|

市场调查报告书

商品编码

1444171

苯乙烯-乙烯-丁烯-苯乙烯 (SEBS):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Styrene-ethylene-butylene-styrene (SEBS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

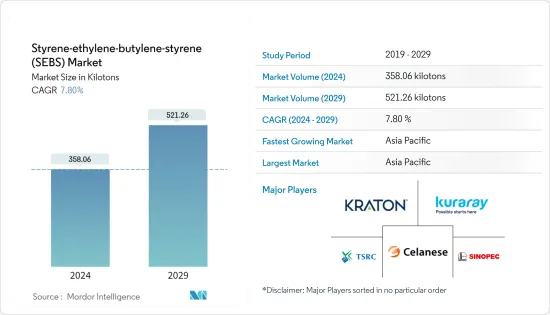

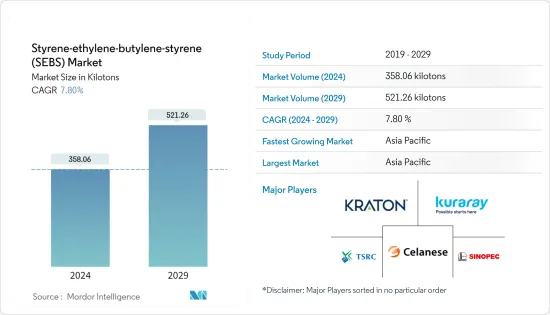

苯乙烯-乙烯-丁烯-苯乙烯(SEBS)市场规模预计到2024年为358,060吨,预计在预测期内(2024-2029年)到2029年将达到521,260吨,复合年增长率为7.80%。

COVID-19大流行对市场产生了负面影响,因为它严重影响了国际贸易并扰乱了製造业、建筑业等多个行业。然而,目前估计市场已达到疫情前的水准。

主要亮点

- 推动所研究市场的主要因素是黏剂和密封剂行业需求的成长以及建筑业对电气元件需求的成长。

- 另一方面,针对生产过剩的环境法规预计将阻碍市场成长。

- 各个最终用户产业对 SEBS 作为 PVC 替代品的需求不断增长,这为所研究的市场带来了机会。

- 预计亚太地区将主导市场,并可能在预测期内呈现最高的复合年增长率。

苯乙烯-乙烯-丁烯-苯乙烯(SEBS)市场趋势

黏剂和密封剂领域预计将主导市场

- SEBS 主要用于黏剂和密封剂产业的胶带、标籤和其他结构黏剂等产品。

- SEBS 的水性特性用途广泛,具有高内聚性和高剥离强度等特性。因此,SEBS衍生的PSA(压敏黏着剂)正在各种应用中取代天然PSA,增加了SEBS在黏剂和密封剂行业的消费量。

- 先进的製造技术,例如与黏剂和密封剂相关的聚烯基材共挤出,进一步扩大了 SEBS 的范围。

- 2021年12月,波士胶推出了一系列含有生物基和可再生成分的新型一次性卫生黏剂产品。 Bostik 推出了两款含有 50% 和 75%可再生的新型黏剂产品,以支持负责任的卫生习惯。新产品的推出预计将推动所研究的市场。

- 因此,基于上述方面,黏剂和密封剂领域预计将主导市场。

亚太地区可能主导市场

- 亚太地区主导了全球市场占有率。随着印度、中国、日本和韩国等国家建设活动的增加,该国黏剂和密封剂以及电气产品的需求和产量不断增加,从而导致印度SEBS的消费量增加。我是。地区。

- 中国也是全球主要的PVC生产国和消费国之一。 SEBS 正在塑胶产业中创造自己的空间,作为各种应用中 PVC 的潜在替代品。 2021 年 11 月,该国电动车销量达到约 413,094 辆。此外,市场占有率增至19%(纯电动车为15%,插电式混合动力汽车为4%)。

- SEBS用于玩俱生产,可取代PVC生产玩偶头。因此,此类 PVC 替代品可能会在未来几年推动 SEBS 市场。

- 受2021年东京奥运的影响,中国体育用品市场正经历成长。体育用品製造商和行业相关人员预计该行业将刺激消费者对体育活动和消费日益增长的兴趣。此外,到2025年,体育产业预计将达到7,730亿美元。

- 印度是世界第二大鞋类製造国,生产的鞋类近90%用于国内,其余用于出口。

- 到 2022 年,鞋类市场预计将达到约 155 亿美元。此外,该国的生产量占全球的10.7%,消费量占全球的11.7%。

- 根据电子情报技术产业协会(JEITA)预测,截至2021年12月,预计2021年日本电子资讯科技产业的全球产值以日圆计算将与前一年同期比较增8%。 2022 年工业产值预估为 373,194 亿日圆(3,327.647 亿与前一年同期比较);确实如此。

- 由于所有这些因素,该地区的苯乙烯-乙烯-丁烯-苯乙烯(SEBS)市场预计在预测期内将稳定成长。

苯乙烯-乙烯-丁烯-苯乙烯(SEBS)产业概述

苯乙烯-乙烯-丁烯-苯乙烯(SEBS)市场是一个整体市场,少数参与者占了市场需求的很大一部分。这些主要企业包括(排名不分先后)科腾公司、可乐丽、中国石化、台橡公司、塞拉尼斯等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对黏剂和密封剂行业的需求不断增长

- 建筑领域对电气元件的需求不断扩大

- 其他司机

- 抑制因素

- 生产环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 形状

- 颗粒

- 粉末

- 最终用户产业

- 鞋类

- 黏剂和密封剂

- 塑胶

- 公路和铁路

- 车

- 运动和玩具

- 电气和电子

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业采取的策略

- 公司简介

- Asahi Kasei Corporation

- Celanese Corporation

- China Petrochemical Corporation(Sinopec Corp.)

- Dynasol Group

- General Industrial Polymers

- JSR Corporation

- Kraton Polymers

- Kuraray Co. Ltd

- LCY GROUP

- Ravago Group

- RTP Company

- Trinseo

- TSRC

- Versalis SpA(Eni SpA)

第七章市场机会与未来趋势

The Styrene-ethylene-butylene-styrene Market size is estimated at 358.06 kilotons in 2024, and is expected to reach 521.26 kilotons by 2029, growing at a CAGR of 7.80% during the forecast period (2024-2029).

The COVID-19 pandemic impacted the market negatively as the pandemic severely affected international trade and hampered several industries, including manufacturing, building, and construction. However, the market has now been estimated to have reached pre-pandemic levels.

Key Highlights

- The major factors driving the market studied are the rising demand from the adhesives and sealants industry and the rising demand for electrical components in the construction sector.

- On the flip side, environmental regulations on overproduction are expected to hinder the growth of the market.

- The rising demand for SEBS as a replacement for PVC in various end-user industries serves as an opportunity for the studied market.

- Asia-Pacific region is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Styrene Ethylene Butylene Styrene (SEBS) Market Trends

Adhesive and Sealants Segment is Expected to Dominate the Market

- SEBS is majorly used in products, such as tapes, labels, and other construction-based adhesives, among others, in the adhesive and sealant industry.

- The water-solvent-borne property of SEBS is versatile, and it exhibits properties such as high cohesiveness and high peel strength. Due to this, SEBS-borne PSAs (pressure-sensitive adhesives) are replacing natural PSAs in a variety of applications, which has increased the consumption of SEBS in the adhesive and sealant industry.

- Advanced production techniques, like co-extrusion with a polyolefin backing related to adhesives and sealants, have further broadened the scope for SEBS.

- In December 2021, Bostik launched a new range of disposable hygiene adhesive products with bio-based renewable content. Bostik launched two new adhesive products with 50% and 75% renewable content in support of its responsible hygiene commitment. The new launches are expected to propel the market studied.

- Hence, based on the aforementioned aspects, the adhesives and sealants segment is expected to dominate the market.

The Asia-Pacific Region is Likely to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing construction activities in countries like India, China, Japan, and South Korea the demand for and production of adhesives and sealants, and electrical products have been increasing in the country, which is further leading to an increase in the consumption of SEBS in the region.

- China is also the world's leading PVC manufacturer and consumer. SEBS is creating its space in the plastic industry as a potential replacement for PVC in various applications. The country's sales of electric vehicles reached around 413,094 units in November 2021. In addition, the market share also increased to 19% including 15% of all-electric and 4% of plug-in hybrid cars.

- SEBS is used in the production of toys and can replace PVC in the production of doll heads. Thus, such a substitution of PVC is likely to drive the SEBS market in the coming years.

- The sports equipment market in China has witnessed growth owing to the Tokyo Olympic Games, in 2021. The sports equipment makers and industry practitioners expect the sector to fuel consumers' increasing appetite for sports activities and consumption. Moreover, it is expected that the sports industry reaches USD 773 billion by 2025.

- India is the second-largest footwear manufacturer in the world with nearly 90% of the manufactured footwear utilized in the country and the rest is exported.

- The footwear market was estimated to reach around USD 15.5 billion by 2022. In addition, the country holds a share of 10.7% of the global production and in terms of consumption, it holds a share of 11.7%.

- In Japan, according to Japan Electronics and Information Technology Industries Association (JEITA), as of December 2021, the global production by the Japanese electronics and IT industry, was estimated to register a growth of 8% year-on-year in 2021 to JPY 37,319.4 billion (USD 332764.7 million) and the industrial production is forecasted to JPY 38,015.2 billion (USD 338968.9 million) in 2022, with an estimated growth of 2% year-on-year.

- Due to all such factors, the market for Styrene-ethylene-butylene-styrene (SEBS) in the region is expected to have a steady growth during the forecast period.

Styrene Ethylene Butylene Styrene (SEBS) Industry Overview

The styrene-ethylene-butylene-styrene (SEBS) market is a consolidated market, where few players account for a significant portion of the market demand. Some of these major players (in no particular order) include Kraton Corporation, Kuraray Co. Ltd, China Petrochemical Corporation (Sinopec), TSRC Corporation, and Celanese, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Adhesive and Sealant Industry

- 4.1.2 Growing Demand for Electrical Components in the Construction Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Regulations Over Production

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Pellets

- 5.1.2 Powder

- 5.2 End-user Industry

- 5.2.1 Footwear

- 5.2.2 Adhesives and Sealants

- 5.2.3 Plastics

- 5.2.4 Roads and Railways

- 5.2.5 Automotive

- 5.2.6 Sporting and Toys

- 5.2.7 Electrical and Electronics

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 Celanese Corporation

- 6.4.3 China Petrochemical Corporation (Sinopec Corp.)

- 6.4.4 Dynasol Group

- 6.4.5 General Industrial Polymers

- 6.4.6 JSR Corporation

- 6.4.7 Kraton Polymers

- 6.4.8 Kuraray Co. Ltd

- 6.4.9 LCY GROUP

- 6.4.10 Ravago Group

- 6.4.11 RTP Company

- 6.4.12 Trinseo

- 6.4.13 TSRC

- 6.4.14 Versalis SpA (Eni SpA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand Due to Use as Replacement for PVC in Various Applications