|

市场调查报告书

商品编码

1444823

网路流量分析 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)Network Traffic Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

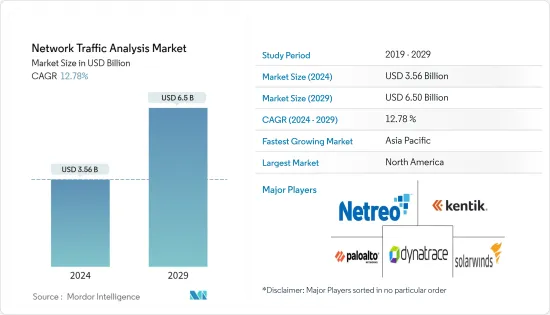

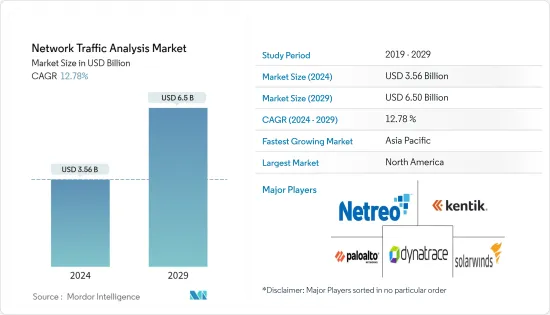

网路流量分析市场规模预计到 2024 年为 35.6 亿美元,预计到 2029 年将达到 65 亿美元,在预测期内(2024-2029 年)CAGR为 12.78%。

公司使用网路流量分析来改善网路管理并加强其安全协议,这正在推动跨行业的市场。

主要亮点

- 网路管理员目前面临着一个动态环境,其中系统应用程式、分散式基础设施、虚拟化和云端服务数量的不断增加对稳定性和改进网路管理产生了巨大的需求。因此,对在设备/系统和网路层级上提供增强的通讯可视性以及对网路应用程式的控制的工具的需求已变得至关重要。这种控制有助于缩短网路问题发生和解决之间的时间、监控网路容量消耗、主动避免网路和应用程式问题,同时确保更高的网路安全性。

- 云端流量的增加导致人们对跨企业网路安全的担忧增加,从而推动了管理分散式阻断服务 (DDoS) 攻击和维护体验品质 (QoE) 的需求。由于资料中心和共享储存解决方案数量的增加,全球网路基础设施的成长推动了网路流量分析市场。

- 随着攻击性质的不断演变,许多技术专家估计,基于网路的微漏洞可能足够小,甚至可以逃避有史以来最先进的侦测系统。众所周知,与端点和沙箱解决方案相比,部署网路流量分析解决方案可提供快速的投资回报。这些因素使得该市场成为企业安全团队不断成长的投资领域。

- 每个工具都有不同的分析方法,分析所需的资料可能因工具和工具类别而异。过去研究的数据对新的分析方法有一定帮助。对于资料收集,需要预算足够的资源,这有时超出了公司的承受能力并限制了市场采用率。

- 在 COVID-19 爆发期间,员工和其他利害关係人开始远距工作,从而给组织的网路安全风险管理带来了更大的压力。在家工作政策造成的另一个重要压力来源是缺乏加强和增强网路能力的准备时间。

网路流量分析市场趋势

BFSI 产业预计将占据重要市场份额

- 由于该行业所服务的客户群庞大,并且有广泛的网路框架和关键资料的支持,BFSI 行业面临着多次资料外洩和网路攻击。人们对线上和行动银行业务的日益增长的倾向增加了这些网路攻击和资料外洩的可能性,从而鼓励银行和其他金融机构使用网路流量监控工具。

- 埃森哲的一项调查显示,提供金融服务的公司每年平均因资料外洩造成的损失已增加至 1,850 万美元。它极大地影响了公司的声誉,从而推动了 BFSI 行业市场,因为金融机构在其营运中优先使用网路流量分析工具。

- 此外,从行动应用程式到柜员热线再到贷款发放,整个客户旅程中都存在安全风险。由于行动银行的广泛使用,客户希望随时存取其银行业务,而根据 ImmuniWeb 的数据,92% 的行动银行应用程式至少存在一个中等风险的安全问题,这为市场创造了机会,因为其在安全管理中的应用。

- 由于新兴经济体银行数位化趋势不断增强,透过线上入口网站使用银行和金融服务的人数正在迅速增加。这可能会增加其平台上的流量,因此这些机构必须持续监控和分析流量,以便更好地为消费者服务。

- 例如,2023 年1 月,全球开源解决方案供应商红帽公司为红帽OpenShift 增加了额外的安全性和合规性功能,其中包括Network Observability Operator,提供可观察的网路流量测量、流量、拓扑和追踪以便更深入地了解网路流量。由于营运商可以帮助解决连接困难并更轻鬆地发现网路瓶颈,因此红帽 OpenShift 丛集可以从增强的网路效能最佳化中受益,这可以在 BFSI 行业中使用,将其工作负载扩展到云端。

北美占有重要的市场份额

- 由于美国和加拿大等两大经济体的存在,北美成为许多全球科技公司、资料中心营运商和服务供应商的中心。所有联盟部门对 NTA 的需求是由部署先进网路功能和关键通讯网路的运作所驱动的。支撑该地区在所研究的市场中占据主导地位的另一个因素是该地区市场供应商的存在,这增加了该地区所服务的直接销售和国际市场销售的比例。

- 政府的措施也有助于促进市场的成长。例如,在公用事业产业,美国政府强制采用北美电力可靠性公司关键基础设施保护(NERC CIP)第5版作为网路安全标准。相比之下,医疗保健产业遵守 HIPPA 保护资料的要求。

- 网路流量分析工具采用先进的自学习技术,在危险檔案感染或窃取资料之前追踪并找到它们。该工具可以透过使用人工智慧和机器学习技术更有效地处理和检查资料,这正在推动北美市场的采用,因为该地区各行业的资料隐私洩露事件不断增加。

- 根据身分盗窃资源中心发布的研究,2021 年美国发生了 1862 起资料外洩事件,这一数字比 2020 年的 1108 起增加了 68%,超过了 2017 年 1506 起资料外洩的历史最高记录。网路安全当局预测,这一数字将持续增加,直到2023 年及以后,迫使地区公司将网路流量分析工具整合到其业务中。

- 医疗保健、金融、商业和零售是最常受到攻击的行业,因为它们每年影响数百万美国人。例如,2022 年 4 月,美国行动支付服务公司 Cash App 发生了超过 800 万客户的资料外洩事件。

网路流量分析产业概述

网路流量分析市场竞争适中,由几个主要参与者组成。然而,随着先进安全系统的发展,许多公司正在透过获得新合约来扩大其市场份额。

2022 年 1 月,SolarWinds 收购了联邦服务提供者 Monalytic,这是一家监控、分析和专业服务公司。此次收购将为 SolarWinds 联邦客户提供全天候支持,透过将该公司的 IT 管理产品与在最安全的环境中工作的 Monalytic 熟练专业人员相结合,帮助优化和保护其动态 IT 环境。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- 产业价值链分析

- COVID-19 对市场的影响评估

第 5 章:市场动态

- 市场驱动因素

- 网路流量分析的出现成为网路安全的关键

- 对更高存取速度的需求不断增加

- 市场挑战

- 网路威胁的本质迅速演变

第 6 章:市场细分

- 按部署

- 本地部署

- 基于云端

- 按最终用户垂直领域

- BFSI

- 资讯科技和电信

- 政府

- 能源与电力

- 零售

- 其他最终用户垂直领域

- 地理

- 北美洲

- 欧洲

- 亚太

- 拉丁美洲

- 中东和非洲

第 7 章:竞争格局

- 公司简介

- Netreo Inc.

- Dynatrace LLC

- Kentik Technologies Inc.

- Palo Alto Networks Inc.

- IpswITCh Inc. (Progress Software Corporation)

- ManageEngine (Zoho Corp. PVT. LTD)

- Flowmon Networks AS

- GreyCortex SRO

- Genie Networks Ltd

- Netscout Systems Inc.

- SolarWinds Corporation

第 8 章:投资分析

第 9 章:市场的未来

The Network Traffic Analysis Market size is estimated at USD 3.56 billion in 2024, and is expected to reach USD 6.5 billion by 2029, growing at a CAGR of 12.78% during the forecast period (2024-2029).

Network traffic analysis is used by companies to improve network management and strengthen their security protocols, which is driving the market across industries.

Key Highlights

- Network administrators currently face a dynamic environment wherein the rising number of system applications, distributed infrastructure, virtualizations, and cloud services have created considerable demand for stability and improved administration of networks. Thus, the need for tools to provide enhanced visibility in communication at both the device/system and network levels and control over network applications has become paramount. This control helps reduce the time between the occurrence and resolution of a network issue, monitor network capacity consumption, and proactively avoid network and application problems while ensuring greater network security.

- Increasing cloud traffic resulted in increased concerns about network security across businesses, thus driving the need to manage distributed denial-of-service (DDoS) attacks and maintain the quality of experience (QoE). The global growth in network infrastructure, owing to the increasing number of data centers and shared storage solutions, drives the network traffic analysis market.

- With the evolving nature of the attacks, many technology experts estimate that the network-based micro-breaches may be small enough to evade even the most advanced detection systems ever built. It is also known that deploying network traffic analysis solutions provides a rapid ROI compared to the endpoint and sandbox solutions. These factors have been instrumental in making the market a growing investment area for enterprise security teams.

- Each tool has a different analytical methodology, and the data required for analysis might vary significantly from tool to tool and within tool categories. Data from past studies are marginally helpful in new analytical methods. For data collecting, it is necessary to budget for adequate resources, which is sometimes more than the companies' affordability and limiting the market adoption rate.

- During the COVID-19 outbreak, employees and other stakeholders began remote work, thus created increased pressure on an organization's cybersecurity risk management. Another significant source of stress being created by work-from-home policies is no lead time for reinforcing and enhancing network capabilities.

Network Traffic Analysis Market Trends

BFSI Sector is Expected to Hold a Significant Market Share

- The BFSI sector faces several data breaches and cyber-attacks due to the large customer base that the industry serves, which is supported by the presence of an extensive networking framework and critical data. People's rising propensity for online and mobile banking has raised the possibilities of these cyber-attacks and data breaches, encouraging banks and other financial institutions to use network traffic monitoring tools.

- According to a survey by Accenture, the average annualized cost of data breaches for companies offering financial services has increased to USD 18.5 million. It significantly impacts a company's reputation, which drives the BFSI sector market because financial institutions prioritize using Network Traffic analysis tools in their operations.

- Additionally, security risks are present throughout the whole customer journey, from mobile apps to the teller line to loan origination. Due to the widespread use of mobile banking, customers expect all-time access to their banking, and 92% of mobile banking apps, according to ImmuniWeb, have at least one medium-risk security issue, which is creating an opportunity for the market because of its applications in security management.

- The utilization of banking and financial services through online portals is increasing rapidly, owing to the increasing digitization trend in banks across emerging economies. This may boost the traffic on their platforms, making it essential for these institutions to continuously monitor and analyze the traffic, enabling them to serve their consumers better.

- For instance, in January 2023, Red Hat, Inc, a provider of open source solutions worldwide, added additional security and compliance features for Red Hat OpenShift, which includes the Network Observability Operator, provides observable network traffic measurements, flows, topology, and tracing for a deeper understanding of network traffic. Because the operator helps fix connectivity difficulties and makes it simpler to discover network bottlenecks, Red Hat OpenShift clusters could be benefited from increased network performance optimization, which can be used across the BFSI industries to scale their workload into the cloud.

North America Holds Significant Market Share

- North America is the hub of many global technology companies, data center operators, and service providers due to the existence of 2 major economies, including the USA and Canada. The requirement for NTAs across all allied sectors is driven by deploying advanced network capabilities and the operation of critical communication networks. Another factor bolstering the region's dominance in the market studied is the presence of market vendors in the region, which has increased the proportion of direct sales and the sales of the international markets served by this region.

- Government initiatives have also been instrumental in aiding the market's growth. For instance, in the utility industry, the US government mandated the adoption of version 5 of the North American Electric Reliability Corporation Critical Infrastructure Protection (NERC CIP) as the cybersecurity standard. In contrast, the healthcare industry abides by HIPPA requirements for securing data.

- Advanced self-learning technology is used in a network traffic analysis tool to track and find dangerous files before they can infect or steal data. The tool can handle and examine data more efficiently by using artificial intelligence and machine learning technology, which is driving market adoption in North America because the region has witnessed a growth in data privacy breaches across industries.

- According to research published by the Identity Theft Resource Center, a record of 1862 data breaches happened in the US in 2021. This number increased by 68% over the 1108 breaches in 2020 and surpassed the previous high of 1506 breaches in 2017. Additionally, many cybersecurity authorities predict that this number will continue to increase until 2023 and beyond, forcing regional companies to integrate Network Traffic Analysis tools into their businesses.

- Healthcare, finance, business, and retail are among the most frequently attacked sectors since they impact millions of Americans annually. For example, in April 2022, Cash App, a mobile payment service company in the USA, underwent a data breach recorded for over 8 million customers.

Network Traffic Analysis Industry Overview

The network traffic analysis market is moderately competitive and consists of several major players. However, with the advanced security system's growth, many companies are increasing their market presence by securing new contracts.

In January 2022, SolarWinds acquired federal services provider, Monalytic, a monitoring, analytics, and professional services company. This acquisition would provide SolarWinds federal customers with round-the-clock support to help optimize and secure their dynamic IT environments by combining the company's IT management products with Monalytic's skilled professionals who work in the most secure environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Network Traffic Analysis as the Key to Cyber Security

- 5.1.2 Increasing Demand for Higher Access Speed

- 5.2 Market Challenges

- 5.2.1 Rapidly Evolving Nature of Cyber Threats

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 IT and Telecom

- 6.2.3 Government

- 6.2.4 Energy and Power

- 6.2.5 Retail

- 6.2.6 Other End-user Verticals

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Netreo Inc.

- 7.1.2 Dynatrace LLC

- 7.1.3 Kentik Technologies Inc.

- 7.1.4 Palo Alto Networks Inc.

- 7.1.5 IpswITCh Inc. (Progress Software Corporation)

- 7.1.6 ManageEngine (Zoho Corp. PVT. LTD)

- 7.1.7 Flowmon Networks AS

- 7.1.8 GreyCortex SRO

- 7.1.9 Genie Networks Ltd

- 7.1.10 Netscout Systems Inc.

- 7.1.11 SolarWinds Corporation