|

市场调查报告书

商品编码

1444473

Quartz - 市占率分析、产业趋势与统计、成长预测(2024 - 2029 年)Quartz - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

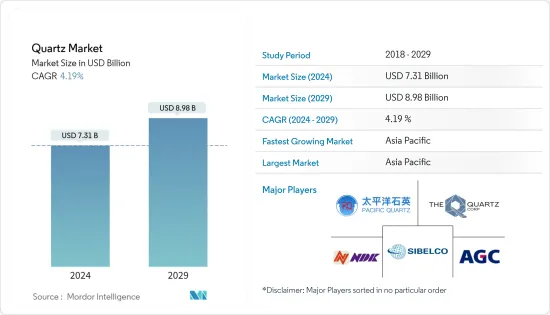

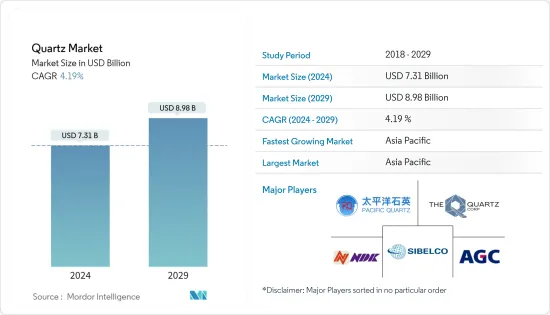

2024年石英市场规模预计为73.1亿美元,预计到2029年将达到89.8亿美元,在预测期内(2024-2029年)CAGR为4.19%。

COVID-19 大流行导致全球多个行业的供应链停止,包括电子和半导体、建筑和汽车。反过来,这对这些产业对石英的需求产生了不利影响。太阳能的使用量增加,但仅此一项并不能提振市场。 COVID-19 大流行影响了全球建筑业,项目面临劳动力短缺、供应链问题和融资压力。其影响波及整个产业,从最初的中国危机到世界各地的建筑工地。然而,随着全球大多数国家解除封锁,大多数产业恢復生产,市场已经復苏。

主要亮点

- 从中期来看,推动市场成长的主要因素是半导体产业对高纯度石英的需求,以及不断成长的太阳能产业。

- 石英开采的生态影响,加上石英砖和石英板的变色,预计将阻碍市场在预测时间内的成长。

- 由于其独特的性能,石英粉的新兴应用可以为市场带来机会。

- 亚太地区主导全球市场,其中中国的消费量最大。

石英市场趋势

电子和半导体产业需求不断成长

- 石英因其高度稳定、高性能的谐振器而在电子行业中使用,进一步用于滤波器和振盪器。石英具有多种适用于电子工业的特性,包括压电特性,其熔点高于 1700°C,固化温度为 573°C。

- 电子业对石英的需求不断增加。这是因为它在手机、平板电脑、笔记型电脑和桌上型电脑等设备中的使用量不断增加。

- 此外,石英晶体也用作收音机、手錶和压力表中的振盪器。石英晶体也用于製造各种产品的电子电路中的频率滤波器、频率控制器和计时器,例如通讯设备、电脑、电子游戏机和电视接收器。

- 几十年来,美国公司在生产为现代技术提供动力的微型半导体晶片方面一直处于世界领先地位。根据半导体产业协会(SIA)统计,美国半导体产业占全球半导体市场的47%,为全球第一大份额。

- 半导体製造商正计划在该国投资,预计这将有助于市场成长。例如,2021 年 3 月,英特尔在新墨西哥州工厂投资 35 亿美元,用于生产几乎所有现代设备中使用的微型微晶片,因为这些设备的需求不断增长。

- 物联网 (IoT) 等数位技术和 5G 等最新通讯技术预计将有助于开发创新的消费性电子产品。根据 JEITA 公布的资料,2022 年全球电子产品产量较 2020 年大幅成长。

- 受此因素影响,电子产业对石英的需求预计将快速成长。

亚太地区将主导市场

- 中国是亚太地区主要国家之一,建筑活动丰富。该国的工业和建筑业预计将占GDP的50%左右。

- 根据住房和城乡建设部的预测,到2025年,中国建筑业占国内生产总值的比重预计将保持在6%。根据上述预测,中国政府公布了五年计划2022 年1 月的计划重点是使建筑业更加永续和品质驱动。

- 由于中美之间的关税战,电子产品供应链在疫情爆发前就已经处于中断的阵痛之中。它迫使一些知名电子製造商从中国迁往东南亚,包括GoPro、京瓷和任天堂,将製造业务转移到越南、卡西欧、大金和理光,并将业务转移到泰国。

- 为了受益于广泛的需求场景,中国启动了「中国製造2025」等战略倡议,中国政府宣布到2030年实现产值3050亿美元,满足80%的国内需求。

- 印度的数位愿景是一个巨大的机会,具有巨大的经济价值。透过实施目前计画的 30 个数位主题,预计到 2022 年印度经济将产生超过 1 兆美元的收入。随着电子设备製造生态系的增加,印度半导体和电子市场的成长幅度极高。

- 根据韩国科学技术通讯部发布的产业展望,2021年电子元件产值较2020年成长12.5%。这一成长的推动因素是资料中心、边缘运算 (IoT)、汽车和 5G 智慧型手机对半导体记忆体的持续需求,以及电视和行动装置对 OLED 面板需求的飙升。

- 越南的电子工业(EI)是该国成长最快、最重要的产业之一。中美贸易战和中国製造成本上升使越南电子产业受益匪浅。它占据了中国电子产业迁移中最重要的份额之一。菲律宾的半导体工业和电子工业是该国製造业最重要的贡献者。而印尼的电子工业主要服务于当地工业,出口很少。

- 预计这些因素将在预测期内增加石英的需求。

石英行业概况

石英市场本质上是分散的。一些重要的参与者包括AGC Inc.、Nihon Dempa Kogyo、Quartz Corporation、Sibelco和Jiangsu Pacific Quartz Co.。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 不断发展的太阳能产业

- 半导体产业对高纯度石英的需求

- 限制

- 石英开采的生态影响

- 石英砖和石英板的变色

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 类型

- 高纯度石英

- 石英石表面和瓷砖

- 熔融石英坩埚

- 石英玻璃

- 石英晶体

- 金属硅

- 高纯度石英

- 最终用户产业

- 电子和半导体

- 太阳的

- 建筑物和建筑

- 光纤和电信

- 汽车

- 其他最终用户产业

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 领先企业采取的策略

- 公司简介

- AGC Inc.

- Beijing Kai de Quartz Co. Ltd

- Dow

- Elkem ASA

- Ferroglobe

- Heraeus Holding

- Jiangsu Pacific Quartz Co. Ltd

- Wonic QnC Corporation

- Nihon Dempa Kogyo Co. Ltd

- Nordic Mining ASA

- RUSNANO Group

- Saint-Gobain

- Sibelco

- SUMCO Corporation

- The Quartz Corporation

第 7 章:市场机会与未来趋势

- 石英粉因其独特的性能而出现新兴应用

The Quartz Market size is estimated at USD 7.31 billion in 2024, and is expected to reach USD 8.98 billion by 2029, growing at a CAGR of 4.19% during the forecast period (2024-2029).

The COVID-19 pandemic halted the supply chain of several industries worldwide, including electronics and semiconductors, building and construction, and automotive. It, in turn, adversely affected the demand for quartz in these industries. Solar power usage increased, but this alone could not lift the market back. The COVID-19 pandemic impacted the global construction industry, with projects facing labor shortages, supply chain issues, and financing pressures. The effects rippled across the sector, from the initial crisis in China to construction sites worldwide. However, as the lockdowns were lifted in most countries worldwide, the market has recovered due to production resumed in most industries.

Key Highlights

- Over the mid-term, the primary factor driving the market's growth is the demand for high-purity quartz in the semiconductor industry, coupled with the growing solar industry.

- The ecological impact of quartz mining, coupled with discoloration in quartz tiles and slabs, is anticipated to hinder the market's growth during the forecast timeframe.

- Due to its unique properties, emerging applications of quartz powder can act as an opportunity for the market.

- Asia-Pacific dominated the global market, with the most significant consumption in China.

Quartz Market Trends

Rising Demand from the Electronics and Semiconductor Industry

- Quartz is used within the electronics industry for its highly stable, high-performance resonators for further use in filters and oscillators. Quartz possesses various properties for the electronics industry, including piezoelectric properties, as its melting point is above 1700º C and its curing temperature is 573º C.

- There is an increasing demand for quartz from the electronics industry. It is because of its growing usage in devices, such as mobile phones, tablets, laptops, and desktops.

- Additionally, quartz crystal is used as an oscillator in radios, watches, and pressure gauges. Quartz crystal is also used to make frequency filters, frequency controls, and timers in electronic circuits for various products, such as communication equipment, computers, electronic games, and television receivers.

- For decades, companies in the United States have led the world to produce tiny semiconductor chips that power modern technologies. According to Semiconductor Industry Association (SIA), the semiconductor industry in the United States accounts for 47% of the global semiconductor market, which is the largest share in the world.

- The semiconductor manufacturers are planning to invest in the country, which is anticipated to contribute to market growth. For instance, in March 2021, Intel invested USD 3.5 billion in its New Mexico plant to manufacture tiny microchips used in nearly all modern devices, as their demand is increasing.

- Digital technologies such as the internet of things (IoT) and the latest communication technologies, such as 5G, are expected to aid in developing innovative consumer electronic products. As per data published by JEITA, global electronics production increased significantly in 2022 compared to 2020.

- Owing to such factors, the demand for quartz is expected to witness rapid growth in the electronics industry.

Asia-Pacific Region to Dominate the Market

- China is one of the major countries in the Asia-Pacific region, with ample construction activities. The country's industrial and construction sectors are expected to account for approximately 50% of the GDP.

- As per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025. Keeping in view the given forecasts, the Chinese government unveiled a five-year plan in January 2022 focused on making the construction sector more sustainable and quality-driven.

- The electronics supply chain was already in the throes of disruption before the outbreak due to the tariff war between the US and China. It forced the relocation of some high-profile electronics manufacturers from China to Southeast Asia, including GoPro, Kyocera, and Nintendo, moving manufacturing to Vietnam, Casio, Daikin, and Ricoh, and shifting operations to Thailand.

- To benefit from the extensive demand scenario, China embarked on strategic initiatives like the "Made in China 2025" plan, under which the Chinese government announced its goal to reach an output of USD 305 billion by 2030 and meet 80% of its domestic demand.

- The digital vision in India is a vast opportunity and includes significant economic value. The Indian economy is expected to generate revenue of more than USD 1 trillion by 2022 by implementing the 30 digital themes that are currently planned. With the increase in electronic device manufacturing ecosystems, the growth scope of the semiconductors and electronics market in India is extremely high.

- According to the industrial outlook released by South Korea's Ministry of Science and ICT, electronic component production in value grew by 12.5% in 2021 compared to 2020 values. This growth is driven by the continuous demand for semiconductor memory for data centers, edge computing (IoT), automobiles, and 5G smartphones, as well as soaring demand for OLED panels for TV and mobile devices.

- Vietnam's electronics industry (EI) is one of the country's fastest-growing and most important industries. The US-China trade war and rising manufacturing costs in China have hugely benefited the Vietnam electronics industry. It captured one of China's most significant shares of electronic industry migration. The Philippines' semiconductor industry, coupled with the electronics industry, is the most critical contributor to the manufacturing sector within the country. While the electronics industry in Indonesia primarily serves the local industry with very little export.

- Such factors are expected to increase the demand for quartz during the forecast period.

Quartz Industry Overview

The quartz market is fragmented in nature. Some significant players include AGC Inc., Nihon Dempa Kogyo Co. Ltd, Quartz Corporation, Sibelco, and Jiangsu Pacific Quartz Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Solar Industry

- 4.1.2 Demand for High-purity Quartz in the Semiconductor Industry

- 4.2 Restraints

- 4.2.1 Ecological Impact of Quartz Mining

- 4.2.2 Discoloration in Quartz Tiles and Slabs

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 High-purity Quartz

- 5.1.1.1 Quartz Surface and Tile

- 5.1.1.2 Fused Quartz Crucible

- 5.1.1.3 Quartz Glass

- 5.1.2 Quartz Crystal

- 5.1.3 Silicon Metal

- 5.1.1 High-purity Quartz

- 5.2 End-user Industry

- 5.2.1 Electronics and Semiconductor

- 5.2.2 Solar

- 5.2.3 Buildings and Construction

- 5.2.4 Optical fiber and Telecommunication

- 5.2.5 Automotive

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Beijing Kai de Quartz Co. Ltd

- 6.4.3 Dow

- 6.4.4 Elkem ASA

- 6.4.5 Ferroglobe

- 6.4.6 Heraeus Holding

- 6.4.7 Jiangsu Pacific Quartz Co. Ltd

- 6.4.8 Wonic QnC Corporation

- 6.4.9 Nihon Dempa Kogyo Co. Ltd

- 6.4.10 Nordic Mining ASA

- 6.4.11 RUSNANO Group

- 6.4.12 Saint-Gobain

- 6.4.13 Sibelco

- 6.4.14 SUMCO Corporation

- 6.4.15 The Quartz Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications of Quartz Powder due to its Unique Properties