|

市场调查报告书

商品编码

1632096

美国智慧电錶:市场占有率分析、产业趋势、统计和成长预测(2025-2030)United States Smart Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

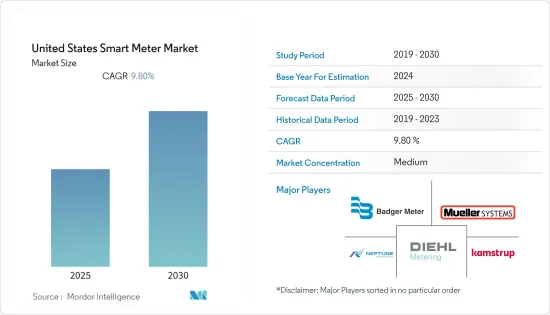

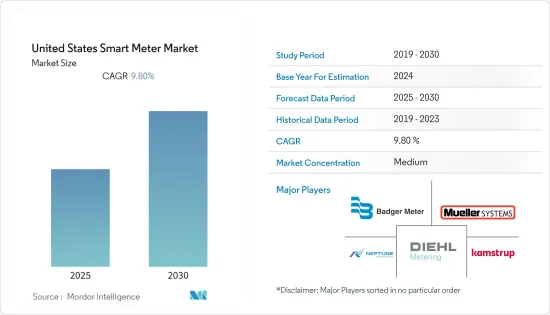

美国智慧电錶市场预计在预测期内复合年增长率为 9.8%。

主要亮点

- 随着公用事业公司寻求更有效率、可靠和安全的方式来管理能源发电、传输和分配,智慧电网是一种将能源供应与特定市场的需求相匹配的有效方法,同时消除了浪费。智慧电錶是智慧电网中最重要的设备之一,具有公用事业公司和客户之间的双向通讯功能。近年来,美国对智慧电网计划的投资增加,各种政府政策,特别是强制要求和财政奖励,是智慧电錶市场采用的主要推动力。

- 例如,2021 年 9 月,美国农业部宣布投入 4.64 亿美元,用于建造或改善可再生能源基础设施,帮助48 个州的农村社区、农业生产者和企业降低能源成本,波多黎各也宣布将进行投资。农业部透过电力贷款计画提供了 3.35 亿美元融资,其中 1.02 亿美元用于智慧电网技术投资。

- 此外,消费者对智慧和环保服务的需求不断增加,消费者现在正在寻找个人化服务,以优化其使用并减少帐单。透过智慧电錶资料,公用事业公司可以帮助客户降低能源成本,这也是推动市场成长的因素。

- 在 COVID-19 爆发之初,许多智慧电錶製造商面临的主要影响是生产中断导致的供应问题。此外,由于封锁措施,住宅、商业和工业对智慧电錶的需求也有所下降。然而,随着疫情封锁的放鬆,智慧电錶的製造和供应正在恢復到正常水平,许多製造商的销售开始復苏。

- 然而,安装智慧电錶基础设施的初始投资通常远高于传统电錶,并且需要更长的时间才能获得高投资回报。庞大的资本需求对能源消费者和电力公司来说都是一个重大挑战,也是一种市场限制。

美国智慧电錶市场趋势

智慧燃气表领域显着成长

- 智慧型瓦斯表使用超音波或电磁技术来测量瓦斯流量,并使用无线通讯连接到区域网路或广域网路。

- 它还配备了洩漏和衝击检测系统,可以检测紧急情况,并在发生地震活动或燃气洩漏时立即关闭燃气流,或启用远端控制以确保安全。智慧型瓦斯表依靠低压电池供电来延长使用寿命并避免火灾风险。

- 智慧燃气表使燃气公司能够有效管理能源生产、发行和交付业务,降低成本并优化资源分配。远端监控客户消费量并打开和关闭燃气,避免昂贵的现场访问。

- 2021 年 8 月,美国电力公司路易斯维尔天然气电力公司(LG&E) 和肯塔基州公用事业公司(KU) 与兰迪斯齿轮公司签署了一项为期五年的协议,提供智慧计量和智慧电网基础设施和技术。该合约包括供应 93 万个智慧电錶、30 万个燃气模组和一个连接的物联网网路。

- 美国政府对智慧电錶安装的有利倡议是推动市场成长的主要因素。此外,网路普及率不断上升,以及高速网路技术和智慧型手机的普及率不断提高,也推动了市场的发展。透过将智慧型燃气表与智慧型手机同步,您可以使用智慧型手机应用程式轻鬆远端监控燃气表。

住宅领域占据主要市场占有率

- 美国对智慧电錶的最大需求是住宅电錶,因为越来越多的消费者使用这些电錶来更准确地监控家庭用电量。大多数的住宅智慧电錶都是由电力公司购买和安装。

- 在住宅领域,对智慧电錶的需求主要是由于空调、电视、冰箱、照明、吊扇、洗衣机、电脑和暖通空调(暖气、通风和空调)等家用电器的使用增加而导致的电力消耗增加。 )设备正在被拖走。公用事业公司正在寻找方法来满足运作这些设备的动态电力需求,因此正在投资智慧电錶以增强电网弹性和营运。

- 智慧电錶还可以帮助将分散式能源(DER)、能源储存和电动车充电设备整合到住宅领域。

- 此外,政府不断努力促进家庭采用智慧电錶,以提高抄表的准确性,并为消费者和公用事业公司提供更好的能源消耗透明度,这正在推动市场成长。

- 根据美国能源局统计,全国已安装超过1亿个先进智慧电錶,其中住宅安装量占所有安装量的88%。随着使用最新技术不断提高电网效率,预计消费者将有越来越多的机会有效管理电力消耗,并透过安装智慧电錶实现长期显着节省。

美国智慧电錶产业概况

美国智慧电錶市场竞争适度,参与者众多。这些公司利用策略协作行动来增加市场占有率并提高盈利。

- 2021 年 9 月 - 卡姆鲁普宣布推出新型智慧电錶 OMNIA,以加强其在先进计量市场的产品。这款新产品基于蜂巢式物联网。随着能源公司和技术供应商寻求开发弹性网路以实现快速、安全的资料远端检测,蜂巢式物联网是通讯标准,在公共产业行业中不断被广泛采用。

- 2022 年 5 月 - Neptune Technology Group 选择美国企业收费和收益解决方案供应商BillingPlatform 来开发Neptune 的智慧水解决方案(例如智慧电錶),推出专为计量工具、网路、软体和服务设计的基于订阅的收费。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 爆发对产业的影响

第五章美国智慧电錶市场:产业政策及政策监管

第六章美国智慧电錶与智慧电网计划

第七章市场动态

- 市场驱动因素

- 消费者意识不断增强,政府法规要求安装智慧电錶

- 加大智慧电网计划投资

- 加大智慧城市建设投入

- 市场挑战

- 与安装智慧电錶相关的成本增加、安全问题和整合困难

- AMI与客户资讯系统、配电管理系统、收费系统等集成

第八章市场区隔

- 按类型

- 智慧燃气表

- 智慧水錶

- 智慧电錶

- 按最终用户

- 商业的

- 产业

- 住宅

第9章智慧电錶软体系统研究

第10章竞争格局

- 公司简介

- Badger Meter Inc.

- Mueller Systems LLC

- Diehl Metering US

- Kamstrup

- Neptune Technology Group Inc.

- General Electric Co.

- Itron Inc.

- Sensus USA Inc.(Xylem Inc.)

- Elster American Meter(Honeywell International Inc.)

第十一章供应商市场占有率分析

第十二章投资分析

第十三章 市场未来前景

简介目录

Product Code: 91304

The United States Smart Meter Market is expected to register a CAGR of 9.8% during the forecast period.

Key Highlights

- As utilities seek more efficient, reliable, and secure ways to manage energy generation, transmission, and distribution, the smart grid has emerged as an effective approach to aligning the supply of energy in a given market with demand while reducing waste. The smart meter is one of the most important devices used in the smart grid and has two-way communication capability between electric utilities and customers. In recent years, increasing investments in smart grid projects along with different government policies, particularly mandates and fiscal incentives, are among the key drivers of market adoption of smart meters in the United States.

- For instance, in September 2021, the U.S. Department of Agriculture announced that it would invest USD 464 million to build or improve renewable energy infrastructure and help rural communities, agricultural producers, and businesses lower energy costs in 48 states and Puerto Rico. The USDA financed USD 335 million of these investments through the Electric Loan Program, including USD 102 million for investments in smart grid technology.

- Further, consumer demand for smart and green services continues to grow and they are now seeking personalized services that enable them to optimize usage and reduce bills. Through smart meter data, utilities are able to help customers reduce energy costs, which is another factor driving the growth of the market.

- At the start of the Covid-19, the primary impact faced by many smart meter manufacturers was supply problems, owing to halted production. Moreover, owing to lockdown measures, demand for residential, commercial, and industrial use of smart meters also decreased. However, with the ease of the pandemic-related lockdowns, manufacturing and supply of smart meters are returning to normal levels, with many manufacturers starting to witness a recovery in sales.

- However, the initial investment involved in setting up smart meter infrastructure is usually much higher as compared to traditional meters, and it also takes a longer time to achieve high returns on investments. The requirement for huge capital poses a significant challenge to both energy consumers and utility providers, which acts as a market restraint.

US Smart Meter Market Trends

Smart Gas Meter Segment to Grow Significantly

- A smart gas meter utilizes ultrasonic or electromagnetic technologies to measure gas flow, while using wireless communication to connect to local or wide area networks, which allows infrastructure maintenance, remote location monitoring, and automatic billing.

- The device also has leakage and shock detection systems that can significantly increase safety by detecting emergency situations and enabling the immediate and remote cutting of the gas flow in case of seismic activity or gas leakage. A smart gas meter relies on low-voltage battery power to extend operational life and avoid ignition hazards.

- Smart gas metering allows gas companies to efficiently manage their operations, including energy production, distribution, and deliveries, while reducing costs and optimizing resource allocation. They can remotely monitor customers' consumption and switch gas on and off to avoid costly onsite visits.

- In August 2021, US utility companies Louisville Gas and Electric Company (LG&E) and Kentucky Utilities Company (KU) signed a five-year contract with Landis+Gyr for the provision of smart meters and smart grid infrastructure and technologies. The agreement includes the supply of 930,000 smart electricity meters, 300,000 gas modules and an IoT network for connectivity.

- Favorable government initiatives towards the installation of smart meters in the US are the primary factors driving the market growth. Further, rising internet penetration along with increased adoption of high-speed network technologies and smartphones are also propelling the market, as the synching of smart gas meters with smartphones can easily be used to perform remote monitoring of the gas meters with smartphone apps.

Residential Sector to Hold a Major Market Share

- The most demand for smart meters in the United States is for residential meters, as more consumers are using these meters to monitor electricity usage at their homes more accurately. The bulk of residential smart meters is procured and installed by utilities.

- In the residential sector, the demand for smart meters is primarily driven by the rising power consumption due to increased use of home appliances like air conditioners, televisions, refrigerators, lighting, ceiling fans, cloth washers, personal computers, and HVAC (Heating, ventilation, and air conditioning) equipment in residential buildings. Utilities are looking for ways to address the dynamic demand for power from the operations of this equipment and are thus investing in smart meters to enhance grid resiliency and operations.

- Smart meters also help in integrating distributed energy resources (DERs), energy storage technologies, and EV charging facilities in the residential sector.

- Further, the increasing government initiatives to boost the adoption of smart meters in households to reinforce accurate meter readings and provide better transparency in energy consumption for both consumers and utility companies are also propelling the market growth.

- As per the United States Department of Energy, over 100 million advanced smart electric meters have already been installed throughout the country, with residential installations representing 88% of the total. With continued efforts to use modern technology to improve the effectiveness of the electric grid, consumers are expected to have more opportunities to manage electricity consumption efficiently and reap significant savings in the long run through the installation of smart meters.

US Smart Meter Industry Overview

The United States smart meter market is moderately competitive and consists of some influential players. These businesses are leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- September 2021 - Kamstrup introduced a new smart electricity meter, OMNIA, to enhance its offering within the advanced metering market. The new product is based on cellular IoT, a communications standard that continues to see widespread adoption within the utility industry, as energy companies and technology vendors seek to develop a resilient network for fast and secure data telemetry.

- May 2022 - Neptune Technology Group selected US-based enterprise billing and monetization solution provider, BillingPlatform, for its subscription-based billing capabilities to be used with Neptune's Smart Water solutions, which include measurement tools like smart meters, networks, software, and services designed for the critical work of water.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 UNITED STATES SMART METERS MARKET - INDUSTRY POLICIES AND REGULATIONS

6 UNITED STATES SMART METERS AND SMART GRID INITIATIVES

7 MARKET DYNAMICS

- 7.1 Market Drivers

- 7.1.1 Higher Consumer Awareness and Government Regulations Mandating the Installation of Smart Meters

- 7.1.2 Increased Investments in Smart Grid Projects

- 7.1.3 Investments in Smart City Developments

- 7.2 Market Challenges

- 7.2.1 Higher Costs, Security Concerns and Integration Difficulties with the Installation of Smart Meters

- 7.3 AMI integration with customer information system, distribution management system, billing systems, etc.

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Smart Gas Meters

- 8.1.2 Smart Water Meters

- 8.1.3 Smart Electricity Meters

- 8.2 By End-User

- 8.2.1 Commercial

- 8.2.2 Industrial

- 8.2.3 Residential

9 STUDY ON SMART METERS SOFTWARE SYSTEM

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Badger Meter Inc.

- 10.1.2 Mueller Systems LLC

- 10.1.3 Diehl Metering US

- 10.1.4 Kamstrup

- 10.1.5 Neptune Technology Group Inc.

- 10.1.6 General Electric Co.

- 10.1.7 Itron Inc.

- 10.1.8 Sensus USA Inc. (Xylem Inc.)

- 10.1.9 Elster American Meter (Honeywell International Inc.)

11 VENDOR MARKET SHARE ANALYSIS

12 INVESTMENT ANALYSIS

13 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219