|

市场调查报告书

商品编码

1640511

零售业巨量资料分析 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Big Data Analytics in Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

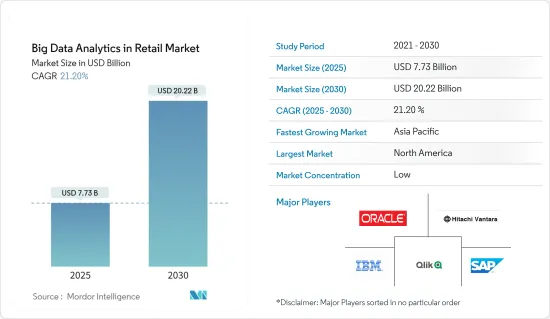

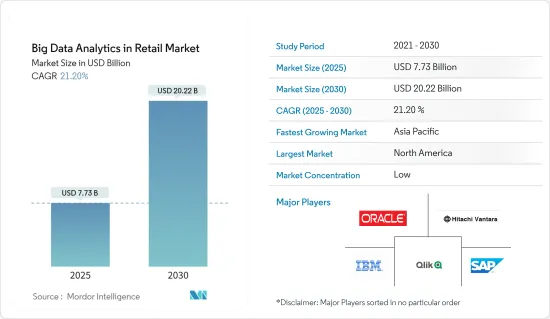

2025 年零售巨量资料分析市场规模估计为 77.3 亿美元,预计到 2030 年将达到 202.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.2%。

先进的分析和巨量资料技术正在深刻改变零售业。随着电子商务和网路购物的成长以及客户忠诚度竞争的加剧,零售商开始转向巨量资料分析以保持市场竞争力。

关键亮点

- 零售业正稳步采用云端、人工智慧和相关技术,被认为是成长最快的产业之一。根据 NASSCOM 的调查,70% 的企业致力于利用人工智慧来增加收益并增加支出。例如,全球最大的零售商之一沃尔玛正在进行数位转型。目前,该公司正在建置全球最大的私有云端系统,预计每小时可管理Petabyte的资料。

- 预测分析是一种主动方法,零售商使用历史资料来预测由于消费者行为和市场趋势的变化而导致的预期销售成长。这使零售商能够保持领先地位,有效竞争,并显着提高市场占有率。为了与客户建立可持续的关係,越来越倾向于重视预测分析,以帮助提高促销效果并促进交叉销售。

- 零售商正在寻找创新的方法,从不断增加的结构化和非结构化消费行为资讯中提取见解。透过在零售流程的每个阶段(包括线下和线上)应用巨量资料分析,零售商可以了解客户的购买行为,将其映射到产品上,并制定行销策略来销售产品。资料为先的策略来推动利润。引入 IPS 系统、自助结帐的商店自动化、机器人技术和零售自动化等创新方法正在推动零售市场对巨量资料分析的需求。

- 资料整合挑战可能会限制市场发展,包括资料管治、可扩展性以及从多个来源获取资料所带来的资料重复和转换规则问题。但是,可以透过制定适当的系统规则来缓解这些问题。

- 由于工厂和製造厂关闭、物价上涨、严格封锁以及人们被迫回家导致的供应链中断,COVID-19 疫情对区域和国家零售市场产生了重大影响。然而,疫情过后,考虑到人类的基本需求,巨量资料正在透过有针对性的广告、产品推荐和定价来帮助零售商以更个人化的方式服务客户。

零售业巨量资料分析的市场趋势

商品行销和供应链分析领域预计将占据大部分市场份额

- 电子商务已经影响了传统的实体零售业,降低了其重要性并引发了零售业的资料主导革命。高效率的供应链(即货物从供应商到仓库、商店到客户的最佳运输)对任何企业都至关重要。这就是巨量资料分析成为零售供应链变革的核心的原因。 i. 即时追踪产品流和库存水平,使用客户资料预测购买模式,甚至使用机器人在庞大的自动化仓库中不知疲倦地完成订单。

- 随着零售业随着商品行销、分析和数位解决方案的整合而不断发展,零售商必须保持领先地位并快速回应客户需求。在英国,零售业的供应链巨量资料分析预计将在预测期内大幅成长,其次是製造业和能源产业。此外,预测分析和机器学习人工智慧有望彻底改变零售供应链。

- 事实证明,先进的商品行销分析可以帮助零售商克服全通路零售世界中取得成功的挑战。根据《麻省理工技术评论》大数据分析洞察调查,该调查以全球消费品和零售业案例,48% 的消费品和零售业受访者认为引进人工智慧将改善客户服务。的是品管( 47%)、库存管理(47%)、产品个人化、定价和诈欺检测被认为有用。

- 随着全球经济变得更加互联和复杂,企业发现很难满足客户的期望。公司需要更快、更果断、更准确地做出供应链决策,并且能够快速、透明地实施这些决策。综合需求计划对于在当今市场保持竞争力至关重要。此外,为了实现按时全额交货 (OTIF),公司需要端到端供应链可视性,即时平衡供需,并快速有效地交付正确的产品。提高客户满意度、优化存量基准和分销网络、缩短上市时间以实现销售额最大化都证明了该领域对巨量资料分析的必要性。

预计北美将占最大份额

- 零售业的巨量资料分析可帮助公司根据顾客的购买历史提出产品推荐。其结果是提高了提供客製化购物体验和增强客户服务的能力。这些资料集数量庞大,可以帮助您预测趋势并做出以资料为主导的策略决策。北美零售市场巨量资料分析的成长是由零售分析工具的需求不断增长以及物联网在零售流程中的使用所推动的,从而提高了零售企业的生产力和效率。

- 该地区大型零售商的销售额正在成长。美国零售联合会(NRF)预计,受消费者信心高涨、失业率低和工资上涨的推动,去年美国零售额将超过4.44万亿美元,增长6%征兆8%。有弹性的经济。

- 此外,北美在巨量资料分析应用方面一直处于创新领先地位并处于先驱地位。该地区拥有强大的巨量资料分析供应商队伍,进一步促进了市场的成长。范例包括 IBM Corporation、SAS Institute Inc.、Alteryx Inc. 和 Microstrategy Incorporated。由于资料生产和零售消费的增加以及相应的销售额的增长,巨量资料分析硬体、软体和服务正在推动支出的增加。

- 零售业越来越多采用工业 4.0 是推动市场成长的主要方面之一。零售 4.0 已经实现了多项零售业务和流程的数位化和自动化,包括库存管理、客户服务、客户帐户、供应链管理和商品管理活动。预计预测期内将进一步推动北美零售大巨量资料分析市场的成长。

零售业巨量资料分析概述

零售市场的巨量资料分析处于中度至高度分散的状态。电子商务和网路购物的成长以及对客户忠诚度的激烈竞争为零售市场的巨量资料分析提供了有利可图的机会。整体来看,现有竞争对手之间的竞争非常激烈。未来,大公司的各种创新策略将有效推动市场成长。

2022 年 8 月,明讯收购了马来西亚零售分析新兴企业ComeBy 的股权,扩大了技术和网路的覆盖范围,帮助推动该国的零售创新和数数位化。

此外,2022广告宣传8 月,人工智慧驱动的品牌分析解决方案公司 DataWeave 宣布已成为亚马逊广告合作伙伴网路的审查合作伙伴,帮助品牌透过可操作的资料洞察 支援优化。亚马逊广告合作伙伴网路和新的合作伙伴目录使品牌能够接触到由代理商和工具提供商组成的全球社区,他们可以帮助广告商使用亚马逊广告产品实现其业务目标。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 更重视预测分析

- 商品行销和供应链分析领域预计将占据大部分市场份额

- 市场限制

- 从不同系统收集和整理资料的复杂性

- 产业价值链分析

- 产业吸引力-波特五力模型

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

第五章 市场区隔

- 按应用

- 商品行销与供应链分析

- 社群媒体分析

- 客户分析

- 营运情报

- 其他的

- 依业务类型

- 中小型企业

- 大型组织

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争格局

- 公司简介

- SAP SE

- Oracle Corporation

- Qlik Technologies Inc.

- Zoho Corporation

- IBM Corporation

- Retail Next Inc.

- Alteryx Inc.

- Salesforce.com Inc.(Tableau Software Inc.)

- Adobe Systems Incorporated

- Microstrategy Inc.

- Hitachi Vantara Corporation

- Fuzzy Logix LLC

第七章投资分析

第八章 市场机会与未来趋势

The Big Data Analytics in Retail Market size is estimated at USD 7.73 billion in 2025, and is expected to reach USD 20.22 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

The retail industry is witnessing a major transformation through advanced analytics and Big Data technologies. With the growth of e-commerce, online shopping, and high competition for customer loyalty, retailers are utilizing Big Data analytics to stay competitive in the market.

Key Highlights

- The retail industry witnessed a steady adoption of cloud, AI, and related technologies and is considered one of the top sectors in terms of growth. According to a survey by NASSCOM, 70 percent of the companies said they focus on revenue growth by leveraging AI and increasing their spending. For Example, Walmart, one of the largest retailers in the world, is undergoing a digital transformation. It is in the process of building the world's largest private cloud system, which is expected to have the capacity to manage 2.5 petabytes of data every hour.

- Predictive analytics is a proactive approach whereby retailers can use data from the past to predict expected sales growth due to changes in consumer behaviors and market trends. It can help retailers stay ahead of the curve, compete effectively, and gain considerable market share. Increased Emphasis on Predictive Analytics which can help increase promotional effectiveness, drive cross-selling, and much more to build sustainable relationships with the customers.

- Retailers attempt to find innovative ways to draw insights from the ever-increasing amount of structured and unstructured information about consumer behavior. Retailers, both offline and online, are adopting the data-first strategy toward understanding their customers' buying behavior, mapping them to products, and planning marketing strategies to sell their products to increase profits by applying Big Data Analytics at every step of the retail process. Innovative ways such as Implementing IPS systems, Store Automation with self check out, Robots, and Automation in retail, etc., drive the need for Big data analytics in the retail market.

- Data integration challenges could restrain the market, including data governance, scalability, and problems associated with getting data from multiple sources to have data duplication and transformation rules. However, these can be reduced with the proper systematic set of rules.

- The COVID-19 pandemic hugely impacted retail markets at the regional and country level due to the shutdown of factories, and manufacturing plants, increase in prices, strict lockdowns, and supply chain disruptions as people's mobility were confirmed to their homes. However, post-pandemic considering the inherent human needs, Big Data is helping retailers to cater to customers in a more personalized way via targeted advertising, product recommendations, and pricing; the retailers increasingly prefer the technology.

Big Data Analytics in Retail Market Trends

Merchandising and Supply Chain Analytics Segment Expected to Hold Significant Share

- E-commerce has impacted traditional brick-and-mortar retailers, reducing their significance and marking the data-driven revolution in the retail sector. An efficient supply chain, the optimized movement of goods from supplier to warehouse to store to the customer, is critical to every business. Therefore, big data analytics is at the core of revolutionizing the retail supply chain, i.e., tracking and tracing product flow and stock levels in real-time, leveraging customer data to predict buying patterns, and even using robots to fulfill orders in vast automated warehouses tirelessly.

- Retailers must stay proactive and quickly fulfill customer needs as the retail industry continues to evolve with the integration of merchandising analytics and digital solutions. In the United Kingdom, the supply chain Big Data analytics for retail is expected to grow significantly over the forecast period, following the manufacturing and energy sector. It is further expected that predictive analytics and machine learning AI will revolutionize the retail supply chain.

- Leveraging advanced merchandising analytics is proven to help retailers overcome the challenges to thrive in an omnichannel retail world. According to the survey conducted by MIT Technology Review Insights for Big Data Analytics using cases in the consumer goods and retail industry worldwide predicts that 48 percent of respondents from the consumer goods and retail industry state that deployment of artificial intelligence can help improve customer care, followed by Quality control (47%), Inventory Management(47%), personalization of products, pricing, and fraud detection.

- As the global economy becomes interconnected and complex, companies find it challenging to meet customer expectations. They must make supply chain decisions faster, more decisive, and more accurate and can implement those decisions rapidly and transparently. Integrated demand planning is necessary to remain competitive in today's marketplace. Further, to achieve OTIF (On-Time-In-Full), a company must have end-to-end supply chain visibility and be able to balance demand and supply in real-time to make the right decisions quickly and effectively. Improving customer satisfaction, optimizing inventory levels and distribution networks, and achieving a faster time to market for sales maximization prove the need for big data Analytics in this sector.

North America Region Expected to Hold the Largest Share

- Big data analytics in retail helps companies to generate customer recommendations based on their purchase history. It results in an improved ability to offer customized shopping experiences and enhanced customer service. These data sets are available in massive volumes and aid in forecasting trends and making strategic decisions guided by data. The growth of North America's big data analytics in the retail market is driven by the rising demand for retail analytics tools and the usage of the IoT in retail processes, enhancing the productivity and efficiency of the retail industry.

- The region's massive retail industry is experiencing growth in sales. In the United States, according to the National Retail Federation (NRF), retail sales are expected in between 6% to 8% to more than USD 4.44 trillion in the last year, citing high consumer confidence, low unemployment, and rising wages and clear signs of a strong and resilient economy.

- Besides, North America is among the leading innovators and pioneers, in terms of the adoption, of Big Data analytics. The region boasts a strong foothold of Big Data analytics vendors, which further contributes to the market's growth. Some include IBM Corporation, SAS Institute Inc., Alteryx Inc., and Microstrategy Incorporated. Big data analytics hardware, software, and services need more significant expenditures due to the rise in data production and retail consumption with corresponding sales increases.

- The increasing adoption of industry 4.0 across the retail sector is one of the primary aspects encouraging market growth. In retail 4.0, several operations and processes in the retail industry, like inventory management, customer service, customer accounts, supply chain management, and merchandising management activities, became digitized and automated. It is further expected to bolster the growth of North America's big data analytics in the retail market during the forecast period.

Big Data Analytics in Retail Industry Overview

Big data analytics in the retail market is moderately to highly fragmented. The growth of e-commerce, online shopping, and high competition for customer loyalty provides lucrative opportunities in big data analytics in the retail market. Overall, the competitive rivalry among existing competitors is high. Moving forward, different kinds of innovation strategies of large companies boost market growth effectively.

In August 2022, Maxis took a significant stake in Malaysian-based retail analytics startup, ComeBy, to empower innovation and digitalization in the retail industry with greater access to technology and the human network to create more economic multipliers for the country.

Also, in August 2022, DataWeave, an AI-powered Brand Analytics solution company, announced its status as a vetted partner in the Amazon Advertising Partner Network to support brands in optimizing their digital advertising campaigns with actionable data insights. The Amazon Advertising Partner Network, and new Partner Directory, provide brands access to a global community of agencies and tool providers that can help advertisers achieve their business goals using Amazon Ads products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Emphasis on Predictive Analytics

- 4.2.2 Merchandising and Supply Chain Analytics Segment Expected to Hold Significant Share

- 4.3 Market Restraints

- 4.3.1 Complexities in Collecting and Collating the Data From Disparate Systems

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Merchandising and Supply Chain Analytics

- 5.1.2 Social Media Analytics

- 5.1.3 Customer Analytics

- 5.1.4 Operational Intelligence

- 5.1.5 Other Applications

- 5.2 By Business Type

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large-scale Organizations

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Oracle Corporation

- 6.1.3 Qlik Technologies Inc.

- 6.1.4 Zoho Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Retail Next Inc.

- 6.1.7 Alteryx Inc.

- 6.1.8 Salesforce.com Inc. (Tableau Software Inc.)

- 6.1.9 Adobe Systems Incorporated

- 6.1.10 Microstrategy Inc.

- 6.1.11 Hitachi Vantara Corporation

- 6.1.12 Fuzzy Logix LLC