|

市场调查报告书

商品编码

1444330

地热能:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Geothermal Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

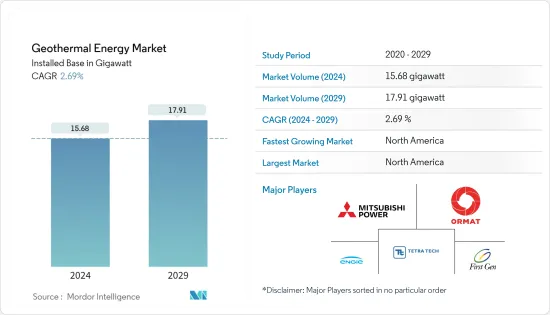

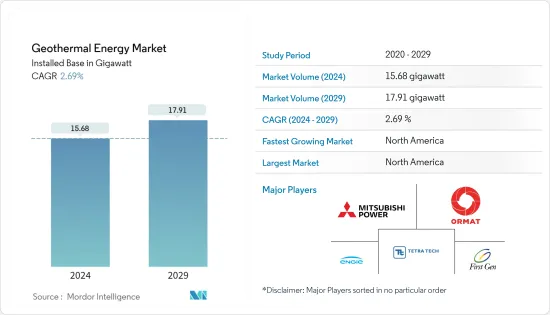

地热能市场规模预计将从2024年的15.68吉瓦成长到2029年的17.91吉瓦,在预测期间(2024-2029年)装机量复合年增长率为2.69%。

主要亮点

- 从中期来看,因素包括对清洁和环保资源的电力安全的日益担忧。此外,对地热热泵和区域供暖等供暖和製冷系统的需求不断增长正在推动地热能源市场的成长。

- 另一方面,太阳能和风能等替代清洁能源来源的有利市场可能会阻碍预测期内的市场成长。

- 儘管如此,政府为促进永续能源生产而实施的财政优惠和退税等措施预计将在预测期内为地热能市场创造许多成长机会。

- 预计北美将成为预测期内最大的市场,大部分需求来自美国、墨西哥等国家。

地热能市场趋势

双回圈发电厂业务预计将显着成长

- 在双回圈发电厂中,地下水或蒸气不会与涡轮机直接接触。相反,来自地热储存的水被泵入热交换器,在热交换器中加热第二种液体形式的异丁烯(其沸点低于水)。

- 第二种液体被加热并转化为蒸气,为发电机的涡轮机提供动力。来自地下的热水透过注入井回收到地下,第二液体透过涡轮机返回热交换器,在那里可以再次使用。

- 干蒸气和闪蒸发电厂比二元发电厂产量更高,经济效率更高,因为它们需要稀有的、热的、浅的储存。然而,二元装置也可以在冷库中运作,增加了合适地点的选择。

- 近年来宣布了许多新装置,这可能会支持预测期内地热能市场的成长。例如,2021年2月,三菱重工株式会社(MHI)集团公司Turboden SpA和三菱动力株式会社联合双回圈,三菱重工株式会社宣布已订单。位于菲律宾巴拉望岛的能源开发公司(EDC)营运的地热发电厂。

- 同样,2023 年 1 月,AP Renewable Inc. 宣布举行奠基仪式,标誌着在菲律宾 Tiwi 地热站点开始建造 17 兆瓦二元地热计划。该计划将从地热盐水中提取可回收热量来产生17兆瓦的电力,该设施预计将于2023年终完工。

- 2022 年全球装置容量约为 14,877 兆瓦,高于 2021 年的 14,696 兆瓦。世界各地的产能正在显着增加。

- 因此,基于上述因素和最近的发展,双回圈发电厂部分预计在预测期内将显着增长。

预计北美将主导市场

- 北美是世界领先的地热能市场之一,其中美国在装置容量方面领先于地区和全球市场。 2020 年,地热发电厂发电量约为 170 亿度 (kWh),占美国公用事业规模发电量的 0.4%。

- 美国大部分地热发电厂位于西部各州和夏威夷大岛,那里的地热能源资源靠近地球表面。儘管加州利用地热发电最多,但北加州的间歇泉干蒸气储存是世界上已知最大的干蒸气田。

- 根据 IRENA 的数据,2022 年地热总装置容量约为 3,712 兆瓦,高于 2021 年的 3,656 兆瓦。美国、加拿大和墨西哥等国家正在增加地热发电能力。

- 此外,该地区还计划新计划,预计将支持该地区的市场成长。例如,2023 年 3 月,墨西哥政府透过名为「收购地热井钻探服务」的竞标宣布了 CFE 下的一个新探勘计划。该计划将考虑位于墨西哥四个地区的六口地热井。这些竞标集中于与单一钻井服务供应商签订的合同,该提供商拥有两台可用于地热井的钻机,并包括来自美洲开发银行(IDB)和世界银行的竞标,融资金额为5100万美元。

- 因此,基于上述因素,预计北美在预测期内将主导地热能市场。

地热能产业概况

地热能市场是半分散的。市场主要企业包括(排名不分先后)Mitsubishi Power Ltd、Ormat Technologies Inc.、Engie SA、Tetra Tech Inc.、First Gen Corporation 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年地热能装置容量及预测

- 最新趋势和发展

- 政府政策法规

- 市场动态

- 促进因素

- 清洁绿色资源引发电力安全担忧

- 包括地源热泵在内的暖气和冷气系统的需求增加

- 抑制因素

- 太阳能和风能等替代清洁能源来源的有利市场机会

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 植物类型

- 干蒸气设备

- 闪化蒸气装置

- 双回圈发电厂

- 地区(地区市场分析{2028年之前的市场规模与需求预测(仅限地区)})

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、合作与协议

- 主要企业采取的策略

- 公司简介

- Geothermal Power Plant Equipment Manufacturers

- Toshiba Corporation

- Ansaldo Energia SpA

- Fuji Electric Co. Ltd.

- Baker Hughes Company

- Doosan Skoda Power

- Geothermal Power Plant EPC Companies and Operators

- Mitsubishi Power Ltd

- Ormat Technologies Inc.

- Kenya Electricity Generating Company(KenGen)

- Sosian Energy Limited

- Tetra Tech Inc.

- Engie SA

- First Gen Corporation

- PT Pertamina Geothermal Energy

- Enel SpA

- Aboitiz Power Corporation

- Geothermal Power Plant Equipment Manufacturers

第七章市场机会与未来趋势

- 增加政府主导的倡议,例如财政转移支付和退税

简介目录

Product Code: 55756

The Geothermal Energy Market size in terms of installed base is expected to grow from 15.68 gigawatt in 2024 to 17.91 gigawatt by 2029, at a CAGR of 2.69% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increasing electricity security concerns due to clean and eco-friendly resources. In addition, increasing demand for heating and cooling systems, including ground source heat pumps and district heating, are driving the growth of the geothermal energy market.

- On the other hand, the lucrative market for alternative clean energy sources like solar and wind is likely to hinder the market growth during the forecast period.

- Nevertheless, government-undertaken initiatives such as financial benefits and tax refunds to promote sustainable energy production are estimated to generate numerous growth opportunities for the geothermal energy market during the forecast period.

- North America is expected to be the largest market during the forecast period, with most of the demand coming from countries like the United States, Mexico, etc.

Geothermal Energy Market Trends

The Binary Cycle Power Plants Segment is Expected to Witness Significant Growth

- In binary cycle power plants, the water or steam below the earth never comes in direct contact with the turbines. Instead, water from geothermal reservoirs is pumped through a heat exchanger where it heats a second liquid-like isobutene (which boils at a lower temperature than water).

- This second liquid is heated into steam, which powers the generator's turbines. The hot water from the earth is recycled into the earth through the injection well, and the second liquid is recycled through the turbine and back into the heat exchanger, where it can be used again.

- Dry-steam and flash plants, which require rarer, high-temperature, shallow reservoirs, produce higher power output and are more economically efficient than binary plants. However, they offer more options for suitable locations because binary plants can operate at reservoirs with lower temperatures.

- Many new installations have been announced in recent years, which may support the growth of the geothermal energy market during the forecast period. For instance, in February 2021, Turboden SpA, a group company of Mitsubishi Heavy Industries Ltd (MHI) and Mitsubishi Power Ltd, jointly announced that it had received an order for 29 megawatts (MW) binary cycle power generation equipment to be installed at the geothermal power plant operated in Palawan, in the Philippines, by Energy Development Corporation (EDC).

- Similarly, In January 2023, AP Renewable Inc. announced a groundbreaking ceremony to indicate the beginning of the 17-MW binary geothermal project's construction in the Tiwi geothermal site in the Philippines. The project will extract recoverable heat from geothermal brine to produce 17 MW of electricity, and this facility is expected to be completed by the end of 2023.

- In 2022, the total geothermal energy installed capacity globally was around 14,877 MW in 2022, increasing from 14,696 MW in 2021. The capacity is increasing significantly across the world.

- Therefore, based on the abovementioned factors and recent developments, the binary cycle power plants segment is expected to grow significantly during the forecast period.

North America is Expected to Dominate the Market

- North America is one of the leading markets for geothermal energy worldwide, with the United States leading the regional and global markets regarding installed capacity. In 2020, geothermal power plants produced about 17 billion kilowatt-hours (kWh), up to 0.4% of US utility-scale electricity generation.

- Most of the geothermal power plants in the United States are in the western states and the island state of Hawaii, where geothermal energy resources are close to the Earth's surface. California generates the most electricity from geothermal energy, whereas Northern California's Geysers dry steam reservoir is the world's largest known dry steam field.

- According to the IRENA, the total geothermal installed capacity was around 3,712 MW in 2022, increased from 3,656 MW in 2021. The countries such as the United States, Canada, and Mexico are increasing the capacities of geothermal energy.

- Moreover, new projects are also planned in the region, which is expected to support the region's market growth. For example, in March 2023, The government in Mexico announced a new exploratory project under CFE through a tender called 'Acquisition of Geothermal Well Drilling Services.' This project will consider 6 geothermal wells in four areas in Mexico. These tenders focus on contracting a single drilling services provider with 2 drilling rigs available for geothermal wells, and this tender will be financed with USD 51 million from the Inter-American Development Bank (IDB) and World Bank.

- Therefore, based on the above factors, North America is expected to dominate the geothermal energy market during the forecast period.

Geothermal Energy Industry Overview

The geothermal energy market is semi fragmented. Some of the major players in the market (in no particular order) include Mitsubishi Power Ltd, Ormat Technologies Inc., Engie SA, Tetra Tech Inc., and First Gen Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Geothermal Energy Installed Capacity and Forecast, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electricity Security Concerns Due to Clean and Eco-Friendly Resources

- 4.5.1.2 Increasing Demand for Heating and Cooling Systems, Including Ground Source Heat Pumps

- 4.5.2 Restraints

- 4.5.2.1 Lucrative Market Opportunities for Alternative Clean Energy Sources Like Solar and Wind

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Plant Type

- 5.1.1 Dry Steam Plants

- 5.1.2 Flash Steam Plants

- 5.1.3 Binary Cycle Power Plants

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.3.1.1 Toshiba Corporation

- 6.3.1.2 Ansaldo Energia SpA

- 6.3.1.3 Fuji Electric Co. Ltd.

- 6.3.1.4 Baker Hughes Company

- 6.3.1.5 Doosan Skoda Power

- 6.3.2 Geothermal Power Plant EPC Companies and Operators

- 6.3.2.1 Mitsubishi Power Ltd

- 6.3.2.2 Ormat Technologies Inc.

- 6.3.2.3 Kenya Electricity Generating Company (KenGen)

- 6.3.2.4 Sosian Energy Limited

- 6.3.2.5 Tetra Tech Inc.

- 6.3.2.6 Engie SA

- 6.3.2.7 First Gen Corporation

- 6.3.2.8 PT Pertamina Geothermal Energy

- 6.3.2.9 Enel SpA

- 6.3.2.10 Aboitiz Power Corporation

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Government-Undertaken Initiatives such as Financial Benefits and Tax Refunds

02-2729-4219

+886-2-2729-4219