|

市场调查报告书

商品编码

1444347

化妆品包装 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

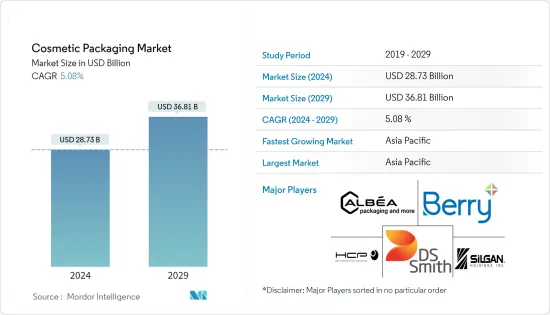

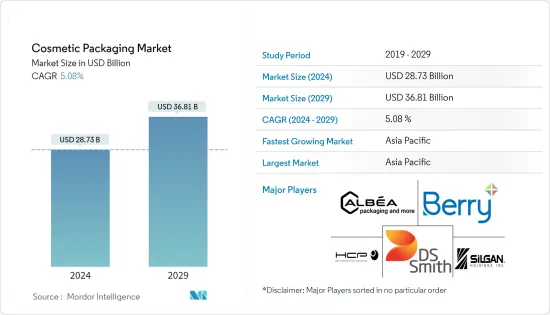

2024年化妆品包装市场规模预估为287.3亿美元,预估至2029年将达368.1亿美元,预测期内(2024-2029年)CAGR为5.08%。

近年来,化妆品行业的包装取得了突飞猛进的发展。在其他行业中,化妆品行业的包装要求最为多样化。所使用的材料包括玻璃、纸张和塑胶等不同金属,这些材料可以製造不同形状和尺寸的容器以及分配机构。

主要亮点

- 初级容器、次级柔性袋、盖子、封闭件和喷嘴中的塑胶是化妆品行业的主要包装材料之一。塑胶管是化妆品行业的重要容器之一,因为它可以储存液体、固体和半固体材料并以受控比例分配产品。此外,与其他容器管相比,它可以提供更好的污染保护。

- 不同的供应商已经设计出创新的产品来满足不断增长的管材需求。全球市场上的主要化妆品製造商 Sally Hansen 在 Topline 的帮助下开发了一种配有涂抹器尖端的可挤压管。此外,包装解决方案提供商 Albea 开发了一种泪滴管,带有用于液体配方的逐滴分配系统。此外,Cosmogen 还提供了 Squeeze'N Roll 包装的改良版管状版本,并附有按摩滚轮。此外,Global Packaging Inc.还开发了一种管子,管头上有棘轮,泵上也有相应的棘轮,透过施加预定扭矩确保完美的防漏组装,同时防止意外打开。

- 企业也希望透过应对气候变迁和减少包装对环境影响的计画来推动变革。例如,斯道拉恩索推出了用于化妆品包装的阻隔涂层、耐油脂纸板管。这种管包装方法适用于护肤霜产品的初级包装,被认为是塑胶管的新型、气候友善的替代品。但化妆品行业现在似乎团结一致,透过新的周到的包装策略和先进的配方来减少塑胶污染的影响。

- 原物料价格的波动会阻碍市场的成长。新冠疫情过后,这家製造和包装公司面临因中断而导致原料成本高昂的问题。

- 此外,一些化妆品包装展和贸易展也推广各种新的包装技术。例如,Cosmo Tech Expo 是印度最重要的化妆品、个人护理、香水和盥洗用品市场製造解决方案贸易展。该博览会为参展商展示了全球 8,000 多家製造商提供的最新成分、原材料、包装、标籤、机械、 OEM和自有品牌、测试、实验室设备和监管解决方案。同样,CPNA(北美美容展)是美洲获奖最多的 B2B 美容盛会。 CPNA 被公认为新美容品牌的首要发布平台,提供独特、创新的产品并收集有关新分销管道、包装和製造解决方案的资讯。

- 随着 COVID-19 的爆发,一些优质美容产品店被关闭。其中一些商店将永远不会再开业,新开张将至少推迟一年。儘管实体药局、大众市场和杂货店仍营业,但其客流量和收入却大幅下降。然而,一些准备扩大库存和运输业务的美容产品品牌和零售商报告称,电子商务销售额明显高于 COVID-19 之前的水平。

化妆品包装市场趋势

塑胶预计将占据重要份额

- 塑胶因其成本低、重量轻、柔韧、耐用等因素而成为化妆品包装中的重要材料。塑胶是製造个人护理产品的防碎和「防洩漏」瓶子、罐子、管子、盖子和封闭件的首选材料。根据包装机械製造商协会(PMMI) 的数据,瓶子、罐子、粉盒和管材等塑胶包装占据61% 的市场份额,在化妆品和其他个人护理产品中占据主导地位,其中瓶子是最常用的容器,占占30%的市占率。由 HDPE 生产的最常见且最便宜的化妆品瓶经济、耐衝击,并保持良好的防潮层。乳液瓶有各种不同的尺寸和形式,有些乳液保留在带盖的管中。

- 此外,化妆品容器最常见的塑胶类型是PP塑胶。然而,它们也可以采用更便宜的 PET 或高端丙烯酸塑料。丙烯酸塑胶通常是透明的,类似于玻璃。这种材料比玻璃具有优势,因为它不易破裂。然而,PP 塑胶比丙烯酸便宜,通常采用圆形或管状塑胶容器。 PP塑胶容器可以模製成心形、人物形状或方形,以适应化妆品的风格或行销推广。该公司主要使用罐子和罐子来存放乳霜、乳液、粉底、润唇膏、粉饼和其他化妆品,其尺寸范围为 20 毫米至 60 毫米,可容纳 25 毫升(或更少)至 250 毫升的任何地方。

- 例如,SKS Bottle & Packaging Inc. 提供各种不同尺寸的塑胶罐,具有多种封闭选项,从带有筛子衬里盖的银色盖到塑胶圆顶盖。他们为润唇膏和眼霜等产品提供 PET 罐,为乳液、香膏等提供带有内衬盖的白色聚丙烯厚壁罐,产品范围还有更多。

- 长期以来,设计专家一直青睐管状包装,希望利用管状包装的便利性和便携性来容纳化妆品和其他个人护理用品。例如,在阿联酋推出了翻盖罐装的凡士林果冻和可挤压塑胶管装的多芬高级护髮系列干油洗髮水,方便了使用。

- 随着製造商寻求减少每件产品材料使用量的方法,塑胶在提供使用更少材料的轻质包装解决方案方面取得了巨大的进步。此外,在过去十年中,塑胶对环境的影响减缓了该领域的放缓。

- 然而,再生塑胶的可用性和材料技术的创新使得环保包装解决方案成为可能。参与者专注于可再填充包装作为设计解决方案,以创造可持续的功能。品牌正在拥抱自然变色,从而提供 PCR(消费后回收)塑胶。这些可再填充产品正在弥补奢侈品市场的这一差距。

- 根据2022年5月发布的资料,到2060年,包装用塑胶用量将增加两倍,超过3.8亿吨。预计当年包装将占全球塑胶用量的 31%。

北美预计将占据重要份额

- 美国是化妆品、个人护理产品和香水市场的最大市场之一。欧莱雅、联合利华、宝洁公司等领导品牌主导了中国化妆品市场。同样,该国的化妆品包装格局也得到了整合,Albea SA、AptarGroup Inc.、Smurfit Kappa Group PLC、WestRock Co. 和 Graphic Packaging Holding Co. 等几家重要企业占据了市场份额。

- 该国的主要产品类别包括护肤品、化妆品、护髮品、香水、除臭剂和盥洗用品以及口腔化妆品。美国化妆品市场对高端化的需求不断增长,这与全球趋势一致。反过来,它又推动了对创新和优质包装的需求。为了满足高端化需求以及对创新和装饰性包装的强烈关注,Apatar Group Inc. 收购了 Fusion Packaging,以扩大其在化妆品领域的差异化设计和装饰产品。

- 美国消费者也越来越多地使用电子商务管道购买个人护理产品。儘管线上销售的份额仍然较低,但预计在预测期内将会成长。此外,联合利华也透过线上通路销售产品进行了新的收购。塑胶瓶和玻璃瓶是保养品最优选的包装材料。因此,随着该产品类别的成长,材料的使用预计也将经历积极的成长轨迹。

- 在塑胶中,PP、PE、HPE、PET和压克力成分是塑胶瓶最优选的材料。越来越多地使用线上管道将使塑胶的运输变得比玻璃更便宜、更安全。此外,由于消费者认为这些产品更安全,美国消费市场正经历对天然美容产品的需求。因此,美国政府提出了一项新法案,在产品贴上天然标籤之前对其进行监管。这可能会导致在将成分标记为天然成分之前对其进行更详细的标记。

化妆品包装行业概况

化妆品包装市场竞争激烈,由多家全球和区域参与者组成。创新和易于部署和使用,透过产品实现端到端客户满意度,一直是推动市场参与者产品创新和策略的关键因素。主要参与者是 Silgan Holdings Inc. 和 DS Smith PLC。

2022 年 3 月 - 在洛杉矶 MakeUp 贸易展期间,国际美容产业首屈一指的全方位服务供应商 WWP Beauty 推出了一系列清新环保的统包、包装和配件系列。

2022 年 7 月 - Quadpack 为固体市场推出可回收棒状包装。美容包装製造商 Quadpack 推出了固体化妆品棒配方的新包装系列。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 化妆品消费增加

- 越来越注重创新和有吸引力的包装

- 市场限制

- 日益增长的可持续发展担忧

- 产业价值链分析

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

第 5 章:COVID-19 对产业的影响

第 6 章:市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸

- 依产品类型

- 塑胶瓶和容器

- 玻璃瓶和容器

- 金属容器

- 折迭纸盒

- 瓦楞纸箱

- 管和棒

- 瓶盖和瓶盖

- 泵浦和分配器

- 滴管

- 安瓿

- 软塑胶包装

- 依化妆品类型

- 头髮护理

- 彩妆

- 皮肤护理

- 男士美容

- 除臭剂

- 其他化妆品类型

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 亚太其他地区

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 南非

- 北美洲

第 7 章:竞争格局

- 公司简介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group PLC (Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging LP

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor PLC

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Corporation

- Gerresheimer AG

- Raepak Ltd

- Ball Corporation

- Verescence France

- SKS Bottle & Packaging, Inc

- Altium Packaging (Loews Corporation)

第 8 章:市场的未来前景

The Cosmetic Packaging Market size is estimated at USD 28.73 billion in 2024, and is expected to reach USD 36.81 billion by 2029, growing at a CAGR of 5.08% during the forecast period (2024-2029).

Packaging in the cosmetic industry has gone leaps and bounds in recent years. The cosmetic industry has the most varied packaging requirements among the other sectors. The materials used vary from different metals from glass, paper, and Plastics, and these materials can make containers with different shapes and sizes and dispensing mechanisms.

Key Highlights

- Plastic in primary containers, secondary flexible pouches, caps, closures, and the nozzle is one of the cosmetic industry's primary packaging materials. The plastic tube is one of the significant containers in the cosmetic industry as it can store liquid-solid and semisolid materials and dispense products in controlled proportions. Also, compared to other container tubes, it can provide better contamination protection.

- Various suppliers have devised innovative offerings to cater to the increasing tube demand. Sally Hansen, a major cosmetics manufacturer in the global market, developed a squeezable tube paired with an applicator tip with Topline's help. Additionally, Albea, a packaging solution provider, developed a Teardrop tube with a drop-by-drop dispensing system for liquid formulations. Also, Cosmogen offered a revised tube version of its Squeeze'N Roll package with an attached massage roller. Furthermore, Global Packaging Inc. had also developed a tube with a ratchet on the head of the tube and a corresponding ratchet on the pump, ensuring a perfect leakproof assembly by applying the predetermined torque while protecting the accidental opening.

- Enterprises are also looking to drive the change with a plan to combat climate change and reduce the environmental impacts of packaging. For instance, Stora Enso introduced barrier-coated, grease-resistant paperboard tubes for cosmetics packaging. This tube packaging method is suitable for the primary packaging of skin cream products and is considered a new, climate-friendly alternative to plastic tubes. But the cosmetics industry now seems united on reducing the impact of plastic pollution with new thoughtful packaging strategies and advanced formulations.

- Fluctuation of the raw material prices can hinder the growth of the market. Post-Covid, the manufacturing and packaging company is facing the issue of high raw material costs due to the disruption.

- Besides, several cosmetic packaging exhibitions and trade shows promote various new packaging technologies. For example, Cosmo Tech Expo is India's most significant manufacturing solutions trade show for the cosmetic, personal care, perfumery, and toiletries markets. The expo brings exhibitors to display the latest ingredients, raw materials, packaging, labeling, machinery, OEM and private labeling, testing, lab equipment, and regulatory solutions offered by over 8,000 manufacturers worldwide. Similarly, CPNA (Cosmoprof North America) is the most awarded B2B beauty event in the Americas. CPNA has been recognized as the premier launching platform for new beauty brands, offering unique, innovative products and gathering information about new distribution channels, packaging, and manufacturing solutions.

- With the outbreak of COVID-19, several premium beauty product outlets were shut down. Some of these stores will never open again, and new openings will get delayed for at least a year. While brick-and-mortar drugstores and mass-market and grocery stores remain open, their customer traffic and revenues have plummeted. However, some beauty-product brands and retailers with inventory and shipment operations ready to scale up report e-commerce sales significantly higher than the pre-COVID-19 levels.

Cosmetic Packaging Market Trends

Plastic is Expected to Hold Significant Share

- Plastic is a prominent material in cosmetic packaging due to its low cost, lightweight, flexibility, durability, and other factors. Plastics are a material of choice for manufacturing shatterproof and "no-spill" bottles, jars, tubes, caps, and closures for personal care products. According to the Packaging Machinery Manufacturers Institute (PMMI), at 61% market share, plastic packaging, such as bottles, jars, compacts, and tubes, dominate in cosmetics and other personal care products, where bottles are the most commonly used containers, accounting for 30% of the market. The most common and least expensive cosmetic bottles produced from HDPE are economical, impact-resistant, and maintain a sound moisture barrier. Lotion bottles come in all different sizes and forms, and some lotions remain in capped tubes.

- Moreover, the most common type of plastic used for cosmetic containers is PP plastics. However, these can also come in more affordable PET or higher-end acrylic plastic. Acrylic plastic is usually transparent and resembles glass. This material has an advantage over glass as it is not prone to breakage. However, PP plastic is more affordable than acrylic and usually comes in round or tube-like shaped plastic containers. PP plastic containers can be molded into heart shapes, character shapes, or square shapes to suit the cosmetic product's style or marketing to get distributed. Companies primarily use jars and pots for face creams, lotions, foundations, lip balms, powders, and other cosmetics, where the size ranges from 20mm to 60mm and can hold anywhere from 25 ml (or less) to 250 ml.

- For instance, SKS Bottle & Packaging Inc. offers various plastic jars in different sizes with multiple closure options, from silver caps with sifters lined caps to the plastic dome. They provide PET jars for products, such as lip balm and eye cream, and white polypropylene thick wall jars with lined caps for lotions, balms, etc., with many more ranges.

- Design experts have favored tubular packaging for a long seeking to capitalize on tubes' convenience and portability to hold cosmetics and other personal care items. For instance, introducing Vaseline Jelly in a flip-cap jar and Dove's Advanced Hair Series Dry Oil Shampoo in a squeezable plastic tube in the UAE facilitated convenient usage.

- As manufacturers seek options to reduce the amount of material used per product, plastics deliver exceptional gains in providing lightweight packaging solutions that use fewer materials. Moreover, over the last decade, plastic's environmental impacts have slowed the segment's slowdown.

- However, the availability of recycled plastics and innovations in material technology have enabled environmentally-friendly packaging solutions. The players focus on refillable packaging as a design solution to create sustainable features. Brands are embracing the natural discoloration that provides PCR (post-consumer recycled) plastics. These refillable products are bridging this gap at the luxury end of the market.

- According to data released in May 2022, the use of plastics for packaging will triple by 2060, surpassing 380 million tons. Packaging is forecast to account for 31% of global plastics use that year.

North America is Expected to Significant Share

- The US is one of the biggest markets for cosmetics, personal care products, and fragrances market. Players like L'Oreal, Unilever, Procter & Gamble Co., and other leading brands have dominated the country's cosmetics market. Similarly, the cosmetic packaging landscape in the country gets consolidated with a few significant players like Albea SA, AptarGroup Inc., Smurfit Kappa Group PLC, WestRock Co., and Graphic Packaging Holding Co. dominating market share.

- The country's primary product categories include skincare, makeup, haircare, perfumes, deodorants and toiletries, and oral cosmetics. The US cosmetics market is experiencing a growing demand for premiumization, in line with the global trend. It, in turn, drives the need for innovative and premium packaging. In sync with the premiumization demands and intense focus on innovative and decorative packaging, Apatar Group Inc. acquired Fusion Packaging to expand its differentiated design and decorative offerings for the cosmetics segment.

- The US is also experiencing an increased use of e-commerce channels to procure personal care products by consumers. While the share of online sales remains low, it is expected to grow during the forecast period. Furthermore, Unilever has made new acquisitions based on selling products through online channels. Plastic and glass bottles are the most preferred packaging materials for skincare products. Hence, with this product category's growth, the use of materials is also expected to experience a positive growth trajectory.

- In plastics, PP, PE, HPE, PET, and acrylic ingredients are the most preferred materials for plastic bottles. The increasing use of online channels will grow cheaper and safer plastics to transport than glass. Additionally, the US consumer market is experiencing a demand for beauty products categorized as natural, driven by consumer perception of these products being safer. On this account, the US government has proposed a new bill to regulate products before labeling them as natural. It will likely lead to more detailed labeling of ingredients before labeling them as natural.

Cosmetic Packaging Industry Overview

The cosmetic packaging market is highly competitive and comprises several global and regional players. Innovation and ease in deployment and usage, leading to end-to-end customer satisfaction through the product, have been the key factors driving product innovation and strategies among the market players. The key players are Silgan Holdings Inc. and DS Smith PLC.

March 2022 - During the MakeUp in Los Angeles tradeshow, WWP Beauty, a premier full-service provider to the international beauty industry, unveiled a lineup of fresh and environmentally friendly turnkey, packaging, and accessory collections.

July 2022 - Quadpack launched recyclable stick packaging for the solids market. Beauty packaging manufacturer Quadpack has launched a new packaging range for solid cosmetic stick formulas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumption of Cosmetic Products

- 4.2.2 Increasing Focus on Innovation and Attractive Packaging

- 4.3 Market Restraints

- 4.3.1 Growing Sustainability Concerns

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 IMPACT OF COVID-19 ON THE INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Product Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tubes and Sticks

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Droppers

- 6.2.10 Ampoules

- 6.2.11 Flexible Plastic Packaging

- 6.3 By Cosmetic Type

- 6.3.1 Hair Care

- 6.3.2 Color Cosmetics

- 6.3.3 Skin Care

- 6.3.4 Men's Grooming

- 6.3.5 Deodorants

- 6.3.6 Other Cosmetic Types

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Thailand

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.3.7 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.5.4 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group PLC (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging LP

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Corporation

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd

- 7.1.15 Ball Corporation

- 7.1.16 Verescence France

- 7.1.17 SKS Bottle & Packaging, Inc

- 7.1.18 Altium Packaging (Loews Corporation)