|

市场调查报告书

商品编码

1444661

NDT:市场占有率分析、产业趋势与统计、成长预测(2024-2029)NDT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

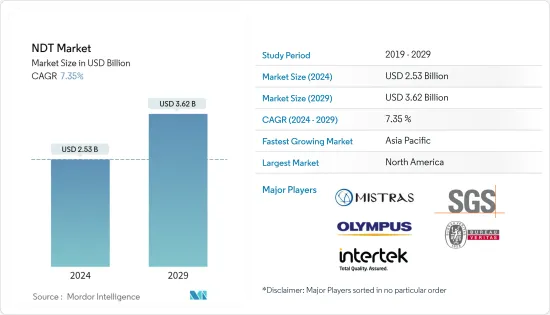

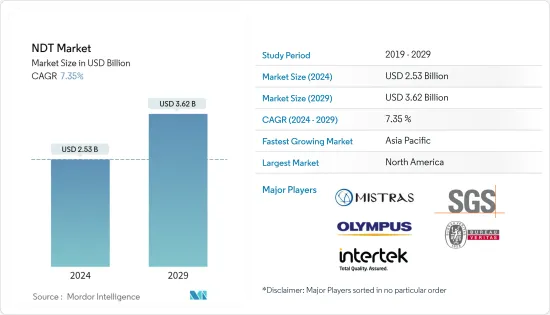

NDT(无损检测)市场规模预计到 2024 年为 25.3 亿美元,预计到 2029 年将达到 36.2 亿美元,在预测期内(2024-2029 年)将增长 73.5 亿美元。复合年增长率为%。

据英国无损检测协会称,英国的工厂和场所每天都会进行超过 25,000 次检查,检测各种产品、工厂和结构中的缺陷和损坏。据估计,全球有超过 12 万名检查员。

主要亮点

- 随着工业生产和基础设施领域的自动化程度不断提高,对裂缝、孔隙、製造缺陷等相关缺陷检测的需求显着增加。因此,符合工业安全标准是无损检测市场成长的关键因素。

- 此外,世界各地还成立了美国机械工程师协会(ASME)和国际标准化组织(ISO)等多个政府机构和区域机构,以实施严格的措施确保设备安全并监督工程服务。正在教学。正在测试中。这对于获得相关机构的许可和证书非常重要。这将对全球无损检测市场产生正面影响。

- 然而,缺乏熟练的专业人员和高昂的设备成本以及高昂的维护成本限制了预测期内的市场。

NDT(无损检测)市场趋势

电力和能源产业具有成长潜力

- 核能发电在世界许多国家的发电中发挥着重要作用。在许多国家,核能发电厂占发电量的 50% 以上(立陶宛 - 81.5%、法国 - 78.2%、比利时 - 60.1%)。

- 确保核能发电厂的可靠性和安全运作是核能工程的核心问题。尤其取决于核燃料的品质和燃料生产的製程设备。解决这个问题与无损检测和诊断的应用直接相关。

- 无损方法在燃料测试等许多应用中非常普及。该领域使用了许多技术,包括超音波、涡流、放射学和声学技术。根据国际原子能总署的研究,全球燃料故障率约为10-5,这意味着每10万根在运作中就有1至3根会发生故障。随着NDT的引入,故障率下降。

- 此外,预计未来四年,全球超过67座核子反应炉的运作时间将达到40年或更长。随着核能发电厂的老化,维护变得更加重要,并且需要检查技术的应用。这为无损检测市场创造了巨大的市场机会。

亚太地区将经历最快的成长

- 据世界核能协会称,中国和印度计划在 2019 年 5 月分别拥有 43 座和 14 座核子反应炉。因此,这些发电厂的维修需求也会增加,进而创造无损检测市场。

- 此外,由于政府增加基础设施支出,亚太地区正在为无损检测市场创造机会。例如,该地区最大的基础设施发展努力是中国的「一带一路」倡议,旨在透过改善亚欧之间的贸易关係来提高生产力和效率。这种基础设施方法为无损检测创造了市场,因为它有助于检测腐蚀、裂缝和其他可能影响承载能力能力的损坏。

NDT(无损检测)产业概述

无损检测市场本质上是竞争性的。无损检测市场正在受到越来越严格的法规的影响,这些法规要求各个组织接受寿命评估程序作为安全措施,并定期进行检查以检查设备是否损坏并采取必要的措施。因此,企业纷纷进入这个市场,看到了巨大的机会。主要公司包括奥林巴斯公司和通用电气测量与控制解决方案公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素与阻碍因素简介

- 市场驱动因素

- 严格的法规强制执行安全标准

- 对缺陷检测的需求不断增加以降低维修成本

- 市场限制因素

- 熟练劳力短缺及培训规定

- 产业价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 按类型

- 服务

- 装置

- 透过测试技术

- X光检查

- 超音波检查

- 磁粉检测

- 液体渗透测试

- 目视检查测试

- 电涡流检测

- 其他测试技术

- 按最终用户产业

- 石油天然气

- 电力和能源

- 建造

- 汽车和交通

- 航太

- 防御

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Olympus Corporation

- GE Measurement &Control Solutions

- Yxlon International Gmbh(Comet Holding Ag)

- Team Inc

- Applus Services

- Mistras Group, Inc.

- SGS Group

- Fujifilm Corporation

- Bureau Veritas SA

- Nikon Metrology NV

- Intertek Group Plc.

- TUV Rheinland AG

- Magnaflux Corp.

第七章 投资分析

第八章市场机会及未来趋势

The NDT Market size is estimated at USD 2.53 billion in 2024, and is expected to reach USD 3.62 billion by 2029, growing at a CAGR of 7.35% during the forecast period (2024-2029).

According to the British Institute of Non-Destructive Testing, every day, more than 25,000 inspections are carried out in factories and on-site in the UK to detect defects and damage in a huge range of products, plant, and structures; it is estimated that there are more than 120,000 inspectors operating worldwide.

Key Highlights

- With the increase in automation in the industrial manufacturing and infrastructure sectors, there has been a substantial hike in the demand for flaw detection related to cracks, porosity, manufacturing disorders, and so on. Therefore, adherence to industrial safety norms is a significant factor behind the growth of the NDT market.

- Moreover, several governmental agencies and regional bodies, like the American Society of Mechanical Engineers (ASME) and the International Organization for Standardization (ISO), have been instituted across the world to take stringent measures for assuring the safety of instruments and overseeing of engineering services testing. This is important for gaining clearances and certificates from concerned authorities. This creates a positive impact on the NDT market globally.

- However, due to the lack of skilled professionals and high equipment cost coupled with high maintenance cost is restraining the market during the forecast period

Non Destructive Testing (NDT) Market Trends

Power and Energy Sector Offers Potential Growth

- Nuclear power is playing an essential role in generating electricity in many countries of the world. In a number of countries, generating electricity at nuclear power plants makes more than 50 percent (Lithuania - 81,5%, France - 78,2 %, Belgium - 60,1%).

- Ensuring a reliable and safe operation of nuclear power plants is the central problem of nuclear power engineering. In particular, it depends on the quality of nuclear fuel and process equipment for fuel manufacture. Solving this problem is directly connected to the application of non-destructive testing and diagnostics.

- Nondestructive methods are very widespread in many applications such as fuel inspection. In this field, many techniques are used, like ultrasonics, eddy current, radiographic testing, and acoustic techniques. According to the IAEA studies, the fuel failure rate in the world is around 10-5, which means 1-3 failed fuel rods from 100 000 fuel rods in operation. With the implementation of NDT, the failure rate is decreasing.

- Moreover, in the next four years, more than 67 nuclear reactors in the world are estimated to reach an age of over 40 years of the operational period. As nuclear power plants age, the importance of maintenance increases and there is a need to apply inspection technologies. This creates huge market opportunities for NDT market.

Asia- Pacific to Witness Fastest Growth

- According to the World Nuclear Association, China and India have planned 43 and 14 nuclear reactors respectively by May 2019. Thus, the need for maintenance of those power plants will also increase which in return will create a market for nondestructive testing.

- Further, the APAC region offers opportunities for the non-destructive testing market owing to the increase in infrastructure spending by the governments. For instance, the largest infrastructure effort in the region is China's "Belt and Road Initiative," aiming to boost productivity and efficiency gains by improving trade links between Asia and Europe. Such infrastructure initiatives create a market for NDT because NDT helps in detecting corrosion, cracking and other damage which can affect load carrying capacity.

Non Destructive Testing (NDT) Industry Overview

The NDT market is competitive in nature. With the increasing regulations, which makes it mandatory for different organizations to undergo a life assessment procedure as a safety measure coupled with the regular inspection required to check for any damage in the equipment and to take necessary is creating a market for NDT. Thus, the companies are entering this market seeing a huge opportunity. Some of the key players areOlympus Corporation,GE Measurement & Control Solutions amongst others. Some recent developments are:

- June 2018 -Comet's Lab Oneand Yxlon's Non-Destructive Testing facility offered samples to customersfor Non-Destructive Test (NDT) contract services. This was designed to bring customer engineers closer to metrology and measurement testing and NDT innovation practices, using the offerings available in the technologies i.e.RF Power, X-ray/CT, and electron beam materials testing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Stringent Regulations Mandating Safety Standards

- 4.3.2 Increase in Demand for Flaw Detection to Reduce Repair Cost

- 4.4 Market Restraints

- 4.4.1 Lack of Skilled Workforce and Training Regulations

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Services

- 5.1.2 Equipment

- 5.2 By Testing Technology

- 5.2.1 Radiography Testing

- 5.2.2 Ultrasonic Testing

- 5.2.3 Magnetic Particle Testing

- 5.2.4 Liquid Penetrant Testing

- 5.2.5 Visual Inspection Testing

- 5.2.6 Eddy Current Testing

- 5.2.7 Other Testing Technologies

- 5.3 By End-user Industry

- 5.3.1 Oil & Gas

- 5.3.2 Power & Energy

- 5.3.3 Construction

- 5.3.4 Automotive & Transportation

- 5.3.5 Aerospace

- 5.3.6 Defense

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.4.4 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Olympus Corporation

- 6.1.2 GE Measurement & Control Solutions

- 6.1.3 Yxlon International Gmbh (Comet Holding Ag)

- 6.1.4 Team Inc

- 6.1.5 Applus Services

- 6.1.6 Mistras Group, Inc.

- 6.1.7 SGS Group

- 6.1.8 Fujifilm Corporation

- 6.1.9 Bureau Veritas S.A.

- 6.1.10 Nikon Metrology NV

- 6.1.11 Intertek Group Plc.

- 6.1.12 TUV Rheinland AG

- 6.1.13 Magnaflux Corp.