买方面的多重要求。将数位技术与现有标籤印刷技术相结合预计将为所有小型和大型行业带来巨大变化,从而改善整体市场。然而,标籤环境法规阻碍了列印标籤市场的成长。

- 标籤应用问题主要是由环境条件引起的,即温度和湿度。仅在干燥、室温状态下贴上标籤才能保存它们。然而,在冬季、夏季和冷藏库中,有时可以避免极端温度或潮湿。

- 市场参与者也致力于加强他们的销售和分销管道。赛康在上海开设了创新中心,旨在支持不断增长的中国需求。该设施预计将使参观者和客户能够测试各种应用程式和选项,以实现新的收入来源和业务成长。多米诺继续发展其数位印刷业务并对其资源进行投资,在北美地区任命了几名新员工担任服务和支援职位。

- 这场流行病为印刷标籤公司带来了两个主要挑战:生产力提高和远端客户支援。疫情初期復苏期间的稳定需求给标籤公司的产能带来了巨大压力,凸显了产品生命週期各个阶段对自动化的需求。

列印标籤市场趋势

食品业将在预测期内创造大量需求

- 预计食品业在预测期内将占据重要的印刷标籤市场。消费者现在更了解他们所消费的食物的成分。人们越来越重视标籤上显示的产品材料,因此製造商选择更知名的品牌。

- 此外,对包装食品不断增长的需求也影响了该市场的成长,因为它确保了食品品质、安全性和较长的保质期。印度工商联合会 (FICCI) 表示,由于人均收入增加、城市化和女性工作时间增加,包装食品的支出正在增加(处于转折点)。

- 随着全球经济的进步,超市和便利商店等现代零售贸易网点的渗透率不断提高,它们可以在几个新兴市场销售更广泛的冷冻食品。根据经济合作暨发展组织(OECD)的数据,冷冻和包装食品的影响急剧增加。德国个人化包装食品的销售量成长了 56%。

- 根据 Label Insight 和食品行销研究所的数据,86% 的购物者在杂货店购物时心智透明,对提供完整、易于理解的成分资讯的食品製造商和零售商有更高的信任感。

亚太地区预计将占据主要份额

- 由于企业的兴趣日益浓厚,中国已成为亚太地区最大的经济体。中国是全球成长最快的经济体之一,由于人口、生活水平和人均收入的不断增长,几乎所有的最终用户产业都在成长。

- 阿里巴巴等电子商务巨头在中国的崛起预计将在预测期内推动印表机标籤市场。例如,在阿里巴巴双11购物节期间,中国消费者收到了近19亿个包裹。

- 该地区电子商务产业的成长是预计在预测期内推动列印标籤采用的重要因素之一。例如,据印度投资局称,印度电子商务市场的CAGR也将达到 30%,到 2026 年商品总价值将达到 2000 亿美元,市场渗透率为 12%。目前2%。

- 根据澳洲后电商产业报告,去年消费者零售总额达3,102.9亿美元,较前一年成长9.7%。此外,参与度的提高导致线上购物年增 57%,消费者线上消费额达到创纪录的 504.6 亿美元,占零售总额的 16.3%,预计到明年该国将见证这一数字。

- 此外,去年3月,着名标籤公司之一的Multi-Color Corporation宣布收购澳洲和纽西兰模内标籤(IML)解决方案供应商Herrods,该公司总部位于澳洲墨尔本。 Herrods 还投资扩大其业务范围并满足不断增长的需求。该公司还表示,额外的产能将帮助两家公司更好地服务澳洲和纽西兰的新旧客户。

列印标籤行业概况

列印标籤市场竞争激烈,由几家主要参与者组成,例如 Multi-Color Corporation、Mondi Group、Avery Dennison Corporation、Ahlstrom-Munksjo Oyj 和 Autajon Group。市场高度分散。许多公司透过推出新产品或建立策略合作伙伴关係或收购来扩大其市场份额。

- 2021 年 10 月 - Resource Label Group LLC 宣布收购密苏里州尼克萨的 Ample Labels。随着 Ample Labels 的加入,Resource Label 将在北美拥有 20 个製造基地,并透过四个基地扩大其在中西部的足迹,为其多元化的客户群提供服务。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 产业价值链分析

- COVID-19 对市场的影响评估

第 5 章:市场动态

- 市场驱动因素

- 数位印刷技术的演变

- 更重视发展中经济体的製造业

- 市场挑战

- 缺乏能够承受恶劣气候条件的产品

第 6 章:市场细分

- 按印刷工艺

- 平版印刷

- 凹版印刷

- 柔版印刷

- 萤幕

- 凸版印刷

- 电子照相术

- 喷墨

- 按标籤格式

- 湿胶标籤

- 压力标籤

- 无底纸标籤

- 多部分追踪标籤

- 模内标籤

- 收缩和拉伸套管

- 按最终用户产业

- 食物

- 饮料

- 卫生保健

- 化妆品

- 家庭主妇

- 工业(汽车、工业化学品、消费品和非耐用消费品)

- 后勤

- 其他最终用户产业

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 波兰

- 荷兰人

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 北美洲

第 7 章:竞争格局

- 公司简介

- Multi-Color Corporation

- Mondi Group

- Avery Dennison Corporation

- Ahlstrom-Munksjo Oyj

- Autajon Group

- Fort Dearborn Company

- CCL Industries

- Multi Packaging Solutions (WestRock Company)

- Clondalkin Group

- Cenveo Corporation

- Brady Corporation

- Fuji Seal International Inc.

- Constantia Flexibles Group GmbH

- RR Donnelley & Sons Company

- 3M Company

- Taylor Corporation

- Huhtamaki OYJ

- Taghleef Industries Inc.

- Ravenwood Packaging

- Sato America

- Coveris

- Fedrigoni Self-Adhesives (Fedrigoni Group)

- Epac holdings LLC

- Neenah Inc.

第 8 章:投资分析

第 9 章:市场的未来前景

The Print Label Market size is estimated at USD 51.05 billion in 2024, and is expected to reach USD 62.37 billion by 2029, growing at a CAGR of 4.09% during the forecast period (2024-2029).

With a growing number of SKUs, a reduction in average job lengths and life cycles for mass-produced products, and an increase in the regulatory content on the label, there is an increasing demand for more attractive brands from print label customers. Moreover, increasing demand for manufactured goods and an upsurge in the disposable income of people are also expected to drive the print label market during the forecast period.

Key Highlights

- Many organizations like Nilpeter, Xeikon, and Bobst Firenze, among others, believe that digitally printed labels are suited to meet the market's demands and have an added advantage over traditional printing technologies.

- Digital technology has met the multiple requirements of various end-user industries in making attractive label designs to encourage potential consumers to make purchases. Integrating digital technology with the existing label printing technique is expected to bring a huge change to all the small-scale and large-scale sectors, improving the overall market. However, environmental regulations for labeling hinder the growth of the print label market.

- Label application problems are caused mainly by environmental conditions, namely temperature and humidity. Applying the labels only in dry, room-temperature states can be preserved them. However, avoiding extreme temperatures or moisture is sometimes possible in winter, summer, and cold warehouses.

- The players in the market are also focusing on strengthening their sales and distribution channels. Xeikon opened an innovation center in Shanghai designed to support the expanding Chinese needs. The facility is expected to enable visitors and customers to test various applications and options for new revenue streams and business growth. Domino continues to grow and invest in resources for its digital printing business, with the appointments of several new hires in service and support roles within North America.

- The pandemic presented two primary challenges for print label companies: productivity improvement and remote customer support. The stable demand during the initial recovery from the pandemic created immense pressure on the labeling companies' production capacity, highlighting the need for automation at various product life cycle stages.

Print Label Market Trends

Food Industry to Create Significant Demand During Forecast Period

- The food industry is expected to account for a significant print label market during the forecast period. Consumers are now more aware of the content of the food they consume. There has been more emphasis on the materials of the products displayed on the label, due to which manufacturers are opting for more prominent brands.

- Moreover, the growing demand for packaged food is also influencing the growth of this market as it ensures food quality, safety, and long shelf life. According to the Federation of Indian Chambers of Commerce & Industry (FICCI), the expenditure on packaged foods is increasing (at an inflection point) due to increased per capita income, urbanization, and working hours for women.

- As the global economies advance, there is greater penetration of modern retail trade outlets, such as supermarkets and convenience stores, which can carry a broader range of frozen food products in several emerging markets. According to the Organisation for Economic Co-operation and Development (OECD), the effects of freezing and packaged foods increased dramatically. The sales of personalized packed food were 56% higher in Germany.

- According to Label Insight and the Food Marketing Institute, 86% of shoppers have transparency on their minds when grocery shopping and would feel a higher sense of trust for food manufacturers and retailers that provide complete, easy-to-understand ingredient information.

Asia Pacific is Expected to Hold a Major Share

- China is the largest economy in the Asia-Pacific region due to the increasing interest of companies. China is one of the fastest-growing economies globally, and almost all the end-user industries have been growing due to the rising population, living standards, and per capita income.

- The rise of e-commerce giants, such as Alibaba, in China is expected to drive the print labels market over the forecast period. For instance, during Alibaba's Double 11 shopping festival, Chinese consumers received nearly 1.9 billion packages.

- The growth of the e-commerce industry in the region is one of the significant factors that is expected to fuel the adoption of print labels over the forecast period. For instance, according to Invest India, the e-commerce market in India is also set to witness a CAGR of 30% for the gross merchandise value to reach USD 200 billion by 2026 and have a market penetration of 12%, as compared to the current 2%.

- According to the Australia post-e-commerce industry report last year, consumers spent USD 310.29 billion on total retail sales, up by 9.7% compared to the previous year. Also, an increased engagement resulted in online purchases growth by 57% Y-O-Y, and consumers spent a record USD 50.46 billion online, which was 16.3% of total retail sales, a figure the country expected to witness by next year.

- Moreover, in March last year, Multi-Color Corporation, one of the prominent label companies, announced the acquisition of Melbourne, Australia-based Herrods, a provider of in-mold label (IML) solutions in Australia and New Zealand. Herrods was also investing in expanding its footprint and satisfying increased demand. The company also stated that the additional capacity would help both the companies to better serve new and existing customers in Australia and New Zealand.

Print Label Industry Overview

The print label market is highly competitive and consists of several major players such as, Multi-Color Corporation, Mondi Group, Avery Dennison Corporation, Ahlstrom-Munksjo Oyj, and Autajon Group. The market is highly fragmented. Many companies are increasing their market presence by introducing new products or entering into strategic partnerships or acquisitions.

- October 2021 - The Resource Label Group LLC announced the acquisition of Ample Labels in Nixa, Missouri. With the addition of Ample Labels, Resource Label will have twenty manufacturing locations in North America and expand its footprint in the Midwest with four locations to serve its diverse customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Digital Print Technology

- 5.1.2 Increased Focus toward Manufacturing in the Developing Economies

- 5.2 Market Challenges

- 5.2.1 Lack of Products with Ability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Print Process

- 6.1.1 Offset lithography

- 6.1.2 Gravure

- 6.1.3 Flexography

- 6.1.4 Screen

- 6.1.5 Letterpress

- 6.1.6 Electrophotography

- 6.1.7 Inkjet

- 6.2 By Label Format

- 6.2.1 Wet-glue labels

- 6.2.2 Pressure-sensitive labels

- 6.2.3 Linerless labels

- 6.2.4 Multi-part tracking labels

- 6.2.5 In-mold labels

- 6.2.6 Shrink and Stretch Sleeves

- 6.3 By End-user Industries

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Cosmetics

- 6.3.5 Househlod

- 6.3.6 Industrial (Automotive, Industrial Chemicals, Consumer and NonConsumer Durables)

- 6.3.7 Logistics

- 6.3.8 Other End-User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.2.6 Poland

- 6.4.2.7 The Netherlands

- 6.4.2.8 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 South Korea

- 6.4.3.6 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Multi-Color Corporation

- 7.1.2 Mondi Group

- 7.1.3 Avery Dennison Corporation

- 7.1.4 Ahlstrom-Munksjo Oyj

- 7.1.5 Autajon Group

- 7.1.6 Fort Dearborn Company

- 7.1.7 CCL Industries

- 7.1.8 Multi Packaging Solutions (WestRock Company)

- 7.1.9 Clondalkin Group

- 7.1.10 Cenveo Corporation

- 7.1.11 Brady Corporation

- 7.1.12 Fuji Seal International Inc.

- 7.1.13 Constantia Flexibles Group GmbH

- 7.1.14 R.R. Donnelley & Sons Company

- 7.1.15 3M Company

- 7.1.16 Taylor Corporation

- 7.1.17 Huhtamaki OYJ

- 7.1.18 Taghleef Industries Inc.

- 7.1.19 Ravenwood Packaging

- 7.1.20 Sato America

- 7.1.21 Coveris

- 7.1.22 Fedrigoni Self-Adhesives (Fedrigoni Group)

- 7.1.23 Epac holdings LLC

- 7.1.24 Neenah Inc.