|

市场调查报告书

商品编码

1686278

能源领域的巨量资料分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Big Data Analytics In Energy Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

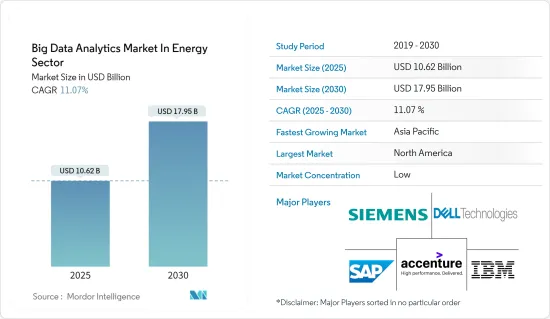

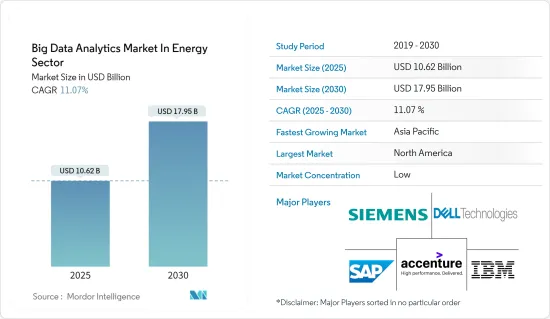

能源领域的巨量资料分析市场预计将从 2025 年的 106.2 亿美元成长到 2030 年的 179.5 亿美元,预测期间(2025-2030 年)的复合年增长率为 11.07%。

巨量资料解决方案可协助石油和天然气公司收集和处理所需的资料,以提高储存生产效率。各种井下感测器用于采集资料(温度、声学、压力等)。例如,公司可以使用巨量资料分析来建立储存管理系统,提供有关储存压力、温度、流量和声学变化的快速、可操作的资讯。这使得公司能够提高盈利,同时增强对营运的控制。

主要亮点

- 目前,整个进程由能源部门推动和支持。每个企业都需要比以往更多的能源,并且他们希望以合适的价格获得能源,而巨量资料和分析的进步正在使这成为现实。巨量资料使公司能够收集、储存和分析大量资讯(Terabyte甚至Petabyte)。多年来,电力和能源产业一直在处理巨量资料,每天都要处理大量资料。

- 与每月提供资料的传统电錶不同,智慧电錶可以提供精确到分钟的更详细读数,从而产生重要资料并增加收集的资料量。随着感测器、无线传输、网路通讯、云端处理技术的应用日益广泛,资料正从需求方和供给方不断收集。

- 油价波动导致能源相关计划的支出增加,对巨量资料分析产生了巨大的需求。对高品质资讯的需求日益增长,预计这将推动市场成长。

- 在当前情况下,数位技能和数位思维的短缺,加上能够有效处理非结构化资料分析的熟练专业人员和劳动力的短缺,是阻碍市场成长的因素之一。

- 能源消耗直接受到GDP成长、工业生产和消费者支出等宏观经济变数的影响。能源消耗通常随着製造业、运输业和住宅等多个领域的经济成长而增加。能源产业越来越需要先进的分析解决方案来优化与生产、分配和消费相关的流程。例如,根据世界银行估计,2023年北美的GDP为32.32兆美元,预计2023-24年将成长1.5%,这预计将导致企业活动和能源领域对巨量资料分析的投资增加。

能源领域的巨量资料分析市场趋势

电网营运应用领域预计将占据相当大的市场占有率

- 世界各地对能源的需求正在增加。根据国际能源总署 (IEA) 的数据,预计 2005 年至 2030 年间能源需求将增加 55%,从 114 亿吨油当量增至 177 亿吨,全球能源消费量预计在 2050 年将达到 886.3 兆英热单位。随着太阳能等可再生能源输入电网,公用事业公司可以使用需求响应分析来决定何时在高峰时段释放这些能源。

- 资料分析在现代工业系统中发挥着至关重要的作用。电网面临传统石化燃料枯竭的问题,迫使电力系统透过脱氢处理减少二氧化碳排放。智慧电网和超级电网是加快电气化步伐、提高再生能源来源渗透率的有效解决方案。

- 电力分配系统中使用的传统电錶仅产生少量资料可以手动收集和分析以用于计费目的。从通讯智慧电网以不同时间分辨率收集的大量资料需要高级资料分析来提取收费和电网健康状况的关键资讯。例如,高解析度的用户消费资料还可用于需求预测、客户行为分析和能源生产优化。

- 智慧电网巨量资料分析有可能改变电力产业。但要最大限度地发挥其价值,就需要适当地利用它。智慧电网分析可分为后勤部门分析(特定功能,如监督并联型、负载预测和可靠性报告)和分散式分析(来自仪表、感测器和其他设备的资料分析)。

- 基于先进计量基础设施的资料分析的预测性维护和故障检测对于电力系统的安全变得越来越重要。随着这些解决方案融入他们的组织中,预计早期采用者将会利用这些解决方案。 GE 的新分析技术正在使电网更有效率。该公司还推出了一系列新的预测分析产品,利用来自输电和配电网的资料,帮助公用事业公司在更多分散式资产引入电网时实现更高的营运效率。

预计北美将占据较大的市场占有率

- 北美一直是巨量资料分析应用领域的领先创新者和先驱之一。巨量资料巨量资料分析表现出巨大的需求,为市场成长提供了有利可图的机会。

- 与加拿大相比,美国在北美地区需求成长中发挥关键作用。石油和天然气、精製和发电行业的需求尤其增加。大多数美国人认为太阳能和风能是环保能源来源。约65%的人认为风能比大多数其他能源来源对环境更有利。

- 石油和天然气公司正在从应用预测性维护解决方案中受益。基于物联网的预测性维护使石油和燃气公司能够识别即将发生的故障并增加关键资产的产量。这就是为什么雪佛龙等公司采用物联网发展来部署预测性维护解决方案来减轻管道腐蚀和损坏的原因。该解决方案使用安装在整个管道中的感测器来测量 pH 值、CO2/H2S 水溶液含量、气体洩漏以及管道内径和厚度。该解决方案收集即时感测器资料并将其传递到云端进行评估、分析和预测。

- 该地区在智慧电网技术应用方面处于领先地位。该地区能源和公用事业领域的许多公司已经全面采用或正在采用巨量资料分析。在美国市场,许多大型投资者拥有的公用事业公司正在向其客户推出智慧电錶。根据美国能源资讯署统计,美国原计划在2022年终安装1.19亿台智慧电錶,但到2023年终将安装1.28亿台智慧电錶。

- 巨量资料被广泛用于准确预测该地区的天气变数。使用计算智能技术观察不同的资料来源和模型并进行即时分析。最近,Bazefield 作为一个市场领先的可再生能源监测和分析平台,为风能、太阳能、水力发电、生物质能、电池储存和其他可再生技术来源提供现成的支持,透过将基于黄金标准机器学习的太阳能高级分析套件 EnSight 整合到 Bazefield 作为单一平台,增强了其太阳能能力。

能源产业巨量资料分析概述

由于全球参与者和中小型企业的存在,能源领域巨量资料分析市场高度分散。市场的主要企业包括 IBM 公司、西门子股份公司、SAP SE、戴尔科技公司和埃森哲公司。市场参与者正在采取联盟和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 11 月-西门子与为关键基础设施公司提供资产规划和分析软体的加拿大公司 Copperleaf 合作,以扩大其现有的电网软体合作伙伴生态系统。此策略伙伴关係关係旨在优化输电系统营运商(TSO)和配电系统营运商(DSO)的投资和技术电网规划。此次伙伴关係将西门子的电网规划、营运和维护软体与铜缆的资产管理能力结合,带来丰富的电力系统和电网控制专业知识。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估宏观经济趋势的影响

第五章 市场动态

- 市场驱动因素

- 大量资料涌入

- 原油价格波动

- 市场限制

- 技术纯熟劳工短缺

第六章 市场细分

- 按应用

- 电网营运

- 智慧电錶

- 资产和劳动力管理

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- Siemens AG

- SAP SE

- Dell Technologies Inc.

- Accenture PLC

- Infosys Limited

- Intel Corporation

- Microsoft Corporation

- Palantir Technologies Inc.

- Enel X Italia Srl(Enel SpA)

第八章投资分析

第九章:市场的未来

The Big Data Analytics Market In Energy is expected to grow from USD 10.62 billion in 2025 to USD 17.95 billion by 2030, at a CAGR of 11.07% during the forecast period (2025-2030).

Big data solutions aid in collecting and processing data required by oil and gas firms to improve reservoir production efficiency. Various downhole sensors are used to obtain the data (temperature, acoustic, pressure, etc.). Companies, for example, can use big data analytics to create reservoir management systems that provide fast and actionable information about changes in reservoir pressure, temperature, flow, and acoustics. This allows companies to gain greater control over their operations while enhancing profitability.

Key Highlights

- Every process currently is driven and supported by the energy sector. Every entity requires more energy than ever before and wants it at a reasonable price, and the advancement of big data and analytics has made it a real possibility. Big data enables enterprises to collect, store, and analyze massive amounts of information (terabytes and petabytes). For years, the power and energy industries have worked with big data and routinely processed large amounts of data.

- Unlike conventional electricity meters, which provide data every month, smart meters can give readings on a minute basis that are on a more granular level, causing considerable data generation and resulting in a volumetric increase in data gathered. Data is being collected from both the demand and supply side, owing to the increasing application of sensors, wireless transmission, network communication, and cloud computing technologies.

- The volatility in the oil prices leads to high expenditure on energy-related projects, which creates a major demand for big data analytics. The need for quality information is increasing, which is expected to boost the market's growth.

- In the current scenario, the lack of digital skills and digital mindsets aggravated by the lack of skilled professionals and workforce to handle the unstructured data effectively for analysis is one of the factors hindering the market growth.

- Energy consumption is directly impacted by macroeconomic variables such as GDP growth rates, industrial production, and consumer expenditure. Energy consumption generally rises with economic growth in several sectors, including manufacturing, transportation, and residential. To optimize the processes involved in production distribution and consumption, the energy sector needs increasingly sophisticated analytic solutions. For instance, according to a World Bank estimate, the North American GDP, which was USD 32.32 trillion in 2023, is predicted to increase by 1.5% in 2023-24, suggesting that corporate activity and possible big data analytics in energy sector investments are projected to flourish.

Big Data Analytics in Energy Sector Market Trends

Grid Operations Application Segment is Expected to Hold Significant Market Share

- The demand for energy across the world is rising. According to the International Energy Agency, between 2005 and 2030, energy needs are estimated to expand by 55%, with the demand rising from 11.4 billion metric tons of oil equivalent to 17.7 billion, and the forecasted global energy consumption will be 886.3 quadrillion British thermal units by 2050. With renewable energy sources, such as solar power, which contributes electricity to the power grid, utilities can use demand response analytics to determine the timings to release these power sources during peak demand.

- Data analytics possess a critical role in modern industrial systems. In the power grid, traditional fossil fuels face the problem of depletion, and de-carbonization demands the power system to reduce carbon emissions. Smart grid and super grid are effective solutions to accelerate the pace of electrification with high penetration of renewable energy sources.

- Traditional electricity meters used in distribution systems only produce a small amount of data that can be manually collected and analyzed for billing purposes. The huge volume of data collected from two-way communication smart grids at various time resolutions requires advanced data analytics to extract important information for billing information and the status of the electricity network. For instance, the high-resolution user consumption data can also be used for demand forecasting, customer behavior analysis, and energy generation optimization.

- Smart grid big data analytics can potentially transform the utility industry. However, it needs to be appropriately used to maximize its value. Smart grid analytics divided itself into back-office analytics (certain functions, like overseeing grid connectivity, load forecasting, and reliability reporting) and distributed analytics (analyzing data from meters, sensors, and other devices).

- Predictive maintenance and fault detection based on data analytics with advanced metering infrastructure are more crucial to the security of the power system. They are expected to be the solutions that are expected to be now utilized by the early adopters as the solutions have been integrated into their organization. GE's New Analytics Technologies is boosting grid efficiency. The company has also rolled out a new portfolio of predictive analytics that could allow utilities to use data from transmission and distribution networks to achieve better operational efficiency as more distributed assets are introduced to the grid.

North America is Expected to Hold Significant Market Share

- North America is one of the leading innovators and pioneers in the adoption of big data analytics. The region offers lucrative opportunities for market growth, exhibiting a massive demand for big data analytics in the energy sector owing to the strong foothold of big data analytics vendors.

- The United States plays a key role in proliferating the demand from the North American region compared to Canada. The country has increased demand, especially from oil and gas, refining, and power generation segments. The majority of Americans consider solar and wind power as good sources of energy for the environment. Around 65% of the population suggests that the environmental effect of wind turbine farms is better than that of most other sources.

- The oil and gas companies benefit from applying predictive maintenance solutions. IoT-based predictive maintenance enables oil and gas companies to identify possible failures and increase the production of highly critical assets. Thus, companies such as Chevron employed IoT development to roll out a predictive maintenance solution that helps mitigate corrosion and pipeline damage. The solution uses sensors installed across the pipeline to measure the pH, aqueous CO2/H2S content, and gaseous leakages along with the pipeline's internal diameter and thickness. The solution collects real-time sensor data and passes it to the cloud for evaluation, analysis, and prediction.

- The region has been at the forefront of adopting smart grid technology. A large number of companies operating in the energy utility sector in the region have either fully deployed big data analytics or are in the process of implementation. Many large investor-owned utilities in the US market are still in the process of rolling out smart meters for their customers. According to the US Energy Information Administration, 119 million smart meters were to be installed in the US by the end of 2022, whereas 128 million smart meter deployments were completed by the end of 2023.

- Big data is extensively being used for the accurate prediction of meteorological variables in the region. Disparate data sources and models are observed using computational intelligence techniques for real-time analysis. Recently, Bazefield, the market-leading renewable monitoring and analytics platform with off-the-shelf support for wind power, solar, hydro, biomass, battery storage, and other renewable technology sources, enhanced its solar capabilities by embedding the gold standard EnSight, machine learning-based solar advanced analytics package, into Bazefield as one single platform.

Big Data Analytics in Energy Sector Industry Overview

Big data analytics in the energy sector market is highly fragmented due to the presence of global players and small- and medium-sized enterprises. Some of the major players in the market are IBM Corporation, Siemens AG, SAP SE, Dell Technologies Inc., and Accenture PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Siemens partnered with Copperleaf, a Canadian-based provider of asset planning software and analytics software for critical infrastructure companies, to grow its existing ecosystem of grid software partners. The strategic partnership aims to optimize investment and technical grid planning for transmission system operators (TSOs) and distribution system operators (DSOs). The partnership will bring extensive power systems and grid control domain expertise, combining Siemens grid planning, operations, and maintenance software and Copperleaf's assets management capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/ Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 An Assessment of the Impact of Macroeconomics Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enormous Influx of Data

- 5.1.2 Volatility in the Oil Prices

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Labor

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Grid Operations

- 6.1.2 Smart Metering

- 6.1.3 Asset and Workforce Management

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Siemens AG

- 7.1.3 SAP SE

- 7.1.4 Dell Technologies Inc.

- 7.1.5 Accenture PLC

- 7.1.6 Infosys Limited

- 7.1.7 Intel Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Palantir Technologies Inc.

- 7.1.10 Enel X Italia Srl (Enel SpA)