|

市场调查报告书

商品编码

1444073

豪华包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Luxury Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

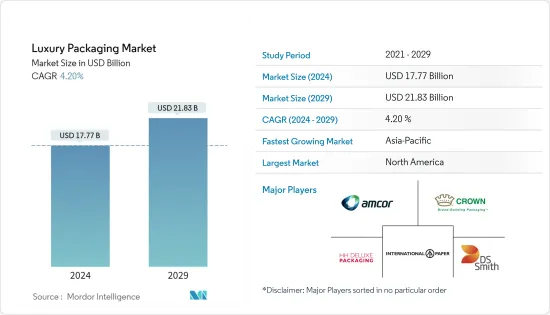

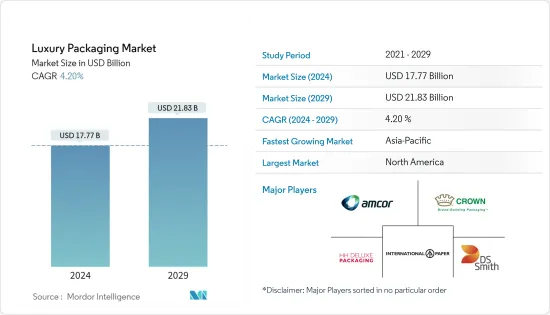

2024年豪华包装市场规模预计为177.7亿美元,预计到2029年将达到218.3亿美元,在预测期内(2024-2029年)复合年增长率为4.20%增长。

由于销售奢侈品的公司越来越多地使用独特且有吸引力的包装,预计奢侈品包装市场在预测期内将会成长。由于环保和永续奢侈品和高端产品的趋势,奢侈品包装市场预计在未来几年将成长更快。

主要亮点

- 奢侈品包装用于奢侈品的包装和装饰,市场不断扩大。这些功能增强了购物体验,因为领先的包装供应商现在可以获得各种优质材料和先进泡棉。此外,由于客户偏好的变化、消费意愿的增强以及各公司对生产方法设计和整体产品开发的日益关注,对优质包装的需求也在增加。

- 使用生物分解性和永续的包装材料是市场的主要驱动力。随着客户的环保意识越来越强,寻求更永续的生活方式选择,一些公司逐渐将永续发展放在首位。乔治阿玛尼的环保化妆品盒旨在提高消费者对环境永续性的认识。

- 国际市场对高品质包装的需求不断增加。儘管如此,某些问题限制了这种扩张,例如建立製造设施以进行包装业务所需的高初始资本支出。坚固且笨重的包装的使用也限制了全球奢侈品包装市场的发展。

- 与其他包装产业一样,奢侈品包装市场也受到了 COVID-19 传播的负面影响。疫情爆发扰乱了全球工商业活动,导致奢侈品包装市场低迷。时尚和服饰、消费品、家居用品和个人护理以及其他行业是奢侈品包装需求的主要来源。疫情期间的製造业停工、原材料短缺和供应链中断,导致许多最终用途行业的产量大幅减少,并减少了消费者对优质包装的需求。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

奢侈品包装市场的趋势

增加纸板等永续和生物分解性材料的使用可能会推动市场成长

- 纸板是最常用的包装材料之一。其他常用材料包括金属、玻璃、塑胶和木材。大多数这些材料都很容易采购,同时有助于在客户心中建立高品质的感觉。

- 纸和纸板在奢侈品和奢侈品包装领域一直占据着重要地位,因为它们能够作为完美图形和有吸引力的装饰的画布。贴合加工、独特涂层以及超级压纹和凹纹效果等特性进一步增强了纸张在豪华包装中的吸引力。是一种强度和光滑度优异的包装材料。

- 纸张一直是优质葡萄酒和烈酒领域中流行的标籤材料。精酿啤酒品牌使用纸质标籤来描述或宣传其产品的优质或手工价值。

- 此外,五星级香水公司 XOXO 的 Eau de Parfum 喷雾采用钻石闪光涂层、多色印花、烫金和压花。纸盒由不变钢 G 纸板製成,采用两种专色和深黑色墨水胶印,并具有 UV 光泽专色涂层。这些功能旨在鼓励客户购买您的产品。

- 例如,根据FAO(粮食及农业组织)的资料,去年31个国家的纸和纸板产能总合2.514亿吨。预计到2026年将增至257,143,000吨。

亚太地区将经历显着成长

- 由于可支配收入和个人奢侈品支出的增加,预计亚太地区在预测期内将显着增长。由于消费模式的变化和对奢侈品的需求不断增加,人口增长和大规模都市化导致人们越来越多地采用城市生活方式。例如,根据中国国家统计局的数据,去年约有64.7%的总人口居住在城市。

- 此外,永续包装正在推动亚太地区的市场,因为高端产品製造商正专注于使用生物分解性材料製造包装。领先的国际品牌正专注于环保的豪华包装解决方案,以维持其永续性目标。

- 推动市场成长的主要关键因素包括时尚和化妆品领域的大量产品发布。主要国际品牌正着眼于在中国和印度等新兴国家开设门市,这些国家的成长前景好坏参半。

- 此外,线上零售和旅游零售的渗透率不断提高,奢侈品包装的创新不断增加,都是推动该地区市场成长的因素之一。

- 中国正迅速成为全球最大的奢侈品消费国,也是越来越多知名的奢侈品牌瞄准的国家之一。中国消费者也想要易于使用、高品质的食品。中国网路零售业的激增预计将增加对优质包装解决方案的需求。

奢侈品包装产业概况

奢侈品包装市场较为分散,新参与企业正向新兴地区扩张。中产阶级收入的增加和基础设施发展的增长导致全球市场上运营的大型供应商数量增加。国际和区域参与者之间的竞争激烈且竞争不断加剧。主要企业包括Amcor Plc、HH Deluxe Packaging、DS Smith Plc等。

2022 年 7 月,Ardagh Metal Packaging 和优质伏特加製造商 Au Vodka 联手为这家英国公司屡获殊荣的蓝莓伏特加生产反光金金属容器。细长的 330 毫升罐子里有一个正方形的金,这是包含原子序数的典型元素週期表,以灼热的蓝色显示。文字简洁,与浓郁的金色形成鲜明对比。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间敌对的强度

- 评估 COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 更多地使用永续和生物分解性的材料,例如纸板

- 游客增加对旅游和零售连锁店的需求

- 市场限制因素

- 不愿意包装重型或散装物品

- 机器初始成本和运作成本高

- 俄乌战争对市场的影响

第六章市场区隔

- 材料

- 纸板

- 玻璃

- 金属

- 其他的

- 最终用户产业

- 化妆品/香水

- 糖果零食

- 手錶/珠宝

- 优质饮品

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- DS Smith Plc

- Crown Holdings, Inc.

- Amcor Plc

- WestRock Company

- Owens-Illinois Inc.

- International Paper Company

- Ardagh Group

- Delta Global

- GPA Global

- HH Deluxe Packaging

- Prestige Packaging Industries

- Pendragon Presentation Packaging

- Stolzle Glass Group

- Keenpac

- Elegant Packaging

- Lucas Luxury Packaging

- Luxpac Ltd.

- McLaren Packaging Ltd

- B Smith Packaging Ltd

第八章投资分析

第九章 市场未来展望

The Luxury Packaging Market size is estimated at USD 17.77 billion in 2024, and is expected to reach USD 21.83 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

The market for luxury packaging is projected to increase throughout the forecast period due to the growing usage of distinctive and appealing packaging by businesses selling luxury goods. In the coming years, the market for luxury packaging is likely to grow even faster due to the growing trend of eco-friendly and sustainable luxury goods and products.

Key Highlights

- The market is expanding due to the utilization of luxury packaging for high-end product packaging and decoration. Major package suppliers now have access to a wide range of premium materials and advanced forms since these features enhance the shopping experience. Further, the need for luxury packaging is driven by shifting customer preferences, a greater willingness to spend more, and increasing attention from different businesses to design production methods and overall product development.

- The lifestyle and cosmetics industries are seeing a rapid expansion of the cannabidiol, or CBD, packaging trend. As these brands go after prominent shops like Sephora and Neiman Marcus, the market for luxury goods manufactured from marijuana's non-psychoactive components is expanding. The demand for luxury packaging is increasing due to the considerations mentioned above.

- The use of biodegradable and sustainable packaging is a significant market driver. As customers become more environmentally conscious and demand more sustainable lifestyle options, several businesses steadily emphasize sustainable development above everything else. Giorgio Armani's eco-friendly cosmetics box aims to raise consumer awareness of environmental sustainability.

- The need for luxury packaging has been increasing in the international market. Still, specific issues limit this expansion, such as the expensive initial capital expenditure needed to set up a manufacturing facility to carry out package operations. Heavy-duty and bulky packaging usage also constrains the development of the luxury packaging market worldwide.

- The luxury packaging market was adversely impacted along with the rest of the packaging sector by the spread of COVID-19. Global industrial and commercial activity had been disrupted by this epidemic, which caused a slowdown in the market for luxury packaging. Fashion & clothing, consumer products, household & personal care, and other industries are the primary sources of the need for luxury packaging. Due to manufacturing halts, raw material shortages, and supply-chain disruptions during the pandemic, numerous end-use sectors' output significantly decreased, which decreased consumer demand for luxury packaging. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Luxury Packaging Market Trends

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard may Drive the Market Growth

- Paperboard is one of the most commonly used materials in packaging. Some of the other commonly used materials include metal, glass, plastic, and wood, among others. Most of these materials are easily sourced and, at the same time, help to establish a sense of premium quality in the minds of customers.

- Paper and paperboard have maintained a strong position in luxury and premium packaging with their ability to serve as the canvas for flawless graphics and attractive decoration. The features, such as laminations, unique coatings, and super embossing and debossing effects, make papers much more appealing in the packaging of luxury items. These packaging materials also provide superior strength and smoothness.

- Papers have always been popular label materials in the high-end wine and spirits segments. Craft beer brands use paper labels to describe or advertise the products' premium or handcrafted values.

- In addition, the five-star fragrance company XOXO's Eau de Parfum spray features diamond glitter coating, multi-color printing, foil stamping, and embossing. The carton is made from Invercote G paperboard and offset printed with two spot colors and dense black inks, as well as UV gloss spot coating.These features are meant to attract customers to purchase the product.

- For instance, 31 countries reported a combined production capacity of 251.4 million metric tons of paper and paperboard last year, according to FAO (Food and Agriculture Organization) data. By 2026, it is anticipated to increase to 257.143 million metric tons.

Asia Pacific to Witness a Significant Growth Rate

- The Asia-Pacific region is expected to grow substantially in the forecast period, owing to the increase in disposable income and consumer spending on luxury products. Large populations and massive urbanization have led to a rise in the adoption of urban lifestyles due to changing consumer patterns and the rising demand for luxurious products. For instance, according to the National Bureau of Statistics of China, about 64.7% of the total population lived in cities last year.

- Further, sustainable packaging is driving the market in the Asia-Pacific region, as the manufacturers of high-end products are focusing on producing packaging with the help of biodegradable materials. Major international brands focus on eco-friendly luxury packaging solutions to maintain sustainability goals.

- The primary vital factors driving the market's growth include massive product launches in the fashion and cosmetic sectors. The major international brands are eyeing emerging economies, such as China, India, etc., to set up their stores in these countries, as they pose various growth prospects.

- Also, the rise in penetration of online retail and travel retail, increasing innovations in technologies in luxury packaging, and others are among various other factors driving market growth in the region.

- China is one of the economies increasingly targeted by prominent luxury brands, as the country is fast becoming the world's largest consumer of luxury goods. Chinese consumers are also looking for easy-to-use and quality food products. A surge in online retailing in China is expected to drive the demand for luxury packaging solutions.

Luxury Packaging Industry Overview

The luxury packaging market is fragmented, and the new players are expanding their businesses into emerging regions. The number of leading vendors operating in the global market is increasing, owing to the increasing income of the middle class and the growing infrastructure developments. There is a high rate of competitive rivalry among international and regional players, intensifying the competition. Key players include Amcor Plc, HH Deluxe Packaging, DS Smith Plc, and more.

In October 2022, GPA Global partners with Ontario Teachers to execute its following-stage expansion goals. The Ontario Teachers' Pension Plan Board has acquired a co-control interest in the company from EQT Private Equity and several small shareholders.With net assets of USD 242.5 billion, Ontario Teachers is a significant global investor. According to GPA Global, the deal would enable them to extend their capabilities and explore both existing and new markets.

In July 2022, Ardagh Metal Packaging and Au Vodka, a luxury vodka maker, collaborated to produce a reflective, gold-colored metal container for the United Kingdom company's award-winning Blue Raspberry vodka. A typical periodic table, Au square, complete with its atomic number, is displayed in sizzling blue on the 330-ml slender can. It also has plain, minimal writing against the rich gold.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard

- 5.1.2 Demand for Travel and Retail Chains Due to Increase in Tourism

- 5.2 Market Restraints

- 5.2.1 Reluctance in Packaging Heavy and Bulk Products

- 5.2.2 High Initial and Operating Costs of Machineries

- 5.3 Impact of Russia-Ukraine War on the Market

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 Paperboard

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Other Material Types

- 6.2 End-User Industry

- 6.2.1 Cosmetics and Fragrances

- 6.2.2 Confectionery

- 6.2.3 Watches and Jewelry

- 6.2.4 Premium Beverages

- 6.2.5 Other End-User Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Russia

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 DS Smith Plc

- 7.1.2 Crown Holdings, Inc.

- 7.1.3 Amcor Plc

- 7.1.4 WestRock Company

- 7.1.5 Owens-Illinois Inc.

- 7.1.6 International Paper Company

- 7.1.7 Ardagh Group

- 7.1.8 Delta Global

- 7.1.9 GPA Global

- 7.1.10 HH Deluxe Packaging

- 7.1.11 Prestige Packaging Industries

- 7.1.12 Pendragon Presentation Packaging

- 7.1.13 Stolzle Glass Group

- 7.1.14 Keenpac

- 7.1.15 Elegant Packaging

- 7.1.16 Lucas Luxury Packaging

- 7.1.17 Luxpac Ltd.

- 7.1.18 McLaren Packaging Ltd

- 7.1.19 B Smith Packaging Ltd