|

市场调查报告书

商品编码

1628751

印尼地热能 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Indonesia Geothermal Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

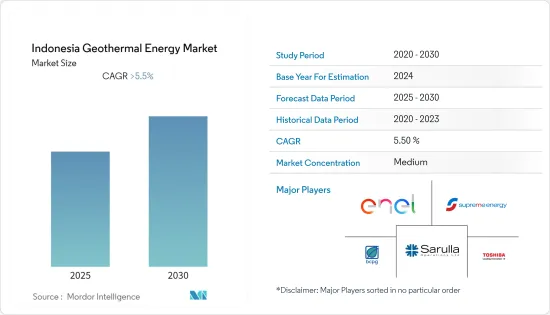

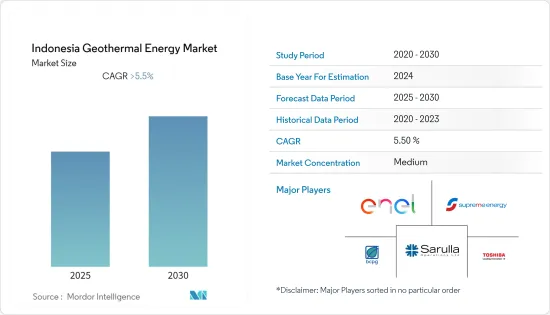

预计印尼地热能市场在预测期内将维持5.5%以上的复合年增长率。

COVID-19 对市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 从长远来看,政府为减少对石化燃料的依赖从而减少二氧化碳排放所做的努力将成为市场的关键驱动力。预计电力需求的增加将在预测期内推动市场。

- 另一方面,由于地热能比石化燃料电力更昂贵,且与太阳能和风能等其他可再生能源的竞争更加激烈,预计预测期内市场成长将放缓。

到2030年,预计人口将达到2.96亿,都市化将上升至71%,电力需求预计将增加。印尼政府希望在 2030 年将二氧化碳排放减少 29%。这可能透过增加可再生能源的使用来满足不断增长的电力需求来实现。预计这将在不久的将来为地热市场提供成长机会。

印尼地热能市场趋势

电力需求的增加可能会推动市场

- 随着印尼人口和城市的成长,对电力的需求逐年增加。 2021年,印尼电力消耗量将达到16,838万桶油当量。

- 2021年,印尼居民电力消耗量总量约为70,289,000桶油当量。家庭电力消耗量最大,约占总电力消耗量的41.7%。

- 印尼的住宅用电需求预计将增加至 350 太瓦时。同时,工业和商业部门的需求预计将分别增加至约80TWh和70TWh。

- 家庭电器产品的使用预计将成为电力消耗量增加的主要因素。相较之下,金属、化学、食品和纺织业预计将成为工业电力消耗的主要驱动力。

随着人口增长,预计到 2050 年印尼家庭数量将增加到近 8,000 万户。因此,未来几年用电量可能会增加。随着各国政府寻求增加可再生能源的发电量,地热能作为潜在的电力源预计将在未来几年内成长。

即将建成的燃煤发电厂可能会限制市场成长

- 2021年,印尼电站装置容量增加至近74,532.94MW,较2020年容量约72,750.73MW。 2021年蒸气电厂在电厂产业中占据主导地位,装置容量约占总设备容量的51.8%。

- 2021年以燃料计算的初级能源消费量为8.31艾焦耳,其中煤炭占39%,天然气占16%,石油占34%,可再生能源占7.5%。

- 该国高度依赖燃煤电厂,并计划在建造新电厂的同时保持现有燃煤电厂的运作。 2021年煤炭能源消费量为8,782万桶油当量。

- 2022年11月,印尼政府批准兴建总容量13吉瓦的新燃煤电厂,并已提交竞标。该国2021-2030年十年能源计画明确阐述了这项战略。值得注意的是,佐科威总统于 2022 年签署了一项允许开发「专属式燃煤电厂」的法律。

- 增加燃煤发电厂的容量预计将成为电力生产的重要组成部分。预计将满足未来几年成长的大部分电力需求。因此,印尼地热能和其他再生能源来源的成长预计将放缓。

印尼地热能产业概况

印尼地热能市场适度整合。市场主要参与企业包括(排名不分先后):Enal SpA、东芝能源系统与解决方案公司、BCPG Public Company Limited、PT Supreme Energy 和 Sarulla Operations Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年装置容量及预测(单位:MW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- PESTLE分析

第五章竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Enal SpA

- Toshiba Energy Systems & Solutions Corporation

- BCPG Public Company Limited

- PT Supreme Energy

- Sarulla Operations Ltd.

第六章 市场机会及未来趋势

The Indonesia Geothermal Energy Market is expected to register a CAGR of greater than 5.5% during the forecast period.

COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the primary driver for the market will be the government's efforts to reduce the country's dependency on fossil fuels and thereby reduce CO2 emissions. Increasing electricity demand is likely to drive the market during the forecast period.

- On the other hand, geothermal energy is more expensive than power from fossil fuels, and there is more competition from other renewable energy sources, like solar and wind, which is expected to slow market growth during the forecast period.

Nevertheless, with an estimated population of 296 million and an increased urbanization rate of 71% by 2030, electricity demand is expected to grow. The Indonesian government wants to cut CO2 emissions by 29% by 2030. This is most likely to be done by increasing the use of renewable energy to meet the growing electricity demand. This is likely to give the geothermal market a chance to grow in the near future.

Indonesia Geothermal Energy Market Trends

Increasing Demand for Electricity is Likely to Drive the Market

- Indonesia's need for electricity has grown over the years as the country's population and cities have grown. In 2021, the electricity consumption in Indonesia accounted for 168.38 million BOE (barrel oil equivalent).

- In 2021, the total electricity consumption of the household sector in Indonesia was nearly 70,289 thousand BOE. Households consumed the highest percentage of electricity, with almost 41.7% of the total electricity consumed.

- It is estimated that the household electricity demand in Indonesia is likely to increase to 350 TWh. In contrast, demand in the industrial and commercial sectors is expected to rise to about 80 TWh and 70 TWh, respectively.

- The use of electronic appliances in the household sector is expected to be the primary driver of the increase in electricity consumption. In contrast, the metal, chemical, food, and textile industries are expected to be the major drivers for industrial electricity consumption.

With a growing population, Indonesian households will likely grow to almost 80 million by 2050. This will likely increase the amount of electricity used in the coming years. Geothermal energy as a possible source of electricity is expected to grow over the next few years because the government is trying to increase the amount of electricity made from renewable energy.

Upcoming Coal Fired Power Plant is Likely to Restrict the Market Growth

- In 2021, Indonesia's power plant installed capacity increased to nearly 74,532.94 MW, which was around 72,750.73 MW compared to the capacity in 2020. With a total installed capacity of about 51.8%, steam power plants dominated the power plant industry in 2021.

- In 2021, primary energy consumption by fuel accounted for 8.31 exajoules, which were generated from 39% coal, 16% natural gas, 34% oil, and 7.5% renewables.

- The country has a high reliance on coal-based power plants; thus, there are plans to build new coal power plants with existing coal power plants in operation. In 2021, energy consumption from coal accounted for 87.82 million BOE (barrel oil equivalent).

- In November 2022, the Indonesian government permitted the building new coal plants that had already been bid out and had a total capacity of 13 gigawatts. The country's 10-year energy plan for 2021-2030 lays out the strategy. Notably, President Joko Widodo signed legislation into law in 2022, allowing the development of "captive coal plants."

- Increasing the capacity of coal-fired power plants is expected to make up a big part of how electricity is made. It will likely meet most of the growing demand for electricity over the next few years. This is expected to slow the growth of the country's geothermal energy and other renewable sources.

Indonesia Geothermal Energy Industry Overview

The Indonesia geothermal energy market is moderately consolidated. Some of the key players in the market ( not in particular order ) include Enal SpA, Toshiba Energy Systems & Solutions Corporation, BCPG Public Company Limited, PT Supreme Energy, and Sarulla Operations Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 COMPETITIVE LANDSCAPE

- 5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 5.2 Strategies Adopted by Leading Players

- 5.3 Company Profiles

- 5.3.1 Enal SpA

- 5.3.2 Toshiba Energy Systems & Solutions Corporation

- 5.3.3 BCPG Public Company Limited

- 5.3.4 PT Supreme Energy

- 5.3.5 Sarulla Operations Ltd.