|

市场调查报告书

商品编码

1444249

全球生物种子处理 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Global Biological Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

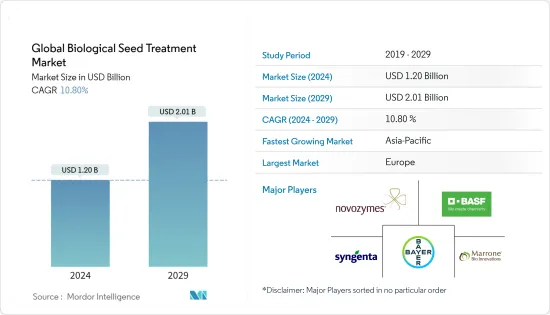

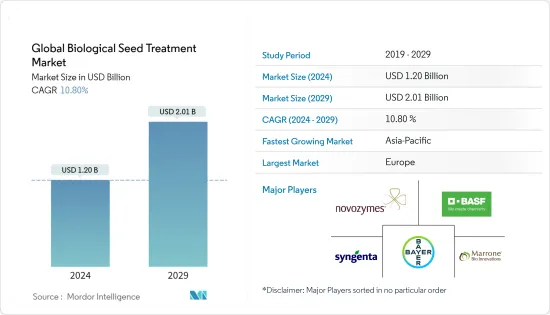

预计2024年全球生物种子处理市场规模为12亿美元,预计2029年将达到20.1亿美元,在预测期间(2024-2029年)CAGR为10.80%。

COVID-19 为製造暂时停顿和供应链中断带来了挑战。儘管如此,在封锁后的最初几週内,农业化学品的必需品的生产活动被允许,包括许多国家归类为必需品的种子处理农药。因此,COVID-19 对所研究市场的影响预计是短期的。由于农民抢购,农化企业利润较前一年实现两位数成长。

越来越多地使用自然处理方法被认为是处理种子的环境友善选择。为了提高生产力而越来越多地使用生物底漆技术、有机农业的成长趋势以及参与者在研发活动上投入更多资金来设计生物产品正在推动全球生物种子处理市场的发展。然而,政府监管障碍、生物种子处理成本高和可用性低正在阻碍农业酵素市场。根据功能,全球市场大致分为种子保护和种子强化。旨在保护种子的生物种子处理可在幼苗阶段有针对性地控制某些害虫和真菌病害。

此外,生物种子处理还可用于多种作物,如谷物、油料种子和蔬菜,以控制多种害虫。不断扩大的农业实践和对优质农产品的需求预计将推动该地区生物种子处理市场的成长。此外,已开发国家对关键活性成分的禁令是推动欧洲地区该市场成长的主要因素。因此,环保选择的增加、有机农业的趋势以及有利的监管环境预计将推动预测期内研究市场的成长。

生物种子处理市场趋势

有机农业的上升趋势

促进生物种子处理市场成长的关键因素之一包括有机农业的崛起趋势。有机农业在 187 个国家实行,2019 年,有机农业研究所 (FiBL) 至少有 310 万农民对 7,230 万公顷农业土地进行了有机管理。在过去几年中,有机农业面积显着增加。全球有机农业用地面积增加,2020 年为7,490 万公顷,高于2017 年的6,950 万公顷。2019 年,有机农业用地面积领先的地区是大洋洲(3,590 万公顷,占世界有机农业用地的一半)和欧洲( 1650万公顷,23%)。拉丁美洲有 830 万公顷(11%),其次是亚洲(590 万公顷,8%)、北美洲(360 万公顷,5%)和非洲(200 万公顷,3%)。在全球范围内,有机产业持续快速发展。

由于 COVID-19,消费者对本地、安全和有机食品的认识有所提高,许多国家报告有机产品的销售增加。然而,对有机产品的需求正在蓬勃发展,这不仅是因为具有健康意识的消费者的增加,还因为收入的增长和耕作方式的改进使有机作物更加健壮。因此,对有机食品的需求不断增加,增加了世界各地有机农业的面积。此外,政府也强调使用生物防治方法进行疾病管理。

有机农业实践的普及推动了生物种子处理的采用,特别是在政府控制的农业社区。农民要求儘早评估田间表现,以了解其作物概况的处理规范。因此,随着消费者对健康、环境、品质和安全意识的不断增强,有机农业实践的不断兴起,再加上有利的政府政策,预计将在预测期内以惊人的速度推动生物肥料市场的发展。

欧洲生物种子处理的消费量增加

虫害攻击的增加、对提高作物生产力的需求、主要参与者的技术进步以及透过使用生物种子处理技术增加收入正在导致预测期内欧洲地区市场的成长。根据西班牙2020 年LIVESEED 项目,有机出口产品(例如阿尔梅里亚和穆尔西亚的辣椒)对非基因改造或有机种子的需求不断增长,以提供保证出口需求和高作物产量的产品,从而增加了生物种子处理的使用随着生物杀菌剂、生物杀线虫剂和生物农药在全球范围内推广国内品种,进一步推动了预测期内所研究市场的需求。

散黑穗病是影响英国谷类作物的主要病害之一。此病害在大麦中最为突出,在小麦中较为罕见。随着使用芽孢桿菌属生物处理的种子,人们越来越关注预防这种疾病的真菌侵袭,这导致了未来几年研究市场的成长。此外,法国推出了一项名为「Ecophyto 2018」的计划,旨在到2018年减少50%的合成化学品消耗,这推动了市场对生物基农业投入品的需求。德国研究机构一直在广泛致力于推广生物种子处理解决方案,以提供永续的解决方案。弗劳恩霍夫有机电子研究所推出了种子电子处理技术,这是一种现代、环保的方法,无需化学成分,并获得了 DLG 奖。国家实体 Biologische Bundesanstalt 将其描述为化学选矿的替代方法。

生物种子处理行业概况

全球生物种子处理市场适度整合,研究市场中的主要参与者包括先正达、拜耳作物科学、巴斯夫、诺维信和 MarroneBio Innovations。根据回顾期间观察到的主要发展,产品发布是市场主导企业最常采用的策略。所研究的市场中的主要参与者正在增加其产品组合併扩大其业务,以透过推出创新产品来维持其在市场中的地位。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 功能

- 种子保护

- 种子强化

- 其他功能

- 作物类型

- 谷物和谷物

- 油籽

- 蔬菜

- 其他作物类型

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 泰国

- 越南

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 北美洲

第 6 章:竞争格局

- 最常用的策略

- 市占率分析

- 公司简介

- BASF SE

- Bayer Cropscience AG

- Bioworks Inc.

- Syngenta AG

- Agrauxine by Lesaffre

- Germains Seed Technology

- Koppert Biological Systems

- Novozymes

- Marrone Bio Innovations

- Groundwork BioAg

第 7 章:市场机会与未来趋势

第 8 章:评估 COVID-19 对市场的影响

The Global Biological Seed Treatment Market size is estimated at USD 1.20 billion in 2024, and is expected to reach USD 2.01 billion by 2029, growing at a CAGR of 10.80% during the forecast period (2024-2029).

COVID-19 caused challenges with respect to a temporary pause in manufacturing and supply chain disruption. Nevertheless, post the lockdown in the first few weeks, manufacturing action was allowed for essential goods with agrochemicals, including seed treatment pesticides classified under essential goods in many countries. Therefore, the impact of COVID-19 on the market studied is anticipated to be short-term. Due to panic buying by farmers, agrochemical firms have had double-digit profits compared to the previous year.

The increasing use of natural treatment methods is witnessed as an environment-friendly option for treating seeds. The increasing use of bio-priming techniques for improved productivity, increasing trend of organic farming, and players investing more in R&D activities to design biological products are driving the global market for biological seed treatment. Nevertheless, government regulatory barriers, high biological seed treatment costs, and low availability are hampering the agriculture enzyme market. Based on function, the global market has broadly been segmented into seed protection and seed enhancement. Biological seed treatments aimed at seed protection deliver targeted control of certain pests and fungal diseases during the early seedling stage.

Additionally, biological seed treatments are used on multiple crops, like grains and cereal, oil seeds, and vegetables, to control a variety of pests. The expanding agricultural practices and requirement for high-quality agricultural produce are factors that are projected to drive the biological seed treatment market growth in this region. Further, the government policies adopted by developed countries for the ban on key active ingredients are the major factors promoting the growth of this market in the Europe region. Hence, the increased adoption of environment-friendly options, the trend of organic farming, and a favorable regulatory environment are anticipated to drive the growth of the market studied during the forecast period.

Biological Seed Treatment Market Trends

Rising Trend of Organic Farming

One of the key factors enhancing the biological seed treatment market growth includes the rising trend of organic farming. Organic agriculture is practiced in 187 countries, and 72.3 million hectares of agricultural land were managed organically by at least 3.1 million farmers by the Research Institute of Organic Agriculture (FiBL) in 2019. Over the past few years, the area under organic farming has significantly increased across the world and was recorded at 74.9 million hectares in 2020, up from 69.5 million hectares in 2017. In 2019, the regions with the leading organic agricultural land areas are Oceania (35.9 million hectares, which is half the world's organic agricultural land) and Europe (16.5 million hectares, 23%). Latin America has 8.3 million hectares (11%), followed by Asia (5.9 million hectares, 8%), North America (3.6 million hectares, 5%), and Africa (2 million hectares, 3%). On a global scale, the organic sector continued to develop rapidly.

Due to COVID-19, consumer awareness of local, safe, and organic food increased, with many countries reporting increasing sales of organic products. However, the demand for organic products is thriving, not only due to a rise in health-conscious consumers but also the growing incomes and improved farming practices that make organic crops more robust. Consequently, the increasing demand for organic food has increased the area under organic farming across the world. In addition, the government is emphasizing the use of biological control methods for disease management.

The proliferation of organic agricultural practices has driven the adoption of biological seed treatment, especially among government-controlled farming communities. Farmers demand an early evaluation of field performance to understand the treatment specification of their crop profile. Hence, the rising organic farming practices with the growing awareness among consumers over health, environmental, quality, and safety, coupled with favorable government policies, is anticipated to boost the biofertilizers market at a phenomenal rate in the forecast period.

Higher Consumption of Biological Seed Treatment in Europe

The increasing insect pest attacks, need for better crop productivity, technological advancements by major players, and increasing incomes with the use of biological seed treatment techniques are leading to the growth of the European region in the market during the forecast period. According to the LIVESEED Project Spain 2020, the rising demand for non-GMO or organic seeds for organic export produces (e.g., peppers in Almeria and Murcia) to offer a product that guarantees export demand and high crop yield enhances the usage of biological seed treatment with bio fungicides, bio nematicides, and biopesticides to promote domestic varieties globally, is further boosting the demand for the market studied during the forecast period.

Loose smut is one of the prominent diseases affecting the cereal crops in the United Kingdom. The disease is most prominent in barley and rare in wheat. The increased concern to prevent the fungal attack of this disease, with the use of biologically treated seeds by Bacillus species, is leading to the growth of the market studied in the coming years. In addition, France introduced a scheme called 'Ecophyto 2018', which aimed at reducing 50% of the synthetic chemical consumption by 2018, which has pushed the demand for bio-based agricultural inputs within the market. German research institutes have been extensively working on advancing biological seed treatment solutions to provide sustainable solutions. Fraunhofer Institute for Organic Electronics launched an electron treatment of seeds, a modern, environmentally friendly method that works without chemical ingredients, and won a DLG award. It was described by the state entity Biologische Bundesanstalt as an alternative method for chemical dressing.

Biological Seed Treatment Industry Overview

The global biological seed treatment market is moderately consolidated, with major players such as, Syngenta, Bayer Crop Science, BASF, Novozymes, and MarroneBio Innovations in the market studied. As per the key developments observed during the review period, product launches are the most adopted strategies by dominant players in the market. Major players in the market studied are increasing their product portfolio and expanding their business to maintain their position in the market by launching innovative products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Seed Protection

- 5.1.2 Seed Enhancement

- 5.1.3 Other Functions

- 5.2 Crop Type

- 5.2.1 Grains and Cereal

- 5.2.2 Oil Seeds

- 5.2.3 Vegetables

- 5.2.4 Other Crop Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Russia

- 5.3.2.6 Italy

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Thailand

- 5.3.3.5 Vietnam

- 5.3.3.6 Australia

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Bayer Cropscience AG

- 6.3.3 Bioworks Inc.

- 6.3.4 Syngenta AG

- 6.3.5 Agrauxine by Lesaffre

- 6.3.6 Germains Seed Technology

- 6.3.7 Koppert Biological Systems

- 6.3.8 Novozymes

- 6.3.9 Marrone Bio Innovations

- 6.3.10 Groundwork BioAg