|

市场调查报告书

商品编码

1444570

液体包装纸盒 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Liquid Packaging Cartons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

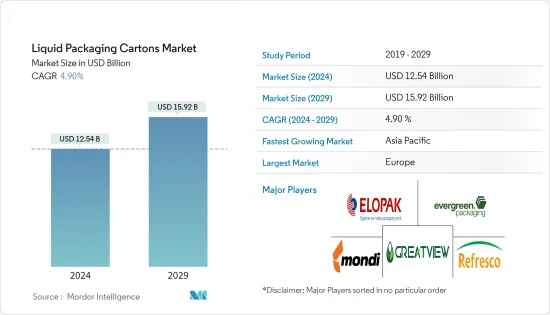

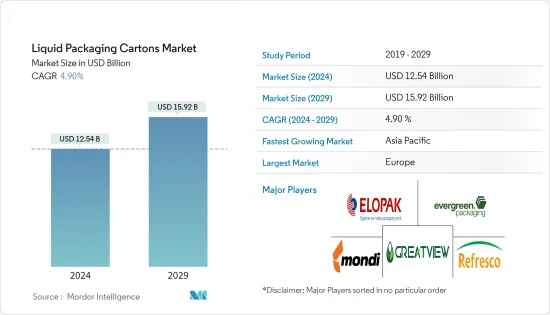

液体包装纸盒市场规模预计到 2024 年为 125.4 亿美元,预计到 2029 年将达到 159.2 亿美元,在预测期内(2024-2029 年)CAGR为 4.90%。

液体包装纸盒可确保内容物的安全并免受外界污染物的影响,从而延长产品的保质期。可食用液体(如乳製品、果汁、番茄酱、软性饮料和水)和不可食用液体(如油、燃料和清洁剂)均包装在纸箱中。

主要亮点

- 发展中国家的快速城市化推动了对包装液体产品的需求,从而促进了市场扩张。此外,消费者支出的增加和可支配收入的增加推动了液体包装纸盒市场的成长。

- 由于环保意识不断增强,该行业正在透过引入生态友好的液体包装纸盒来扩大规模。各国政府推动使用可回收和环保包装的优惠政策进一步支持了这一趋势,从而加速了市场扩张。

- 果汁是一种正在迅速扩张的饮料类别,但大多数果汁都容易氧化。维生素在氧化过程中会流失,风味和外观也会发生不利的改变。这些不良的质量变化经常发生在流体的加工、包装、运输或储存过程。液体纸盒的扩张受到品质控制要求带来的新包装设计进步的影响。

- 由于塑胶容器易于运输且具有成本效益,人们越来越倾向于使用塑胶容器来包装液体食品,因此对液体包装纸盒的需求可能会受到阻碍。

- 随着COVID-19的爆发,由于世界各地实施封锁,液体包装纸盒市场成长缓慢,这扰乱了供应链并导致生产工厂关闭。

液体包装纸盒市场趋势

牛奶和其他乳製品饮料见证成长

- 牛奶是主要主食之一,也是均衡饮食的重要组成部分,因为它含有高比例的钙和其他必需营养素。各种研究表明,牛奶对健康有益,例如预防糖尿病、增强骨骼健康和健康的大脑功能。

- 消费者对牛奶等包装商品的日益偏好推动了对液体纸盒包装解决方案的需求。对塑胶使用的可持续性担忧的增加推动了对砖液纸盒的需求。

- 牛奶传统上采用纸盒包装,因为它们可以保护食品并且环保。纸板是经常用于製造牛奶包装纸盒的材料之一。牛奶纸盒通常称为屋顶纸盒,是一种聚酯涂布纸包装。

- 牛奶盒具有更长的保质期和更低的污染风险。由于液体包装纸盒在使用后易于重新封闭,因此预计这些容器的消耗量将比过去 10 年增长得更快。

- 乳製品饮料市场(尤其是亚太地区)的稳定成长带动了牛奶无菌包装的发展。与传统包装方法相比,保质期长和无需冷藏等优点也可能有助于纸盒的成长。

亚太地区预计将出现最高成长

- 领先的饮料企业最近进入中国和印度市场,这为亚太液体纸盒包装行业带来了销售的大幅成长。此外,千禧世代越来越多地使用包装饮料,包括乳製品、软性饮料和果汁,是推动液体纸盒包装需求的另一个因素。

- 对永续性、技术进步和诱人的经济效益的担忧是过去二十年来推动中国液体包装扩张的几个因素。消费者对包装的看法以及与包装的互动正在迅速改变。供应商更加强调永续性,创意和更永续的纸板纸盒包装正在取代该国旧的硬包装选择。由于市场对消费者友善包装和增强产品保护的需求不断增长,液体包装预计将成为更实用、更实惠的替代品。

- 天然材料很容易取得并用于製造液体包装的纸箱。此外,从製造商和消费者的角度来看,液体包装纸盒越来越多地用于工业和机构环境,有助于该领域的扩张。

- 政府为减少碳足迹和开发永续包装的有利措施也刺激了亚太地区对液体纸盒包装的需求。例如,印度被印度品牌资产基金会评为第四大快速消费品市场。

液体包装纸盒产业概况

由于 Elopak、Evergreen Packaging LLC 和 SIG Global Pte 等知名企业的加入,液体包装市场呈现零碎状态。有限公司以及该行业的本地参与者。不断增长的合作、合併和收购也可能支持未来几年的市场扩张。液体包装产业将受益于环境问题日益严重、塑胶包装的过度使用、纸箱包装的可回收性以及使用液体包装而不是玻璃包装的便利性等因素。再生纸和轻质包装是推动该市场的液体包装创新的例子。

- 2022 年 4 月 - Elopak AS 宣布与 GLS 合作,为印度各地的消费者提供永续包装解决方案。客户可以从 GLS 购买「ALPAK」品牌的各种尺寸的捲筒式无菌纸盒,并提供端对端服务支援。该业务计划提供新鲜的 Pure-Pak 纸盒、Pure-Pak 无菌纸盒和辅助解决方案。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争激烈程度

- 产业供应链分析

第 5 章:市场动态

- 市场驱动因素

- 对环保包装的需求不断成长

- 市场限制

- 来自玻璃和塑胶包装等替代品的竞争

- COVID-19 对市场的影响

第 6 章:市场细分

- 按液体类型

- 牛奶

- 果汁

- 能量饮品

- 其他液体类型

- 按地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 中东和非洲其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- Elopak AS

- Evergreen Packaging LLC

- Greatview Aseptic Packaging Co. Ltd

- Mondi PLC

- Refresco Group NV

- SIG Global Pte. Ltd

- Tetra Laval International SA

- Nippon Paper Industries Co. Ltd

- IPI SRL

第 8 章:投资分析

第 9 章:市场的未来

The Liquid Packaging Cartons Market size is estimated at USD 12.54 billion in 2024, and is expected to reach USD 15.92 billion by 2029, growing at a CAGR of 4.90% during the forecast period (2024-2029).

Liquid packing cartons ensure content security and protection from outside pollutants, extending the product's shelf life. Both edible liquids, such as dairy goods, fruit juices, tomato sauce, soft drinks, and water, and non-edible liquids, like oils, fuels, and cleansers, are packaged in cartons.

Key Highlights

- The need for packaged liquid products is driven by the quick urbanization of developing countries, fostering market expansion. In addition, rising consumer expenditure and higher disposable income fuel the growth of the liquid packaging cartons market.

- The industry is expanding by introducing ecologically friendly liquid packing cartons due to growing environmental awareness. This trend is further supported by favorable policies by governments from various nations to promote the use of recyclable and eco-friendly packaging choices, speeding up market expansion.

- Fruit juice is a beverage category that is expanding quickly, yet the majority of these juices are susceptible to oxidation. Vitamins are lost during oxidation, and flavor and appearance also undergo unfavorable modifications. These undesirable quality changes frequently occur during the fluid's processing, packaging, transportation, or storage. Liquid carton expansion is impacted by new package design advancements brought on by the requirement for quality control.

- The demand for liquid packaging cartons will likely be hampered by the increased preference for plastic containers for packaging liquid food products due to their ease of transportation and cost-effective benefits.

- With the COVID-19 outbreak, the liquid packaging cartons market saw slow growth due to lockdowns being imposed across the world, which disrupted the supply chains and led to the closure of production plants.

Liquid Packaging Cartons Market Trends

Milk and Other Dairy Beverages to Witness Growth

- Milk is one of the main staple foods and a crucial component of a balanced diet as it contains a high percentage of calcium and other essential nutrients. Various research studies have shown that milk offers health benefits, such as preventing diabetes and enhancing bone health and healthy brain functioning.

- Consumers' growing preference for packaged goods like milk drives the need for liquid carton packaging solutions. The demand for brick-liquid cartons is fueled by increased sustainability concerns surrounding plastic usage.

- Milk has traditionally been packaged in cartons because they protect food and are eco-friendly. Paperboard is one of the materials that is regularly utilized to create milk packing cartons. Milk cartons, commonly referred to as gable-top cartons, are a type of poly-coated paper packaging.

- Milk cartons have a longer shelf life and a lower risk of contamination. Because liquid packing cartons are easy to reclose after use, consumption of these containers is anticipated to increase more quickly than in the previous 10 years.

- Steady growth in the dairy beverage market, especially in Asia-Pacific, has led to the development of aseptic packaging for milk. Advantages such as long shelf life and no refrigeration may also aid the growth of cartons over traditional packaging methods.

Asia-Pacific is Expected to Witness the Highest Growth

- Leading beverage businesses have recently entered the markets of China and India, which has given the Asia-Pacific liquid carton packaging industry a substantial boost in sales. In addition, millennials' growing use of packaged beverages, including dairy products, soft drinks, and juices, is another factor driving the need for liquid carton packaging.

- Concerns about sustainability, technological advancement, and alluring economics are a few factors that have contributed to the expansion of liquid packaging in China over the past two decades. Consumer perceptions of and interactions with packaging are evolving quickly. Vendors are emphasizing more on sustainability, and creative and more sustainable paperboard carton packaging is replacing old rigid packaging options in the country. Liquid packaging is anticipated to become a more practical and affordable alternative due to the market's growing desire for consumer-friendly packaging and enhanced product protection.

- Natural materials are readily available and used to make cartons for liquid packing. In addition, from the standpoints of manufacturers and consumers, liquid packing cartons are increasingly being used in industrial and institutional settings, thus contributing to the expansion of the segment.

- Favorable government initiatives to reduce carbon footprints and develop sustainable packaging also boost the demand for liquid carton packaging in Asia-Pacific. For instance, India is ranked as the fourth-largest fast-moving consumer goods market by the Indian Brand Equity Foundation.

Liquid Packaging Cartons Industry Overview

The liquid packaging market is fragmented because of prominent players, like Elopak, Evergreen Packaging LLC, and SIG Global Pte. Ltd, and local players in this industry. Growing collaborations, mergers, and acquisitions will also likely support the market expansion in the coming years. The sector for liquid packaging will be benefitted by factors such as rising environmental concerns, the excessive use of plastic packaging, the recyclable nature of carton packs, and the convenience of using liquid packaging rather than glass packaging. Recycled paper and lightweight packaging are examples of liquid packaging innovations propelling this market.

- April 2022 - Elopak AS announced a collaboration with GLS to deliver sustainable packaging solutions to consumers across India. Customers can purchase Roll-Fed aseptic cartons in a range of sizes from GLS under the "ALPAK" brand, together with end-to-end service support. The business plans to provide fresh Pure-Pak cartons, Pure-Pak aseptic cartons, and ancillary solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Eco-friendly Packaging

- 5.2 Market Restraints

- 5.2.1 Competition from Substitutes, such as Glass and Plastic Packaging

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Liquid Type

- 6.1.1 Milk

- 6.1.2 Juices

- 6.1.3 Energy Drinks

- 6.1.4 Other Liquid Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 France

- 6.2.2.2 United Kingdom

- 6.2.2.3 Germany

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia and New Zealand

- 6.2.3.5 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 United Arab Emirates

- 6.2.5.2 Saudi Arabia

- 6.2.5.3 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Elopak AS

- 7.1.2 Evergreen Packaging LLC

- 7.1.3 Greatview Aseptic Packaging Co. Ltd

- 7.1.4 Mondi PLC

- 7.1.5 Refresco Group NV

- 7.1.6 SIG Global Pte. Ltd

- 7.1.7 Tetra Laval International SA

- 7.1.8 Nippon Paper Industries Co. Ltd

- 7.1.9 IPI SRL