|

市场调查报告书

商品编码

1444652

能源领域的云端安全:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Cloud Security in Energy Sector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

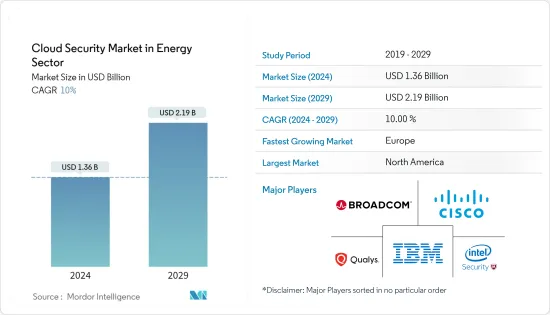

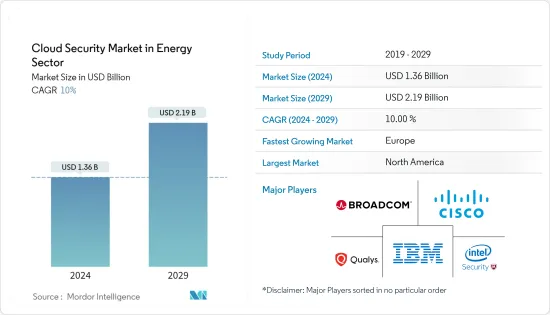

能源领域的云端安全市场预计将从2024年的13.6亿美元成长到2029年的21.9亿美元,预测期间(2024-2029年)复合年增长率为10%。

鑑于各国希望减少碳足迹并转向再生能源来源,能源产业正处于重大转型之中。减少温室气体排放的需要、可再生能源成本的下降以及智慧电网等新技术的引入正在推动对资料储存、管理和分析的需求。能源公司从使用云端技术收集和利用这些资料中获益匪浅。公共产业公司与各种云端运算公司合作,为这些关键资料提供安全保障。

主要亮点

- 根据Gartner预测,到2024年,云端运算将占基础设施系统、基础设施软体、应用软体和业务流程外包IT支出的45%以上。根据德勤最近的一份报告,83% 的能源和公用事业公司正在使用云端服务或希望在未来两年内使用云端服务。许多变数正在推动能源和公共产业领域云端的使用,包括提高敏捷性和弹性、降低资本支出 (CapEx) 成本以及提高营运效率。

- 从办公场所外部存取系统时,安全性至关重要。遗留设备是能源领域的主要挑战之一。营运技术 (OT) 网路通常使用使用超过 15 年的设备构建,从而增强连接性。 IT(资讯科技)和 OT 环境的整合产生了安全性问题。

- COVID-19感染疾病是云端储存作为创新技术最重要的时期,进一步增加了对云端保全服务的需求。从远端位置安全存取系统对于发电厂来说至关重要。一些公司已转向零信任架构等数位解决方案,透过在单一仪表板上即时组合来自不同位置的来源,为安全团队提供更多上下文资讯。

- 2022 年 4 月 - 巴拉特石油公司 (BPCL) 与 Microsoft 签署协议,为 BPCL 提供智能,以业务现代化、建立更智能的供应链并提高客户参与。根据这份为期七年的协议,微软将向该组织提供网路和保全服务。

能源领域云端安全市场趋势

网路攻击的增加增加了能源产业对云端安全的需求

- 能源产业的公司通常必须管理数千个不同的供应商,在许多地点运营,并从其他大陆采购产品。这使其成为骇客和网路恐怖分子的重要目标。为了确保适当的安全级别,公司必须在整个生命週期中监控其产品的漏洞,并遵守最新的标准和法规。

- 网路攻击代价高昂,可能导致停电和敏感客户资料外洩。这可能会对公司的业务运作和依赖其服务的人员产生重大影响。透过聘请网路安全公司,能源公司可以培训员工如何加密敏感资料并保护其免受恶意攻击。

- 2022 年 2 月,德国 Oil Tanking、比利时 SEA-Invest 和荷兰 Evos 的中断影响了全球数十个石油储存和运输码头。这些网路攻击迫使企业以有限的产能运作并造成供应链问题。

- 此外,2022 年 4 月,印度石油公司遭受网路攻击,导致其在阿萨姆邦的营运中断。这次网路攻击发生在印度石油公司地质与储存部门(印度石油有限公司)的一台工作站上。网路攻击者透过受感染 PC 上的一张纸条索要 750 万美元的赎金。不过,钻井和生产作业并未受到影响。

- 此外,2023 年 11 月,领先的混合云端储存解决方案之一 Nasuni 宣布与能源产业数位解决方案的全球领导者之一 Cegal 建立策略合作伙伴关係。能源组织越来越依赖 Nasuni 来加速云端转型、实现文件资料架构现代化并增强网路弹性 Nasuni 和 Cegal 提供从任何地方大规模管理和保护资料所需的工具我们透过提供技术基础设施和专业知识来帮助组织加速云端转型。

预计欧洲将经历最高成长

- 公共部门组织和欧洲政府必须调整其组织,以适应日益增长的线上服务需求。这就产生了对云端运算技术的需求,以主导在超复杂的全球经济中保持竞争力所需的基础设施和服务。

- 欧洲能源系统需要重大转型,其中数位化发挥至关重要的作用,以应对气候挑战并减少欧盟对俄罗斯石化燃料的依赖。为了支持这些发展,欧盟成立了智慧型能源专家小组,以支援欧洲通用资料空间的开发和部署。

- 欧盟51%的家庭和中小企业配备了智慧电錶,并推出了各种政策引导能源数位化,存在安全、隐私和消费者保护等问题。在与网路和资讯安全小组 (NIS) 协商后,欧盟委员会将优先确定可能需要接受协调风险评估的某些 ICT 服务、系统和产品。

- 英国经历了 2022 年最热的夏季,极端天气导致伦敦的 Oracle 和 Google Cloud资料中心暂时中断。水资源短缺和能源不安全给资料中心营运商带来了焦虑,并影响了云端运算营运。为了克服这些不确定性,欧盟计划向电网投资6,200亿美元,其中数位化投资1,804亿美元。

能源领域云端安全产业概况

与多家云端安全供应商的竞争非常激烈。主要参与者包括 IBM 公司、Intel Security-McAfee、赛门铁克公司、思科系统公司、CA Technologies、CA Technologies、Nutanix、Netskope, Inc. 和 ProtectWise。由于竞争力较高,市场集中度较低。

- 微软和斯伦贝谢推出微软能源数据服务。此资料解决方案使能源公司能够利用 Microsoft 安全可靠的云端服务快速建立软体应用程式。

- 斯伦贝谢和 Cognite 宣布建立策略伙伴关係。 Cognite 为工业公司提供软体和物联网服务。客户可以利用内建人工智慧和高级分析功能来最大限度地提高产量、节省成本并最大限度地减少操作空间,同时将来自油藏、油井和设施的资料整合到开放平台中。您可以抑制它。斯伦贝谢为客户提供企业资料解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素与阻碍因素简介

- 市场驱动因素

- 整个供应链的物联网采用率不断提高

- 日益增长的网路威胁

- 市场限制因素

- 与现有架构集成

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19 对产业的影响

第五章市场区隔

- 解决方案类型

- 身分和存取管理

- 预防资料外泄

- IDS/IPS

- 安全资讯和事件管理

- 加密

- 其他解决方案类型

- 安全类型

- 应用程式安全

- 资料库安全

- 端点安全

- 网路安全

- 网路和电子邮件安全

- 其他安全类型

- 服务模式

- Infrastructure-as-a-Service

- Platform-as-a-Service

- Software-as-a-Service

- 部署类型

- 公共云端

- 私有云端

- 混合云端

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争形势

- 公司简介

- IBM Corporation

- Intel Security-McAfee

- Cisco Systems, Inc.

- Broadcom Inc.

- Qualys, Inc.

- Nutanix

- ProtectWise

- AmazonWebServices

第七章 投资分析

第八章市场的未来

The Cloud Security Market in Energy is expected to grow from USD 1.36 billion in 2024 to USD 2.19 billion by 2029, at a CAGR of 10% during the forecast period (2024-2029).

Considering that nations want to reduce their carbon impact and switch to renewable energy sources, the energy sector is in the midst of a major transformation. The need to reduce greenhouse gas emissions, the falling cost of renewables, and the adoption of new technologies, such as smart grids, have increased the demand for storing, managing, and analyzing data. Energy firms have greatly benefited from using cloud technology to collect and utilize this data. Utility companies are collaborating with various cloud computing firms to provide security for this important data.

Key Highlights

- According to Gartner, by 2024, cloud computing will account for more than 45% of IT spending on system infrastructure, infrastructure software, application software, and business process outsourcing. According to a recent Deloitte report, 83% of energy and utility companies either use cloud services or want to do so within the next two years. Many variables, such as greater agility and flexibility, lower capital expenditure (CapEx) costs, and enhanced operational efficiency, drive the use of clouds in the energy and utilities sector.

- Security becomes paramount when the systems are accessed outside the office premises. Legacy equipment is one of the main challenges of the energy sector. Operational Technology (OT) networks are becoming more connected because they are typically constructed using equipment over 15 years old. Security issues arise due to the fusion of the IT (Information Technology) and OT environments.

- The Covid-19 pandemic was the most important time for Cloud Storage as a revolutionary technology, further driving the demand for cloud security services. For power plants accessing the systems securely from remote locations became essential. Some companies switched to digital solutions like Zero Trust architecture, which provided security teams with greater contextual information by combining feeds from various places on a single dashboard in real time.

- April 2022 - Bharat Petroleum Corporation (BPCL) signed a contract with Microsoft that will give BPCL the intelligence to revamp its operations, create smarter supply chains, and boost customer engagement. Microsoft will provide network and security services to the organization in this seven year deal.

Energy Sector Cloud Security Market Trends

Increasing Number of Cyber Attacks to Drive the Need for Cloud Security in the Energy Sector

- Companies in the energy sector frequently have to manage thousands of different suppliers, operate in many locations, and source their products from other continents. This makes them a prominent target for both hackers and cyber terrorists. To ensure the appropriate level of security, companies must monitor the vulnerabilities in their products during their entire lifecycle and adhere to the most recent standards and regulations.

- A cyber attack can cost a lot of money and lead to power disruptions or the leaking of confidential customer data. This could significantly affect the company's business operations and those who depend on its services. By hiring a cybersecurity company, Energy firms can encrypt sensitive data and train employees on how to protect from malicious attacks.

- In february 2022, the disruption at Oiltanking in Germany, SEA-Invest in Belgium, and Evos in the Netherlands affected dozens of terminals with oil storage and transport worldwide. These cyber-attacks compel companies to operate at a limited capacity, giving rise to supply chain issues.

- Further, in April 2022 - Oil India suffered a cyberattack disrupting its operations in Assam. The cyberattack occurred at one of the workstations of OIL's Geological and Reservoir department (Oil India Ltd.). The cyberattacker demanded USD 7.5 million as a ransom through a note from the infected PC. However, the drilling and production work was unaffected.

- Moreover, in November 2023, Nasuni, one of the leading hybrid cloud storage solutions, announced a strategic partnership with Cegal, one of the global leaders of digital solutions for the energy industry. Energy Organizations Increasingly Rely on Nasuni for Accelerating Cloud Transformations, Modernizing File Data Architectures and Enhanced Cyber Resiliency Nasuni and Cegal are assisting organizations to accelerate their cloud transformations by providing the technology infrastructure and expertise needed to manage and protect data at scale from any location.

Europe is Expected to Witness the Highest Growth

- Public agencies and the European government had to adapt their organizations to meet the increased demand for online services. This created a demand for cloud computing technologies that led infrastructure and services essential for staying competitive in a hypercomplex global economy.

- The European energy system needs to undergo a significant transition, with digitalization playing a pivotal role, in addressing the climate issue and reduce the EU's reliance on Russian fossil fuels. To support these developments, European Union formed a Smart Energy Expert Group to support the development and rolling out of a common European data space for energy.

- 51% of all EU households and SMEs are equipped with smart electricity meters, and various policies have been introduced to guide the digitalization of energy as issues like security, privacy, and consumer protection. In consultation with Network and Information Security Group (NIS), the Commission will identify the specific ICT services, systems, and products that might be subjected to coordinated risk assessments with priority.

- The UK experienced the warmest summer in 2022, and the extreme weather caused temporary failures at Oracle and Google Cloud's data centers in London. Water scarcity and energy insecurity made data center operators uneasy, which affected cloud computing operations. To overcome these uncertainties, EC plans an investment of USD 620 billion in the electricity grid, including USD 180.4 billion in digitalization.

Energy Sector Cloud Security Industry Overview

There is intense competition with several providers of Cloud Security. The major players include IBM Corporation, Intel Security- McAfee, Symantec Corporation, Cisco Systems, Inc., CA Technologies, CA Technologies, Nutanix, Netskope, Inc., and ProtectWise. Due to high competency, the market concentration will be low.

- Microsoft and Schlumberger launched Microsoft Energy Data Services. This data solution will make it possible for energy corporations to create software applications quickly, and it will be powered by Microsoft's secure and trusted cloud services.

- Schlumberger and Cognite announced a strategic partnership. Cognite provides software and IoT services to industrial companies. While integrating data from reservoirs, wells, and facilities into a single, open platform, clients can utilize embedded AI and advanced analytics capabilities to maximize production, save costs, and minimize operational footprint. Schlumberger will provide customers with access to the Enterprise Data Solution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 StudyAssumptionsandMarketDefinition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Adoption of IoT across the Supply Chain

- 4.3.2 Increasing Number of Cyber Threats

- 4.4 Market Restraints

- 4.4.1 Integration with Existing Architecture

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 An Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Solution Type

- 5.1.1 Identity and Access Management

- 5.1.2 Data Loss Prevention

- 5.1.3 IDS/IPS

- 5.1.4 Security Information and Event Management

- 5.1.5 Encryption

- 5.1.6 Other Solution Type

- 5.2 Security Type

- 5.2.1 Application Security

- 5.2.2 Database Security

- 5.2.3 Endpoint Security

- 5.2.4 Network Security

- 5.2.5 Web & Email Security

- 5.2.6 Other Security Type

- 5.3 Service Model

- 5.3.1 Infrastructure-as-a-Service

- 5.3.2 Platform-as-a-Service

- 5.3.3 Software-as-a-Service

- 5.4 Deployment Type

- 5.4.1 Public Cloud

- 5.4.2 Private Cloud

- 5.4.3 Hybrid Cloud

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 IBM Corporation

- 6.1.2 Intel Security - McAfee

- 6.1.3 Cisco Systems, Inc.

- 6.1.4 Broadcom Inc.

- 6.1.5 Qualys, Inc.

- 6.1.6 Nutanix

- 6.1.7 ProtectWise

- 6.1.8 AmazonWebServices