|

市场调查报告书

商品编码

1444177

农业消毒剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Agricultural Disinfectants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

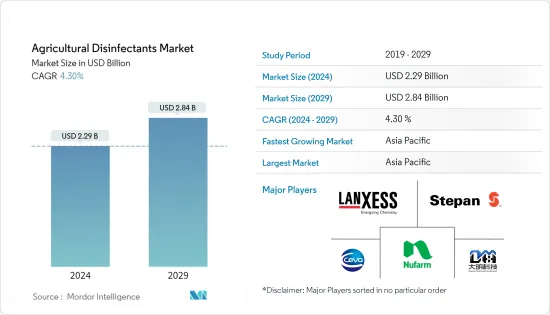

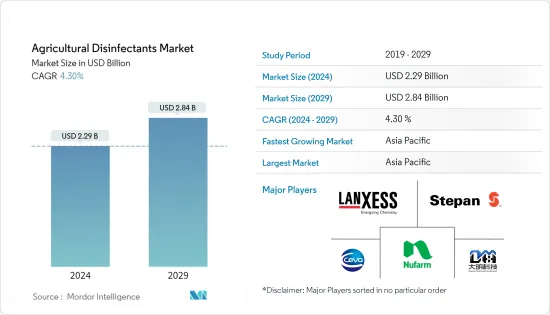

农业消毒剂市场规模预计到2024年为22.9亿美元,预计到2029年将达到28.4亿美元,在预测期内(2024-2029年)增加43亿美元,复合年增长率为%。

COVID-19 大流行迫使许多公司暂时关闭部分製造工厂并限制人员流动,对生产投入需求产生负面影响。运输限制也为该行业带来了物流挑战。

农业消毒剂是用来保护作物和牲畜的重要成分。适当的消毒对于保护作物和牲畜免受有害疾病是必要的。它也用于对植物和牲畜中的微生物进行灭菌。

亚太地区是农业消毒剂市场中最大的地理区域。由于畜牧业产量的增加以及人们对在农业中实施生物安全程序的必要性的认识的提高,预计该地区将成为世界上成长最快的地区。

整体市场受到保护耕地面积增加和畜牧生产中抗生素禁用的推动,这增加了对生物安全的需求。

农业消毒剂市场趋势

保护地栽培面积

各种保护性栽培系统,例如室内农业、垂直农业和水耕,也可以减少作物的生物胁迫,例如害虫和病原体的侵袭。因此,保护性耕作带来了一些好处,例如作物几乎没有或没有农药残留。虽然保护地栽培可以最大限度地减少作物病原体感染的机会,但 100% 害虫和病原体控制需要保持保护地栽培设施免受建筑材料和设备传播的病原体的影响。您将需要。在种植前阶段,必须使用消毒剂对保护地栽培设施和设备进行消毒,以便在作物生长阶段清除害虫和病原体。全球保护性种植面积的增加预计将对市场成长产生正面影响。

亚太地区主导整个市场

亚太地区已成为整个农业消毒剂市占率最高的地区。畜牧业产量的增加和畜牧场数量的增加,加上保护性耕作的日益普及,正在推动亚太地区农业消毒剂市场的发展。缺乏对农业遗体科学消毒实践的认识以及最终用户行业的快速增长等挑战预计将在预测期内推动该地区的市场。

农业消毒剂产业概况

农业消毒剂市场适度分散,有多家区域和地方参与者。为各种非农业任务提供消毒剂的公司也很重要。在市场上运营的公司旨在透过增加销售额来实现有机成长。我们也参与併购、合资和联盟等策略性措施。该行业的主要企业包括朗盛公司、Stepan公司、Nufarm有限公司、山东大明消毒科技和Ceva Sante Animale Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 化学类型

- 氯化季铵盐

- 二氧化氢和哌氧乙酸

- 次氯酸盐和卤素

- 其他的

- 型态

- 液体

- 粉末

- 目的

- 表面

- 空气

- 水杀菌

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Lanxess AG

- Neogen Corporation

- Nufarm Limited

- Stepan Company

- Zoetis Services LLC

- Ceva Sante Animale Group

- Corteva Agri Science

- Thymox Technology

- Entaco NV

- Bayer Cropscience AG

第七章市场机会与未来趋势

第 8 章 评估 COVID-19 对市场的影响

The Agricultural Disinfectants Market size is estimated at USD 2.29 billion in 2024, and is expected to reach USD 2.84 billion by 2029, growing at a CAGR of 4.30% during the forecast period (2024-2029).

The COVID-19 pandemic forced many companies to temporarily close some of their manufacturing plants and placed restrictions on human movement, thus negatively impacting the demand for production inputs. Restrictions on transportation also led to logistics challenges in the industry.

Agricultural disinfectants are vital components used for crop and livestock protection. Proper disinfection is required to protect crops and livestock from harmful diseases. They are also used to sterilize microorganisms in plants and livestock. Agricultural disinfectants are

The Asia-Pacific region was the largest geographical segment of the agricultural disinfectants market. It is also projected to be the fastest-growing region globally, owing to the increasing livestock production and improved awareness about the need for the adoption of biosafety procedures in agriculture.

The overall market is driven by the increasing area under protected cultivation and the ban on antibiotics in livestock production, which, in turn, is driving the need for biosafety.

Agricultural Disinfectants Market Trends

Growing Area Under Protected Cultivation

Various systems of protected cultivation, such as indoor farming, vertical farming, and hydroponics, also reduce biotic stresses on crops, such as attacks by pests and pathogens. Thus, protected cultivation has provided benefits such as crops with little or no pesticide residues. While the susceptibility of crops attacked by pathogens is minimal in protected cultivation, maintaining the protected cultivation facility to be free from pathogens borne from the construction material and equipment has become necessary to have 100% pest and pathogen control. Disinfectants are essential in sanitizing the protected cultivation facilities and equipment in the pre-planting stage to enable the crop to be free of pests and pathogens in its growth stage. The increased area under protected cultivation globally is expected to positively influence the market's growth.

Asia-Pacific Dominates the Overall Market

Asia-Pacific emerged as the region with the highest share in the overall agricultural disinfectants market. The increased production of livestock and the growth in the number of livestock farms, coupled with the increased penetration of protected cultivation, are driving the market for agricultural disinfectants in Asia-Pacific. Challenges, such as lack of awareness about scientific disinfection practices in agricultural remains and the sheer growth of the end-user industries, are expected to drive the market in the region over the forecast period.

Agricultural Disinfectants Industry Overview

The agricultural disinfectants market is moderately fragmented, with the presence of several regional and local players. There is also a significant presence of companies that offer disinfectants for multiple operations apart from agriculture. Companies operating in the market are looking for organic growth through increasing sales. They are also involved in strategic moves, such as mergers and acquisitions, joint ventures, and collaborations. The major players in the industry are Lanxess AG, Stepan Company, Nufarm Limited, Shandong Daming Disinfection Technology Co. Ltd, and Ceva Sante Animale Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Chemical Type

- 5.1.1 Quaternary Ammonium Chloride Salts

- 5.1.2 Hydrogen Dioxide and Pyeroxyacetic Acid

- 5.1.3 Hypochlorites and Halogens

- 5.1.4 Other Chemical Types

- 5.2 Form

- 5.2.1 Liquid

- 5.2.2 Powder

- 5.3 Application

- 5.3.1 Surface

- 5.3.2 Aerial

- 5.3.3 Water Sanitizing

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Germany

- 5.4.2.5 Russia

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Lanxess AG

- 6.3.2 Neogen Corporation

- 6.3.3 Nufarm Limited

- 6.3.4 Stepan Company

- 6.3.5 Zoetis Services LLC

- 6.3.6 Ceva Sante Animale Group

- 6.3.7 Corteva Agri Science

- 6.3.8 Thymox Technology

- 6.3.9 Entaco NV

- 6.3.10 Bayer Cropscience AG