|

市场调查报告书

商品编码

1444302

碳纤维 -市场占有率分析、产业趋势与统计、成长预测(2024-2029)Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

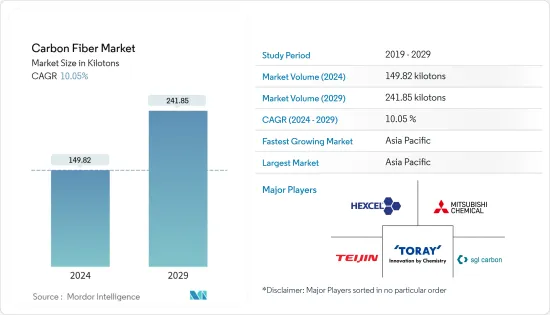

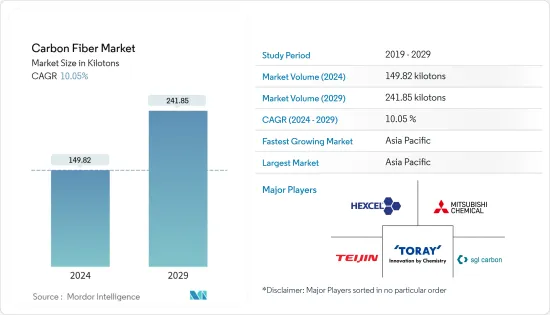

预计2024年碳纤维市场规模为149,820吨,预计2029年将达到241,850吨,在预测期(2024-2029年)复合年增长率为10.05%。

受新冠肺炎 (COVID-19) 影响,2020 年汽车、建筑、航太等多个行业的产量均出现下降。全球汽车和航太产业受到感染疾病的严重影响,并正在考虑因 COVID-19 暂时停止最终用户活动。世界各国政府实施的封锁。然而,在大流行后的情况下,该行业已经復苏,预计未来几年将显着成长。

主要亮点

- 从中期来看,推动所研究市场成长的主要因素是航太和国防领域的最新进展以及风力发电领域应用的增加。

- 另一方面,再生碳纤维供应链的安全性和替代品的可近性也成为调查市场的限制因素。

- 再生碳纤维的日益普及以及对使用木质素作为碳纤维原材料的重视可能成为预测期内需要探索的市场机会。

- 就数量而言,亚太地区在受访的全球市场中占据主导地位,其中中国占据了大部分需求。

碳纤维市场趋势

航太和国防工业主导市场

- 从最终用户产业来看,航太和国防占据了最大的市场份额。在过去的几年里,这个领域已经增加了一些新产品。碳纤维是许多航太和国防应用的理想选择,因为它可以在需要时提供强度、耐用性和稳定性。

- 国防工业在飞弹防御、地面防御和军舰上使用碳纤维增强塑胶 (CFRP)。

- 在北美,消费者支出的增加和民航机的持续老化是影响碳纤维产品在航太业整体普及的主要因素之一。

- 在亚洲,由于全部区域的新兴国家)对民航机的需求不断增长,航太技术领域的碳纤维市场可能在预测期内呈现最高增长率。

- COVID-19 加速了航空航太领域的几个现有趋势,市场参与企业将永续技术、产业整合以及环境、社会和公司管治(ESG) 视为后电晕领域的三个关键趋势。这被引用为最大的主题。

- 例如,波音公司《2022-2041 年商业展望》预计,到 2041 年,全球新飞机交付总量将达到 41,170 架。由于预计交付如此之大,全球飞机製造对碳纤维的需求可能会增加。

- 2021年,全球国防开支首次突破2兆美元。 2021年全球国防开支较2020年成长0.7%。国防开支最高的五个国家分别是美国、中国、印度、英国和俄罗斯。这些占总支出的62%。这可能会增加国防应用中对碳纤维的需求。

- 航太和国防工业的此类趋势预计将推动碳纤维市场的发展。

亚太地区主导市场

- 由于中国和印度等国家各种终端用户行业的成长,亚太地区预计将在数量上主导全球市场。

- 中国航空公司计划在未来20年内采购约7,690架新飞机,价值约1.2兆美元,预计将进一步增加碳纤维的市场需求。

- 根据波音《2022-2041年商业展望》,到2041年,中国将新增交付约8,485架,市场服务价值达5,450亿美元。随着该国新的交付,对碳纤维的需求可能会增加。

- 根据斯德哥尔摩国际和平研究所(SIPRI)统计,印度军费开支为766亿美元,位居世界第三。这比 2020 年增长了 0.9%。为了加强本土军事工业,2021年军事预算中64%的资本支出专门用于购买本土武器。

- 印度目前拥有全球第四大风力发电装置容量,总设备容量为39.25兆瓦(截至2021年3月31日),预计2020年至2021年发电量约为601.49亿台。我明白了。风电产业的扩张创造了强大的生态系统、计划管理能力和每年约10,000兆瓦的製造地。

- 所有上述因素预计将在预测期内对该地区碳纤维市场需求产生重大影响。

碳纤维产业概况

全球碳纤维市场本质上是整合的,主要企业之间为了增加市场占有率而展开激烈的竞争。碳纤维市场的主要企业包括(排名不分先后)东丽工业株式会社、西格里碳素公司、三菱化学公司、赫氏公司、帝人公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 航太和国防领域的最新进展

- 风力发电领域应用不断增加

- 抑制因素

- 再生碳纤维供应链安全

- 确保替补人员

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 价格分析

- 技术形势- 快速简介

- 生产分析

第五章市场区隔(市场规模与金额)

- 原料

- 聚丙烯腈 (PAN)

- 石油沥青和人造丝

- 类型

- 原生纤维 (VCF)

- 再生碳纤维(RCF)

- 目的

- 复合材料

- 纺织品

- 微电极

- 催化作用

- 最终用户产业

- 航太和国防

- 替代能源

- 车

- 建筑和基础设施

- 体育用品

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- A&P Technology Inc.

- Anshan Sinocarb Carbon Fibers Co. Ltd

- DowAksa USA LLC

- Formosa Plastics Corporation

- Hexcel Corporation

- Holding company Composite

- Hyosung Advanced Materials

- Jiangsu Hengshen Co. Ltd

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries Inc.

- Zhongfu Shenying Carbon Fiber Co. Ltd

第七章市场机会与未来趋势

- 再生碳纤维越来越受欢迎

- 专注于木质素作为碳纤维原料的利用

The Carbon Fiber Market size is estimated at 149.82 kilotons in 2024, and is expected to reach 241.85 kilotons by 2029, growing at a CAGR of 10.05% during the forecast period (2024-2029).

Due to COVID-19, production in various industries, including automotive, construction, aerospace, etc., decreased in 2020. The global automotive and aerospace industry has been heavily impacted by the pandemic, considering a temporary halt in end-user activities due to government-imposed lockdowns in various parts of the world. However, in the post-pandemic scenario, the industry has recovered and is expected to grow at a significant rate during the coming years.

Key Highlights

- In the medium term, the major factors driving the growth of the market studied are recent advancements in the aerospace and defense sector and increasing applications in the wind energy sector.

- On the flip side, supply chain security for recycled carbon fiber and the availability of substitutes have been acting as restraints to the market studied.

- The increasing popularity of recycled carbon fiber and the emphasis on the usage of lignin as raw material for carbon fiber is likely to act as opportunities for the market studied over the forecast period.

- In terms of volume, Asia-Pacific dominated the market studied across the world, with China accounting for most of the demand.

Carbon Fiber Market Trends

Aerospace and Defense Industry to Dominate the Market

- Aerospace and defense account for the largest share of the market based on end-user industries. Over the past few years, there have been several new products added in this field. Carbon fibers are a perfect choice for numerous aerospace and defense applications as they provide strength, endurance, and stability as required.

- In the defense industry, the use of carbon fiber-reinforced plastics (CFRP) is present in missile defense, ground defense, and military marine.

- In North America, higher consumer spending and the constant aging of commercial aircraft are among the primary factors influencing the overall product penetration of carbon fibers in the aerospace industry.

- In Asia, the market for carbon fibers in aerospace technology is likely to witness the highest growth rate over the forecast period due to the rising demand for commercial aircraft across the region, especially in emerging economies, including China.

- COVID-19 has accelerated several pre-existing trends in aviation and aerospace, with market participants identifying sustainable technologies, industry consolidation, and environmental, social, and corporate governance (ESG) as the three biggest themes in the post-COVID-19 space.

- For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. Owing to such huge expected deliveries, the demand for carbon fiber during aircraft production is likely to rise across the world.

- The global defense expenditure crossed USD 2 trillion for the first time in 2021. Global spending was 0.7% higher in 2021 compared to 2020. The top five countries with the highest defense expenditure were the United States, China, India, the United Kingdom, and Russia. They accounted for 62% of the total spending. This is likely to increase the demand for carbon fiber used in defense applications.

- Such trends in the aerospace and defense industries are expected to drive the carbon fiber market.

Asia-Pacific to Dominate the Market

- The Asia Pacific region is expected to dominate the global market in terms of volume due to the growth of various end-user industries in countries like China and India.

- The Chinese airline companies are planning to purchase about 7,690 new aircraft in the next 20 years, which were valued at approximately USD 1.2 trillion, which is further expected to raise the market demand for carbon fiber.

- According to the Boeing Commercial Outlook 2022-2041, in China, around 8,485 new deliveries are likely to be made by 2041, with a market service value of USD 545 billion. Owing to such new deliveries in the country, the demand for carbon fiber is likely to rise.

- According to the Stockholm International Peace Research Institute (SIPRI), India's military spending of USD 76.6 billion ranked third highest in the world. This was up by 0.9% from 2020. In a push to strengthen the indigenous arms industry, 64% of capital outlays in the military budget of 2021 were earmarked for acquisitions of domestically produced arms.

- India currently has the fourth-highest wind installed capacity in the world, with a total installed capacity of 39.25 GW (as of March 31, 2021), and generated around 60.149 billion units during 2020-21. The expansion of the wind industry resulted in a strong ecosystem, project operation capabilities, and a manufacturing base of about 10,000 MW per annum.

- All the aforementioned factors are expected to show a significant impact on the demand for the carbon fiber market in the region over the forecast period.

Carbon Fiber Industry Overview

The global carbon fiber market is consolidated in nature, with intense competition among the top players to increase their share in the market. The major companies in the carbon fiber market include (not in any particular order) Toray Industries Inc., SGL Carbon, Mitsubishi Chemical Corporation, Hexcel Corporation, and Teijin Limited, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Recent Advancements in Aerospace and Defense Sector

- 4.1.2 Increasing Applications in Wind Energy Sector

- 4.2 Restraints

- 4.2.1 Supply Chain Security for Recycled Carbon Fiber

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

- 4.6 Technology Landscape - Quick Snapshot

- 4.7 Production Analysis

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Raw Material

- 5.1.1 Polyacrylonitrile (PAN)

- 5.1.2 Petroleum Pitch and Rayon

- 5.2 Type

- 5.2.1 Virgin Fiber (VCF)

- 5.2.2 Recycled Carbon Fiber (RCF)

- 5.3 Application

- 5.3.1 Composite Materials

- 5.3.2 Textiles

- 5.3.3 Microelectrodes

- 5.3.4 Catalysis

- 5.4 End-user Industry

- 5.4.1 Aerospace and Defense

- 5.4.2 Alternative Energy

- 5.4.3 Automotive

- 5.4.4 Construction and Infrastructure

- 5.4.5 Sporting Goods

- 5.4.6 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A&P Technology Inc.

- 6.4.2 Anshan Sinocarb Carbon Fibers Co. Ltd

- 6.4.3 DowAksa USA LLC

- 6.4.4 Formosa Plastics Corporation

- 6.4.5 Hexcel Corporation

- 6.4.6 Holding company Composite

- 6.4.7 Hyosung Advanced Materials

- 6.4.8 Jiangsu Hengshen Co. Ltd

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Nippon Graphite Fiber Co. Ltd

- 6.4.11 SGL Carbon

- 6.4.12 Solvay

- 6.4.13 Teijin Limited

- 6.4.14 Toray Industries Inc.

- 6.4.15 Zhongfu Shenying Carbon Fiber Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Recycled Carbon Fiber

- 7.2 Emphasis on Usage of Lignin as Raw Material for Carbon Fiber