|

市场调查报告书

商品编码

1444710

智慧电錶 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Smart Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

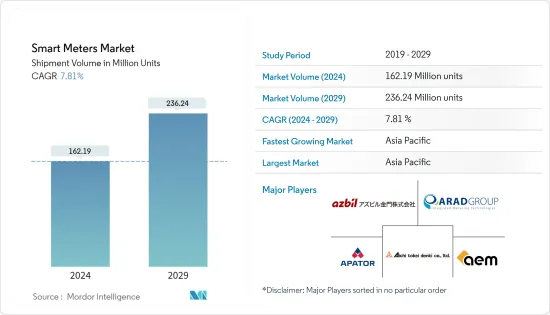

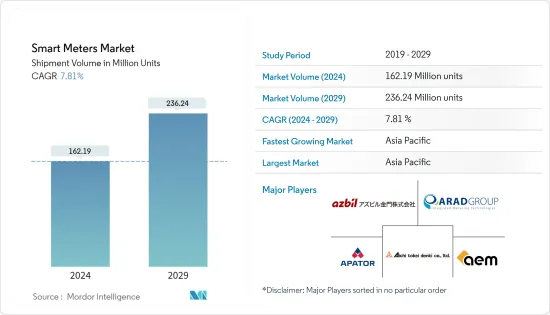

就出货量而言,智慧电錶市场规模预计将从2024年的1.6219亿台成长到2029年的2.3624亿台,预测期间(2024-2029年)CAGR为7.81%。

为了提高电网的有效性,世界各地正在引入智慧电网。因此,包括智慧电錶在内的智慧电网正在全球部署。为了因应污染对环境的负面影响,世界各国正在製定排放控制规则。这是推动市场的主要因素。

主要亮点

- 由于其双向通讯能力,智慧电錶在全球更广泛的采用,用于各种部署,包括电力、天然气和水。此功能允许公用事业供应商和消费者即时追踪公用事业使用情况,并鼓励供应商远端启动、读取或切断供应。

- 在非主要模式下,消费性电子产品、办公设备和其他插头负载消耗了住宅和商业总电力的近 15% 至 20%。大部分能量在它们以低功耗模式运行时消耗(即使它们未使用)。消费者越来越倾向于安装智慧能源管理系统来追踪此类情况。

- 智慧电錶的部署还可以实现家庭能源管理系统(HEMS)或建筑能源管理系统(BEMS)的实施,从而实现单一家庭或整个建筑物的电力使用情况的可视化。

- 此外,数位化正在加速能源效率措施的现代化,因此智慧电网的部署在全球范围内不断增加,因为它们能够动态优化供应并促进太阳能等再生能源的大量电力供应。

- 此外,政府支持和投资的增加预计将促进智慧电錶在该国的采用和部署。例如,印度国有能源效率服务有限公司 (EESL) 根据印度政府智慧电錶国家计划,在印度各地完成了约 100 万个智慧电錶的安装。 EESL 设定的目标是在未来几年安装 2.5 亿卢比的智慧电錶。此外,需要在该国建立智慧电錶製造基地,以确保在全国各地安装的电錶数量充足,排除垄断,预计将成为主要推动力。

- 全球新冠肺炎 (COVID-19) 疫情造成的封锁导致许多产业的营运陷入停顿。结果,智慧电錶的出货量和安装量下降。

- 然而,随着COVID-19要求逐渐放宽,预计随着时间的推移,智慧电錶的安装量也会增加。大多数能源供应商很容易鼓励他们的消费者在许多已开发地区更新到智慧电錶。

智慧电錶市场趋势

智慧电錶主导市场并将在预测期内继续占据主导地位

- 预计更多的政府支持和投资将加速亚太地区智慧电錶的采用和部署。为了防止垄断,确保整个地区可以安装的智慧电錶的充足供应,还需要在该地区建立製造基地。敦促各州政府在三年内实施智慧电錶,并获得了约 2,200 亿印度卢比(26.77 亿美元)的拨款用于电力和再生能源领域。

- 根据GSMA预测,到2025年,北美地区预计将有约14亿栋智慧建筑和7亿栋智慧家居,主要是美国和加拿大,因此智慧建筑和智慧家庭数量的不断增加预计也会导致智慧家庭的成长。销售智慧电錶。

- 此外,城市化进程的加速和人们越来越注重发展城市生活方式,导致智慧家庭技术和设备的部署扩大,其中涉及自动控制电力、照明和能源以避免浪费。因此,全球家庭越来越多地采用智慧家庭设备和技术,预计将进一步促进智慧电錶在住宅领域的成长。

- 在非主要模式下,消费性电子产品、办公设备和其他插头负载消耗了住宅和商业总电力的近 15% 至 20%。大部分能量在它们以低功耗模式运行时消耗(即使它们未使用)。消费者越来越倾向于安装智慧能源管理系统来追踪此类场景。

- 根据美国能源情报署(EIA)的数据,未来三十年全球发电量预计将增加一倍以上,到2050年达到约14.7太瓦。2020年,全球发电装置容量为7.1太瓦,这显示需求旺盛。因为全球电力不断增长。公用事业公司管理和优化其能源分配网路的需求日益增长。因此,提供有关能源消耗的详细资讯可以帮助消费者找到减少能源使用并使用智慧电錶节省资金的机会,预计将增加全球智慧电錶的采用。

亚太地区将持有主要份额

- 中国目前在亚太地区处于领先地位,由于华南政府和国家电网(中国仅有的两家推动这项进程的电网公司)的严格要求,该计画的推出正处于高峰期。然而,中国目前已接近全面部署,投放的逐渐结束导致年度需求大幅减少。

- 中国是智慧电錶的主要製造商,本土企业数量众多。它也是最大的智慧电錶生产商之一,智慧电錶在推出阶段主要用于家庭用途。国营企业在中国市场占据主导地位。因此,非中国公司几乎不可能在该国竞争。

- 日本是世界第五大碳排放国。 2021年,迫于许多环保组织和欧洲国家的压力,日本政府承诺在2030年减量46%。智慧电网的实施、增强的电力和配电网路以及低碳能源可能有助于实现这一目标。

- 当时,由于日本政府的大力支持、放鬆管制以及多个大型项目的成本普遍下降,投资者对日本智慧电网技术的兴趣显着增加。根据《亚洲电力》报道,预计到 2024 年全国智慧电錶安装量将达到 8,000 万个。

- 这些改进主要归功于智慧电錶、DES 和储能技术的部署,但也出现了许多试点项目和虚拟发电厂 (VPP)、区块链和车辆到电网 (V2G) 技术等其他创新的发展。此外,日本政府计划斥资 20 兆日圆(1,550 亿美元)促进对新电网技术、节能住宅和其他技术的投资,以减少国家的碳足迹。

- 亚太地区的其他地区包括纽西兰、印度、澳洲、菲律宾、印尼、泰国、韩国、马来西亚、新加坡、越南、孟加拉、巴基斯坦等国家和大陆。预计在预测期内,多项政府措施、合作伙伴关係、创新和收购将推动该地区的市场成长。

智慧电錶产业概况

智慧电錶市场竞争激烈,由AEM、爱知时计马达、Apator SA、Arad Group 和Azbil Kimmon 等几家主要参与者组成。大规模投资的介入增加了现有参与者的壁垒,从而推动了该行业的发展走向竞争。此外,智慧电錶越来越多地被各种最终用户部署。因此,需求的大幅增加以及政府增加各地区推出数量的措施预计将加剧市场参与者之间的竞争程度。

2023年1月,Badger Meter Inc.宣布策略收购智慧水监测解决方案供应商Syrinix Ltd.。透过此次收购,该公司旨在将 Syrinix 的硬体软体功能添加到我们的智慧水解决方案组合中。同样,它还收购了智慧测量和智慧水质监测领域的领导者Analytical Technology, Inc. (Ati)和Scan GmbH。

2023 年1 月,代傲基金会(Diehl Stiftung & Co. KG) 宣布,卢安达首都基加利的水与卫生公司(WASAC) 选择代傲表计采用仪表技术,以实现其网路现代化,以实现可持续发展。 WASAC 认识到 AURIGA 适合透过安装可靠的水錶来实现减少无收益水的主要目标。 AURIGA 水錶将构成未来 AMR 解决方案的基础。

2022年12月,Apator SA推出了专为工业应用设计的smartESOX pro和双向智慧电錶OTUS 3。也展示了其他智慧选项,例如 Ultrimis W 超音波水錶和 iSMART2 瓦斯表。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 对产业的影响

第 5 章:市场动态

- 市场驱动因素

- 增加智慧电网专案投资

- 需要提高公用事业效率

- 支持性政府法规

- 智慧城市部署的成长

- 所有最终用户对可持续公用事业供应的需求

- 市场挑战

- 高成本和安全问题

- 与智慧电錶的整合困难

- 基础建设安装资金投入不足,缺乏投资报酬率

- 公用事业供应商转换成本

第 6 章:市场细分

- 按地理位置 - 智慧瓦斯表

- 北美洲

- 美国

- 加拿大和中美洲

- 欧洲

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 亚太地区其他地区

- 世界其他地区

- 北美洲

- 按地域-智慧水錶

- 北美洲

- 美国

- 加拿大和中美洲

- 欧洲

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 亚太其他地区

- 世界其他地区

- 北美洲

- 按地理位置-智慧电錶

- 北美洲

- 美国

- 加拿大和中美洲

- 欧洲

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 亚太地区其他地区

- 世界其他地区

- 北美洲

第 7 章:竞争格局

- 公司简介

- AEM

- Aichi Tokei Denki Co.Ltd.

- Apator SA

- Arad Group

- Azbil Kimmon Co. Ltd.

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Elster Group GmbH (Honeywell International Inc.)

- General Electric Company

- Hexing Electric company Ltd.

- Holley Technology Ltd.

- Itron Inc.

- Jiangsu Linyang Energy Co. Ltd.

- Kamstrup A/S

- Landis+ GYR Group AG

- Mueller Systems LLC (Muller Water Products Inc.)

- EDMI Limited (OSAKI ELECTRIC CO. LTD.)

- Neptune Technology Group Inc. (Roper Technologies, Inc.)

- Ningbo Sanxing Medical Electric Co., Ltd

- Pietro Fiorentini SpA

- Sagemcom SAS

- Sensus USA Inc. (Xylem Inc.)

- Aclara Technologies LLC (Hubbell Inc.)

- Wasion Holdings Limited

- Yazaki Corporation

- Zenner International GmbH & Co. KG

第 8 章:市场机会与未来趋势

- 市场的未来—智慧电錶

- 市场的未来—智慧瓦斯表

- 市场的未来—智慧水錶

The Smart Meters Market size in terms of shipment volume is expected to grow from 162.19 Million units in 2024 to 236.24 Million units by 2029, at a CAGR of 7.81% during the forecast period (2024-2029).

In order to increase the effectiveness of electrical networks, smart grids are being introduced all over the world. As a result, smart grids, which include smart electricity meters, are being deployed globally. To combat the negative impacts of pollution on the environment, nations all over the world are enacting emission control rules. This is the main factor driving the market.

Key Highlights

- Due to their two-way communication capability, smart meters are being adopted more widely across the globe for various deployments, including electricity, gas, and water. This feature allows both utility suppliers and consumers to track utility usage in real-time and encourages suppliers to start, read, or cut off supply remotely.

- Consumer electronics, office equipment, and other plug loads consume nearly 15% to 20% of the total residential and commercial electricity while not in the primary mode. Most of this energy is consumed when they operate in low-power modes (even while they are not in use). Consumers are increasingly tending to install a smart energy management system to track such scenarios.

- Smart meters deployment also enables the implementation of a Home Energy Management System (HEMS) or Building Energy Management System (BEMS) that allows visualization of the electric power usage in individual homes or entire buildings.

- Further, digitization is accelerating and modernizing energy efficiency measures, due to which the deployment of smart grids is increasing globally, as they are capable of dynamically optimizing supply and fostering supply of large amounts of electricity from renewable energy sources such as solar power.

- Moreover, increasing government support and investments are expected to boost smart meters adoption and deployment in the country. For instance, India's state-owned Energy Efficiency Services Limited (EESL) completed the installation of approximately 10 lakh smart meters across India under the Government of India's Smart Meter National Programme. EESL set the target to install 25 crore smart meters over the next few years. Also, the need to establish a manufacturing base of smart electricity meters in the country to ensure an adequate supply of an adequate number of meters to be installed all over the country, by ruling out monopoly, is expected to act as a major driver.

- Lockdowns caused by the global COVID-19 epidemic caused a number of operations in many industries to come to a standstill. As a result, there was a decline in smart meter shipments and installations.

- However, as the COVID-19 requirements are gradually relaxed, it is anticipated that over time, the installation of smart meters will rise as well. The majority of energy providers are easily encouraging their consumers to update to smart meters in many developed locations.

Smart Meters Market Trends

Smart Electricity Meter Dominates the Market and will Continue its Dominance Over the Forecast Period

- Greater government support and investments are anticipated to accelerate the adoption and deployment of smart meters in Asia and the Pacific. In order to prevent monopolies and ensure an adequate supply of smart electricity meters that can be installed throughout the region, it is also necessary to establish a manufacturing base in the area. The state governments were urged to implement smart meters in three years and received an allocation of about INR 2,20,000 million (USD 2.677 billion) for the power and renewable energy sectors.

- According to the GSMA, by 2025, around 1.4 billion smart buildings and 700 million smart homes are expected to be in North America, mainly the United States and Canada, so an increasing number of smart buildings and homes are expected to also lead to an increase in the sale of smart electricity meters.

- Moreover, increasing urbanization and the increasing inclination toward a focus on developing urban lifestyles led to the expansion of the deployment of smart home technologies and devices, which involve automatic control of electricity, light, and energy to avoid wastage. Hence, the increasing adoption of smart home devices and technologies across homes globally is further expected to foster the growth of smart meters in the residential segment.

- Consumer electronics, office equipment, and other plug loads consume nearly 15% to 20% of the total residential and commercial electricity while not in the primary mode. Most of this energy is consumed when they operate in low-power modes (even while they are not in use). Consumers are increasingly inclined to install a smart energy management system to track such scenarios.

- According to the Energy Information Administration (EIA), global electricity generation capacity is expected to more than double in the next three decades, reaching approximately 14.7 terawatts by 2050. In 2020, the world's installed electricity capacity stood at 7.1 terawatts, which shows the demand for electricity around the globe is growing continuously. There is a growing need for utilities to manage and optimize their energy distribution networks. Thus, the availability of detailed information about energy consumption, which can help the consumer identify opportunities to reduce energy usage and save money with smart electricity meters, is projected to increase the adoption of smart electricity meters globally.

Asia-Pacific to Hold Major Share

- China is currently the leading segment in Asia Pacific, with the rollout at its peak due to strict mandates by the government of South China and State Grid, the only two grid companies in the country that drive the process. However, China is currently approaching full deployment, and the gradual end of the launch results in a significant reduction in annual demand.

- China is a major manufacturer of smart electricity meters, with a strong presence of local companies. It is also one of the largest producers of smart electric meters, which were consumed for domestic purposes during the rollout phase. State-owned enterprises dominate the Chinese market. Thus, it is nearly impossible for non-Chinese companies to compete in the country.

- Japan is the fifth-largest carbon emitter in the world. In 2021, the Japanese government promised to reduce emissions by 46% by 2030 due to pressure from many environmental organizations and European nations. Smart grid implementation, enhanced power and distribution networks, and low-carbon energy sources will likely help achieve this objective.

- By then, investor interest in smart grid technology was seen to have significantly increased in Japan due to the country's strong backing from the government, deregulation, and generally declining costs, with several large-scale projects. According to an Asian Power article, it is anticipated that up to 80 million smart meters will be installed nationwide by 2024.

- These improvements have mainly resulted from deploying smart electricity meters, DES, and energy storage technologies but have also seen numerous pilot projects and developments into other innovations like virtual power plants (VPPs), blockchain, and vehicle-to-grid (V2G) technologies. Additionally, the Japanese government plans to spend JPY 20 trillion (USD 155 billion) on promoting investments in new power grid technology, energy-saving homes, and other technology to reduce the nation's carbon footprint.

- The rest of the Asia-Pacific region contains countries and continents like New Zealand, India, Australia, the Philippines, Indonesia, Thailand, South Korea, Malaysia, Singapore, Vietnam, Bangladesh, Pakistan, and many more. Several government initiatives, partnerships, innovations, and acquisitions are expected to fuel market growth in the region during the projected period.

Smart Meters Industry Overview

The smart meter market is highly competitive and consists of several major players such as AEM, Aichi Tokei Denki Co., Ltd., Apator SA, Arad Group, and Azbil Kimmon Co., Ltd. The involvement of large-scale investments is increasing the barriers for the existing players, thereby pushing the industry toward competition. Also, smart meters are increasingly being deployed by various end users. Hence, the substantial increase in demand and government initiatives to increase the number of rollouts in various regions are expected to increase the degree of competition among the market players.

In January 2023, Badger Meter Inc. announced the strategic acquisition of Syrinix Ltd., a provider of intelligent water monitoring solutions. Through this acquisition, the company aims to add the hardware-enabled software capabilities of Syrinix to our smart water solutions portfolio. Similarly, it has also acquired Analytical Technology, Inc. (Ati) and Scan GmbH, leaders in intelligent measurement and smart water quality monitoring.

In January 2023, Diehl Stiftung & Co. KG announced that the Water and Sanitation Corporation (WASAC) in Rwanda's capital, Kigali, chose Diehl Metering for meter technology to modernize its network for its sustainability efforts. WASAC recognized the suitability of AURIGA to achieve its primary objective of reducing non-revenue water by installing reliable meters. The AURIGA water meter will form the basis for a future AMR solution.

In December 2022, Apator SA presented the smartESOX pro, which was specially designed for industrial applications, and the OTUS 3, a bidirectional smart electricity meter. Other smart options were presented, such as the Ultrimis W ultrasonic water meter and the iSMART2 gas meter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Need for Improvement in Utility Efficiency

- 5.1.3 Supportive Government Regulations

- 5.1.4 Growth in Smart City Deployment

- 5.1.5 Demand for Sustainable Utility Supply for All End Users

- 5.2 Market Challenges

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Lack of Capital Investment for Infrastructure Installation and Lack of ROI

- 5.2.4 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Geography - Smart Gas Meter

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada and Central America

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 France

- 6.1.2.3 Italy

- 6.1.2.4 Rest of Europe

- 6.1.3 Asia Pacific

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.3.3 Rest of Asia Pacific

- 6.1.4 Rest of the World

- 6.1.1 North America

- 6.2 By Geography - Smart Water Meter

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada and Central America

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 France

- 6.2.2.3 Italy

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Rest of Asia-Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

- 6.3 By Geography - Smart Electricity Meter

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada and Central America

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Rest of Asia Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEM

- 7.1.2 Aichi Tokei Denki Co.Ltd.

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Azbil Kimmon Co. Ltd.

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Elster Group GmbH (Honeywell International Inc.)

- 7.1.9 General Electric Company

- 7.1.10 Hexing Electric company Ltd.

- 7.1.11 Holley Technology Ltd.

- 7.1.12 Itron Inc.

- 7.1.13 Jiangsu Linyang Energy Co. Ltd.

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+ GYR Group AG

- 7.1.16 Mueller Systems LLC (Muller Water Products Inc.)

- 7.1.17 EDMI Limited (OSAKI ELECTRIC CO. LTD.)

- 7.1.18 Neptune Technology Group Inc. (Roper Technologies, Inc.)

- 7.1.19 Ningbo Sanxing Medical Electric Co., Ltd

- 7.1.20 Pietro Fiorentini SpA

- 7.1.21 Sagemcom SAS

- 7.1.22 Sensus USA Inc. (Xylem Inc.)

- 7.1.23 Aclara Technologies LLC (Hubbell Inc.)

- 7.1.24 Wasion Holdings Limited

- 7.1.25 Yazaki Corporation

- 7.1.26 Zenner International GmbH & Co. KG

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 Future of the Market - Smart Electricity Meter

- 8.2 Future of the Market - Smart Gas Meter

- 8.3 Future of the Market - Smart Water Meter