|

市场调查报告书

商品编码

1687155

地热能-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Geothermal Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

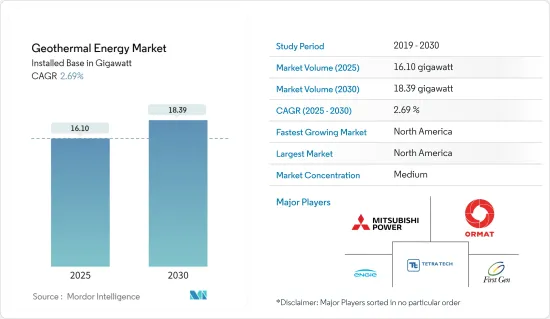

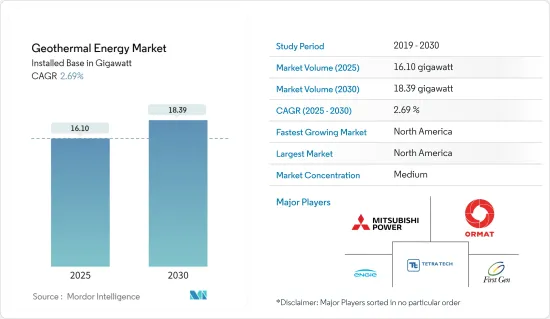

基于安装基数,地热能市场规模预计将从 2025 年的 16.10 吉瓦成长到 2030 年的 18.39 吉瓦,预测期内(2025-2030 年)的复合年增长率为 2.69%。

关键亮点

- 从中期来看,人们对清洁环保能源电力安全的兴趣日益浓厚,以及对地源热泵和区域供热等供暖和製冷系统的需求不断增加等因素,正在推动地热能市场的成长。

- 然而,太阳能和风能等替代清洁能源来源利润丰厚,可能会在预测期内阻碍市场成长。

- 预计政府主导的财政诱因和退税等促进永续能源生产的措施将在预测期内为地热能市场创造大量成长机会。

- 预计北美将成为预测期内最大的市场,大部分需求来自美国、加拿大和墨西哥等国家。

地热能市场趋势

双回圈地热发电厂预计将强劲成长

- 双回圈地热发电厂采用低于 182 摄氏度(360 华氏度)的低温流体,该流体通过由二次流体组成的热交换器。这种二次或二元流体使地热流体蒸发,然后推动涡轮机发电。

- 双回圈地热发电厂的运作方式与其他两种地热技术不同,因为地热流体不会直接接触涡轮机。

- 双回圈发电厂的优势在于中温地热流体比高温地热资源更容易获得,根据美国能源局的数据,双回圈发电厂有可能成为利用这一特性的一种流行的发电形式。

- 双回圈发电厂的组成部分包括热交换器、膨胀机、冷凝器、发电机、生产井、回注井和涡轮机。这些电厂的平均额定容量约为6MW。相反,较大的额定容量在二元设计循环中共存,例如双压循环、双流体循环和卡林纳双回圈。

- 双回圈发电厂的优势在于中温地热流体比高温地热资源更容易获取,根据美国能源局的数据,这项特性意味着双回圈发电厂可能会变得更加受欢迎。

- 近年来,已宣布了许多新设施,这可能会在预测期内支持地热能市场的成长。自 2023 年 9 月起,土耳其 MTN 能源公司再次开始为巴巴德雷地热发电厂 2 号机组实施环境影响评估 (EIA) 法规。进行此项审查是为了扩建这座 11.8 兆瓦的双回圈发电厂,以满足该地区的电力需求。

- 截至 2023 年,义大利政府已批准在托斯卡纳开发一座提案的10 兆瓦双回圈地热发电厂。义大利首座双燃料发电厂计画于2027年投入运作,预计将满足3.2万户家庭的电力需求,并减少高达4万吨的二氧化碳排放。因此,此类计划的启动可能有助于在预测期内利用双回圈发电厂。

- 此外,到2023年,全球整体地热能总设备容量将达到约14,846兆瓦,高于2022年的14,653兆瓦。全球装置容量正在大幅成长。

- 因此,由于上述因素和最近的趋势,双回圈发电厂部分预计在预测期内将大幅成长。

北美预计将主导市场

- 北美是全球地热能主要市场之一,美国在装置容量方面领先于地区和全球市场。 2023年,美国地热发电量约为16.5兆瓦时。这比 2022 年增加了约半兆瓦时。

- 美国大部分地热发电厂都位于西部各州和夏威夷岛,这些地方的地热资源更接近地表。加州是利用地热能发电最多的州,北加州的盖瑟斯干蒸气储层被称为世界上最大的干蒸气田。

- 此外,加州的地热发电厂数量比美国其他州都多。截至 2023 年,加州有 31 座由公用事业公司营运的地热发电厂。其次是内华达州,拥有26座地热发电厂。当年,美国地热发电量达到高峰164.6亿度。

- 根据国际可再生能源机构2024年的预测,2023年美国地热发电总合装置容量约为26.74 GkW。此外,2023 年 5 月,Contact Energy 宣布与微软签署了一份为期 10 年的购电协议。根据协议,Contact Energy 将供应其位于纽西兰的 51.4 兆瓦 Te Huka 3 号机组地热发电厂所持有的所有可再生能源。 Contact Energy 于 2022 年 8 月宣布将启动 Te Huka 3 号地热发电厂项目,预计耗资 1.89 亿美元。预计2023年底投入营运。

- 2024年2月,美国能源局地热技术办公室宣布为支持利用低温地热能进行地热井钻井工具和工业系统的计划提供高达3,100万美元的资助机会。此外,高达 2,310 万美元的资金将用于加强井下固井和案例评估工具计划。

- 此外,该地区还计划开展新计划,预计将支持该地区的市场成长。例如,2023年3月,墨西哥政府宣布透过联邦电力委员会(CFE)下属的竞标进行探勘计划。

- 因此,由于上述因素,预计北美将在预测期内主导地热能市场。

地热能产业概况

地热能市场分散。市场的主要企业(不分先后顺序)包括三菱电力有限公司、Ormat Technologies Inc.、Engie SA、Tetra Tech Inc. 和 First Gen Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 地热能装置容量及2029年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 人们越来越担心清洁环保能源的电力安全

- 对暖气和冷气系统(包括地热热泵)的需求不断增加

- 限制因素

- 太阳能和风能等替代清洁能源来源的良好市场机会

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场区隔

- 植物类型

- 干蒸气厂

- 闪蒸蒸气厂

- 双回圈发电厂

- 市场分析:按地区(截至 2029 年按地区分類的市场规模和需求预测)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Geothermal Power Plant Equipment Manufacturers

- Toshiba Corporation

- Ansaldo Energia SpA

- Fuji Electric Co. Ltd.

- Baker Hughes Company

- Doosan Skoda Power

- Geothermal Power Plant EPC Companies and Operators

- Mitsubishi Power Ltd

- Ormat Technologies Inc.

- Kenya Electricity Generating Company(KenGen)

- Sosian Energy Limited

- Tetra Tech Inc.

- Engie SA

- First Gen Corporation

- PT Pertamina Geothermal Energy

- Enel SpA

- Aboitiz Power Corporation

- Geothermal Power Plant Equipment Manufacturers

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 增加政府主导的倡议,如财政转移支付和退税

简介目录

Product Code: 55756

The Geothermal Energy Market size in terms of installed base is expected to grow from 16.10 gigawatt in 2025 to 18.39 gigawatt by 2030, at a CAGR of 2.69% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing electricity security concerns due to clean and eco-friendly resources and increasing demand for heating and cooling systems, including ground source heat pumps and district heating, are driving the growth of the geothermal energy market.

- On the other hand, the lucrative market for alternative clean energy sources like solar and wind is likely to hinder the market growth during the forecast period.

- Nevertheless, government-undertaken initiatives such as financial benefits and tax refunds to promote sustainable energy production are estimated to generate numerous growth opportunities for the geothermal energy market during the forecast period.

- North America is expected to be the largest market during the forecast period, with most of the demand coming from countries like the United States, Canada and Mexico, etc.

Geothermal Energy Market Trends

The Binary Cycle Power Plants Segment is Expected to Witness Significant Growth

- The binary cycle geothermal power plants incorporate low-temperature fluids below 182 degrees Celsius (or 360 degrees Fahrenheit) that are made to pass through a heat exchanger consisting of a secondary fluid. This secondary or binary fluid vaporizes the geothermal liquid and propels the turbine to produce electricity.

- In a binary-cycle geothermal power plant, the geothermal fluid does not directly come into contact with turbines, which makes it function differently from the other two geothermal technologies.

- The advantage of binary cycle power plants is that as the geothermal fluid of moderate temperature has greater availability than high-temperature geothermal resources, binary cycle power plants might become more prevalent to take advantage of this attribute in electricity generation, as per the US Department of Energy.

- The components of a binary cycle power plant include a heat exchanger, expander, condenser, generator, production well, reinjection well, and turbine. The average rated capacity of these power plants is around 6 MW. Conversely, large rated capacities co-exist with binary design cycles such as dual pressure, dual-fluid, and Kalinabinary cycles.

- The advantage of binary cycle power plants is that as the geothermal fluid of moderate temperature has greater availability than high-temperature geothermal resources, binary cycle power plants might become more prevalent to take advantage of this attribute in electricity generation, as per the US Department of Energy.

- Many new installations have been announced in recent years, which may support the growth of the geothermal energy market during the forecast period. As of September 2023, MTN Energy in Turkey re-initiated the process to conduct an Environmental Impact Assessment (EIA) method for the 2nd unit of the Babadere geothermal power plant. The examination is done to expand 11.8 MW of binary cycle plant to fulfill the electricity requirement of the region.

- As of 2023, the government of Italy consented to develop the proposed 10 MW binary cycle geothermal plant in Tuscany. Italy's first-ever binary cycle plant is expected to become active in 2027. It holds the potential to fulfill the power requirement of nearly 32,000 households and curtail carbon emissions of up to 40,000 tonnes. Hence, the onset of such projects could likely help in utilizing binary cycle plants in the forecast period

- Moreover, in 2023, the total geothermal energy installed capacity globally was around 14,846 MW, increasing from 14,653 MW in 2022. The capacity is increasing significantly across the world.

- Therefore, based on the abovementioned factors and recent developments, the binary cycle power plants segment is expected to grow significantly during the forecast period.

North America is Expected to Dominate the Market

- North America is one of the leading markets for geothermal energy worldwide, with the United States leading the regional and global markets regarding installed capacity. In 2023, approximately 16.5 terawatt hours of geothermal electricity were generated in the United States. This was an increase of roughly 0.5 terawatt hours from the 2022.

- Most of the geothermal power plants in the country are in the western states and the island state of Hawaii, where geothermal energy resources are close to the Earth's surface. California generates the most of the electricity from geothermal energy, whereas Northern California's Geysers dry steam reservoir is the world's largest known dry steam field.

- Moreover, California is home to the greatest number of geothermal power plants in the country. As of 2023, there were 31 such plants operated by electric utilities in the state. Nevada followed, with 26 geothermal power plants. That year, geothermal electricity generation across the United States reached a peak of 16.46 billion kilowatt hours.

- According to the International Renewable Energy Agency 2024, the total geothermal installed capacity in United States was around 2,674 MW in 2023. Moreover, in May 2023, Contact Energy announced that the company had signed a 10-year Power Purchase Agreement with Microsoft. Under the contract, Contact Energy will supply all the renewable energy attributes generated by the company's 51.4 MW Te Huka Unit 3 geothermal power station, New Zealand. Contact Energy announced the Te Huka Unit 3 geothermal power station in August 2022 and will be built at a cost of USD 189 million. The plant is expected to commence operations by the end of 2023.

- In February 2024, the United States Department of Energy's Geothermal Technologies Office announced a funding opportunity of up to USD 31 million for projects that support geothermal systems wellbore tools as well as the use of low-temperature geothermal heat for industrial systems. Also, funding of up to USD 23.1 million will enhance projects to address downhole cement and casing evaluation tools.

- Furthermore, new projects are also planned in the region, which is expected to support the region's market growth. For example, in March 2023, Also, the government in Mexico announced a exploratory project under Federal Electricity Commission (CFE) through a tender called 'Acquisition of Geothermal Well Drilling Services.

- Therefore, based on the above factors, North America is expected to dominate the geothermal energy market during the forecast period.

Geothermal Energy Industry Overview

The geothermal energy market is semi-fragmented. Some of the major players in the market (in no particular order) include Mitsubishi Power Ltd, Ormat Technologies Inc., Engie SA, Tetra Tech Inc., and First Gen Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Geothermal Energy Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electricity Security Concerns Due to Clean and Eco-Friendly Resources

- 4.5.1.2 Increasing Demand for Heating and Cooling Systems, Including Ground Source Heat Pumps

- 4.5.2 Restraints

- 4.5.2.1 Lucrative Market Opportunities for Alternative Clean Energy Sources Like Solar and Wind

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Plant Type

- 5.1.1 Dry Steam Plants

- 5.1.2 Flash Steam Plants

- 5.1.3 Binary Cycle Power Plants

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Spain

- 5.2.2.5 NORDIC

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.3.1.1 Toshiba Corporation

- 6.3.1.2 Ansaldo Energia SpA

- 6.3.1.3 Fuji Electric Co. Ltd.

- 6.3.1.4 Baker Hughes Company

- 6.3.1.5 Doosan Skoda Power

- 6.3.2 Geothermal Power Plant EPC Companies and Operators

- 6.3.2.1 Mitsubishi Power Ltd

- 6.3.2.2 Ormat Technologies Inc.

- 6.3.2.3 Kenya Electricity Generating Company (KenGen)

- 6.3.2.4 Sosian Energy Limited

- 6.3.2.5 Tetra Tech Inc.

- 6.3.2.6 Engie SA

- 6.3.2.7 First Gen Corporation

- 6.3.2.8 PT Pertamina Geothermal Energy

- 6.3.2.9 Enel SpA

- 6.3.2.10 Aboitiz Power Corporation

- 6.3.1 Geothermal Power Plant Equipment Manufacturers

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Government-Undertaken Initiatives such as Financial Benefits and Tax Refunds

02-2729-4219

+886-2-2729-4219