|

市场调查报告书

商品编码

1444496

3D 测绘和 3D 建模 -市场占有率分析、行业趋势和统计、成长预测 (2024-2029)3D Mapping and 3D Modelling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

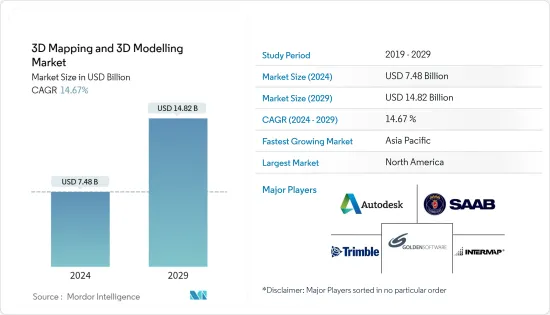

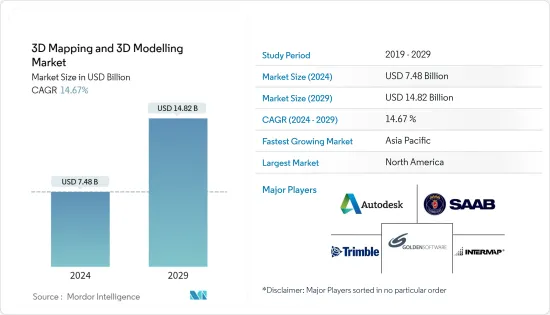

3D 测绘和 3D 建模市场规模预计 2024 年为 74.8 亿美元,预计到 2029 年将达到 148.2 亿美元,在预测期内(2024-2029 年)增加 146.7 亿美元,复合年增长率为 %。

在这个竞争激烈的市场中,3D 映射和建模方面的创新是创建 3D 环境的最简单方法。 3D 地图解决方案可快速产生周围环境的高品质 3D 地图,以便整合到专业视觉化流程中。

主要亮点

- 3D 内容的可用性不断增加正在推动 3D 绘图和建模产业的发展。 3D 内容是可以在三个不同方向(通常是长度、高度和宽度)进行测量的物理项目的开发。随着对 3D 内容的需求增加,对 3D 映射和建模的需求也在增加,3D 映射和建模使用专用的软体来创建专案的 3D 表示。

- 3D 映射和建模通常用于游戏和视讯娱乐产业来创建动作序列,让观众感觉彷佛置身于真实位置。近年来,由于行动游戏和其他应用程式中对 3D 动画的需求不断增长,以及视讯娱乐产业对提供更好的观看体验的渴望,3D 映射和 3D 建模市场显着增长。SONY、Xbox、微软和腾讯等游戏公司已经在使用 3D 技术来开发 3D 游戏,透过建立可以模仿使用者动作并提供更真实体验的虚拟世界。

- VR 技术的这些发展,尤其是游戏产业的发展,预计将在预测期内对下一代 3D 显示器的全球市场产生重大影响。根据游戏开发者大会的说法,游戏世界正在迅速发展。在 2023 年的调查中,全球 36% 的参与游戏开发商正在积极为 Meta Quest虚拟实境装置开发游戏。

- 与资料盗版和技术使用相关的高成本是可能影响预测期内市场成长的一些因素。

- 在 COVID-19 危机期间,3D 测绘和建模行业消费者对 3D 测绘和建模软体产品和服务的需求不断增加。电子商务、物流、线上学习、食品配送、医疗保健和许多其他线上业务协作显着增长,超越了内部应用程式和麵向客户的应用程式之间的界限。例如,iMap9是一款地板消毒机器人,无需人工干预即可移动和清洁地板。使用 3D 绘图技术清洁地板。企业使用 3D 测绘和建模软体解决方案来管理大量地理资料,同时满足使用者需求。

3D 绘图与 3D 建模市场趋势

支援 3D 的显示设备的出现推动市场发展

- 目前,3D显示技术主要在电视和智慧型手机上广泛应用。三星、SONY和 LG 等主要电视、智慧型手机、电脑显示器和游戏机製造商纷纷加入 3D 潮流,透过 3D 技术提高市场占有率。

- 虚拟实境在游戏中的使用越来越多,正在推动全球对下一代 3D 显示器的需求。 VR游戏主机在美国、英国、中国和日本等主要经济体越来越受欢迎。在预测期内,VR 游戏的这些技术进步预计将推动全球下一代 3D 显示器产业的成长。

- 游戏产业对 3D 技术日益增长的需求预计将推动 3D 显示器的未来扩展。在游戏产业中,3D 技术涉及以3D:高度、宽度和深度。大多数电脑游戏都是3D设计的。因此,製造笔记型电脑和其他具有立体3D显示器的设备对于游戏业务非常重要。

- 由于中阶人口的扩大和生活水准的提高,中国和印度等新兴经济体预计将在预测期内快速成长。由于消费者偏好的不断变化和对高解析度图形的需求不断增加,投影机和显示器是 3D 显示器的两种主要应用,预计其销量将大幅增长。

- 能够表达3D(3D)影像的显示器是一个极其有效的研究和开发领域,为广泛的应用带来了巨大的好处。例如,显示的影像可以是来自 CAD 软体包、多种医学影像设备(例如 CAT 或 MRI)之一的 3D 建模资料,或来自 3D 程式的统计模型。因此,对 3D 显示器及其使用的需求不断增长预计将在预测期内增加对 3D 建模和 3D 测绘的需求。

亚太地区预计将成为成长最快的市场

- 预计亚太地区将在 3D 测绘和建模领域占据重要市场占有率。其扩张可归因于医疗保健和生命科学、製造、建筑以及媒体和娱乐产业对 3D 成像感测器、3D 建模、3D 视觉化和渲染软体工具的需求不断增长。

- 该地区的小型企业和政府机构对用于行销目的的真实产品展示的需求不断增长,这将刺激对 3D 绘图和建模产品的需求。云端和物联网的日益普及以及网路使用的增加是推动市场发展的一些原因。

- 在过去十年中数位化和网路使用量增加的推动下,媒体和娱乐业务是该地区蓬勃发展的行业之一。该地区游戏业的崛起可能会在预测期内带来潜在的机会。

- 2022 年8 月,印度科学研究所(IISc) 将与3D 生物列印机开发的全球供应商Cellink 合作,帮助研究人员跨关键应用进行研究,以改善与心臟相关的健康结果。我们提供了生物列印系统,这些系统可以加速。使用 3D 建模设备观察骨骼、软骨和癌症。

- 中国、澳洲、新加坡、印度和日本是该地区网路生态系统发达的国家。该地区也开始尝试利用IT基础设施来帮助企业用户采用更先进的技术。由于经济原因鼓励亚洲各地生产设施的开发和维护,预计该地区将迅速扩张。该地区的崛起可归因于其不断扩张的经济,许多公司越来越多地采用 3D 绘图和建模来创新其产品。

3D 测绘和 3D 建模产业概述

3D 测绘和 3D 建模市场高度分散,主要公司包括 Autodesk Inc.、Saab AB、Golden Software LLC、Trimble Inc. 和 Intermap Technologies。市场参与企业正在采取合作和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 9 月 - Autodesk 发布了最新的 3D 建模和渲染软体更新 3DS Max 2023.2。此更新为从程式建模到动态图像建立等任务添加了新的阵列修改器,并改进了倒角操作、网膜重新三角化和 glTF 汇出。

- 2022 年 9 月 - Golden Software 是经济实惠的 2D 和 3D 科学建模软体包开发商,升级了其 Surfer 网格、轮廓和 3D 表面映射软体包,改进了网格显示和资料座标转换选项。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间竞争的激烈程度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 3D 相容显示设备的出现

- 3D 扫描器、3D 感测器和其他撷取设备的进步

- 市场限制因素

- 初始投资高

- 评估 COVID-19 对产业的影响

第六章市场区隔

- 按类型

- 3D 测绘

- 3D建模

- 按用途

- 投影映射

- 纹理映射

- 地图和导航

- 其他用途

- 按行业 按最终用户

- 娱乐和媒体

- 车

- 卫生保健

- 建筑与建造

- 防御

- 交通设施

- 其他最终用户领域

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Autodesk Inc.

- Saab AB

- Golden Software LLC

- Trimble Inc.

- Intermap Technologies

- The Foundry Visionmongers Ltd

- Bentley Systems Inc.

- Topcon Positioning Systems Inc.

- Airbus Defense and Space

- Cybercity 3D Inc.

- ESRI Inc.

第八章投资分析

第九章市场机会与未来趋势

The 3D Mapping and 3D Modelling Market size is estimated at USD 7.48 billion in 2024, and is expected to reach USD 14.82 billion by 2029, growing at a CAGR of 14.67% during the forecast period (2024-2029).

In this competitive market, 3D mapping and modeling innovations are the easiest ways to create 3D environments. 3D mapping solutions quickly generate high-quality 3D maps of surroundings, ready to be integrated into professional visualization processes.

Key Highlights

- The growing availability of 3D content propels the 3D mapping and modeling industry. 3D content is the development of a physical item that can be measured in three different directions - typically the length, height, and breadth. As the need for 3D content grows, the demand for 3D mapping and modeling is also growing, which uses specialized software to produce a three-dimensional representation of an item.

- 3D mapping and modeling are frequently used in the gaming and video entertainment industries to create action sequences that make viewers feel as if they are in the actual location. The market for 3D mapping and 3D modeling has grown significantly in recent years due to the rising demand for 3D animation in mobile gaming and other applications and the video entertainment industry's desire to deliver a better watching experience. Gaming firms such as Sony, Xbox, Microsoft, and Tencent already use 3D technology and develop 3D games by building a virtual world that can mimic the user's motion and give them a more realistic experience.

- These developments in VR technology, particularly in the gaming industry, are expected to substantially impact the global market for next-generation 3D displays throughout the projected period. According to the Game Developers Conference, the gaming world is fast evolving. In a 2023 study, 36% of participating game developers worldwide are actively developing games for the Meta Quest virtual reality gear.

- Data piracy and the high cost associated with the use of technology are some of the factors that may affect the growth of the market over the forecast period.

- During the COVID-19 crisis, the 3D mapping and modeling industry has experienced an increase in consumer demand for 3D mapping and modeling software products and services. E-commerce, logistics, online learning, food delivery, healthcare, and many other online business collaborations witnessed substantial growth, exceeding the boundaries of their internal and customer-facing applications. For instance, iMap9 is a floor-disinfecting robot that can navigate and cleanse floors without human intervention. It cleanses the floors using 3D mapping technology. The companies use 3D mapping and modeling software solutions to manage massive volumes of geographical data while meeting user requirements.

3D Mapping & 3D Modelling Market Trends

Advent of 3D-enabled Display Devices Drives the Market

- Currently, 3D display technology is widely employed, particularly in televisions and smartphones. Major TV, smartphone, computer monitor, and gaming console manufacturers like Samsung, Sony, and LG are on the 3D bandwagon to boost their market share through 3D technology.

- The growing use of virtual reality in gaming propels global demand for next-generation 3D displays. VR gaming consoles are becoming increasingly popular in major economies such as the United States, the United Kingdom, China, and Japan. Over the projected period, these technological advancements in VR gaming are likely to boost the growth of the worldwide next-generation 3D display industry.

- The gaming industry's increased need for 3D technology is projected to fuel the future expansion of the 3D display. In the gaming industry, 3D technology relates to interactive computer content visually portrayed in three dimensions: height, breadth, and depth. Most computer games are designed in three dimensions. Thus, it is critical for the gaming business to produce laptops and other devices with stereo 3D displays.

- Developing economies such as China and India are anticipated to grow rapidly during the projection period due to an expanded middle-class population and rising living standards. Projectors and monitors, two main uses of 3D displays, are expected to experience a surge in sales due to evolving consumer preferences and increased demand for high-definition graphics.

- Displays that can create three-dimensional (3D) pictures are a very effective field for R&D that is highly advantageous to a wide range of applications. For example, the picture that would be presented may be 3D modeling data from a CAD software package, one of several medical imaging equipment (such as a CAT or MRI), or statistical models of 3D programs. Thus, the growing demand for and the use of 3D displays are expected to drive the demand for 3D modeling and 3D mapping during the forecast period.

Asia-Pacific is Expected to Be the Fastest-growing Market

- The Asia-Pacific region is anticipated to have a substantial 3D mapping and modeling market share. Its expansion may be attributable to the rising demand for 3D imaging sensors, 3D modeling, and 3D visualization, rendering software tools in healthcare and life sciences, manufacturing, construction, and media and entertainment industries.

- The growing demand for a realistic representation of the product for marketing purposes by small and medium-sized companies and government agencies in the region would stimulate demand for 3D mapping and modeling products. Rising cloud and IoT adoption and increased web usage are some of the reasons driving the market.

- The media and entertainment business is one of the region's thriving industries, propelled by increased digitalization and internet usage over the last decade. The region's gaming industry's rise is likely to present potential opportunities during the forecast period.

- In August 2022, the Indian Institute of Sciences (IISc) collaborated with Cellink, a global provider of developing 3D Bioprinters, to provide researchers with access to bioprinting systems that will allow them to accelerate their work across critical applications to improve health outcomes related to heart, bone, cartilage, and cancer using 3D modeling devices.

- China, Australia, Singapore, India, and Japan are among the countries in the region with well-developed cyber ecosystems. The region is also launching various attempts to utilize IT infrastructure, allowing business users to adopt more advanced technology. The region is expected to expand rapidly due to economic considerations driving the development and maintenance of production facilities throughout Asia. The region's rise may also be ascribed to its expanding economy, where many firms are increasingly embracing 3D mapping and modeling to innovate their products.

3D Mapping & 3D Modelling Industry Overview

The 3D mapping and 3D modeling market is highly fragmented, with the presence of major players like Autodesk Inc., Saab AB, Golden Software LLC, Trimble Inc., and Intermap Technologies. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2022 - Autodesk released 3DS Max 2023.2, the latest 3D modeling and rendering software update. The update adds a new Array Modifier for tasks ranging from procedural modeling to creating motion graphics and improves chamfer operations, mesh re-triangulation, and glTF export.

- September 2022 - Golden Software, a developer of affordable 2D and 3D scientific modeling packages, upgraded its Surfer gridding, contouring, and 3D surface mapping package with improved grid display and data coordinate conversion options.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advent of 3D-enabled Display Devices

- 5.1.2 Advancement of 3D Scanners, 3D Sensors, and Other Acquisition Devices

- 5.2 Market Restraints

- 5.2.1 High Initial Investments

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 3D Mapping

- 6.1.2 3D Modeling

- 6.2 By Application

- 6.2.1 Projection Mapping

- 6.2.2 Texture Mapping

- 6.2.3 Maps and Navigation

- 6.2.4 Other Applications

- 6.3 By End-user Vertical

- 6.3.1 Entertainment and Media

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 Building and Construction

- 6.3.5 Defense

- 6.3.6 Transportation

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk Inc.

- 7.1.2 Saab AB

- 7.1.3 Golden Software LLC

- 7.1.4 Trimble Inc.

- 7.1.5 Intermap Technologies

- 7.1.6 The Foundry Visionmongers Ltd

- 7.1.7 Bentley Systems Inc.

- 7.1.8 Topcon Positioning Systems Inc.

- 7.1.9 Airbus Defense and Space

- 7.1.10 Cybercity 3D Inc.

- 7.1.11 ESRI Inc.