|

市场调查报告书

商品编码

1444225

水凝胶 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Hydrogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

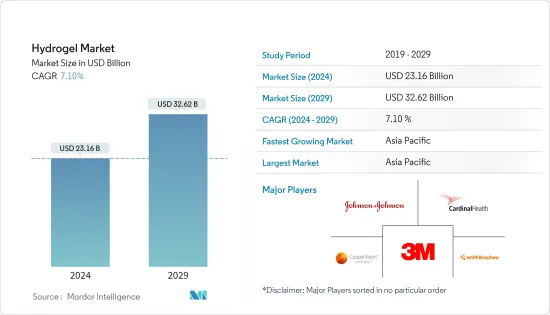

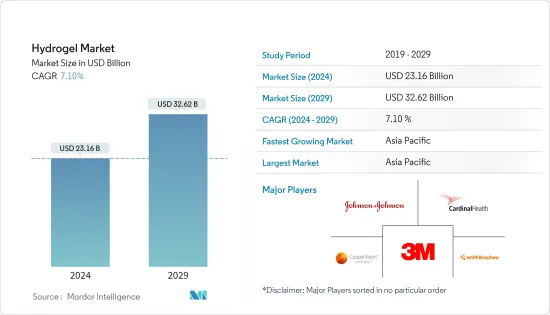

水凝胶市场规模预计2024年为231.6亿美元,预计到2029年将达到326.2亿美元,在预测期内(2024-2029年)复合年增长率为7.10%增长。

COVID-19大流行对水凝胶领域造成了打击。由于全球封锁和各国政府实施的严格监管,大多数生产基地被关闭,造成毁灭性打击。儘管如此,业务自 2021 年以来已经復苏,预计未来几年将大幅成长。

主要亮点

- 短期内,水凝胶在医疗保健行业的应用不断增加以及农业行业的快速采用预计将推动市场成长。

- 然而,水凝胶的高製造成本预计将阻碍市场成长。

- 水凝胶新应用领域的出现以及生物医学和个人护理领域对水凝胶的认识和采用不断增强,将为所研究的市场带来好兆头。

- 亚太地区在全球水凝胶市场中占据主要份额,预计在预测期内将以最快的复合年增长率发展。

水凝胶市场趋势

个人护理和卫生领域主导市场

- 水凝胶因其柔软、类似组织的物理特性、优异的吸水性、良好的透氧渗透性、良好的生物相容性以及用于额外传输通道的微孔结构而适用于卫生用品。

- 卫生产品旨在製造更薄的垫片,在负载下具有更高的吸收性、更高的膨胀压力和更强的吸力。因此,它们的特性使水凝胶成为最合适的选择。

- 世界卫生组织、世界银行集团和联合国儿童基金会等多个政府机构正在提高人们对卫生重要性的认识,特别是对妇女和少女来说月经卫生管理 (MHM)。

- 世界银行集团在印度 Swachh Bharath 使命下启动了一项旗舰卫生工作。这项活动旨在提高社区(包括男孩和男性)的认识,并打破有关月经的禁忌。

- 此外,随着电商销售额的飙升,个人护理行业预计年轻的独立品牌数量也会激增,并与宝洁等个人护理行业的一些最大的参与者展开激烈的竞争。曾经。 Revlon Inc.、Oriflame Cosmetics Global SA、雅芳公司、雅诗兰黛公司和联合利华。

- 个人保健产品市场由欧莱雅、宝洁、联合利华和资生堂等几家主要企业主导。欧莱雅的化妆品和个人护理品销售额是所有公司中最高的,预计该公司 2022 年的销售额约为 419.5 亿美元。

- 据欧洲个人护理协会称,5亿欧洲消费者每天使用化妆品和个人保健产品来保护自己的健康、提高幸福感并增强自尊。它们的范围包括止汗剂、香水、化妆品、洗髮精、肥皂、防晒油等。

- 奥贝罗表示,在美国,个人护理产业预计2022年将成长2.95%,这一成长预计将超过2023年,达到422亿美元。预计将刺激国内水凝胶市场的需求。

- 由于所有这些因素,全球个人护理和卫生产品可能会在预测期内推动对水凝胶的需求。

亚太地区主导市场

- 由于中国、印度和日本等国家的个人护理和卫生、农业、製药和医疗保健行业的成长,亚太地区在全球市场占有率占据主导地位。

- 根据ECHEMI预计,2022年中国医药产业与前一年同期比较增约17%。胃肠药和代谢药物约占全国医药市场总量的14%。

- 中国不断壮大和老化的中产阶级、收入的增加和都市化进程的加速正在推动该国的药品销售。根据CEIC资料,2022年6月中国药品销售收益为2,239.46亿美元,而2022年4月为1,460.41亿美元。该国拥有庞大且多元化的国内製药业,由约 5,000 家製造商和许多中小型製药公司组成。 ~有规模的公司。

- 印度是全球製药业的重要且不断成长的参与者。据PIB India称,印度是全球领先的学名药供应国之一,占全球供应量的20%。印度药品出口到200多个国家,其中美国是主要市场。

- 印度药品出口促进委员会 (Pharmexcil) 总干事表示,2021-22 财年,印度出口了价值 17,504 亿印度卢比(246.2 亿美元)的药品,其中包括活性原料药成分/药物中间体。此外,2022年4月至10月,印度药品出口成长4.22%,达145.7亿美元。上一财年同期出口额为139.8亿美元。

- 此外,根据印度品牌股权基金会的数据,到 2030 年,印度製药业预计将达到 1,300 亿美元。相较之下,到年终,全球药品生产收益预计将达到近1兆美元。

- 因此,由于上述因素,预计未来几年对水凝胶的需求将会增加。

水凝胶产业概况

水凝胶市场较为分散,少数公司占了相当大的市场。市场的主要企业包括(排名不分先后)3M、Johnson & Johnson Services、Cardinal Health、CooperVision 和 Smith & Nephew。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 医疗保健产业的应用不断增加

- 农业产业采用率迅速增加

- 其他司机

- 抑制因素

- 水凝胶生产成本高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 消费者议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 结构

- 非晶质

- 半结晶

- 结晶

- 材料

- 聚丙烯酸酯

- 聚丙烯酰胺

- 硅胶

- 其他材料(琼脂、明胶、PVP、PEG)

- 最终用户产业

- 个人护理和卫生

- 製药和医疗保健

- 食品

- 农业

- 其他最终用户产业(法医学和研究)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率分析(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- 3M

- Ambu A/S

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Bausch Health Companies Inc.

- Cardinal Health

- Coloplast Corp.

- ConvaTec Inc.

- CooperVision

- DSM

- Essity Health &Medical

- HOYA Corporation

- Integra LifeSciences Corporation

- Johnson &Johnson Medical Limited

- Molnlycke Health Care AB

- Medtronic

- Novartis AG

- PAUL HARTMANN Pty Ltd.

- SEIKAGAKU CORPORATION

- Sekisui Kasei Co. Ltd.

- Smith &Nephew

第七章市场机会与未来趋势

- 新应用领域的出现

- 生物医学和个人护理领域对水凝胶的认识和采用不断提高

- 其他机会

The Hydrogel Market size is estimated at USD 23.16 billion in 2024, and is expected to reach USD 32.62 billion by 2029, growing at a CAGR of 7.10% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the hydrogel sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business has been recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, the increasing application of hydrogel in the healthcare industry and the surge in adoption in the agriculture industry are expected to drive the market's growth.

- However, the high production cost of hydrogel is expected to hinder the market's growth.

- The emergence of a new application area for hydrogel and rising awareness and adoption of hydrogel in the biomedical and personal care sector will act as an opportunity for the market studied.

- The Asia-Pacific region dominated the global hydrogel market with a significant share, and it is expected to register the fastest CAGR during the forecast period.

Hydrogel Market Trends

Personal Care and Hygiene Segment to Dominate the Market

- Hydrogel is suitable for hygiene products due to its soft and tissue-like physical properties, superior water absorption, good oxygen permeability, superior biocompatibility, and micro-porous structure for additional transport channels.

- Hygiene products aim to make thinner pads with higher absorbency under load, increased swelling pressure, and increased suction power. Hence, the hydrogel is the most suitable option due to its properties.

- Several government organizations, such as the World Health Organization, World Bank Group, and UNICEF, are raising awareness about the importance of hygiene, especially menstrual hygiene management (MHM) for women and adolescent girls.

- The World Bank Group initiated a flagship sanitation operation under the Swachh Bharath Mission in India. This operation aims to increase awareness among the community, including boys and men, to break the taboo around menstruation.

- Further, the personal care industry is also expected to observe a surge in the number of young and independent brands, as e-commerce sales are surging and providing stiff competition to some of the major companies in the personal care industry, including Procter & Gamble, Revlon Inc. Oriflame Cosmetics Global SA, The Avon Company, The Estee Lauder Companies Inc., and Unilever.

- The market for personal care products is dominated by a few key players, such as L'Oreal, Procter & Gamble, Unilever, and Shiseido Co., Ltd. L'Oreal has the highest cosmetics and personal care sales among the companies, and the company generated sales of around USD 41.95 billion in 2022.

- According to Cosmetic Europe, the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, shampoos, soaps, and sunscreens, to many others.

- Oberlo stated that, in the United States, the personal care industry grew by 2.95% in 2022, and this growth is expected to outpace in 2023 to reach USD 42.2 billion. This is expected to stimulate the demand for the hydrogel market in the country.

- Owing to all these factors, the personal care and hygiene products in the world may drive the demand for hydrogel during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share due to the growing personal care and hygiene, agriculture, pharmaceuticals, and healthcare sectors in countries such as China, India, and Japan.

- The pharmaceutical industry in China was anticipated to grow by about 17% year-on-year in 2022 stated by ECHEMI. Digestive and metabolic drugs account for around 14% of the total pharmaceutical market of the country.

- The growing middle-class and aging population in China, rising incomes, and increasing urbanization drive pharmaceutical sales in the country. According to CEIC Data, the pharmaceutical sales revenue in China in June 2022 accounted for USD 223,946 million, up compared to USD 146,041 million in April 2022. The country has a large and diverse domestic drug industry, comprising around 5,000 manufacturers and many small or medium-sized companies.

- In the global pharmaceuticals sector, India is a prominent and expanding player. According to PIB India, India is one of the world's major suppliers of generic medicines, accounting for 20% of the global supply by volume. Indian drugs are exported to more than 200 countries, with the United States being the key market.

- According to the Director General of the Pharmaceutical Export Promotion Council of India (Pharmexcil), India exported INR 1,75,040 crore (USD 24.62 billion) worth of pharmaceutical products, including bulk drugs/drug intermediates, in FY2021-22. Furthermore, India's pharmaceutical exports increased by 4.22% from April to October 2022, reaching USD 14.57 billion. The exports were valued at USD 13.98 billion during the same period in the previous fiscal.

- Further, according to Indian Brand Equity Foundation, by 2030, the Indian Pharma industry is expected to reach USD 130 billion. In contrast, global pharmaceutical production's revenue is forecasted to reach nearly USD 1 trillion by the end of 2023.

- Therefore, the abovementioned factors are expected to increase the demand for hydrogel in the coming years.

Hydrogel Industry Overview

The hydrogel market is fragmented, with a few players holding a considerable share in the market. Some of the market's key players (not in any particular order) include 3M, Johnson & Johnson Services, Inc., Cardinal Health, CooperVision, and Smith & Nephew.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Healthcare Industry

- 4.1.2 Surge in Adoption in Agriculture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Production Cost of Hydrogel

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Structure

- 5.1.1 Amorphous

- 5.1.2 Semi-crystalline

- 5.1.3 Crystalline

- 5.2 Material

- 5.2.1 Polyacrylate

- 5.2.2 Polyacrylamide

- 5.2.3 Silicone

- 5.2.4 Other Materials (Agar, Gelatin, PVP, and PEG)

- 5.3 End-user Industry

- 5.3.1 Personal Care and Hygiene

- 5.3.2 Pharmaceuticals and Healthcare

- 5.3.3 Food

- 5.3.4 Agriculture

- 5.3.5 Other End-user Industries (Forensics and Research)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ambu A/S

- 6.4.3 Ashland

- 6.4.4 Axelgaard Manufacturing Co., Ltd.

- 6.4.5 Bausch Health Companies Inc.

- 6.4.6 Cardinal Health

- 6.4.7 Coloplast Corp.

- 6.4.8 ConvaTec Inc.

- 6.4.9 CooperVision

- 6.4.10 DSM

- 6.4.11 Essity Health & Medical

- 6.4.12 HOYA Corporation

- 6.4.13 Integra LifeSciences Corporation

- 6.4.14 Johnson & Johnson Medical Limited

- 6.4.15 Molnlycke Health Care AB

- 6.4.16 Medtronic

- 6.4.17 Novartis AG

- 6.4.18 PAUL HARTMANN Pty Ltd.

- 6.4.19 SEIKAGAKU CORPORATION

- 6.4.20 Sekisui Kasei Co. Ltd.

- 6.4.21 Smith & Nephew

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emergence of New Application Areas

- 7.2 Rising Awareness and Adoption of Hydrogel in Biomedical and Personal Care Sector

- 7.3 Other Opportunities