|

市场调查报告书

商品编码

1444269

全球塑胶包装 - 市场份额分析、行业趋势与统计、成长预测(2024 - 2029)Global Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

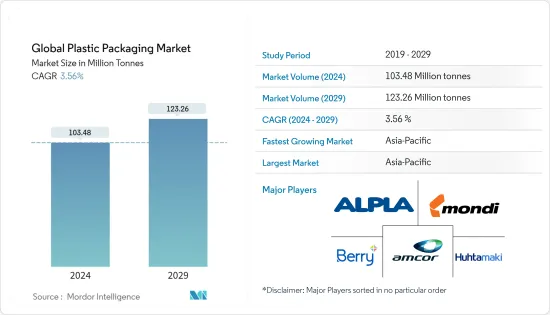

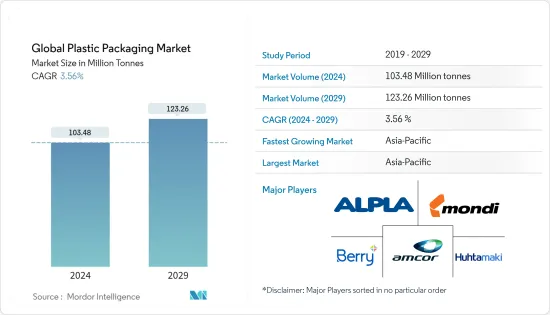

2024年全球塑胶包装市场规模预计为1.0348亿吨,预计到2029年将达到1.2326亿吨,在预测期内(2024-2029年)CAGR为3.56%。

与其他包装产品相比,消费者越来越倾向于塑胶包装,因为塑胶包装重量轻且易于处理。同样,即使是大型製造商也更喜欢塑胶包装解决方案,因为它们的生产成本较低。

主要亮点

- 塑胶容器在饮料、食品、化妆品和製药行业中变得越来越重要。新的填充技术和耐热包装材料的出现为市场开闢了新的可能性和选择。虽然 PET 瓶在多个领域都很常见,但饮料、化妆品、卫生用品和洗涤剂主要以聚乙烯 (PE) 瓶销售。

- 禁止使用塑胶袋以及其他类型的塑胶包装是解决全球塑胶垃圾问题最常用的补救措施。根据《国家地理》报道,截至 2021 年 6 月,已有 115 个国家以各种方式采取了这种做法。例如,法国禁止使用厚度小于 50 微米的塑胶袋。在突尼斯,禁止使用厚度小于 40 微米的塑胶袋。

- 多家跨国公司越来越认识到将 PET 回收製成饮料容器等食品级产品的迫切性。这一趋势可以推动全球PET需求的成长。例如,可口可乐公司计划在 2030 年之前在其容器中使用 50% 的回收 PET。此外,联合利华致力于到 2025 年使其塑胶包装 100% 可重复使用或可回收。

- 电子商务产业的快速扩张或将创造新的市场拓展机会。为了降低运输成本,电商企业青睐轻质、灵活的包装选择。随着越来越多的人在网路上购买日常生鲜食品、快速消费品、电子设备和服装,预计该行业将会成长。

- 此外,由于越来越多地引入创新包装解决方案,包括活性包装、改良环境包装、可食用包装和生物塑胶包装,预计未来几年塑胶包装将面临更多机会。然而,随着可持续意识的增强以及为减少塑料污染而严格禁止使用一次性塑料,该行业的生存预计将受到挑战。

- 自 COVID-19 大流行爆发以来,消费者和企业不得不改变他们对包装健康和安全的看法。自从疫情爆发初期以来,一次性塑胶就变得越来越重要。消费者担心可重复使用的包装会增加传播风险。

塑胶包装市场趋势

食品领域将占据主要份额

- 食品包装是塑胶的最大用户之一。食品业对硬质塑胶包装的需求正在不断增长,因为它们由于其轻质和降低成本等有益特性而越来越多地取代纸板、金属和玻璃等传统材料。

- 烘焙产品消费量的增加进一步推动了柔性塑胶包装解决方案的采用,以延长保质期并避免麵包出现白垩现象。大约80% 的烘焙食品以软包装形式出售,麵包店现在生产的麵包、小圆麵包和麵包卷的种类比以往任何时候都更加全面,包括特色麵包和无麸质麵包,市场参与者正在开发满足需求的先进解决方案。

- 供应商进行策略合作,以增强该领域的软包装。例如,2021 年 5 月,ProAmpac 收购了爱尔兰软包装公司和 Fispak,为爱尔兰的麵包店提供软包装产品。同样,2021年9月,PPC软包装宣布收购客製化软包装,以提高包括烘焙产品在内的所有产品的软膜销售。

- 硬质塑胶包装包括塑胶瓶和容器,在食品包装应用行业中继续流行。容器用于包装酱料和其他使用 HDPE 和 LDPE 材料进行包装的消费品。此外,塑胶瓶和容器在食品工业中变得越来越重要,因为它们能够延长包装食品的保质期。

- 目前的市场状况显示全球对糖果产品软包装解决方案的需求。东欧对柔性塑胶的需求也在增加,预计到 2023 年销售量将成长(30 亿件)。波兰预计将见证最显着的变化。此外,柔性塑胶一直是包装的主要选择,尤其是糖果产品。

- 根据商务部2021年最终贸易资料,美国向其他国家出口了价值1770亿美元的农产品和食品,比2020年增长18%,比2014年的历史高点增长14.6%。贸易统计显示美国农业的强大是因为它不断为世界各地的消费者提供优质、价格合理的农产品和食品。这一趋势对食品加工和运输行业来说是一个重大收益,这些行业严重依赖塑胶包装,因为塑胶包装价格实惠,并且具有防潮等理想品质。

亚太地区将占据最大市场份额

- 亚太地区包装产业深受人均收入成长、社会氛围变化和人口统计等变数的影响。这种转变的结果是需要新的包装材料、工艺和形式。

- 中国是塑胶包装使用量最大的国家。盒装食品的成长趋势、餐厅和超市数量的增加以及瓶装水和饮料消费的增加是该国市场成长的重要驱动因素。

- 根据中国国家统计局的数据,2021年12月,中国生产了约795万吨塑胶製品。中国塑胶产品使用量的增加预计将推动各种硬质塑胶包装产品的市场需求。

- 此外,市场供应商正在提供注重永续性承诺的产品。例如,作为其永续发展承诺的一部分,总部位于印度的层压塑胶管製造商 Essel Propack 生产了可回收的 HDPE 屏障管。 Platina 250 和 Green Maple Leaf (GML) 300 Lamitube 专为希望改用可回收、环保阻隔包装形式的品牌而设计。

- 据日本塑胶工业联合会称,2022年第一季日本塑胶容器数量大幅增加。这一趋势预计将增加该国各种最终用户客户对塑胶瓶的市场需求。

- 此外,2022年3月,日本石化製造商东曹计划在2025年3月年底前建成其化学回收技术,从混合聚合物中萃取原料单体。该生产商于 2021 年 11 月开始与东北大学、回收公司 KeiwaKogyo、水处理公司 TohzaiChemical Industry 和国有研究所国家先进工业科学技术研究所合作研究该技术。

塑胶包装行业概况

全球塑胶包装市场竞争非常激烈,因为许多参与者在国内和国际范围内开展业务。市场较为集中,有 Alpla Group、Amcor plc、Berry Global Inc. 和 Mondi PLC 等主要参与者。

- 2022 年 5 月 - Amcor PLC 开发了最新技术 PowerPostTM,该技术使瓶子重量减轻了 30%,并且可以由 100% 回收材料製成。该技术专为热灌装饮料而开发,可避免溢出溢出。此外,该产品基于真空吸收技术 PowerStrap 建构。

- 2022 年 3 月 - ALPLA 集团从 FROMM 集团收购了回收公司 Texplast 及其在合资企业 PET Recycling Team Wolfen 中的所有股份。这家国际公司将把在德国的 PET 瓶年加工量增加到 75,000 吨。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 评估 COVID-19 对市场的影响

- 产业价值链分析

- 市场动态

- 市场驱动因素

- 老年人口的增长和疾病的流行

- 产品创新,例如小型化和相对较低的成本

- 市场挑战

- 法规的动态性和无法支援重型货物

- 市场驱动因素

第 5 章:市场细分

- 硬质塑胶包装

- 材料

- 聚乙烯(PE)

- 聚对苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和发泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他硬质塑胶包装材料

- 产品

- 瓶子和罐子

- 托盘和容器

- 其他产品类型

- 最终用户产业

- 食物

- 饮料

- 卫生保健

- 化妆品和个人护理

- 其他最终用户产业

- 地理

- 北美洲

- 材料

- 最终用户产业

- 国家

- 美国

- 加拿大

- 欧洲

- 材料

- 最终用户产业

- 国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太

- 材料

- 最终用户产业

- 国家

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 印尼

- 亚太其他地区

- 拉丁美洲

- 材料

- 最终用户产业

- 国家

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 材料

- 最终用户产业

- 国家

- 阿拉伯联合大公国 (UAE)

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 材料

- 柔性塑胶包装

- 材料种类

- 聚乙烯(PE)

- 双向聚丙烯 (BOPP)

- 流延聚丙烯 (CPP)

- 聚氯乙烯 (PVC)

- 乙烯乙烯醇 (EVOH)

- 其他材料类型

- 产品类别

- 袋

- 包包

- 薄膜和包装材料

- 其他产品类型

- 最终用户产业

- 食物

- 烘焙食品

- 休閒食品

- 肉类、家禽和海鲜

- 糖果/甜点

- 宠物食品

- 其他食品

- 饮料

- 化妆品及个人护理品

- 其他最终用户产业

- 地理

- 北美洲

- 材料种类

- 最终用户产业

- 国家

- 美国

- 加拿大

- 欧洲

- 材料种类

- 最终用户产业

- 国家

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太

- 材料种类

- 最终用户产业

- 国家

- 中国

- 印度

- 日本

- 亚太其他地区

- 拉丁美洲

- 材料种类

- 最终用户产业

- 国家

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 材料种类

- 最终用户产业

- 国家

- 阿拉伯联合大公国 (UAE)

- 南非

- 中东和非洲其他地区

- 材料种类

第 6 章:竞争格局

- 公司简介

- DS Smith PLC

- ES-Plastic GmbH

- Pact Group

- Liquibox (Olympus Partners)

- UFlex Limited

- Anchor Packaging LLC

- Plastipak Holdings Inc.

- Dart Container Corporation

- ALPLA Group

- Amcor PLC

- American Packaging Corporation

- Berry Global Inc.

- Constantia Flexibles Group GmbH

- Mondi PLC

- Novolex

- Printpack Inc.

- Reynolds Consumer Products Inc.

- Quadpack Industries SA

- Sealed Air Corporation

- Sigma Plastics Group

- Sonoco Products Company

- Tetra Pak International SA (Tetra Laval Group)

- Toppan Inc.

- Transcontinental Inc.

- Winpak Ltd

- Huhtamaki Oyj

第 7 章:投资分析

第 8 章:市场的未来

The Global Plastic Packaging Market size is estimated at 103.48 Million tonnes in 2024, and is expected to reach 123.26 Million tonnes by 2029, growing at a CAGR of 3.56% during the forecast period (2024-2029).

Compared to other packaging products, consumers have shown an increasing inclination toward plastic packaging, as plastic packages are lightweight and easier to handle. Similarly, even the big manufacturers prefer plastic packaging solutions because of their lower cost of production.

Key Highlights

- Plastic containers are becoming important in the beverage, food, cosmetics, and pharmaceutical industries. New filling technologies and the emergence of heat-resistant packaging material opened up new possibilities and options in the market. While PET bottles are common in multiple segments, beverages, cosmetics, sanitary products, and detergents are predominantly sold in polyethylene (PE) bottles.

- Banning plastic bags, along with other types of plastic packaging, is the most used remedy to solve the problem of plastic waste worldwide. According to National Geographic, as of June 2021, 115 countries had taken that approach in various ways. For instance, plastic bags less than 50 microns thick are banned in France. In Tunisia, plastic bags less than 40 microns thick are forbidden.

- Several global companies increasingly recognize the urgency of recycling PET into food-grade products, such as beverage containers. The trend can drive the growth of the demand for PET in the world. For instance, the Coca-Cola Company intends to use 50% recycled PET in its containers by 2030. Also, Unilever is committed to making 100% of its plastic packaging reusable or recyclable by 2025.

- The e-commerce industry's rapid expansion will probably create new opportunities for market expansion. To cut the cost of transportation, e-commerce enterprises favor lightweight and flexible packaging options. The sector is anticipated to increase as more people shop online for everyday fresh foods, FMCG products, electrical devices, and clothing.

- Additionally, greater opportunities for plastic packaging are anticipated in the upcoming years due to the growing introduction of innovative packaging solutions, including active packaging, modified environment packaging, edible packaging, and bioplastic packaging. However, the industry's existence is expected to be challenged by growing sustainability awareness and a strict prohibition on single-use plastic to reduce plastic pollution.

- Since the outbreak of the COVID-19 pandemic, consumers and businesses have had to alter how they view packaging health and safety. Since the early days of the pandemic, single-use plastic has been gaining importance; consumers were concerned that reusable packaging would increase the risk of transmission.

Plastic Packaging Market Trends

Food Segment to Occupy Major Share

- Food packaging is one of the largest users of plastics. The demand for rigid plastic packaging for the food industry is witnessing demand, as they are increasingly replacing traditional materials such as paperboard, metals, and glass, owing to their beneficial properties, such as lightweight and reduced cost.

- The increasing consumption of bakery products is further driving the adoption of flexible plastic packaging solutions to increase the shelf-life and avoid chalky bread conditions. With roughly 80% of baked goods being sold in flexible packaging and bakeries now producing a more comprehensive range of bread, buns, and rolls than ever before, including specialty and gluten-free, market players are developing advanced solutions catering to the demand.

- Vendors strategically partnered to enhance flexible packaging for the segment. For instance, in May 2021, ProAmpac acquired Irish Flexible packaging and Fispak to serve flexible packaging products to bakeries in Ireland. Similarly, in September 2021, PPC Flexible Packaging announced the acquisition of custom flexible packaging to enhance the sales of flexible films for all products, including bakery products.

- Rigid plastic packaging includes plastic bottles and containers and continues to be popular in industries for food packaging applications. Containers are used to pack sauces and other consumer goods that use HDPE and LDPE material for packaging. Moreover, plastic bottles and containers gained importance in the food industry due to their ability to provide extended shelf life to packaged food items.

- The current market scenario indicates a global demand for flexible packaging solutions for sweets and confectionery products. The need for flexible plastic is also increasing in Eastern Europe, with expected growth in volume (3.0 billion units) by 2023. Poland is expected to witness the most significant change. Also, flexible plastic has been the primary choice for packaging, especially for confectionery products.

- According to the Department of Commerce's final 2021 trade data, the United States exported USD 177 billion worth of farm and food goods to other countries, an increase of 18% over 2020 and a 14.6% increase over the previous high from 2014. The trade statistics show that American agriculture is strong because it keeps supplying consumers worldwide with quality, reasonably priced farm, and food items. The trend is a significant gain for food processing and transportation sectors, which rely heavily on plastic packaging because it is affordable and has desirable qualities, like moisture resistance.

Asia-Pacific to Hold the Largest Market Share

- The Asia-Pacific packaging sector is heavily influenced by variables such as rising per capita income, changing social atmosphere, and demographics. As a result of the shift, new packaging materials, processes, and forms are required.

- China is the largest country contributing to plastic packaging usage. The growing trend of packed meals, the increasing number of restaurants and supermarkets, and increasing bottled water and beverage consumption are significant driving factors of the country's market growth.

- According to the National Bureau of Statistics of China, in December 2021, China produced about 7.95 million metric tons of plastic products. Such an increase in plastic product use in China is expected to drive the market demand for various rigid plastic packaging products.

- Moreover, the market vendors are offering products that focus on sustainability commitments. For instance, as part of its commitment to sustainability, the manufacturer of laminated plastic tubes, Essel Propack, based in India, has produced recyclable HDPE barrier tubes. Platina 250 and Green Maple Leaf (GML) 300 Lamitubeswere created for brands looking to switch to recyclable, environmentally friendly barrier packaging formats.

- According to the Japan Plastics Industry Federation, the number of plastic containers in Japan increased significantly in the first quarter of 2022. The trend is expected to increase the market demand for plastic bottles in the country for various end-user customers.

- Furthermore, in March 2022, Tosoh, a Japanese petrochemical manufacturer, aimed to construct its chemical recycling technology by the end of March 2025 to extract raw monomers from mixed polymers. The producer began researching the technique in November of 2021 in collaboration with Tohoku University, recycling company KeiwaKogyo, water treatment company TohzaiChemical Industry, and state-owned research institute National Institute of Advanced Industrial Science and Technology.

Plastic Packaging Industry Overview

The global plastic packaging market is highly competitive because of the presence of many players running their businesses within national and international boundaries. The market is mildly concentrated with the presence of major players like Alpla Group, Amcor plc, Berry Global Inc., and Mondi PLC.

- May 2022 - Amcor PLC developed its latest technology, PowerPostTM, which delivers a bottle up to 30% lighter and can be made from 100% recycled material. The technology was developed for hot-fill beverages and avoids spills from overflow. Furthermore, the product is built on a vacuum-absorbing technology, PowerStrap.

- March 2022 - The ALPLA Group acquired the recycling company Texplastfrom the FROMM Group and all its shares in the joint venture, PET Recycling Team Wolfen. The international company will increase its annual processing volume in Germany to 75,000 tons of PET bottles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Growing Geriatric Population and Prevalence of Diseases

- 4.5.1.2 Product Innovations such as Downsizing coupled with Relatively Low Costs

- 4.5.2 Market Challenges

- 4.5.2.1 Dynamic Nature of Regulations and Inability to Support Heavy Goods

- 4.5.1 Market Drivers

5 MARKET SEGMENTATION

- 5.1 RIGID PLASTIC PACKAGING

- 5.1.1 Material

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polyethylene terephthalate (PET)

- 5.1.1.3 Polypropylene (PP)

- 5.1.1.4 Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.1.1.5 Polyvinyl chloride (PVC)

- 5.1.1.6 Other Rigid Plastic Packaging Materials

- 5.1.2 Product

- 5.1.2.1 Bottles and Jars

- 5.1.2.2 Trays and containers

- 5.1.2.3 Other Product Types

- 5.1.3 End-user Industry

- 5.1.3.1 Food

- 5.1.3.2 Beverage

- 5.1.3.3 Healthcare

- 5.1.3.4 Cosmetics and Personal Care

- 5.1.3.5 Other End-user Industries

- 5.1.4 Geography

- 5.1.4.1 North America

- 5.1.4.1.1 Material

- 5.1.4.1.2 End-user Industry

- 5.1.4.1.3 Country

- 5.1.4.1.3.1 United States

- 5.1.4.1.3.2 Canada

- 5.1.4.2 Europe

- 5.1.4.2.1 Material

- 5.1.4.2.2 End-user Industry

- 5.1.4.2.3 Country

- 5.1.4.2.3.1 United Kingdom

- 5.1.4.2.3.2 Germany

- 5.1.4.2.3.3 France

- 5.1.4.2.3.4 Italy

- 5.1.4.2.3.5 Spain

- 5.1.4.2.3.6 Rest of Europe

- 5.1.4.3 Asia-Pacific

- 5.1.4.3.1 Material

- 5.1.4.3.2 End-user Industry

- 5.1.4.3.3 Country

- 5.1.4.3.3.1 China

- 5.1.4.3.3.2 India

- 5.1.4.3.3.3 Japan

- 5.1.4.3.3.4 Australia

- 5.1.4.3.3.5 South Korea

- 5.1.4.3.3.6 Indonesia

- 5.1.4.3.3.7 Rest of Asia-Pacific

- 5.1.4.4 Latin America

- 5.1.4.4.1 Material

- 5.1.4.4.2 End-user Industry

- 5.1.4.4.3 Country

- 5.1.4.4.3.1 Brazil

- 5.1.4.4.3.2 Argentina

- 5.1.4.4.3.3 Mexico

- 5.1.4.4.3.4 Rest of Latin America

- 5.1.4.5 Middle East & Africa

- 5.1.4.5.1 Material

- 5.1.4.5.2 End-user Industry

- 5.1.4.5.3 Country

- 5.1.4.5.3.1 United Arab Emirates (UAE)

- 5.1.4.5.3.2 Saudi Arabia

- 5.1.4.5.3.3 South Africa

- 5.1.4.5.3.4 Rest of Middle East & Africa

- 5.1.1 Material

- 5.2 FLEXIBLE PLASTIC PACKAGING

- 5.2.1 Material Type

- 5.2.1.1 Polyethene (PE)

- 5.2.1.2 Bi-orientated Polypropylene (BOPP)

- 5.2.1.3 Cast polypropylene (CPP)

- 5.2.1.4 Polyvinyl Chloride (PVC)

- 5.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 5.2.1.6 Other Material Types

- 5.2.2 Product Type

- 5.2.2.1 Pouches

- 5.2.2.2 Bags

- 5.2.2.3 Films & Wraps

- 5.2.2.4 Other Product Types

- 5.2.3 End-user Industry

- 5.2.3.1 Food

- 5.2.3.1.1 Baked Food

- 5.2.3.1.2 Snacked Food

- 5.2.3.1.3 Meat, Poultry & Sea Food

- 5.2.3.1.4 Candy/Confections

- 5.2.3.1.5 Pet Food

- 5.2.3.1.6 Other Food

- 5.2.3.2 Beverage

- 5.2.3.3 Cosmetics & Personal Care

- 5.2.3.4 Other End-user Industries

- 5.2.4 Geography

- 5.2.4.1 North America

- 5.2.4.1.1 Material Type

- 5.2.4.1.2 End-user Industry

- 5.2.4.1.3 Country

- 5.2.4.1.3.1 United States

- 5.2.4.1.3.2 Canada

- 5.2.4.2 Europe

- 5.2.4.2.1 Material Type

- 5.2.4.2.2 End-user Industry

- 5.2.4.2.3 Country

- 5.2.4.2.3.1 United Kingdom

- 5.2.4.2.3.2 Germany

- 5.2.4.2.3.3 France

- 5.2.4.2.3.4 Rest of Europe

- 5.2.4.3 Asia-Pacific

- 5.2.4.3.1 Material Type

- 5.2.4.3.2 End-user Industry

- 5.2.4.3.3 Country

- 5.2.4.3.3.1 China

- 5.2.4.3.3.2 India

- 5.2.4.3.3.3 Japan

- 5.2.4.3.3.4 Rest of Asia-Pacific

- 5.2.4.4 Latin America

- 5.2.4.4.1 Material Type

- 5.2.4.4.2 End-user Industry

- 5.2.4.4.3 Country

- 5.2.4.4.3.1 Brazil

- 5.2.4.4.3.2 Argentina

- 5.2.4.4.3.3 Mexico

- 5.2.4.4.3.4 Rest of Latin America

- 5.2.4.5 Middle East & Africa

- 5.2.4.5.1 Material Type

- 5.2.4.5.2 End-user Industry

- 5.2.4.5.3 Country

- 5.2.4.5.3.1 United Arab Emirates (UAE)

- 5.2.4.5.3.2 South Africa

- 5.2.4.5.3.3 Rest of Middle East & Africa

- 5.2.1 Material Type

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 DS Smith PLC

- 6.1.2 ES-Plastic GmbH

- 6.1.3 Pact Group

- 6.1.4 Liquibox (Olympus Partners)

- 6.1.5 UFlex Limited

- 6.1.6 Anchor Packaging LLC

- 6.1.7 Plastipak Holdings Inc.

- 6.1.8 Dart Container Corporation

- 6.1.9 ALPLA Group

- 6.1.10 Amcor PLC

- 6.1.11 American Packaging Corporation

- 6.1.12 Berry Global Inc.

- 6.1.13 Constantia Flexibles Group GmbH

- 6.1.14 Mondi PLC

- 6.1.15 Novolex

- 6.1.16 Printpack Inc.

- 6.1.17 Reynolds Consumer Products Inc.

- 6.1.18 Quadpack Industries SA

- 6.1.19 Sealed Air Corporation

- 6.1.20 Sigma Plastics Group

- 6.1.21 Sonoco Products Company

- 6.1.22 Tetra Pak International SA (Tetra Laval Group)

- 6.1.23 Toppan Inc.

- 6.1.24 Transcontinental Inc.

- 6.1.25 Winpak Ltd

- 6.1.26 Huhtamaki Oyj