|

市场调查报告书

商品编码

1686614

发泡聚丙烯(EPP) -市场占有率分析、产业趋势与成长预测(2025-2030)Expanded Polypropylene (EPP) Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

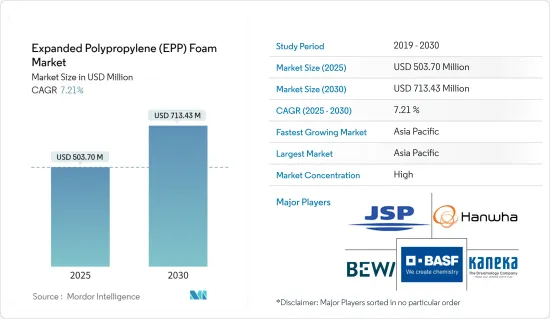

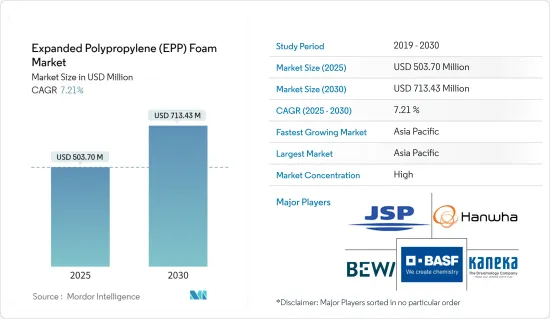

发泡聚丙烯市场规模预计在 2025 年为 5.037 亿美元,预计到 2030 年将达到 7.1343 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.21%。

2020 年,市场受到了 COVID-19 疫情的负面影响。不过,预计 2021 年市场将復苏,并在整个预测期内稳定成长。

主要亮点

- 短期内,材料的无毒、可回收特性以及包装行业日益增长的需求是刺激市场需求的驱动力之一。

- 过去几年,汽车产业一直在衰退,与市场上其他结构发泡体相比,其价格较高可能会阻碍市场成长。

- 另一方面,与其他结构发泡体相比,其价格较高,这可能是预测期内研究市场的限制因素。

- 生物基聚丙烯泡沫的需求不断增长、其作为其他产品替代品的出现以及电动车的日益普及可能会为未来几年的市场提供机会。

- 亚太地区占据市场主导地位,预计在预测期内将以最高的复合年增长率成长。

发泡聚丙烯(EPP)市场趋势

在汽车产业的应用日益广泛

- 汽车产业目前是EPP泡沫的最大消费者。由于欧盟排放法规趋严以及报废汽车回收立法的出台,EPP泡沫的需求量逐年增加。

- EPP发泡体具有优异的可恢復性,能吸收衝击能量,在保险桿的应用日益广泛。保险桿系统中整合的 EPP 模製部件可减少碰撞时的压力,最大限度地减少传递底盘的衝击能量。

- 在座椅和其他汽车零件中增加 EPP发泡体的使用可以将车辆整体重量减轻约 10%。燃料消费量减少约7%。车辆中可重复使用和可回收材料的比例也同时增加。

- 此外,电动车的兴起正在推动EPP泡棉市场的成长。这是因为EPP在减轻电动车重量、绝缘和增强其能量吸收能力方面发挥着重要作用。

- EPP 泡棉也用于製作门垫、车顶内衬和垫子。 EPP泡棉有助于保持驾驶座内空气温度恆定,为电池的运作创造理想条件。

- 根据国际能源总署2021年展望,2021年全球电动车销量预计将翻倍,达到660万辆。预计2022年销量将大幅成长,2022年第一季全球电动车销量将达200万辆。

- 2021年亚洲和大洋洲的汽车总产量为4,673万辆,美洲的汽车总产量为1,615万辆,分别比2020年增加6%和3%。不过,2021年欧洲的汽车产量为1,634万辆,比2020年下降了4%。

- 由于上述所有原因,汽车应用可能会占据市场主导地位。

亚太地区占市场主导地位

- 亚太地区占据全球市场占有率的主导地位。在亚太地区,中国是GDP最大的经济体。

- 中国是亚太地区最大的EPP泡沫消费国和生产国。该国活性化的製造业活动正在增加该地区的塑胶和聚合物的消费量,预计这将推动发泡聚丙烯 (EPP) 市场的发展。

- 该国的汽车产业正在塑造产品的演变,随着人们对环境问题的日益关注(由于该国污染的增加),该国正专注于製造确保燃油效率和减少排放气体的产品。

- 中国汽车製造业规模位居世界第一。 2021年汽车产量达2,608万辆,较2020年的2,523万辆成长3%。预计汽车产量的成长将推动EPP泡沫的需求。

- 此外,中国食品饮料产业面临的市场竞争日益激烈,促使企业纷纷进军海外市场,寻求更多的资源和商机。

- 印度包装产业在进出口方面表现强劲,促进了该国技术和创新的成长,并为各个製造业增加了价值。包装产业是推动印度所研究市场巨大成长的催化剂。此外,过去几年印度对包装食品的需求庞大。预计这种状况将在预测期内持续,从而刺激市场需求。

- 印度的家具市场也表现良好。根据印度国家投资促进和便利化机构 (InvestIndia) 的数据,2021 财年印度家具和家电租赁市场总额达到 33,500 亿印度卢比。预计到2023年底将达到610.9亿美元。

- 由于这些因素,预计该地区的发泡聚丙烯市场在预测期内将稳定成长。

发泡聚丙烯(EPP)产业概况

发泡的聚丙烯市场正在整合。市场的主要企业包括(不分先后顺序) BASF SE、JSP、Hanwha Solutions、BEWI(Izoblok)和工业, Ltd.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 无毒、可回收的材料特性

- 包装产业需求不断成长

- 限制因素

- 汽车产业衰退

- 与其他结构发泡体相比价格较高

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 定价分析

第五章市场区隔

- 原料

- 合成聚丙烯

- 生物基聚丙烯

- 形式

- 加工过的EPP

- 模压EPP

- 其他形式

- 应用

- 车

- 垫材

- 家具

- 食品包装

- 空调设备

- 运动休閒

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- BASF SE

- BEWi(IZOBLOK)

- Clark Foam Products Corporation

- Hanwha Solutions

- JSP

- KK Nag Pvt. Ltd

- Kaneka Corporation

- Knauf Industries

- Polyfoam Australia Pty Ltd

- Signode Industrial Group Llc

- Sonoco Products Company

- Woodbridge

第七章 市场机会与未来趋势

- 生物基聚丙烯泡沫的需求不断成长

- 作为其他产品的替代品出现

- 电动车日益普及

The Expanded Polypropylene Foam Market size is estimated at USD 503.70 million in 2025, and is expected to reach USD 713.43 million by 2030, at a CAGR of 7.21% during the forecast period (2025-2030).

The market was negatively impacted due to the COVID-19 pandemic in 2020. However, the condition recovered in 2021, and it is expected to observe a stable growth trajectory over the forecast period.

Key Highlights

- Over the short term, the non-toxic and recyclable nature of the material and the rising demand from packaging industries are some of the driving factors which are stimulating the market demand.

- The declining automobile Industry through previous years and higher prices, among other structural foams available in the market, may hinder the market's growth.

- On the flip side, higher prices, among other structural foams, are likely to act as restraints for the market studied during the forecast period.

- The rising demand for bio-based polypropylene foam, its emergence as a replacement for other products, and the increasing adoption of electric vehicles are likely to create opportunities for the market in the coming years.

- The Asia-Pacific region dominated the market and is expected to witness the highest CAGR over the forecast period.

Expanded Polypropylene (EPP) Foam Market Trends

Increasing Usage in the Automotive Industry

- The automotive sector is currently the largest consumer of EPP foams. The demand for EPP foams has increased over the years as the EU regulations on emissions have become more rigorous, and laws on recycling vehicles withdrawn from use have been introduced.

- Excellent recoverability and the ability to absorb the impact energy of EPP foams increase the usage of EPP foams in bumpers. In a collision, molded EPP parts built into bumper bar systems reduce pressure and minimize the amount of impact energy transmitted to the chassis.

- Increasing usage of EPP foams in seating and other automotive components reduces the overall weight of the vehicle by ~10%. The fuel consumption was reduced by ~7%. The share of recyclable materials in vehicles that can be reused is increasing simultaneously.

- In addition, increasing electric cars are promoting the EPP foam market's growth, as EPP plays a significant role in making electric cars lightweight and thermally insulated and enhancing energy absorption capabilities.

- EPP foams are also used in the manufacturing of door pads, headliners, and mats. They make it possible to maintain a constant air temperature in the cockpit and generate ideal conditions for battery operations.

- According to the IEA 2021 Outlook, worldwide electric car sales doubled in 2021 and reached 6.6 million. The sales increased strongly in 2022, with 2 million electric cars sold across the globe in the first quarter of 2022.

- The Asia-Oceania and Americas regions recorded 46.73 million and 16.15 million of total automotive production in 2021, registering an increase of 6% and 3%, respectively, compared to 2020. However, Europe recorded 16.34 million of automotive production in 2021, a decrease of 4% compared to 2020.

- The aforementioned aspects may result in the automotive application dominating the market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. In Asia-Pacific, China is the largest economy in terms of GDP.

- China is the largest consumer and manufacturer of EPP foams in the Asia-Pacific region. The growing manufacturing activities in the country are increasing the consumption of plastics and polymers in the region, which is expected to drive the expanded polypropylene (EPP) foam market.

- The country's automotive sector has been shaping product evolution, with the country focusing on manufacturing products that ensure fuel economy and minimize emissions, owing to the increasing environmental concerns (due to mounting pollution in the country).

- The Chinese automotive manufacturing industry is the largest in the world. In 2021, the automotive production in the country reached 26.08 million, which increased by 3%, compared to 25.23 million vehicles produced in 2020. The increase in automotive production is estimated to drive the demand for EPP foam.

- Additionally, the market competition in China has become increasingly fierce in the food and beverage industry, which has enabled companies to tap into overseas markets to seek more resources and business opportunities.

- The Indian packaging industry has made a mark with its exports and imports, thus driving technology and innovation growth in the country and adding value to the various manufacturing sectors. The packaging industry is enacting the role of catalyst in promoting the huge growth of the market studied in India. Furthermore, the country has been exhibiting a significant demand for packed foods for the past few years. This scenario is expected to continue during the forecast period, thus boosting the demand for the market studied.

- The Indian furniture market is also very strong. According to InvestIndia (National Investment Promotion and Facilitation Agency), the total rental furniture and appliances market in India reached INR 33,500 crores during FY21. The market is expected to garner USD 61.09 billion by the end of 2023.

- Due to all such factors, the market for expanded polypropylene foam in the region is expected to have steady growth during the forecast period.

Expanded Polypropylene (EPP) Foam Industry Overview

The expanded polypropylene foam market is consolidated. Some of the major players in the market include BASF SE, JSP, Hanwha Solutions, BEWI (Izoblok), and Kaneka Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Non-toxic and Recyclable Nature of the Material

- 4.1.2 Rising Demand from the Packaging Industry

- 4.2 Restraints

- 4.2.1 Declining Automobile Industry Through Previous Years

- 4.2.2 Higher Price Among Other Structural Foams

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Revenue)

- 5.1 Raw Material

- 5.1.1 Synthetic Polypropylene

- 5.1.2 Bio-based Polypropylene

- 5.2 Foam

- 5.2.1 Fabricated EPP

- 5.2.2 Molded EPP

- 5.2.3 Other Foams

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Dunnage

- 5.3.3 Furniture

- 5.3.4 Food Packaging

- 5.3.5 HVAC

- 5.3.6 Sports and Leisure

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BEWi (IZOBLOK)

- 6.4.3 Clark Foam Products Corporation

- 6.4.4 Hanwha Solutions

- 6.4.5 JSP

- 6.4.6 K K Nag Pvt. Ltd

- 6.4.7 Kaneka Corporation

- 6.4.8 Knauf Industries

- 6.4.9 Polyfoam Australia Pty Ltd

- 6.4.10 Signode Industrial Group Llc

- 6.4.11 Sonoco Products Company

- 6.4.12 Woodbridge

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polypropylene Foam

- 7.2 Emergence as a Replacement for Other Products

- 7.3 Increasing Adoption Of Electric Vehicles