|

市场调查报告书

商品编码

1444860

小蜂窝网路 - 市场份额分析、行业趋势与统计、成长预测(2024 - 2029 年)Small Cell Networks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

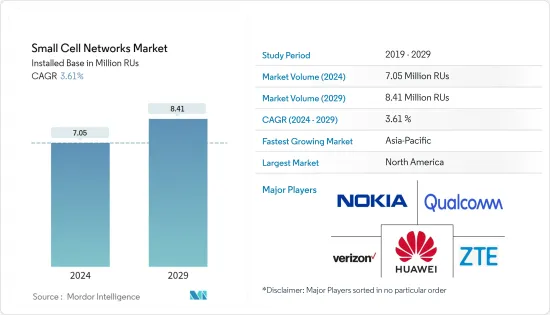

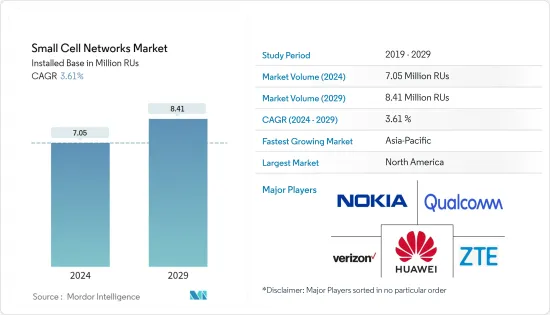

以安装基数计算的小蜂巢网路市场规模预计将从 2024 年的 705 万 RU 成长到 2029 年的 841 万 RU,预测期间(2024-2029 年)CAGR为 3.61%。

由于消费者对快速行动资料连线的需求突然增长,下一代无线接取网路的部署已经扩大。小型蜂窝网路安装正在扩展到商业、住宅和工业应用,以便以更低的成本提供更好的覆盖范围。

主要亮点

- 不断增长的行动资料流量促使电信公司转向网路緻密化,以便为大众消费者提供高速容量。由于智慧城市的兴起,特别是在美国、加拿大、新加坡、英国、德国、义大利和法国等已开发经济体,越来越多的小型蜂巢 5G 网路正在建立用于住宅、商业、政府和工业用途。

- 此外,快速成长的智慧家庭和互联物联网设备以不同的方式塑造了对互联网的需求。一些智慧家庭功能,例如控制供水、监控电力以及语音启动安全系统,只是连网设备功能的开始。为了获得无缝体验,这些设备需要始终高速连接到网路。

- 使用者行为统计数据表明,室内使用者连线越来越多地使用传统的短距离免许可频谱技术,例如 Wi-Fi。此类设备主要应用于室内场景,有利于启动汇聚频谱。因此,透过小型蜂窝网路进行频谱融合可以更有效地进行网路规划和利用未经许可的频谱范围。此外,小型基地台製造商正在观察室内应用的实施情况增加。例如,爱立信与中国联通合作,在北京500多栋商业和住宅建筑部署了Radio Dot系统。

- 几个重要国家正在大力投资主要电信业者部署虚拟化小型蜂窝 5G 网路基础设施。例如,Mavenir宣布于2022年9月为企业和公共区域推出高容量5G小型基地台室内独立覆盖。5G小型基地台的多功能性允许分散式和集中式端对端开放无线电存取网路(ORAN) )架构。该公司的ORAN 技术为製造、零售、公共场所和仓库的最终客户提供大容量、易于部署且经济实惠的解决方案。

- 世界仍在从新冠肺炎 (COVID-19) 的影响中恢復,互联网的广泛使用表明需要全新的资料传输速率。由于缺乏网路基础设施,远距医疗、线上教育和电话会议最近针对在家工作概念的调整必须解决。据 ASSIA, Inc. 称,由于 COVID-19 大流行,美国自 3 月初以来 PC 和智慧型手机上传流量增加了 80%,网路摄影机、笔记型电脑和 PC 一直在运行视讯串流。

小型蜂窝网路市场趋势

IT 和电信产业预计将在市场格局中占据重要份额。

- 不断增长的行动资料流量需要先进的电信网路。 5G 的部署将以所需的效率促进资料使用量的成长。最新的网路发展需求预计将在预测期内推动小型蜂窝 5G 网路市场的发展。

- 在现代环境中,连接设备数量的增加需要增加频宽。例如,据思科系统公司称,预计到 2030 年将有 5,000 亿台设备连接到网际网路。此外,5G 电信公司正专注于在低频段部署小型基地台,为客户提供更高的频宽服务。

- 此外,行动资料流量呈指数级增长,主要是由具有数据功能的设备和高频宽应用程式 (APP) 推动的。沃达丰、AT&T、软银和其他大型营运商已经利用其宏网路透过实施小型基地台解决方案来创造差异化。例如,Verizon 在美国多个城市部署了小型基地台,包括纽约、芝加哥、亚特兰大和旧金山。

亚太地区预计将在预测期内保持最快的成长率

- 由于行动装置的普及和各种供应商合作伙伴关係的增加,以及电信公司引入和加强 5G 基础设施,亚太地区将呈现最快的成长速度。例如,去年1月,爱立信与高通和亚太电信(APT)合作,完成了台湾首个5G新无线电双连接(NR-DC)资料呼叫,收集了APT在中频段(2.6 GHz)的频谱持有量)和高频段(28 GHz 或毫米波)频率。这项试验对于台湾向 5G 独立网路的过渡至关重要,带来了一些新的机会和应用。此类测试描绘了 5G 小型基站在为其提供基础设施方面将成为电信业未来的前景。

- 亚太地区不断增长的行动资料流量将有力地支持小型蜂窝网路产业。例如,去年 1 月,Datareportal 报告称全球网路使用者数量为 49.5 亿。此外,根据思科估计,到今年年底,该地区预计将拥有 26 亿网路用户。当我们将两个消息来源所述的事实联繫起来时,亚太地区在全球用户的整体份额中占据主导地位。思科也提到,中国在主场总数方面将领先世界,其次是美国和日本。该地区不断增长的行动资料流量将有力地支持小型蜂窝网路产业。

- 去年3月,中兴通讯、AIS和Qualcomm Technologies, Inc.宣布进行全球首个5G NR-DC(新无线电双连接)现场演示,实现下行峰值速度8.5GB/s,上行峰值速度2.17GB /s 在泰国使用单一行动装置。关键频段频率落在 2.6 GHz 和 26 GHz 之间的频谱。此次合作涵盖了 Sub-6 和 5G 毫米波这两个关键 5G 频段,作为提高泰国 5G 网路能力并拓展 5G 应用空间的合作努力的一部分。

- 主要市场参与者之间联盟的最新发展表明小型蜂窝和 5G 电信行业进一步发展的强劲前景,凸显了从 4G 到 5G 的过渡。例如,诺基亚与 TPG Telecom 合作,在即时网路中部署了亚太地区首个即时 Femtocell,使 TPG 的企业客户成为焦点。诺基亚智慧节点的「即插即用」特性在高速 4G 和 5G 连接方面提供了高品质、可靠性和低延迟的交付成果。

小蜂窝网路产业概述

由于诺基亚网路、高通技术公司、思科系统公司和华为科技公司等众多大型竞争对手的存在,小型蜂窝网路产业呈现碎片化。这些公司处于激烈的竞争中,并不断尝试改进其产品以获得竞争优势。这些公司还与供应商和技术提供者建立策略合作伙伴关係,以扩大其市场份额。

2022 年 3 月,开放电信解决方案的全球领导者之一 Radisys Corporation 宣布,韩国小型基地台厂商 Qucell Networks 正在利用 Radisys Connect RAN gNodeB 软体为全球市场部署 5G 小型基地台解决方案。全球多家营运商网路正在测试整合商用级5G小基地台解决方案。大型企业之间的全球合作伙伴关係透过共享技术对市场颠覆做出了重大贡献。

2022 年 3 月,O2 和 Telefónica 德国以及 NEC 公司(NEC;TSE:6701)宣布成功推出德国首个基于开放式虚拟 RAN 架构的小型基地台。小型蜂窝服务首先在慕尼黑市中心部署,透过增加这个人口稠密地区当前行动网路的容量来改善客户体验。 NEC 是 Telefónica SA 四个国家的主要係统整合商,也是 NEC 致力于研究如何在不同地区(城市、郊区和农村)针对不同用例部署 Open RAN 架构的主要係统整合商。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 对市场的影响

- 市场驱动因素

- 网路技术和连接设备的演变

- 对行动装置的需求不断增长

- IT 和电信业的成长将推动整体市场

- 市场限制

- 管理网路的需求增加

- 技术简介

- 毫微微蜂窝基地台

- 微微小区

- 微蜂巢

- 都市细胞

- 无线电点系统

第 5 章:市场细分

- 操作环境

- 室内的

- 户外的

- 最终用户产业

- BFSI

- 资讯科技和电信

- 卫生保健

- 零售

- 电力与能源

- 其他最终用户垂直领域

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太

- 中国

- 日本

- 印度

- 澳洲

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

- MEA 的其余部分

- 北美洲

第 6 章:竞争格局

- 公司简介

- Nokia Networks

- American Tower Corporation

- Qualcomm Technologies Inc.

- ZTE Corporation

- Huawei Technologies Co. Ltd

- Verizon Wireless

- Airvana Inc. (CommScope Inc.)

- Cisco Systems Inc.

- Qucell Inc.

- Telefonaktiebolaget LM Ericsson

- AT&T Inc.

- Cirrus Core Networks

- Airspan Networks Inc.

第 7 章:投资分析

第 8 章:市场的未来

The Small Cell Networks Market size in terms of installed base is expected to grow from 7.05 Million RUs in 2024 to 8.41 Million RUs by 2029, at a CAGR of 3.61% during the forecast period (2024-2029).

The deployment of the next-generation radio access network has expanded due to consumers' suddenly rising need for fast mobile data connectivity. Small cell network installation is expanding across commercial, residential, and industrial applications to offer better coverage at a lower cost.

Key Highlights

- Rising mobile data traffic has caused telecom companies to move toward network densification to provide mass consumers with high-speed capacity. Due to the rise of smart cities, especially in developed economies like the U.S., Canada, Singapore, the UK, Germany, Italy, and France, more small cell 5G networks are being set up for residential, commercial, government, and industrial use.

- Further, the rapidly growing smart home and connected IoT devices shape the need for the internet differently. Several smart home features, like controlling the water supply, keeping an eye on the electricity, and having voice-activated security systems, are just the beginning of what connected devices can do. For a seamless experience, these devices need to be connected to the internet all the time and at a high speed.

- Statistics on user behavior have indicated that indoor user connections increasingly use traditional short-range unlicensed spectrum technologies, like Wi-Fi. Such devices are mainly applied to indoor scenarios, which makes them beneficial for starting the convergence spectrum. Thus, spectrum convergence through a small cell network allows for network planning and utilizing the unlicensed spectrum range more efficiently. Moreover, manufacturers of small cells are observing an increased implementation among in-building applications. For example, Ericsson collaborated with China Unicom to deploy the Radio Dot System at over 500 commercial and residential buildings in Beijing.

- Several significant countries are investing heavily in the deployment of virtualized small cell 5G network infrastructure by major telecom providers. For instance, Mavenir announced the introduction of high-capacity 5G small cell in-building independent coverage for businesses and public areas in September 2022. The 5G small cell's versatility allows for both distributed and centralized end-to-end open radio access network (ORAN) architectures.The company's ORAN technology provides end customers in manufacturing, retail, public spaces, and warehouses with a high-capacity, simple-to-deploy, and affordable solution.

- The world is still recovering from COVID-19 and has extensive internet usage, indicating the need for a whole new scale of data transfer rates. Recent adaptations of telemedicine, online education, and teleconferencing for work-from-home concepts must be fixed due to a lack of internet infrastructure. According to ASSIA, Inc., due to the COVID-19 pandemic, there was an 80% increase in PC and smartphone upload traffic since the beginning of March in the United States, with webcams, laptops, and PCs running video streams all the time.

Small Cell Networks Market Trends

IT and Telecom Sectors Expected to have Significant Share in the Market Landscape.

- The increasing mobile data traffic demands advanced telecommunication networks. The deployment of 5G will facilitate the growing data usage with the required efficiency. The latest network development needs are expected to boost the market for small cell 5G networks over the forecast period.

- In the modern environment, the increased number of connected devices creates the need for increased bandwidth. For instance, according to Cisco Systems Inc., 500 billion devices are expected to be connected to the internet by 2030. Furthermore, 5G telecom companies are focusing on deploying small cells in low-frequency bands to provide customers with increased bandwidth services.

- Also, mobile data traffic is growing exponentially, primarily driven by data-capable devices and high-bandwidth applications (APPs). Vodafone, AT&T, Softbank, and other big operators have already leveraged their macro networks to create differentiation by implementing small-cell solutions. For instance, Verizon has deployed small cells in several U.S. cities, including New York, Chicago, Atlanta, and San Francisco.

Asia-Pacific Expected to Hold the Fastest Growth Rate over the Forecast Period

- Asia-Pacific is set to depict the fastest growth rate because of the increased adoption of mobile devices and various vendor partnerships, with telecom companies introducing and strengthening 5G infrastructure. For example, in January last year, Ericsson, in association with Qualcomm and Asia Pacific Telecom (APT), completed Taiwan's first data call with 5G New Radio Dual Connectivity (NR-DC), collecting APT's spectrum holdings across mid-band (2.6 GHz) and high-band (28 GHz, or mmWave) frequencies. The trial is pivotal in Taiwan's transition to 5G standalone networks, opening several new opportunities and applications. Tests like these portray the scope for 5G small cells to be the future of the telecom industry when it comes to providing infrastructure for the same.

- Asia Pacific's constantly increasing mobile data traffic will strongly support the small cell network industry. For instance, in January last year, Datareportal reported 4.95 billion internet users worldwide. Also, as estimated by Cisco, the region is expected to have 2.6 billion internet users by the end of the year. As we correlate the facts stated by the two sources, Asia-Pacific dominates the overall share of users worldwide. Cisco also mentioned that China would lead the world in terms of the total number of home spots, followed by the US and Japan. The region's constantly increasing mobile data traffic will strongly support the small cell network industry.

- In March last year, ZTE, AIS, and Qualcomm Technologies, Inc. announced the world's first 5G NR-DC (New Radio Dual Connectivity) field demonstration, achieving a peak downlink speed of 8.5 GB/s and a peak uplink speed of 2.17 GB/s with a single mobile device in Thailand. The key band frequencies fell in the spectrum between 2.6 GHz and 26 GHz. This collaboration incorporates two critical 5G frequency bands, Sub-6 and 5G mmWave, as part of the cooperative effort to improve Thailand's 5G network's capabilities and expand the 5G application space.

- Recent developments through alliances among chief market players indicate the strong prospects of further development in the small cell and 5G telecom industries, highlighting the transition from 4G to 5G. For instance, in association with TPG Telecom, Nokia placed Asia-Pacific's first live Femtocell in a live network, keeping TPG's enterprise customers in focus. The "plug and play" nature of the Nokia Smart Node provides high quality, reliability, and low latency deliverables in terms of high-speed 4G and 5G connectivities.

Small Cell Networks Industry Overview

The small cell network industry is fragmented because of numerous large competitors such as Nokia Networks, Qualcomm Technologies Inc., Cisco Systems Inc., and Huawei Technologies Co. Ltd. The companies are in intense competition and are constantly attempting to improve their products to acquire a competitive advantage. The corporations are also forming strategic partnerships with vendors and technology providers to expand their market share.

In March 2022, Radisys?iR) Corporation, one of the global leaders in open telecom solutions, announced that Qucell Networks, a Korean small cell player, is deploying 5G small cell solutions for global markets leveraging Radisys' Connect RAN gNodeB software. Multiple operators' networks worldwide are testing the integrated commercial-grade 5G small-cell solution. Global partnerships among big players have contributed significantly to market disruption by sharing technologies.

In March 2022, O2 and Telefónica Germany and NEC Corporation (NEC; TSE: 6701) announced the successful launch of Germany's first open and virtual RAN architecture-based small cells. The small cell service was first deployed in Munich's city center to improve the customer experience by adding capacity to the current mobile network in this densely populated location. NEC is the primary system integrator for Telefónica S.A.'s four nations and for NEC's effort to investigate how Open RAN architecture may be deployed in various geographies (urban, suburban, and rural) for various use cases.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Evolution of Network Technology and Connectivity Devices

- 4.5.2 Rising Demand for Mobile Devices

- 4.5.3 Growth in IT and Telcom Sector to drive the overall market

- 4.6 Market Restraints

- 4.6.1 Increased Need for Managing Network

- 4.7 Technology Snapshot

- 4.7.1 Femtocell

- 4.7.2 Picocell

- 4.7.3 Microcell

- 4.7.4 Metrocell

- 4.7.5 Radio Dot Systems

5 MARKET SEGMENTATION

- 5.1 Operating Environment

- 5.1.1 Indoor

- 5.1.2 Outdoor

- 5.2 End-user Industry

- 5.2.1 BFSI

- 5.2.2 IT and Telecom

- 5.2.3 Healthcare

- 5.2.4 Retail

- 5.2.5 Power and Energy

- 5.2.6 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of APAC

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of Latin America

- 5.3.5 Middle East & Africa

- 5.3.5.1 UAE

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of MEA

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nokia Networks

- 6.1.2 American Tower Corporation

- 6.1.3 Qualcomm Technologies Inc.

- 6.1.4 ZTE Corporation

- 6.1.5 Huawei Technologies Co. Ltd

- 6.1.6 Verizon Wireless

- 6.1.7 Airvana Inc. (CommScope Inc.)

- 6.1.8 Cisco Systems Inc.

- 6.1.9 Qucell Inc.

- 6.1.10 Telefonaktiebolaget LM Ericsson

- 6.1.11 AT&T Inc.

- 6.1.12 Cirrus Core Networks

- 6.1.13 Airspan Networks Inc.