|

市场调查报告书

商品编码

1444245

苜蓿牧草:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Alfalfa Hay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

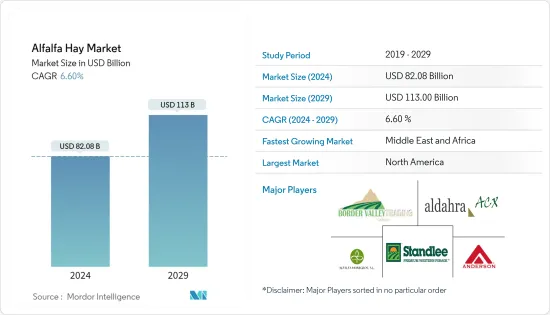

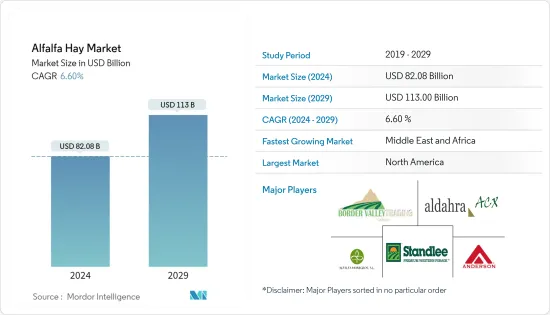

苜蓿牧草市场规模预计2024年为820.8亿美元,预计到2029年将达到1130亿美元,在预测期内(2024-2029年)复合年增长率为6.60%增长。

主要亮点

- 短期内,由于牲畜和牛对优质干草的需求不断增加,预计市场将显着成长。苜蓿牧草的重要粗蛋白含量使其作为动物饲料的用途非常重要。苜蓿牧草促进动物生长和发育,提高产奶量。因此,在预测期内,对苜蓿牧草作为动物饲料的依赖可能会继续推动市场。

- 对乳製品和肉类动物产品的需求增加、放牧动物土地的减少、产量牛的生长以及对牛饲料的需求正在推动全球苜蓿牧草市场的发展。

- 北美预计将成为苜蓿牧草的最大市场。中国、日本、阿拉伯联合大公国和沙乌地阿拉伯是美国苜蓿牧草干草的重要进口国。美国和西班牙是世界上主要的苜蓿牧草干草出口国。最近,苜蓿牧草作为家禽饲料变得重要,随后由于其粗蛋白含量的重要性而作为动物饲料。

- 2021年,印度商工部宣布,印度和美国已就实施两国农产品市场进入的框架达成协议。印度已同意取消对美国种植的苜蓿牧草的热处理要求,并承认美国现行的苜蓿牧草干草害虫缓解方法。印度政府也澄清,进口用于动物饲料的美国苜蓿牧草干草不需要非基因改造证书。

苜蓿牧草市场趋势

对乳製品和肉品的需求增加

- 牲畜是苜蓿牧草市场成长的关键因素。到 2030 年,发展中国家肉类和奶类产量的年增长率预计将分别为 2.4% 和 2.5%。这一因素预计将使发展中国家在全球肉类产量中所占的份额增加到 66.0%,即 2.47 亿吨,在牛奶产量中所占的份额将增加到 55.0%,即 4.84 亿吨。此外,畜牧业面临着满足对高价值动物蛋白质不断增长的需求的巨大压力。

- 印度是全球最大的牛奶生产国,约有7,000万小规模生产商,占全球牛奶产量的23%。该国对牛奶和乳製品的需求正在增加。例如,2021 年当地消费了约 8,300 万吨液态奶,而 2018 年为 7,700 万吨。

- 在预测期内,对苜蓿牧草作为动物饲料的依赖可能会继续推动市场。中国乳製品产业生产方式的变化显着增加了中国对苜蓿牧草的需求。这种变化是由于现代酪农饲养的牛数量不断增加,他们更喜欢使用进口干草或商业饲料。

- 例如,根据联合国粮食及农业组织的数据,到2020年,中国的牛量从4,880万头增加到5,100万头。此外,中国政府正致力于扩大国内苜蓿牧草产量以满足高需求。

- 由于2017年至2021年牛数量持续增加以及对优质动物饲料的需求不断增加,预计预测期内对苜蓿牧草的需求将增加。

北美市场占据主导地位

- 截至 2021 年,美国部分苜蓿牧草生产州包括德克萨斯州、堪萨斯州、加利福尼亚州和密苏里州。这些州占全国苜蓿牧草产量的大部分。对美国的最大出口目的地是中国、日本、韩国、台北、沙乌地阿拉伯和阿拉伯联合大公国。预计中国将继续成为美国苜蓿牧草出口的主要市场。

- 除了产量之外,由于非流动性乳製品消费量的增加,近年来国内乳製品消费量也有所增加。美国农业部(USDA)的资料显示,美国乳製品消费量持续呈上升趋势。自1975年以来,人均消费量成长了22%。此外,乳製品作为一个强调永续食品生产的类别预计将继续增长。

- 在美国,苜蓿牧草是餵养乳牛的最重要的作物。在加州、威斯康辛州、纽约州、爱达荷州和新墨西哥州等主要乳製品生产州,乳製品用量占紫花苜蓿总用量的三分之二。乳製品生产是苜蓿牧草的重要市场,而牛肉生产商则根据供应量和价格利用紫花苜蓿作为饲料需求的一部分。

- 此外,苜蓿牧草是加拿大最主要的饲料豆类作物。加拿大近 30% 的农地都种植它,其中安大略省占 22%。亚伯达和安大略省是加拿大苜蓿牧草的主要生产地。因此,国内和出口市场对紫花苜蓿的需求增加预计将导致预测期内苜蓿的显着成长。

紫花苜蓿牧业概况

苜蓿牧草市场高度分散,主要企业包括 Al Dahra ACX Global Inc.、Standlee Hay Company、Alfalfa Monegros、Anderson Hay and Grain Co Inc. 和 Border Valley。这些公司开展了各种策略活动,例如合作伙伴关係、业务扩展以及併购,以加强其在市场上的影响力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 面纱

- 颗粒

- 立方体

- 目的

- 乳製品和肉类动物饲料

- 家禽饲料

- 秣

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Al Dahra ACX Global Inc.

- Alfalfa Monegros SL

- Anderson Hay &Grain Inc.

- Bailey Farms

- Border Valley

- Coaba

- Cubeit Hay Company

- Glenvar Hay

- Green Prairie International

- Grupo Oses

- Gruppo Carli

- Hay USA

- Haykingdom Inc.

- Knight AG Sourcing

- Los Venteros SC

- M&C Hay

- McCracken Hay Company

- Riverina(Australia)Pty Ltd

- SL Follen Company

- Standlee Hay Company

第七章市场机会与未来趋势

The Alfalfa Hay Market size is estimated at USD 82.08 billion in 2024, and is expected to reach USD 113 billion by 2029, growing at a CAGR of 6.60% during the forecast period (2024-2029).

Key Highlights

- Over the short term, the market is anticipated to achieve notable growth due to the increasing demand for quality hay for livestock and the cattle population. The use of alfalfa hay has become critical to animal feed due to its importance for crude protein content. Alfalfa hay enhances the growth and development of animals at a faster rate and improves milk productivity. Thus, dependence on alfalfa hay for animal feed may continue to drive the market over the forecast period.

- The increasing demand for dairy and animal products, shrinking land for grazing animals, growth in high-yielding cattle, and demand for cattle feed are driving the alfalfa hay market globally.

- North America is projected to be the largest market for alfalfa hay. China, Japan, the United Arab Emirates, and Saudi Arabia are significant importers of alfalfa hay from the United States. The United States and Spain are major exporters of alfalfa hay globally. Recently, alfalfa hay became critical to poultry feed, followed by animal feed, due to its importance for crude protein content.

- In 2021, the Indian Ministry of Commerce and Industry announced that India and the United States agreed to a framework to implement market access for agricultural products from both countries. India agreed to remove the heat treatment requirement for the US-origin alfalfa hay and recognize the current US pest mitigation methods for alfalfa hay. The Indian government also clarified that importing US alfalfa hay for animal feed will not require a non-genetically modified certificate.

Alfalfa Hay Market Trends

Increasing Demand for Dairy and Meat Products

- Livestock is a significant factor responsible for the growth of the alfalfa hay market. The annual growth of meat production and milk production in developing countries is projected to be 2.4% and 2.5%, respectively, by 2030. This factor is expected to increase the share of the developing countries in the world's meat production to 66.0%, i.e., 247.0 million metric tons, and 55.0% for milk production, i.e., 484.0 million metric tons. Furthermore, there has been immense pressure on the livestock sector to meet the increasing demand for high-value animal protein.

- India is the world's largest milk producer, contributing 23% of global milk production with around 70 million small-scale producers. There has been a growing demand for milk and milk-based products in the country. For instance, in 2021, about 83.0 million metric tons of fluid milk was consumed locally compared to 77.0 million metric tons in 2018.

- Dependence on alfalfa hay for animal feed may continue to drive the market over the forecast period. The demand for alfalfa hay is increasing significantly in China due to changing production practices in the Chinese dairy industry. This change is due to the increasing number of cows raised by modern dairy farmers who prefer using imported hay and commercial feeds.

- For instance, by 2020, the cattle population in China increased from 48.8 million heads to 51.0 million heads, according to the Food and Agriculture Organization. Furthermore, the Chinese government is focusing on boosting the domestic production of alfalfa hay to meet its high demand.

- A continual increase in the number of cattle through 2017-2021 and increasing demand for quality animal feed are expected to boost the demand for alfalfa hay over the forecast period.

North America Dominates the Market

- As of 2021, some of the alfalfa hay-producing states in the United States are Texas, Kansas, California, and Missouri. These states account for the majority of the alfalfa hay production in the country. China, Japan, Korea, Taipei, Saudi Arabia, and the United Arab Emirates are the top export destinations to the United States. China is expected to remain the key market for US alfalfa hay exports.

- In addition to the production, domestic dairy consumption has been rising over the years due to increasing non-fluid dairy sales. United States Department of Agriculture (USDA) data shows that American dairy consumption is continuing its growth trajectory. Since 1975, per capita consumption has grown by 22%. Further, dairy is anticipated to continue to grow as a category in the future, with a greater focus on producing sustainable food production.

- In the United States, alfalfa hay is the most important hay crop fed to dairy cattle. Dairy utilization accounts for two-thirds of the total alfalfa usage in the major dairy-producing states, such as California, Wisconsin, New York, Idaho, and New Mexico. Although dairy production is an important market for alfalfa hay, beef producers utilize alfalfa as a part of forage needs depending on availability and price.

- Further, alfalfa hay is Canada's most predominant legume grown for forage. It is grown almost 30% of Canada's cropland, and Ontario accounts for 22%. Alberta and Ontario are the major alfalfa hay-producing states in Canada. Hence, increased demand for alfalfa in domestic and export markets is anticipated to result in significant growth over the forecast period.

Alfalfa Hay Industry Overview

The alfalfa hay market is highly fragmented, with the presence of key players like Al Dahra ACX Global Inc., Standlee Hay Company, Alfalfa Monegros, Anderson Hay and Grain Co Inc, and Border Valley. These companies were involved in various strategic activities such as partnerships, expanding their presence, and mergers and acquisitions to strengthen their presence in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Bales

- 5.1.2 Pellets

- 5.1.3 Cubes

- 5.2 Application

- 5.2.1 Dairy Animal Feed

- 5.2.2 Poultry Feed

- 5.2.3 Horse Feed

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Spain

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Al Dahra ACX Global Inc.

- 6.3.2 Alfalfa Monegros SL

- 6.3.3 Anderson Hay & Grain Inc.

- 6.3.4 Bailey Farms

- 6.3.5 Border Valley

- 6.3.6 Coaba

- 6.3.7 Cubeit Hay Company

- 6.3.8 Glenvar Hay

- 6.3.9 Green Prairie International

- 6.3.10 Grupo Oses

- 6.3.11 Gruppo Carli

- 6.3.12 Hay USA

- 6.3.13 Haykingdom Inc.

- 6.3.14 Knight AG Sourcing

- 6.3.15 Los Venteros SC

- 6.3.16 M&C Hay

- 6.3.17 McCracken Hay Company

- 6.3.18 Riverina (Australia) Pty Ltd

- 6.3.19 SL Follen Company

- 6.3.20 Standlee Hay Company