|

市场调查报告书

商品编码

1685958

全球行动化运营服务-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Managed Mobility Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

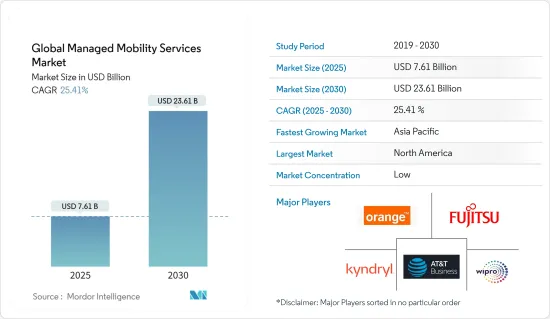

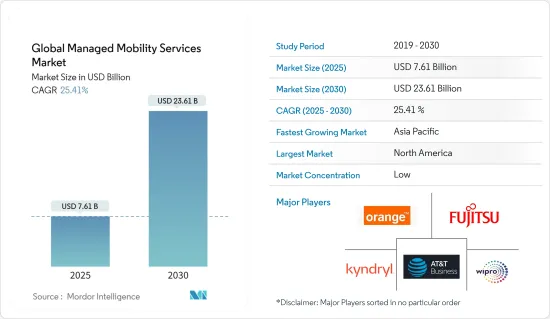

预计 2025 年全球行动化运营服务市场规模为 76.1 亿美元,到 2030 年将达到 236.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 25.41%。

主要亮点

- 行动化运营服务供应商提供的解决方案可透过处理管理各种装置平台的复杂性来减轻企业 IT 部门的负担。因此,行动化运营服务透过将行动办公人员连接到管理、伺服器和资料库,实现了与行动办公人员的轻鬆沟通。这使得企业能够超越传统的通讯方式,在传统通讯方式中,个人电脑仅用于处理商业电子邮件、资料库和其他公司内容。

- 此外,行动即服务解决方案透过提供单一合作伙伴来管理行动装置的整个生命週期,简化了企业员工复杂的行动装置技术需求。这样,透过消除管理行动技术的麻烦,这些公司能够释放 IT 团队的资源和时间,专注于有助于转变业务的策略计画。

- 成熟的组织正在经历向数位连接的转变,至少 50% 的员工使用多台设备进行需要集中管理的业务。因此,新型营运商设备的兴起不断涌入职场并扩大行动生态系统,增加了对经验丰富的 MMS 供应商的需求,以解决组织之间通讯的复杂性。

- 在全球范围内,医生、护士、患者和其他支援人员对行动装置的使用正在增加。此外,医疗保健终端使用者产业的组织必须遵守有关资料共用和储存的 HIPAA 法规。这些因素预计将推动医疗保健产业采用行动化运营服务。

- 在投资第三方行动化运营服务时,客户仍面临着获得成本可见性的挑战。一些供应商缺乏估算总成本、容量和资源的专业知识,因此他们手动添加各个参数来得出估算成本。这些挑战造成了市场缺陷。

- 整体而言,COVID-19 对全球行动化运营服务市场的影响好坏参半。虽然疫情导致人们转向远距工作,增加了对 MMS 服务的需求,但也造成了供应链中断和经济不确定性,在某些情况下导致投资下降。然而,疫情加速了全球 MMS 市场的技术进步,带来了新的创新解决方案。随着企业寻求提高效率和适应不断变化的商业环境的方法,MMS 服务市场预计将长期成长。

行动化运营服务市场趋势

IT和通讯终端用户产业占据主要市场占有率

- IT和通讯业是託管服务的重要市场。由于各种技术的高采用率,企业行动化的趋势已经出现多年。如今,企业主要专注商务策略和核心竞争力,从而刺激了自带设备 (BYOD) 的利用和采用。这可能会推动对简化行动服务的需求,并增加对管理这些行动装置的需求。

- 此外,中国、印度和巴西等新兴国家的行动用户数量不断增长,推动了 BYOD 政策的采用,从而提高了工作效率和业务灵活性。根据思科的报告,实施 BYOD 政策的公司平均每年每位员工可节省 350 美元。此外,反应式计画每年可为每位员工节省高达 1,300 美元。

- 由于新冠疫情导致的政府限制和封锁,全球对託管云端服务的需求正在增加,这进一步推动了行动化运营服务的发展,并迫使企业转向远端工作。

- 此外,州和地方政府以及监管机构规定的网路安全合规要求正在推动以安全为重点的託管行动应用服务的需求。此外,随着用于运算目的的专用内部硬体的减少以及大多数功能转向云端基础,隐私和安全问题变得更加严重。

- 预计在预测期内,行动化运营服务中采用物联网解决方案将推动市场发展,该解决方案将连接硬体设备、内建软体和通讯服务,以提供智慧通讯环境、智慧交通、智慧家庭和智慧医疗保健。

预测期内,北美将占据主要份额

- 根据思科年度网路报告,预计到2023年底,全球人均设备和连线数将成长到3.6个。到2023年,在人均平均设备和连接数最高的国家中,美国预计将以13.6个设备保持领先,其次是韩国和日本。

- 此外,5G在国内的普及也将在未来推动对物联网设备的需求。过去几年,随着 AT&T、Sprint、T-Mobile 和 Verizon 等全国性行动电话电信商专注于推出 5G,取得了重大进展。根据GSMA预测,5G将在2023年初达到1亿个行动连线,到2025年,5G连线数将超过1.9亿个,成为印度领先的行动网路技术。

- 云端运算和数位转型正在增加资料外洩的总成本。行动平台的采用、广泛的云端迁移和物联网设备正在推高成本。根据波耐蒙研究所的资料外洩成本研究,全球资料外洩的平均成本为 383 万美元。然而,美国资料外洩的平均成本明显更高,达到 864 万美元。资料外洩的可能性很高,可能促使企业更加重视IT安全,这有望推动託管行动服务市场的发展。

- 受新冠疫情 (COVID-19) 疫情导致的工作文化推动,加拿大行动化运营服务市场正在获得进一步的投资。例如,MSP Corp Investments Inc. 于 2021 年 9 月筹集了 3,500 万美元的成长资本,用于收购和投资加拿大各地的託管 IT 服务提供者 (MSP)。主要财务支持者包括加拿大帝国商业银行 (CIBC) 和 BDC Capital 的 Growth Equity Partners-Fund II。该公司与加拿大各地的高效能 MSP 合作并收购它们,为他们提供技术、资源和业务支援以加强他们的团队。该公司的主要关注领域包括託管网路服务、行动性管理、网路安全和云端託管。

- 全球工业4.0倡议带来的数位化趋势也正在推动工业IoT的需求。例如,2021年5月,总部位于多伦多的新兴企业BehrTech因2020年开发的物联网无线连接产品而奖励。该公司还获得了一项来自联邦和非营利组织联合资助计划的300万美元津贴,用于建立工业4.0实验室。

行动化运营服务产业概览

行动化运营服务市场较为分散,主要参与者包括 AT&T 智慧财产权、富士通、Kyndryl Inc.、Wipro 和 Orange SA。该市场中的公司正在采用伙伴关係、协议、创新和收购等策略来增强其服务产品并获得永续的竞争优势。

- 2023 年 2 月 Kindleyland 诺基亚扩大全球网路和边缘运算合作伙伴关係。这项为期三年的协议扩大了合作计划,并加速部署灵活、可靠和安全的 LTE 和 5G 私有无线连接服务以及工业 4.0 解决方案。此外,获得最高级别的诺基亚数位自动化云端 (DAC) 认证扩大了 Kyndryl 对诺基亚的策略投资,增加了可为全球客户提供支援的专家资源和熟练从业人员的数量。 Kyndryland Nokia 在北卡罗来纳州罗利市开设了一个合作伙伴创新实验室。该实验室将采用多因素、零信任模型,将先进的无线连接和边缘运算结合在一起,以整合企业 IT 和 OT。

- 2023年3月,Wipro正式推出其「5G Def-i」平台。这个整合平台使行动市场中的公司能够无缝转变其基础设施、网路和服务,并在巴塞隆纳世界行动通讯大会 (MWC) 的一个小组讨论中首次亮相,实现了互联企业的宏伟目标。 Wipro 的 5G Def-iplatform 基于开放标准构建,提供企业整合现有基础设施、孵化新应用和服务以及跟上技术变革所需的云端原生环境、网路 API 和第三方整合。此整合套件将云端的可扩展性与 5G 的速度和容量相结合。它还包括一个用于构建可操作的商业洞察的智慧层。它还提供端点设备的可见性和资料洞察,加速网路营运商的服务引入,并支援新企业应用程式的快速部署。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 各行各业对 BYOD 的采用率不断提高

- 企业IT活动外包

- 市场限制

- 缺乏对营运管理和成本的了解

第六章市场区隔

- 按功能

- 行动装置管理

- 行动应用程式管理

- 行动安全

- 其他功能

- 按部署

- 云

- 本地

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 卫生保健

- 製造业

- 零售

- 教育

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章竞争格局

- 公司简介

- AT&T Intellectual Property

- Fujitsu

- Kyndryl Inc.

- Wipro

- Orange SA

- Telefonica SA

- Samsung Electronics Co. Ltd

- Hewlett Packard Enterprise

- Vodafone Group PLC

- Microsoft Corporation

- Tech Mahindra

第八章投资分析

第九章:市场的未来

The Global Managed Mobility Services Market size is estimated at USD 7.61 billion in 2025, and is expected to reach USD 23.61 billion by 2030, at a CAGR of 25.41% during the forecast period (2025-2030).

Key Highlights

- The managed mobility service providers offer solutions that ease the burden on enterprise IT departments by dealing with complex managing of various device platforms, with the help of interpreted content for specialized mobile applications. Therefore, managed mobility services enable easy communication with mobile office workers by connecting them with management, servers, and databases. Thus, it allows enterprises to overcome the traditional communications that involve PC only for business emails, databases, and other corporate content.

- Furthermore, mobility as a service solution simplifies corporate personnel's complex mobile device technology needs by offering a single partner to manage the whole mobile device lifecycle. Thus, these companies take the hassle of managing mobile technology so that IT teams can save resources and time to focus on the strategic initiatives that are helping them to transform their businesses.

- The growing shift of mature organizations toward digital connectivity drives at least 50% of employees to use more than one device for work that demands centralized management. Thus, the rise of new types of carrier devices continues to flood workplaces and expand the mobility ecosystem, driving the need for experienced MMS providers to handle the complexity of communication across organizations.

- The use of mobile devices among doctors, nurses, patients, and other supporting staff has increased worldwide. Moreover, organizations in the healthcare end-user industry must adhere to HIPAA regulations for data sharing and storage. These factors are expected to drive the adoption of managed mobility services in the healthcare industry.

- Customers are still witnessing challenges for cost visibility as they invest in the third-party managed mobility service. Some vendors lack the expertise to estimate the total costs or the capacity or resources in order to add individual parameters to arrive at an estimated cost manually. Such challenges add a drawback to the market.

- Overall, the impact of COVID-19 on the global managed mobility services market has been mixed. While the pandemic has increased demand for MMS services due to the shift toward remote work, it has also caused disruptions to supply chains and economic uncertainties, leading to a decrease in investment in some cases. However, the pandemic has also accelerated technological advancements in the global MMS market, leading to new and innovative solutions. The market for MMS services is expected to grow in the long term as companies look for ways to increase efficiency and adapt to changing business environments.

Managed Mobility Services Market Trends

IT and Telecom End-user Industry Segment Holds Significant Market Share

- The IT and telecom sector is a significant market for managed services. Due to the high rate of various technological adoptions, the enterprise mobility trend has emerged over the years. Today, companies primarily focus on business strategies and core competencies, fueling the utilization and adoption of bring-your-own-device (BYOD). This increases the requirement for streamlined mobility services, likely to boost the demand for managing these mobile devices.

- Furthermore, the growing mobile subscriber base in emerging countries, such as China, India, and Brazil, has been propelling the adoption of BYOD policies, enhancing work efficiency and flexibility in operations. According to a Cisco report, enterprises with a BYOD policy save, on average, USD 350 per year per employee. Moreover, reactive programs can boost these savings to USD 1,300 per year per employee.

- The demand for managed cloud services has increased across the globe due to government regulations and lockdown measures due to the COVID-19 pandemic, further boosting the managed mobility services and forcing businesses to move towards remote working modes, which has led companies to adopt cloud-based solutions to expand their requirements.

- Cybersecurity compliance requirements mandated by the state and local governments and regulatory bodies also drive the need for managed mobility application services to be security-focused. Additionally, as dedicated, on-premise hardware for computing purposes will decrease, and most of the functionality will become cloud-based, privacy and security issues will become more intense.

- Adopting IoT solutions in managed mobility services, which connect hardware devices, embedded software, and communication services, offers smart communication environments, smart transportation, smart homes, and smart healthcare and is expected to drive the market during the forecast period.

North America to Hold Major Share over the Forecast Period

- According to the annual internet report by Cisco, the average number of devices and connections per capita worldwide is anticipated to increase to 3.6 by the end of the year 2023. Among the countries with the highest average per capita devices and connections by 2023, the United States is expected to remain at the top with an average of 13.6 devices and connections per capita, followed by South Korea and Japan.

- Moreover, the 5G penetration in the country also encourages the demand for IoT devices in the future. The focus on deploying 5G by national mobile operators, like AT&T, Sprint, T mobile, and Verizon, has led to significant developments over the years. According to the GSMA, 5G will reach 100 million mobile connections in early 2023 and become the country's leading mobile network technology by 2025, with more than 190 million 5G connections.

- Cloud and digital transformation have increased the total cost of a data breach. The use of mobile platforms, extensive cloud migration, and IoT devices are the drivers increasing the cost. According to the Ponemon Institute's "Cost of Data Breach Study," the global average for a data breach was USD 3.83 million. However, the average data breach cost in the United States was significantly high at USD 8.64 million. The high potential of data breaches is expected to drive the managed mobile services market as enterprises focus more on IT security.

- The Canadian managed mobility services market is witnessing increased investments further driven by the COVID-19 pandemic-induced work culture. For instance, in September 2021, MSP Corp Investments Inc. raised USD 35 million in growth capital to acquire and invest in managed IT services providers (MSPs) across Canada. Major financial backers include CIBC and BDC Capital's Growth Equity Partners - Fund II. The company partners and acquires high-performing MSPs in the country to deliver technology, resources, and business support to empower MSP teams. Key areas of focus of the company include managed network services, mobility management, cybersecurity, and cloud hosting.

- The digital trends brought globally by the Industry 4.0 initiatives also drive the need for industrial IoT. For instance, in May 2021, Toronto-based BehrTech, a startup, was awarded for its wireless connectivity products for the IoT that the company developed in 2020, and the company also received a USD 3 million grant from a joint funding program between the federal government and a non-profit organization to build an Industry 4.0 lab.

Managed Mobility Services Industry Overview

The managed mobility services market is fragmented, with the presence of major players like AT&T Intellectual Property, Fujitsu, Kyndryl Inc., Wipro, and Orange SA. Players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

- February 2023: Kyndryland Nokia expanded its global network and edge computing alliance. The three-year agreement extends plans to collaborate on and accelerate the deployment of flexible, dependable, and secure LTE and 5G private wireless connectivity services, as well as Industry 4.0 solutions. Furthermore, Kyndryl increases its strategic investment in Nokia by achieving the highest tier Nokia Digital Automation Cloud (DAC) accreditation status, increasing expert resources and skilled practitioners ready to support customers worldwide. Kyndryland Nokia opened a partner innovation lab in Raleigh, North Carolina. The lab will integrate advanced wireless connectivity and edge computing with a multi-factor zero trust model, converging IT and OT for enterprises.

- March 2023: Wipro officially launched its "5G Def-I" platform. The integrated platform, which enables businesses in the mobility market to transform their infrastructure, networks, and services seamlessly, debuted at the MWC Barcelona panel, realizing the connected enterprise's goals. Wipro's 5G Def-iplatform, built on open standards, offers the cloud-native environment, network APIs, and third-party integrations required for businesses to onboard existing infrastructure, incubate new apps and services, and keep up with technological changes. The integrated suite combines cloud scalability with 5G speed and capacity. It also includes an intelligence layer for creating actionable business insights. It also includes visibility into endpoint devices and data insights, faster service implementation for network operators, and rapid deployment of new enterprise applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of BYOD in Multiple Industries

- 5.1.2 Companies Outsourcing IT Activities

- 5.2 Market Restraints

- 5.2.1 Lack of Control over Operations and Cost Visibility

6 MARKET SEGMENTATION

- 6.1 By Function

- 6.1.1 Mobile Device Management

- 6.1.2 Mobile Application Management

- 6.1.3 Mobile Security

- 6.1.4 Other Functions

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End-user Industry

- 6.3.1 IT and Telecom

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Retail

- 6.3.6 Education

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Intellectual Property

- 7.1.2 Fujitsu

- 7.1.3 Kyndryl Inc.

- 7.1.4 Wipro

- 7.1.5 Orange SA

- 7.1.6 Telefonica SA

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 Hewlett Packard Enterprise

- 7.1.9 Vodafone Group PLC

- 7.1.10 Microsoft Corporation

- 7.1.11 Tech Mahindra