|

市场调查报告书

商品编码

1640638

微电网控制系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Microgrid Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

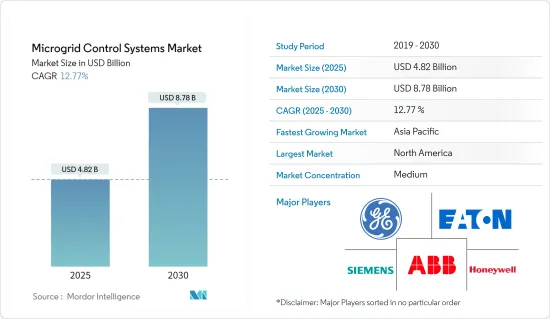

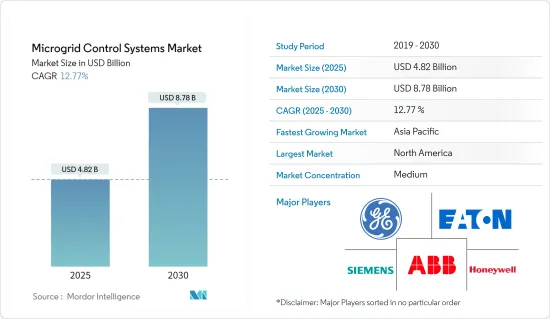

微电网控制系统市场规模预计在 2025 年为 48.2 亿美元,预计到 2030 年将达到 87.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.77%。

控制和能源管理的持续改进预计将对市场成长产生积极影响。分散式可再生能源和电池技术价格的下降,以及能源管理系统的技术进步,正在带来更有效率的可再生能源电网和先进的智慧电网技术。

主要亮点

- 根据 2022 年 5 月发表的世界经济论坛报导,传统电网可以覆盖整个大陆或国家,这意味着,如果暴风雨或停电导致某个地区的主要电网瘫痪,许多家庭、企业和关键服务可能会受到影响。微电网可以与主电网隔离,从而允许其在紧急情况下继续供电。这个过程被称为「孤岛化」。

- 由于微电网应用于许多领域并与燃料电池等新技术相结合,需要高效可靠的控制系统来处理新系统的复杂性。这导致对高效和集中的微电网控制器的需求增加。传统网路由于排队较长而被认为效率很低。

- 2022 年 11 月,先进电力和能源计画 (APEP) 与南加州爱迪生公司 (SCE)、能源部 (DOE)、KB Home、SunPower 和Schneider Electric合作,宣布在梅尼菲建立影子公用事业。规划中开发、部署和测试了两个微电网社群。总体而言,APEP 将确保微电网控制器符合国家标准 (IEEE 2030.7),该标准是在 APEP 为 DOE 完成的领先工作的基础上发展起来的,利用UCI 微电网作为演示和开发平台。 。

- 然而,高昂的实施成本可能会阻碍市场成长。这些系统需要不断维护,并需要熟练的人员来排除技术问题。这些因素阻碍了市场的成长。

- COVID-19 疫情以多种方式影响了微电网控制系统市场。 COVID-19疫情爆发导致供应链中断和早期计划延迟。自那时起,人们对弹性能源基础设施和远端能源管理的关注度不断提高,加速了微电网控制系统的采用和投资。

微电网控制系统市场趋势

公共产业部门占据了大部分市场份额

- 微电网透过适应太阳能发电装置和电动车等再生能源来源的日益增长的使用,实现了高效、动态的电网。此外,透过减少输配电过程中的能源损失以及利用当地能源满足家庭需求,可以进一步提高电力供应系统的效率。

- 根据美国能源局的数据,到 2035 年,微电网将成为具有弹性、脱碳且价格合理的新型电力系统的关键基石。

- 2023年3月,Volvo遍达与电池能源储存领域分散式微电网系统领导者公共事业 Innovation Group建立合作关係。两家公司将共同努力,透过电池储存和整合来提高电网的可靠性和弹性,并充分利用太阳能和风能等可再生能源。

- 此外,2023年1月,加州电力公司PG&E将与以重力解决方案闻名的Energy Vault公司合作,建造结合绿色氢能和电池的长效能源储存微电网。两家公司正在合作营运和部署公共事业规模的电池和绿色氢能能源储存系统。

- 随着电力需求的增加,电力公司正在转向替代能源并整合更多分散式能源来源。在管理这种复杂而分散的能源网路时,优化电力流和微电网控制系统以实现可再生能源的无缝整合至关重要。根据美国能源资讯署 (EIA) 的数据,2022 年美国公用事业的发电量与前一年相比小幅增加约 2,537兆瓦时。

北美占据很大市场份额

- 预计预测期内可再生能源发电和分散式发电系统的增加将推动市场发展。传统电网市场面临越来越大的压力。同时,我们老化的基础设施需要进行大规模整修。美国环保署(EPA)正在实施前所未有的温室气体法规,进一步推动可再生能源综合微电网控制系统市场的发展。

- 此外,该地区市场参与者的发展预计将推动市场发展。例如,自动化和能源管理数位转型的领导者Schneider Electric于 2023 年 5 月宣布,EcoStruxure Microgrid Flex 将显着缩短计划週期时间,并在整个计划生命週期内实现更高的回报。微电网解决方案对于内部系统投资,这是该行业首次为应对这些挑战而设计的。据估计,到 2050 年,分散式能源将占美国发电量的 40%,从而推动对微电网的需求。微电网系统需要大量的工程时间和集中的注意力来配置、规划和部署系统。

- 2022 年 10 月,ENGIE North America(ENGIE)宣布已为圣塔芭芭拉联合学区安装最先进的设备,扩展了其微电网产品范围。停电和安全性降低已成为加州的新常态,给社区带来了减轻和适应直接影响的巨大压力。

- 政府以资金补助和州级復原力计画形式提供的支持不断增加,推动了教育机构和校园应用的需求,成为美国市场成长的主要驱动力。例如,2023 年 5 月,美国能源局(DOE) 宣布拨款 3,400 万美元,用于推进阿拉斯加 18 个美洲原住民和原住民社区的清洁能源技术。这笔资金将透过增加微电网和太阳能的使用、为未通电的部落建筑供电以及提高能源安全性和弹性来加强部落社区。

- 预计能源储存价格下降将降低可再生能源的整合成本。预计这一因素也将提高大型社区以及商业和工业领域采用微电网的比例。

微电网控制系统产业概况

微电网控制系统市场相当分散,因为进入该市场需要大量的前期投资。市场的主要企业包括 ABB 集团、西门子股份公司、日立有限公司、伊顿公司、普林斯顿电力系统、通用电气公司、帕累托能源有限公司、霍尼韦尔国际公司、北方电力系统公司和 Exelon 公司。市场近期的主要发展包括:

2023 年 3 月,西门子加拿大公司与汉博学院合作,在学校北校区开发可再生技术和永续微电网实验室 (SMART Lab)。汉博学院的 SMART Lab 投资基于永续数位技术,并得到安大略省的支持。电动车充电站、太阳能智慧花卉和电池储存系统等设备整合到微电网控制系统中,以在局部产生和分配能源,并实现更有效率和永续的电力使用和消耗。

2023年3月,ABB投资直流微电网新兴企业Direct Energy Partners,加速能源转型。直流(DC)能源网路对于能源产业的发展至关重要,此次伙伴关係增强了 ABB 在未来关键成长市场的技术领导地位。 Direct Energy Partners 的软体平台可将直流微电网的设计和采购流程自动化。

2022 年 8 月,工程和管理顾问公司 Tetra Tech 为大曼彻斯特郡奥尔德姆议会推出了 300kW 未来微型电网。 ABB宣布交付配电和控制系统。计划的初始阶段计划于 2023 年春季完成,将包括太阳能发电面板、500kVA并联型、电动车充电站和透过空气源热泵供暖,以满足办公大楼的能源需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 备用解决方案的需求增加(以支援紧急断电)

- 提高业务效率的需求日益增加

- 市场限制

- 实施成本高,且有营运/技术问题

第六章 市场细分

- 按类型

- 电网连接

- 离网

- 杂交种

- 按应用

- 公共产业

- 城市和市政当局

- 防御

- 产业

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Group

- Siemens AG

- Hitachi, Ltd

- Eaton Corporation PLC

- Princeton Power Systems

- General Electric Corporation

- Pareto Energy, Ltd

- Honeywell International, Inc.

- Northern Power Systems Corporation

- Exelon Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Microgrid Control Systems Market size is estimated at USD 4.82 billion in 2025, and is expected to reach USD 8.78 billion by 2030, at a CAGR of 12.77% during the forecast period (2025-2030).

Continued control and energy management improvements are expected to impact market growth positively. Declining prices for distributed renewable energy and battery technology and technological advances in energy management systems have led to more efficient renewable energy grids and advanced smart grid technologies.

Key Highlights

- As per an article by the World Economic Forum published in May 2022, many homes, businesses, and critical services could be affected if a region's primary power grid were to go down due to storms or power outages, as conventional power grids can cover entire continents or countries. Microgrids can switch off from the primary grid and continue to supply power during such emergencies. This process is known as "islanding."

- As microgrids are used in many fields and integrated with new technologies, including fuel cells, efficient and reliable control systems are needed to handle the new systems' complexity. Therefore, there is a growing need for effective and centralized microgrid controllers. Traditional networks are considered very inefficient due to long lines.

- November 2022, Advanced Power and Energy Program (APEP) collaborated with Southern California Edison (SCE), the Department of Energy (DOE), KB Home, SunPower, and Schneider Electric on the development, deployment, and testing of two microgrid communities in the Shadow Mountain master plan in Menifee. Overall, APEP will guarantee that the microgrid controller meets the (IEEE 2030.7) national standards that advanced from prior research achieved by APEP for the DOE utilizing the UCI Microgrid as a platform for both demonstration and development.

- However, high implementation costs may hinder market growth. These systems require constant maintenance and need skilled workers to troubleshoot technical issues. These factors impede market growth.

- The COVID-19 outbreak had mixed impacts on the microgrid control systems market. The outbreak caused supply chain disruptions and project delays in the early stages. Subsequently, increased focus on resilient energy infrastructure and remote energy management has accelerated adopting and investing in microgrid control systems.

Microgrid Control System Market Trends

Utilities Segment Accounts for a Significant Share in the Market

- Microgrids allow an efficient and dynamic electricity grid by adapting to the growing use of renewable energy sources, such as photovoltaic equipment and electric vehicles. Additionally, reducing energy loss in transmission and distribution further increases the electricity delivery system's efficiency by using Local Energy Resources to serve households' needs.

- As per the U.S. Department of Energy, microgrids will be essential building blocks for a new electricity delivery system by 2035 to ensure resilience, decarbonization, and affordability.

- In March 2023, Volvo Penta partnered with Utility Innovation Group, a decentralized microgrid systems leader in the battery energy storage sector. Both companies cooperate to improve power grid reliability and resilience through battery storage and integration, maximizing renewable energy sources use, including solar and wind.

- Moreover, in January 2023, California utility PG&E created an energy storage microgrid, which has a long duration by combining green hydrogen and batteries, in collaboration with Energy Vault, the firm known for its gravity-based solution. The two firms are partnering to operate and deploy utility-scale battery and green hydrogen energy storage systems.

- As demand for electricity increases, electric power companies are looking at alternative energy sources and have integrated a more decentralized energy source. In managing such complex and decentralized energy networks, optimizing electrical flows to help integrate renewable energies seamlessly and microgrid control systems are essential. According to the EIA, in 2022, electricity generation from electrical utilities in the U.S. increased slightly compared with the preceding year by about 2,537 terawatt hours.

North America Accounts for a Significant Share in the Market

- The increase in renewable energy and distributed generation systems is anticipated to drive the market during the forecast period. The traditional grid market is under increasing pressure. At the same time, its aging infrastructure requires significant overhauls. The US EPA (Environmental Policy Agency) has imposed unprecedented greenhouse gas regulations, further driving the integrated renewable energy microgrid control systems market.

- Moreover, developments by market players in the region are expected to drive the market. For instance, in May 2023, Schneider Electric, a leader in the automation and energy management digital transformation, announced that EcoStruxure Microgrid Flex is an industry-first designed to significantly reduce project cycle times and achieve higher returns throughout the project lifecycle, announced an innovative standardized microgrid solution about investing in in-house systems. Distributed energy resources are estimated to account for 40% of U.S. electricity generation by 2050, increasing the microgrids demand to meet that need. Microgrid systems need significant engineering time and focused attention to configure, plan, and deploy the system.

- In October 2022, ENGIE North America (ENGIE) announced that it had expanded its microgrid offering with state-of-the-art equipment for the Santa Barbara Unified School District. Power and safety outages have become the new normal in California, putting communities under tremendous pressure to mitigate and adapt their immediate impact.

- The rising governmental support in the form of funding and state-level resiliency programs has increased the demand from institutions or campus applications, making it a key driver for U.S. market growth. For instance, in May 2023, the U.S. Department of Energy (DOE) announced USD 34 million in funding to advance clean energy technologies in 18 Native American and Indigenous communities in Alaska. The funds will empower tribal communities by increasing access to microgrids and solar power, powering non-electrified tribal buildings, and increasing energy security and resilience.

- The drop in energy storage prices is expected to lower the cost of integrating renewable energy. This factor is also expected to drive the adoption rate of Microgrids in larger communities and commercial and industrial sectors.

Microgrid Control System Industry Overview

The Microgrid Control Systems Market is moderately fragmented due to the large initial investments required to start a firm in the market. Some of the major companies in the market include ABB Group, Siemens AG, Hitachi Ltd, Eaton Corporation PLC, Princeton Power Systems, General Electric Corporation, Pareto Energy Ltd, Honeywell International Inc., Northern Power Systems Corporation, and Exelon Corporation, among others. Some key recent developments in the market include:

In March 2023, Siemens Canada partnered with Humber College to develop a Renewable Technology and Sustainable Microgrid Lab (SMART Lab) at its North Campus. Humber's investments in the SMART Lab are based upon sustainable digital technology, supported by the Province of Ontario. To generate and distribute energy locally and to allow for more efficient and sustainable use and consumption of electricity, devices such as electric vehicle charging stations, solar Smartflower, and battery energy storage systems will be used in the microgrid control system.

In March 2023, ABB invested in Direct Current microgrid start-up Direct Energy Partners to accelerate energy transformation. Direct Current (DC) energy networks will be crucial to the evolution of the energy industry, and this partnership enhances ABB's technological leadership in a significant future growth market. Direct Energy Partners' software platform automates the design and sourcing processes for DC Microgrids.

In August 2022, Engineering and management consulting firm Tetra Tech was implementing a 300kW future Microgrid for Oldham Council in Greater Manchester. ABB announced the delivery of electrical distribution and control systems for it. The project's initial phase, scheduled to be finished by the spring of 2023, was to incorporate solar photovoltaic panels, a 500kVA grid connection, EV charging stations, and the energy needs of an office building as heating provided by an air source heat pump.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Backup Solutions (For Support, In Case Of Emergency Blackouts)

- 5.1.2 Growing Need to Improve Operational Efficiency

- 5.2 Market Restraints

- 5.2.1 High Implementation Costs and Operational and Technical Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Grid-connected

- 6.1.2 Off-Grid

- 6.1.3 Hybrid

- 6.2 By Application

- 6.2.1 Utilities

- 6.2.2 Cities and Municipalities

- 6.2.3 Defense

- 6.2.4 Industrial

- 6.2.5 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 Siemens AG

- 7.1.3 Hitachi, Ltd

- 7.1.4 Eaton Corporation PLC

- 7.1.5 Princeton Power Systems

- 7.1.6 General Electric Corporation

- 7.1.7 Pareto Energy, Ltd

- 7.1.8 Honeywell International, Inc.

- 7.1.9 Northern Power Systems Corporation

- 7.1.10 Exelon Corporation