|

市场调查报告书

商品编码

1444166

农用拖拉机:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Agricultural Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

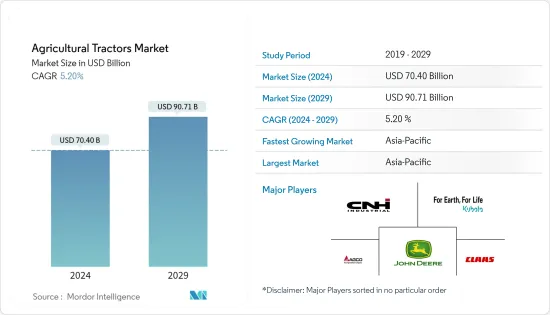

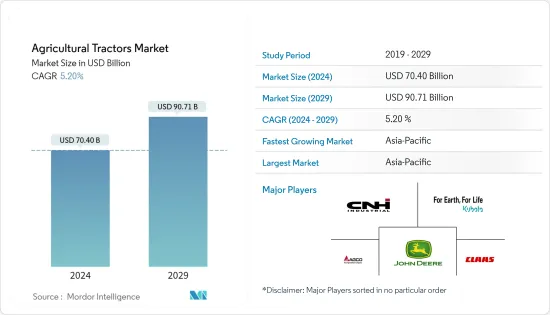

农用拖拉机市场规模预计2024年为704亿美元,预计到2029年将达到907.1亿美元,在预测期内(2024-2029年)复合年增长率为5.20%增长。

主要亮点

- 拖拉机是一种农业机械,用于执行耕地、耕作和种植水稻等农业任务。它也用于散布肥、清理灌木丛和其他活动。都市化和人口向都市区迁移显着增加了人事费用。农业劳动成本与生产成本成正比。机械化可以降低工人的薪水。劳动力工资上涨和农业劳动力短缺正在提高机械化率。

- 此外,政府为提高产量而增加对农业机械化的补贴也导致拖拉机数量的增加。此外,技术进步也与机械化程度的提高相匹配,导致农民对农业机械化好处的认识不断提高。

- 许多公司正在发布新型农用拖拉机,并能够透过更快的产品发布和进步来主导市场。几个主要市场参与者正在投入资金进行研发,以生产尖端设备并保持在市场上的强势地位。这一因素促进了拖拉机在市场上的销售。例如,迪尔公司在 2020 年推出了全新 8 系列拖拉机产品线,包括 8R轮圈拖拉机、8RT 2 履带拖拉机和业界首款固定架 4 履带拖拉机。这些新型拖拉机配备了最新的精密农业技术,让客户可以选择最适合工作的机器配置、选项和马力。另一方面,缺乏合适的技术纯熟劳工来操作专业现代拖拉机可能是拖拉机市场的一个限制。

农用拖拉机市场趋势

发展中市场农业机械化程度提高

- 精密农业和越来越多地采用农业技术来提高产量正在增加对拖拉机的需求。农业设备可以利用高精度定位系统(GPS和GNSS、自动转向系统、地理测绘、感测器、遥感探测等)和整合式电子通讯技术,使机器操作产生更好的效果。例如,迪尔公司为拖拉机和其他产品等农业机械提供 Precision AG 技术。该公司提供显示系统、用于播种和种植、收割的接收接收器以及整地和耕作设备。此类产品的推出对农用拖拉机市场的成长产生了重大影响。

- 促进农业机械广泛使用的农业培训计画的增加也促进了拖拉机行业的发展。该拖拉机的引擎排气量小于1500cc,占用空间更小,使用更灵活。易于自订有利于实验,因此,製造商更愿意在该领域尝试新的组件和技术,然后再转向高功率的组件和技术。低马力拖拉机在河流流域等鬆软土壤条件下运作良好。 40马力以下的拖拉机主要用于园艺。在新兴国家,由于农民可支配所得低、人事费用高,低马力拖拉机的需求量大。由于农地面积较小,农民更喜欢为耕作定制的小型拖拉机。此外,小型拖拉机减少燃料消费量有助于增强小型和边缘农民的能力。印度等新兴国家政府正透过补贴设备采购、支持前端代理商批量采购等方式推动农业机械化。

- 此外,新兴国家不断增长的需求促使市场主要企业创新新产品。例如,TAFE于2021年2月推出了全新的DYNATRACK系列。这是一款先进的拖拉机,旨在透过一台强大的拖拉机提供动态性能、先进的技术、无与伦比的实用性和多功能性。这些因素可能会在预测期内推动市场。

亚太地区主导市场

- 在亚太地区,中国、日本和印度在拖拉机销售方面处于领先地位。中国约60%的农业活动实现了机械化。根据中国国家统计局资料显示,大中型拖拉机正逐步被小型拖拉机取代。截至年终,全国大中型拖拉机保有量440万台。政府已将农业机械纳入「中国製造2025」宣传活动。该计划将使中国能够在国内生产大部分农业设备,并有望增加拖拉机在中国的销售量。

- 印度大多数人依赖农业为生。据印度品牌股权基金会称,印度总人口的 58% 是农民。因此,印度拖拉机市场庞大。印度农业部门对动物和人力的使用显着下降。相反,拖拉机和柴油引擎等石化燃料驱动的车辆正在被使用,导致传统农业过程向机械化程度的转变。

- 为了提高机械化水平,印度政府正在通过对各种设备提供补贴、支持前端代理商大规模采购等方式推动“平衡农业机械化”,有望壮大印度拖拉机市场。它一直。例如,印度政府为农业机械提供各种计划,例如购买拖拉机的贷款和补贴。此外,根据NABARD规范,拥有8英亩土地的农民可以以12.5%的利率获得为期9年的拖拉机贷款。因此,该地区政府计划的实施和全国拖拉机使用量的增加预计将在预测期内推动市场发展。

农用拖拉机产业概况

农用拖拉机市场整合,龙头企业占较大市场占有率。迪尔公司、久保田公司、CNH Industrial NV、AGCO 公司、CLAAS KGaA mbH 是市场的主要企业。新产品发布、合作和收购是全球市场领先公司采取的关键策略。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 来自替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按马力

- 小于40马力

- 40马力至99马力

- 100马力至150马力

- 151马力至200马力

- 201马力至270马力

- 271马力至350马力

- 超过350马力

- 按类型

- 果园拖拉机

- 中耕作物拖拉机

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 其他非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Claas KGaA mbH

- Deere &Company

- Mahindra &Mahindra Ltd

- CNH Industrial NV

- Kubota Corporation

- AGCO Corporation(Massey Ferguson Limited)

- Tractors and Farm Equipment Ltd

- Iseki &Co. Ltd

- Yanmar Holdings Co. Ltd

第七章市场机会与未来趋势

The Agricultural Tractors Market size is estimated at USD 70.40 billion in 2024, and is expected to reach USD 90.71 billion by 2029, growing at a CAGR of 5.20% during the forecast period (2024-2029).

Key Highlights

- Tractors are agriculture equipment that is used to perform farming operations such as plowing, tilling, and planting. They are also used for spreading fertilizers, clearing bushes, and other activities. The cost of labor has been increasing at significantly high rates due to the urbanization and migration of people to urban areas. The cost of farm labor is directly proportional to the cost of production. Mechanization can reduce labor wages. The increasing labor wages and the lack of farm labor have led to increasing rates of mechanization.

- Furthermore, the increased government support to raise farm mechanization for obtaining high yield by providing subsidies is helping to increase the number of tractors. Moreover, technological advancements are also catering to the increased mechanization and raising awareness among farmers about the benefits of farm mechanization.

- Numerous businesses have been releasing new agricultural tractors, allowing them to dominate the market with speedier product launches and advancements. Several major market players are spending on research and development in order to produce cutting-edge equipment and retain a strong market position. This factor drives the sales of tractors in the market. For instance, in 2020, Deere & Company launched a new 8 Family Tractor line-up that included 8R wheel tractors, 8RT two-track tractors, and the industry's first fixed-frame four-track tractors. These new tractors come equipped with the latest precision agriculture technology and allow customers to choose the machine configuration, options, and horsepower to best fit their operation. On the other hand, the lack of properly skilled labor for operating specialized and modern tractors may become a restraining factor for the tractor market.

Agricultural Tractors Market Trends

Increasing Farm Mechanization in Developing Markets

- Precision farming and the increasing adoption of farm technology to boost production are driving up demand for tractors. Agricultural equipment can use technology like high-precision positioning systems (such as GPS and GNSS, automated steering systems, geo-mapping, sensors, and remote sensing) and integrated electronic communication to produce superior results from machine operations. For instance, Deere & Company provides Precision AG technology for farm machinery like tractors and other items. The company provides display systems, receivers for seeding and planting, harvesting, and field preparation and tillage equipment. The launch of such items has a substantial impact on the growth of the agricultural tractor market.

- The increasing number of farm training programs promoting the use of agricultural machinery on a wide scale is also driving the tractor industry. With an engine volume of not more than 1,500 CC, these tractors occupy less space and can be used with greater flexibility. Ease of customization makes them more amenable to experimentation, and consequentially, manufacturers are willing to try new components and technologies in this segment before moving on to high-powered ones. Low-horsepower tractors work well in soft soil conditions, such as river basins. The lesser than 40 HP tractors are mainly used for horticulture. In developing countries, the demand for lower HP tractors is high due to the low disposable income of farmers and high labor costs. Farmers prefer small and customized tractors for agricultural purposes due to small farmland sizes. Moreover, lesser fuel consumption by small tractors helps empower small and marginal farmers. Governments in developing countries like India promote farm mechanization by subsidizing equipment purchases and supporting bulk buying through front-end agencies.

- Furthermore, due to the increasing demand from developing countries, the major players in the market are innovating new products. For instance, in February 2021, TAFE launched a new DYNATRACK Series, which is an advanced range of tractors that offer dynamic performance, sophisticated technology, unmatched utility, and versatility, engineered into a single powerful tractor. These factors are likely to drive the market during the forecast period.

Asia-Pacific Dominating the Market

- In the Asia-Pacific, China, Japan, and India lead in terms of the number of tractors sold. Around 60% of China's farm activities are mechanized. According to data from the National Bureau of Statistics of China, large and medium-sized tractors are gradually being replaced by small tractors. At the end of 2020, there were 4.4 million large- and medium-sized tractors in the country. The government included agricultural machinery in its 'Made in China 2025' campaign. The program is expected to help the country produce most of its farm equipment domestically, which is expected to increase the sales of tractors in China.

- Most people in India are agriculture-dependent. According to the Indian Brand Equity Foundation, 58% of the total population in India are farmers. Thus, there is a great market for tractors in India. The agriculture sector in India has witnessed a substantial decline in the use of animal and human power in the agriculture sector. Fossil fuel-operated vehicles, such as tractors and diesel engines, are being used instead, which has resulted in a shift from the traditional agriculture process to a more mechanized process.

- In order to increase the mechanization level, the Indian government is promoting 'Balanced Farm Mechanization' by providing subsidies on various equipment and supporting bulk buying through front-end agencies, which is expected to strengthen the tractors market in India. For instance, the government of India offers various schemes for agricultural equipment, such as loan-cum-subsidy for the purchase of tractors. In addition, as per NABARD norms, any farmer with eight acres of land can take a tractor loan for a period of nine years with a 12.5% rate of interest. Thus, the implementation of programs by governments in the region, along with the increasing tractor usage across, is expected to drive the market during the forecast period.

Agricultural Tractors Industry Overview

The agricultural tractor market is consolidated, with major players occupying a significant market share. Deere and Company, Kubota Corporation, CNH Industrial NV, AGCO Corporation, and CLAAS KGaA mbH are the major players in the market. New product launches, partnerships, and acquisitions are the major strategies being adopted by the leading companies in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat from Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Horse Power

- 5.1.1 Lesser than 40 HP

- 5.1.2 40 HP to 99 HP

- 5.1.3 100 HP to 150 HP

- 5.1.4 151 HP to 200 HP

- 5.1.5 201 HP to 270 HP

- 5.1.6 271 HP to 350 HP

- 5.1.7 Greater than 350 HP

- 5.2 By Type

- 5.2.1 Orchard Tractors

- 5.2.2 Row-crop Tractors

- 5.2.3 Other Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Poland

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Claas KGaA mbH

- 6.3.2 Deere & Company

- 6.3.3 Mahindra & Mahindra Ltd

- 6.3.4 CNH Industrial NV

- 6.3.5 Kubota Corporation

- 6.3.6 AGCO Corporation (Massey Ferguson Limited)

- 6.3.7 Tractors and Farm Equipment Ltd

- 6.3.8 Iseki & Co. Ltd

- 6.3.9 Yanmar Holdings Co. Ltd