|

市场调查报告书

商品编码

1444081

电子线控线控系统:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)X-by-wire System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

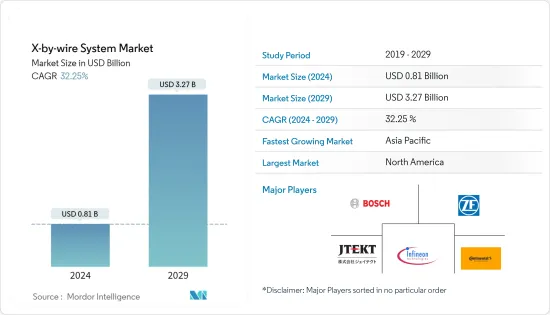

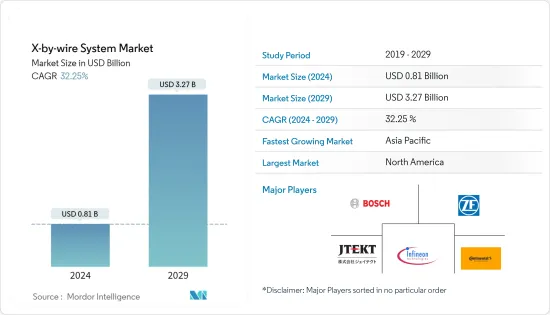

电子线控-by-Wire 系统的市场规模预计到 2024 年将达到 8.1 亿美元,在预测期内预计到 2029 年将达到 32.7 亿美元(2024 年至 2029 年复合年增长率将达到 32.25%)。

封锁期间,由于新型冠状病毒感染疾病(COVID-19)大流行,约 95% 的汽车相关企业被迫停工。在全球范围内,由于製造业活动暂停,封锁的影响是巨大且前所未有的。然而,随着经济活动的恢復和全球汽车产量的增加,市场在 2021 年开始恢復动力。

从长远来看,由于 ADAS(高级驾驶员电子线控系统)的出现和车辆自动化程度的提高,对汽车线控系统的需求预计将会增加。然而,目前这些系统在汽车市场的普及较低。随着汽车製造商专注于提高燃油效率和降低车辆排放水平,未来电子线控系统市场可能会扩大。

车辆系统与车辆的整合度不断提高,加上汽车产业的车辆电气化程度不断提高,预计也将推动市场的发展。自动驾驶、巡航控制、自动排檔变速箱、车道偏离警告系统和其他监控系统等先进功能在车辆中的使用越来越多,预计将增加对油门、悬吊等电子线控系统的需求。

电子线控系统在欧洲和北美已经成熟并广泛使用。在消费者购买力增加、改善安全措施的需求以及提高车辆燃油效率的需求的推动下,这些系统的使用在亚太地区也迅速增加。

中国、德国、美国和日本是这些线控系统的主要市场。预计墨西哥等发展中国家汽车製造商对这些技术的需求将快速成长,电子线控系统产量的增加就证明了这一点。

电子线控系统的市场趋势

线控油门系统预计将在预测期内主导市场

全球范围内电动车的采用率正在不断上升。随着人们对ADAS功能的认知度不断提高,以前只专注于高端豪华车的各大厂商纷纷进军入门级车型市场以获取客户。此类案例预计会增加车辆线控油门系统的要求。

线控油门越来越受欢迎,因为它比传统机械系统具有多种优势。消除机械连动绑定问题,提高燃油效率,实施模组化系统,并将 ECU 扭力管理与巡航、牵引力控制和稳定性控制整合。

包括奥迪、大陆集团、福特和博世在内的许多汽车製造商正在开发自动驾驶汽车,其中线控油门系统通过感测油门踏板输入并向电源逆变器模组发送命令来控制马达,从而发挥关键作用。专注于创意的商业化。

2021年11月,长城汽车推出了基于GEEP 4.0的智慧咖啡系统2.0的智慧底盘底盘。 GEEP 4.0是全新的电子电气架构,涉及线控转向、线传煞车五大核心底盘系统。整合线控、线传换檔、线控油门和线控悬吊。

随着自动驾驶汽车的发展和技术的发展,各国政府也采取必要的措施来维持市场需求。

从2020年开始,所有在美国生产的新车都将被要求配备自动煞车系统、车道偏离警告系统和停车辅助系统。预计此因素将推动线控油门系统市场的发展。

基于这些发展,线控油门市场预计将在预测期内呈现良好的成长。

北美可能在市场发展中发挥关键作用

预计北美在预测期内将占据最大的市场占有率。电动车,尤其是先进自动驾驶汽车的需求不断增长,预计将在预测期内推动市场成长。北美电子线控系统市场已经成熟,普及很高。

一些公司已经采取了伙伴关係、协作和其他策略来稳定其市场地位。

- 2021 年 3 月,Motional 宣布计划使用全电动现代 IONIQ 5 作为下一代机器人计程车的汽车平臺。透过此次合作,该公司将从 2023 年开始允许特定市场的消费者透过 Lyft 应用程式预订 Motional Robo 计程车。 Motional的IONIQ 5将配备4级自动驾驶功能,为线控转向系统创造机会。

- 2021 年 6 月,丰田行动基金会 (TMF)、能源系统网路 (ESN) 和印第安纳州经济发展公司 (IEDC) 与 MayMobility 合作,在印第安纳州中部推出免费自动驾驶接驳车服务。预计自动驾驶汽车未来将创造对电子线控系统的需求。

这些因素可能会增加北美对电子线控系统的需求。在消费者购买力增加、安全措施改进以及车辆燃油效率提高的需求的推动下,亚太地区电子线控系统的使用也显着增加。

电子线控系统产业概述

该市场高度整合,罗伯特博世有限公司和大陆集团等主要参与者占据了大部分市场份额。虽然一些主要企业专注于透过收购其他市场参与企业、与市场上其他公司形成策略联盟以及推出新的电子线控系统等来扩大自己的业务,但其他公司则制定不同的成长策略以获得竞争优势。超过其他公司。

- 2020年10月,采埃孚开始量产新一代AKC主动后轴转向系统。该系统可提供10度的后转向角,线控转向技术为远距电动车提供了灵活性。

- 2020年4月,英飞凌科技股份公司宣布收购赛普拉斯半导体公司。此次收购将使该公司能够提供全面的产品组合,将实体机械零件连接到数位世界,并旨在为电子线控系统让路。

该市场的主要企业包括罗伯特博世有限公司、采埃孚、捷太格特公司、英飞凌科技和大陆集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔(市场规模,十亿美元)

- 按类型

- 线控油门系统

- 线传煞车系统

- 线控转向系统

- 线控停车系统

- 线传换檔系统

- 按车型

- 小客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- Nissan Motor Corp.

- Groupe PSA

- Nexteer Automotive

- Infineon Technologies AG

- JTEKT Corporation

- ZF Friedrichshafen AG

- Orscheln Products LLC

- Tesla Inc.

- Audi AG

- Torc Robotics

- Lokar Performance Products

- Robert Bosch GmBH

- Continental AG

第七章市场机会与未来趋势

The X-by-wire System Market size is estimated at USD 0.81 billion in 2024, and is expected to reach USD 3.27 billion by 2029, growing at a CAGR of 32.25% during the forecast period (2024-2029).

During the lockdowns, the COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold. Globally, the repercussions of the lockdown have been immense and unprecedented due to the halt of manufacturing activities. However, the market started to regain momentum in 2021 as economic activities resumed and vehicle production increased globally.

Over the long term, the emergence of advanced driver assistance systems and the increasing levels of vehicle automation is expected to increase the demand for automotive x-by-wire systems. However, currently, these systems have low penetration rates in the automotive market. The focus of automobile manufacturers on increasing fuel efficiency and reducing the emission level of the vehicle is likely to boost the x-by-wire system market in the future.

Increased integration of vehicular systems in vehicles is also expected to boost the market, coupled with an increase in vehicle electrification in the automotive sector. Increased use of advanced features in vehicles, such as self-driving, cruise control, automatic transmission, lane departure warning systems, and other monitoring systems, is also anticipated to boost the demand for x-by-wire systems in terms of throttle, suspension, braking, and gear shift in the automotive market.

X-by-wire systems are well-established and widely used in Europe and North America. The usage of these systems is also increasing rapidly in Asia-Pacific due to increased consumer spending power, demand for improved safety measures, and the requirement for increased vehicle fuel economy.

China, Germany, the United States, and Japan are major markets for these by-wire systems. Developing countries, such as Mexico, are projected to witness a rapid demand for these technologies from automotive manufacturers, as seen by the increased manufacturing of x-by-wire systems.

X-by-wire Systems Market Trends

Throttle-by-wire System is Expected to Dominate the Market During the Forecast Period

The adoption rate of electric vehicles is increasing globally. With growing awareness about the ADAS features, key manufacturers that operated only in high-end luxury cars are now entering the entry-level models market to attract customers. Such instances are expected to boost the requirements for throttle-by-wire systems in vehicles.

Throttle-by-wire is gaining popularity due to several benefits over traditional mechanical systems, such as eliminating binding problems in mechanical linkages, improving fuel economy, deploying a modular system, and allowing the ECU to integrate torque management with cruise, traction control, and stability control.

Many automakers, including Audi, Continental, Ford, and Bosch, are focusing on commercializing the autonomous car idea where throttle-by-wire systems play a crucial role in controlling electric motors by sensing the accelerator pedal input and sending commands to the power inverter modules.

In November 2021, China's Great Wall Motors unveiled its intelligent chassis-by-wire based on Smart Coffee System 2.0 based on GEEP 4.0, a completely new electronic and electrical architecture where five core chassis systems related steer-by-wire, brake-by-wire, shift-by-wire, throttle-by-wire, and suspension-by-wire are integrated. It controls automotive motions in the principle of six degrees of freedom.

In line with the growth in autonomous cars and technological developments, governments are also taking necessary steps to maintain the demand in the market. For instance,

From 2020 onward, all newly manufactured cars in the United States should be installed with an automatic braking system, a lane departure warning system, and a parking assistance system. This factor is expected to fuel the market for throttle-by-wire systems.

Based on such developments, the throttle-by-wire segment of the market is expected to witness decent growth over the forecast period.

North America Likely to Play a Significant Role in Market Development

North America is anticipated to hold the largest market share during the forecast period. The rising demand for electric vehicles, especially advanced self-driving cars, is anticipated to boost the market's growth over the forecast period. The market for x-by-wire systems in North America is already well-established, with a high penetration rate.

Several companies are also adopting partnerships, collaborations, and other strategies to stabilize their position in the market.

- In March 2021, Motional announced its plans to use the all-electric Hyundai IONIQ 5 as the vehicle platform for its next-generation Robo taxi. Through its partnership, the company could allow consumers in select markets to book a Motional Robo taxi through the Lyft app starting in 2023. Motional's IONIQ 5 would be equipped with Level 4 autonomous driving capabilities, thus creating opportunities for steer-by-wire systems.

- In June 2021, Toyota Mobility Foundation (TMF), Energy Systems Network (ESN), and the Indiana Economic Development Corporation (IEDC) partnered with May Mobility to launch a free autonomous shuttle service in Central Indiana. Autonomous vehicles are expected to create demand for the x-by-wire system in the future.

Such factors are likely to boost the demand for x-by-wire systems in North America. The use of x-by-wire systems is also growing significantly in the Asian-Pacific region due to increased consumer purchasing power, preference for better safety measures, and the need for higher fuel efficiency in the vehicle.

X-by-wire Systems Industry Overview

The market is fairly consolidated, with the key major players, such as Robert Bosch GmbH and Continental AG, holding the majority share in the market. While some key players focus on expanding their presence by acquiring other market participants, forming strategic alliances with other players in the market, and launching new and advanced x-by-wire systems, others are developing various growth strategies to gain a competitive edge over other players.

- In October 2020, ZF launched a new next-generation AKC active rear-axle steering system for mass production. This system could offer a rear steering angle of 10 degrees, and the steer-by-wire technology offers agility for longer electric vehicles.

- In April 2020, Infineon Technologies AG announced the acquisition of Cypress Semiconductor Corporation. With this acquisition, the company could aim to offer a comprehensive portfolio for linking real mechanical parts with the digital world, making way for x-by-wire systems.

Some of the key players in the market are Robert Bosch GmbH, ZF, JTEKT Corp., Infineon Technologies, and Continental AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION ( Market Size in USD Billion)

- 5.1 By Type

- 5.1.1 Throttle-by-wire System

- 5.1.2 Brake-by-wire System

- 5.1.3 Steer-by-wire System

- 5.1.4 Park-by-wire System

- 5.1.5 Shift-by-wire System

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Nissan Motor Corp.

- 6.2.2 Groupe PSA

- 6.2.3 Nexteer Automotive

- 6.2.4 Infineon Technologies AG

- 6.2.5 JTEKT Corporation

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Orscheln Products LLC

- 6.2.8 Tesla Inc.

- 6.2.9 Audi AG

- 6.2.10 Torc Robotics

- 6.2.11 Lokar Performance Products

- 6.2.12 Robert Bosch GmBH

- 6.2.13 Continental AG