|

市场调查报告书

商品编码

1444699

医疗保健 BI - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Healthcare BI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

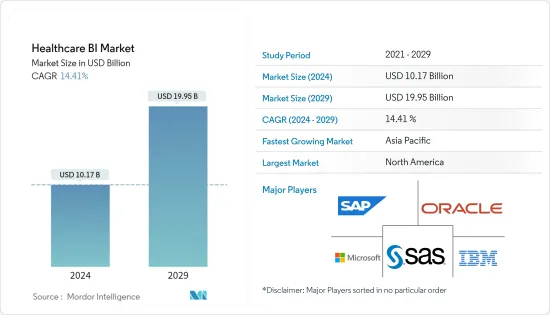

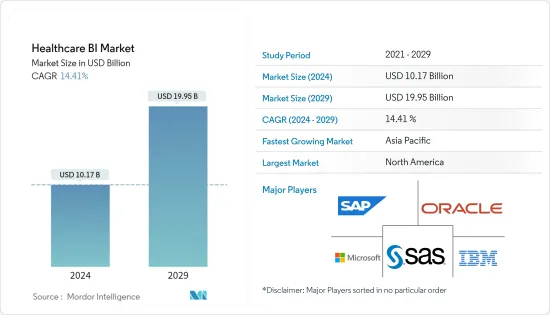

2024年医疗保健BI市场规模预计为101.7亿美元,预计到2029年将达到199.5亿美元,在预测期内(2024-2029年)CAGR为14.41%。

COVID-19 的爆发证明了公共卫生危机对急诊和医院系统的影响。近年来,第一线医疗机构已经展示瞭如何使用资料分析和应用程式有效管理有限的资产。 COVID-19资料由疫情爆发地点的工作人员收集,包括传播性、危险因子、潜伏期和死亡率。这些资讯创建视觉化、数学模型和神经网路训练。例如,爱思唯尔 (Elsevier) 2022 年 2 月发布的一项研究显示,疫情期间欧洲数位技术采用率从 81% 跃升至 95%。事实证明,应用于紧急医疗服务(EMS)的商业智慧对于改善流行病管理和加速疫情应对决策过程极为有益。因此,所研究的市场受到了 COVID-19 大流行的显着影响。然而,随着疫情的消退,预计市场将失去一些吸引力,但预计在预测期内将实现健康成长。

在软体即服务市场中,商业智慧的资金越来越充足。 BI 承诺透过处理大量资料来分析和基准化业务线,帮助识别、开发和创造新的收入机会。病患登记数量的增加是推动市场成长的主要因素。例如,根据 Frontiers 2022 年 8 月发表的一篇文章,病患登记被认为是医疗保健实践、药物利用和临床结果的重要资料来源。这些登记处透过提供罕见疾病的流行病学、护理标准和治疗模式等资讯来帮助应对各种挑战。因此,病患登记的优势预计将增加病患登记的使用,从而增加健康商业智慧的采用。

由于政府提高 EHR 采用率和病患登记数量的倡议,以及医疗保健产业巨量资料的出现,医疗保健 BI 市场将呈现快速成长。根据《生物医学科学与技术研究杂誌》于 2021 年 1 月发表的文章,印度政府重点关注其医疗保健数位化,包括电子健康记录 (EHR),以提供更好的患者资料管理、医疗保健提供者之间的无缝协调以及改善医疗保健研究。正在製定多项国家级政策,例如国家数位健康蓝图,以创建泛印度数位健康记录系统。据同一消息来源称,在提供者层面,塔塔纪念医院和 Max Hospitals Private Limited 等大型医疗系统已经实施了电子病历 (EMR) 系统,并正在转向 EHR。因此,与 BI 相关的好处及其在整个医疗保健行业日益增长的采用率正在推动市场成长。然而,系统的复杂性可能会阻碍预测期内的市场成长。

医疗保健 BI 市场趋势

预计在预测期内,基于云端的模型将在医疗保健 BI 市场中显着成长

基于云端的交付模式是成长最快的部分,因为公司越来越多地采用基于云端的商业智慧工具,例如销售人员的客户关係管理 (CRM) 应用程式、患者参与 CRM 等。这是由于基于云端的工具的敏捷性和可访问性。此外,与本地或混合模型相比,基于云端的模型具有成本效益、用户友好且接受率更高;因此,所有这些因素都促成了该细分市场的重要份额。

越来越多地采用基于云端的模型,加上医疗保健对数位技术的高度依赖来操作复杂的医疗保健系统的功能,进一步推动了市场的成长。此外,创新产品的推出也有助于市场成长。例如,2022 年 3 月,Snowflake 为医疗保健产业推出了一个基于云端的资料共享平台,该平台将公司的核心资料仓储、分析和商业智慧产品与资料市场和按需咨询服务整合在一起。

此外,2022 年 3 月,微软宣布全面推出 Azure 健康数据服务,这是一个基于云端的平台,用于管理和分析各种形式的患者资料。 Azure 健康资料服务平台即服务 (PaaS) 可协助组织在多个资料储存中管理不同形式的受保护健康资讯 (PHI),让他们能够使用更少的时间和精力来处理并理解患者资料。资源。因此,技术先进产品的推出正在推动市场成长。

北美预计将在市场中占据重要份额,并在预测期内保持相同的势头

由于提供者越来越多地实施医疗保健 BI 解决方案和服务以提供更好的患者护理以及人们对商业智慧的认识不断增强,北美地区在全球市场占据主导地位。此外,不断升级的医疗保健和 IT 基础设施以及云端运算采用的增加极大地促进了市场成长。例如,根据 PubMed Central 2022 年 3 月发表的一篇文章,在美国进行的一项研究表明,商业智慧 (BI) 流程有助于识别碘造影剂 (ICA) 被浪费的情况在对患者进行CT 扫描期间。因此,BI 在各个医疗保健领域的日益采用预计将推动该地区市场的成长。

北美的科技业正在有效地利用资料服务来应对流行病。例如,2021 年 4 月,美国能源部橡树岭国家实验室 (ORNL) 部署了由 IBM 製造的世界上最强大、最聪明的超级电脑之一,名为「Summit」。这个新系统将有助于紧急计算,并且还可以用于以非常高的速度执行模拟。

此外,根据国家卫生资讯科技协调员办公室 2021 年发布的资料,大约五分之四的办公室医生 (78%) 和几乎所有非联邦急诊医院 (96%) 采用了经过认证的 EHR预计2021 年将在美国实现这一目标。因此,美国EHR 的高采用率预计也将推动市场成长。此外,新产品的推出也有助于整体市场的成长。例如,2021 年 9 月,Med Tech Solutions (MTS) 推出了 MTS Practice Data Analytics 视觉化商业智慧 (BI) 工具。实践数据分析根据电子健康记录 (EHR)资料产生 40 多个标准商业智慧 (BI) 报告,可以在轻鬆自订的仪表板中查看。因此,由于上述因素,预计北美市场将显着成长。

医疗保健 BI 行业概览

该市场竞争适中,有多家大型和新兴参与者。产品创新和持续开发先进技术的研发活动预计将推动市场的成长。市场上一些主要的参与者包括 Oracle 公司、微软公司、IBM 公司、SAP SE 和 SAS Institute Inc。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 政府不断加强医疗保健数位化倡议,例如采用电子病历

- 病患登记数量不断增加

- 大数据在医疗保健产业的出现

- 市场限制

- 实施成本高

- 缺乏熟练的专业人员

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 按组件

- 软体

- 服务

- 按交付方式

- 内部部署模型

- 混合模型

- 基于云端的模型

- 按应用

- 财务分析

- 临床数据分析

- 病人护理分析

- 其他应用

- 按最终用户

- 付款人

- 医疗保健机构

- 其他最终用户

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太其他地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 中东和非洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第 6 章:竞争格局

- 公司简介

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Salesforce

- MicroStrategy Incorporated

- QlikTech International AB

- Information Builders

- Sisense Inc.

- EPIC SYSTEMS

- Infor Inc.

- CareCloud Inc.

- Domo Inc.

第 7 章:市场机会与未来趋势

The Healthcare BI Market size is estimated at USD 10.17 billion in 2024, and is expected to reach USD 19.95 billion by 2029, growing at a CAGR of 14.41% during the forecast period (2024-2029).

The COVID-19 outbreak demonstrated the effects of public health crises on emergency departments and hospital systems. In recent years, frontline healthcare facilities have demonstrated how to effectively manage limited assets using data analytics and applications. COVID-19 data was collected by workers at outbreak sites, including transmissibility, risk factors, incubation period, and mortality rate. This information creates visualizations, mathematical models, and neural network training. For example, according to a study published by Elsevier in February 2022, a study was conducted which showed that digital technology adoption in Europe jumped from 81% to 95% during the pandemic. BI applied to emergency medical services (EMS) has proven extremely beneficial in improving pandemic management and speeding up the outbreak response decision-making process. Hence, the studied market was significantly impacted by the COVID-19 pandemic. However, as the pandemic has subsided, the market is expected to lose some tractions, but it is expected to have healthy growth during the forecast period.

In the software-as-a-service market, business intelligence is becoming increasingly well-funded. BI promises to help identify, develop, and otherwise create new revenue opportunities by handling large amounts of data to analyze and benchmark lines of business. The increasing number of patient registries is a major factor driving the growth of the market. For instance, according to an article published by Frontiers in August 2022, patient registries are considered an important source of data for healthcare practices, drug utilization, and clinical outcomes. These registries help in addressing various challenges by providing information on epidemiology, standards of care, and treatment patterns of rare diseases, among others. Hence, the advantages of patient registries are expected to increase the usage of patient registries, thereby increasing the adoption of health business intelligence.

The healthcare BI market will show rapid growth due to government initiatives to increase EHR adoption and the number of patient registries, and the emergence of big data in the healthcare industry. As per the article published by the Biomedical Journal of Scientific & Technical Research in January 2021, the Government of India focused on digitizing its healthcare, including Electronic Health Records (EHR), to provide better patient data management, seamless coordination between healthcare providers, and improved healthcare research. Several national-level policies, such as National Digital Health Blueprint, are being formulated to create a pan-India digital health record system. As per the same source, at the provider level, large health systems like Tata Memorial Hospital and Max Hospitals Private Limited have implemented electronic medical record (EMR) systems and are moving toward EHR. Hence, the benefits associated with the BI and its increasing adoption rate across the healthcare industry are driving the market growth. However, the complexity of systems may hinder market growth over the forecast period.

Healthcare BI Market Trends

Cloud-based Model is Expected to Grow Significantly in the Healthcare BI Market Over the Forecast Period

The cloud-based delivery model is the fastest-growing segment as companies are increasingly adopting cloud-based business intelligence tools, such as Customer Relationship Management (CRM) applications by salesforce, patient engagement CRM, and others. This is due to the agility and accessibility of cloud-based tools. In addition, cloud-based models are cost-effective, user-friendly, and have a higher acceptance rate in comparison to on-premise or hybrid models; therefore, all these factors contribute to the segment's significant share.

Increasing adoption of cloud-based models coupled with the high dependency of healthcare on digital technology to operate functions of a complex healthcare system is further boosting the market growth. Furthermore, the launch of innovative products is also contributing to market growth. For instance, in March 2022, Snowflake launched a cloud-based data-sharing platform for the healthcare industry that integrates the company's core data warehousing, analytics, and business intelligence offerings with a data marketplace and on-demand consulting services.

Also, in March 2022, Microsoft announced the general availability of Azure Health Data Services, a cloud-based platform for managing and analyzing various forms of patient data. The Azure Health Data Services platform-as-a-service (PaaS) helps organizations manage disparate forms of protected health information (PHI) across multiple data stores, letting them work with -- and make sense of -- patient data using less time and resources. Hence, the launch of technologically advanced products is driving market growth.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is found to dominate the global market due to the providers' increasing implementation of healthcare BI solutions and services to offer enhanced patient care and the increasing awareness about business intelligence. Moreover, constantly upgrading healthcare and IT infrastructure along with increased adoption of cloud computing contributes significantly to the market growth. For instance, according to an article published by PubMed Central in March 2022, a study was conducted in the United States which showed that the business intelligence (BI) process helped in the identification of situations in which iodinated contrast agents (ICA) were being wasted during the CT scan in the patient. Hence, the increasing adoption of BI in various healthcare fields is expected to drive the growth of the market in the region.

The tech sector of North America is using data services efficiently to survive pandemics. For instance, in April 2021, the United States Department of Energy's Oak Ridge National Laboratory (ORNL) deployed one of the world's most powerful and smartest supercomputers, named 'Summit,' built by IBM. This new system will help in emergency computation, and it can also be used to perform simulations at a very high speed.

Moreover, according to the data published by the Office of the National Coordinator for Health Information Technology in 2021, approximately 4 in 5 office-based physicians (78%) and nearly all non-federal acute care hospitals (96%) adopted a certified EHR in the United States in 2021. Hence, the high adoption rate of EHR in the United States is also expected to boost market growth. In addition, the introduction of new products contributes to overall market growth. For instance, in September 2021, Med Tech Solutions (MTS) launched MTS Practice Data Analytics visual business intelligence (BI) tools. Practice Data Analytics generates over 40 standard business intelligence (BI) reports from electronic health record (EHR) data, which can be viewed in easily customizable dashboards. Hence, the market is projected to grow significantly in North America due to the above-mentioned factors.

Healthcare BI Industry Overview

The market is moderately competitive, with several big and emerging players. Product innovation and ongoing R&D activities to develop advanced technologies are expected to boost the market's growth. Some of the major players operating in the market include Oracle Corporation, Microsoft Corporation, IBM Corporation, SAP SE, and SAS Institute Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Government Initiatives for Healthcare Digitalization, Like Adoption of EHR

- 4.2.2 Increasing Number of Patient Registries

- 4.2.3 The Emergence of Big Data in the Healthcare Industry

- 4.3 Market Restraints

- 4.3.1 High Cost of Implementation

- 4.3.2 Lack of Skilled Professionals

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Mode of Delivery

- 5.2.1 On-premise Model

- 5.2.2 Hybrid Model

- 5.2.3 Cloud-based Model

- 5.3 By Application

- 5.3.1 Financial Analysis

- 5.3.2 Clinical Data Analysis

- 5.3.3 Patient Care Analysis

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Payers

- 5.4.2 Healthcare Providers

- 5.4.3 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Microsoft Corporation

- 6.1.2 IBM Corporation

- 6.1.3 Oracle Corporation

- 6.1.4 SAP SE

- 6.1.5 SAS Institute Inc.

- 6.1.6 Salesforce

- 6.1.7 MicroStrategy Incorporated

- 6.1.8 QlikTech International AB

- 6.1.9 Information Builders

- 6.1.10 Sisense Inc.

- 6.1.11 EPIC SYSTEMS

- 6.1.12 Infor Inc.

- 6.1.13 CareCloud Inc.

- 6.1.14 Domo Inc.