|

市场调查报告书

商品编码

1687744

AIOps:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)AIOps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

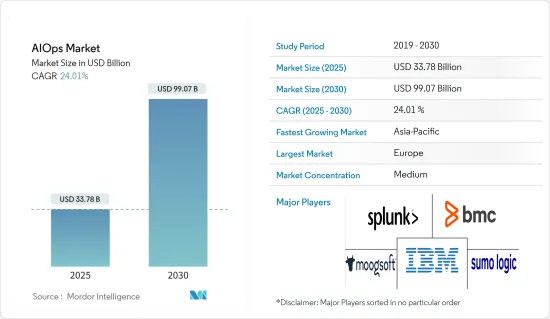

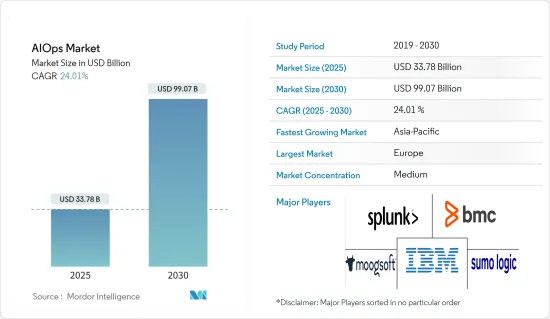

预计 2025 年 AIOps 市场规模为 337.8 亿美元,到 2030 年将达到 990.7 亿美元,预测期间(2025-2030 年)的复合年增长率为 24.01%。

随着越来越多的人在家工作,并且公司实施在家工作(WFH) 政策,资讯安全的重点已从企业基础设施转移到云端和虚拟基础设施。

关键亮点

- DevOps 专业人员被大量警报、大量 IT 噪音以及跨多种技术的信号所淹没。同时,企业越来越需要提高IT基础设施的效能并更准确、更快速地管理事件。

- 随着企业意识到人工智慧如何应对挑战并协助 IT 运营,他们正在转向基于人工智慧的解决方案。此外,随着在家工作人数的增加,AIOps 行业可能会进一步成长。根据世界经济论坛统计,美国员工在家工作的天数从2021年1月的每週1.58天增加到去年6月的每週2.37天。

- 此外,随着装置智慧化,网路变得更加复杂,资料量也不断增加,推动了 AIOps 的采用。全球范围内云端运算的使用日益增长也推动着许多业务的自动化。随着越来越多的企业转向云端,对 AIOps 平台的需求预计将会激增。

- IT 营运管理 (ITOM) 产业已经对基于 SaaS 的 ITOM 的出现做出了反应。事实证明,SaaS 作为 IT 帮助台和基础设施监控的交付模式是有益的。这些解决方案通常透过收购的 SaaS 供应商整合日誌管理、网站监控、伺服器监控和云端管理。然而,认知度低是预测期内限制市场成长的主要问题之一。

- 由于各企业增加在家工作政策,新冠疫情刺激了包括人工智慧在内的下一代技术领域的市场成长。例如,LogMeIn, Inc.(美国)是一家基于云端和 SaaS 的远端连线和客户互动服务供应商,在疫情爆发期间,其整个服务组合的新註册量均显着增长。

- 资料安全是许多企业关注的问题,因为骇客攻击、网路钓鱼、网路身分窃盗和勒索软体攻击等网路犯罪在世界各地呈上升趋势,造成业务中断和财务损失。 gov.uk 去年的一项民意调查发现,39% 的英国企业在过去 12 个月内遭受网路攻击,这与前几年的调查结果一致。此外,即使是小型企业也越来越接受自动化技术,这有助于基于人工智慧的平台的部署,预计这将推动 AIOps 市场的成长。

AIOps市场趋势

BFSI 预计将占很大份额

- 银行业务涉及员工、客户和外部机构进行的许多常规和非常规活动和交易。这些活动的复杂性使得监控至关重要。 AIOps 提供即时资讯和自动化问题解决方案,预计将在预测期内推动市场成长。 CA Technology 的 AIOps 平台,即 CA Digital Experience Insights,使金融机构能够解决包括效能、容量和配置问题在内的复杂 IT 问题。

- 银行和其他金融机构非常重视保护其产生的资料,主要是因为过去几年发生了多起资料外洩事件。

- 许多银行和其他金融机构正在转向 AIOps 来提高效率。例如,印度一家中央银行旨在提高其数位商家入职流程的成功率,并简化和简化新客户的交易。 QualityKiosk 基于 AIOps 的分析解决方案 AnaBot 透过更好地处理国内和美国交易,使收益增加了 7%,并提高了商家入职成功率。

- 根据 BAE 系统应用情报公司的数据,美国和英国近四分之三(74%)的金融机构遭遇了网路犯罪的增加。除了可察觉的金钱损失之外,网路犯罪还会对企业造成严重的财务影响,包括股价暴跌、声誉受损和法律诉讼。 AIOps 可以帮助防御这些犯罪。 AIOps 解决方案提供全天候监控、可疑活动侦测和防御措施以保护易受攻击的系统。

- 此外,人工智慧与金融机构营运服务的整合增强了服务台系统的内建功能。这为高阶管理层提供了所需的监控和关键绩效指标,以便在业务趋势对现有产品和流程产生不利影响之前了解这些趋势。

欧洲经济强劲成长

- 欧洲 AIOps 市场成长的关键原因之一是该地区的 MSP 希望为正在进行大规模数位转型并需要现代营运解决方案的企业提供全面的服务。

- 该地区的公司正在采取各种策略来赢得竞争。例如,总部位于英国的 Micro Focus 去年 10 月宣布,其 Operations Bridge 在「研究行动 (RIA) 供应商评估矩阵」调查的 AIOps 平台类别中被评为领导者。除了这项荣誉之外,Micro Focus 还宣布了两款新的 SaaS 解决方案:Operations Bridge Reports 和 Cloud Observability。

- 此外,据报道,IT/技术部门最常采用人工智慧,占 47%,其次是研发部门,占 36%,客户服务部门占 24%。这意味着人工智慧在 IT业务领域变得越来越重要。

- 政府在提高日常业务中对人工智慧的认识方面发挥着重要作用。透过宣布人工智慧为关键战略重点,一些成员国和欧盟机构正在采取措施推进该地区在人工智慧领域的领导地位。这包括致力于制定国家和欧盟层面的人工智慧战略文件,促进研发和创新,并探索新的监管方法来管理人工智慧的发展和使用。

- 此外,欧盟委员会计划透过其「地平线欧洲」和「数位欧洲」计画每年向人工智慧投资 10 亿欧元(10.7 亿美元)。在数位化十年期间,委员会计划吸引来自私营部门和成员国的更多投资,达到每年 200 亿欧元(213.9 亿美元)的投资金额。

- 为了采取合乎道德的方式对待新技术,以获得相对于中国和美国的竞争优势,欧洲最近宣布了一套针对人工智慧开发和使用的严格规则和保障措施。所有「高风险」人工智慧应用在进入市场前都必须接受强制评估。这对于使用 AIOps 处理敏感资料的医疗保健和 BFSI 行业尤其有利。

AIOps产业概览

AIOps市场的主要企业包括Moogsoft Inc.、IBM Corporation、Splunk Inc.、BMC Software Inc.和Sumo Logic Inc.,竞争激烈。他们不断创新产品和服务的能力使他们比市场上的其他参与企业更具竞争优势。这些参与企业可以透过策略伙伴关係、併购和研发活动来占领更大的市场占有率。

- 2022 年 11 月 - 网路智慧供应商 Aprecomm 宣布推出 Aprecomm Virtual Wireless Expert,这是针对 Edgecore ecCloud 控制器的 AIOps 解决方案。据发布消息称,两家公司联合宣布推出Edgecore Wi-Fi AIOps解决方案,该解决方案将使所有Edgecore Wi-Fi 6网路基地台的用户都能提高网路效能。

- 2022 年 6 月 - HCL Technologies DRYiCE 宣布推出 DRYiCE IntelliOps(IntelliOps),这是一种满足企业对全端 AIOps 和工作流程可观察性需求的解决方案。企业已对先进的数位化计划进行了大量投资,以实现其 IT 环境的现代化并满足消费者对始终在线的数位服务的期望。但仍有一些障碍需要克服。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- IT营运对基于人工智慧的服务的需求不断增长

- 端到端业务保证及增加执行时间

- 市场限制

- IT营运变化加剧

- 市场机会与关键发展

- 小型企业转向云端基础设施

- 各国政府推出人工智慧倡议

- 过去两年发布的 AIOps 工具以及需要考虑的关键 AIOps 平台功能

- 在整个应用程式生命週期中将 AIOps 应用于各种使用案例

- AIOps 的演变和使用案例

第六章 主要用途状况

- 根本原因分析

- 网路可用性和优化

- 分配问题

- 异常检测和网路安全

- 改进的储存管理

第七章市场区隔

- 组织类型

- 中小型企业

- 大型企业

- 扩张

- 本地

- 云/SaaS

- 最终用户产业

- 媒体娱乐

- 资讯科技/通讯

- 零售

- 医疗保健

- BFSI

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章竞争格局

- 公司简介

- Bigpanda Inc.

- BMC Software Inc.

- Broadcom Inc

- Elasticsearch BV

- IBM Corporation

- Logz.Io(Logshero Ltd.)

- Loom Systems Ltd.(Service Now Inc)

- Moogsoft Inc.

- Splunk Inc

- Appdynamics LLC(Cisco Systems Inc)

- Dynatrace LLC

- Extrahop Networks Inc.

- New Relic Inc.

- Resolve Systems LLC

- Stackstate BV

第九章投资分析

第十章:市场的未来

The AIOps Market size is estimated at USD 33.78 billion in 2025, and is expected to reach USD 99.07 billion by 2030, at a CAGR of 24.01% during the forecast period (2025-2030).

With the increase in the number of people working from home, enterprise-instituted work-from-home (WFH) policies shifted information security focus from enterprise infrastructure to cloud and virtualized infrastructure.

Key Highlights

- DevOps professionals are hampered by large amounts of warnings, substantial IT noise, and signals spread across diverse technologies. Meanwhile, companies need to increase IT infrastructure performance and manage events more precisely and quickly is expanding.

- Enterprises are moving toward AI-based solutions as they become more aware of how AI can handle difficulties and assist operating IT operations. Furthermore, the growing number of individuals working from home will likely increase the AIOps industry. According to the World Economic Forum, the number of days US employees work from home climbed from 1.58 per week in January 2021 to 2.37 in June last year.

- Furthermore, as devices gain intelligence, networks have become more complex, and data volumes have increased, boosting AIOps usage. The growing global use of cloud computing is also pushing the automation of many operations. As more businesses transition to the cloud, the need for AIOps platforms is projected to surge.

- The IT Operations Management (ITOM) industry is already reacting to the emergence of SaaS ITOM. SaaS as a delivery model for IT helpdesks and infrastructure monitoring is proven beneficial. These solutions typically incorporate log management, website monitoring, server monitoring, and cloud management from acquired SaaS vendors. However, lack of awareness is one of the significant concerns restraining market growth during the forecast period.

- Due to the increasing work-from-home policy across companies, the COVID-19 outbreak stimulated market growth in next-generation tech sectors, including artificial intelligence. For example, during the outbreak, LogMeIn, Inc. (US), a provider of cloud and SaaS-based remote connection and customer interaction services, substantially increased the number of new sign-ups across all its service portfolios.

- The rising number of cybercrimes, such as hacking, phishing, online identity theft, and ransomware assaults, which cause business disruptions and financial losses worldwide, generated concerns for many companies about their data security. According to a last year's gov.uk poll, 39% of UK firms recognized a cyber assault in the preceding 12 months, consistent with prior years of the study. Furthermore, the increased acceptance of automation technologies in enterprises, even on a small scale, is driving the deployment of AI-based platforms, which is expected to boost AIOps market growth.

AIOps Market Trends

BFSI is Expected to Hold Significant Share

- Banking operations include many periodic and aperiodic activities and transactions performed by employees, customers, and external agencies. These activities are complex, which makes monitoring essential. AIOps delivering real-time information and automated problem-solving are expected to boost market growth over the forecast period. The AIOps platform from C.A. technologies, i.e., C.A. Digital Experience Insights, enables financial firms to solve complex I.T. problems, including performance, capacity, and configuration issues.

- Banks and other financial institutions focus on ensuring the security of the data they generate, primarily due to the numerous high-profile data breaches over the past few years.

- Many banks and other financial institutions are using AIOps to increase their efficiency. For instance, a central Indian bank intended to increase the success rate of its digital merchants' onboarding process and streamline and simplify transactions for its new clients. By better servicing ON-US & OFF-US transactions, QualityKiosk's AIOps-based analytics solution AnaBot boosted revenue by 7% and enhanced the success percentage of merchant onboarding.

- According to BAE Systems Applied Intelligence, cybercrime increased at about three-fourths (74%) of financial institutions in the U.S. and the United Kingdom. In addition to the recognized financial losses, cybercrime can have severe financial implications for enterprises, including collapsing stock prices, reputational damage, and legal action. AIOps can help in the defense against this crime. AIOps solutions offer round-the-clock monitoring, suspicious activity detection, and defense operation initiation to safeguard susceptible systems.

- Furthermore, the integration of A.I. in operation services across financial institutions enhanced the capabilities built into the service desk systems. It thus provides the oversight and critical performance indicators necessary for the higher management to identify operational trends before adversely impacting the existing products and processes.

Europe to Witness Significant Growth

- One of the primary reasons for the European AIOps market growth is the region's MSPs seeking to offer comprehensive services to enterprises undergoing large-scale digital transformation and requiring modern operations solutions.

- Companies in the region employ various strategies to achieve a competitive edge. For instance, in October last year, Micro Focus, a business with headquarters in the UK, declared that Operations Bridge had been recognized as a Leader in the Research in Action (RIA) Vendor Evaluation MatrixTM study for AIOps Platforms. In addition to receiving this honor, Micro Focus also unveiled Operations Bridge Reports and Cloud Observability, two new SaaS solutions.

- Moreover, the most widely reported adoption of AI (47%) was in the IT/technology function, followed by R&D with 36% and customer service with 24%. It signifies the growing importance given to AI in the IT operations field.

- The government plays a significant role in increasing awareness about artificial intelligence in daily operations. By declaring AI as a major strategic priority, several member states and EU institutions are taking steps to advance the region's ambitions for AI leadership. It includes rolling out devoted national and EU-level AI strategy documents, boosting research and innovation, and exploring new regulatory approaches for managing the development and use of AI.

- Additionally, the European Commission intends to invest EUR 1 billion (USD 1.07 billion) annually in AI through Horizon Europe and Digital Europe programs. Over the digital decade, it will mobilize further investment from the private industry and the Member States to reach an annual capital volume of Euro 20 billion (USD 21.39 billion), predicted to propel the AIOps industry in the region.

- Europe recently released a set of strict rules and safeguards for the development and artificial intelligence use as it tries to make an ethical approach to the new technology to gain a competitive advantage over China and the United States. Before entering the market, all 'high-risk' AI applications will be subject to a compulsory assessment. It will be especially beneficial for the healthcare and BFSI sectors which handle sensitive data using AIOps.

AIOps Industry Overview

The competitive rivalry amongst the players in the market is high owing to the presence of some key players such as Moogsoft Inc., IBM Corporation, Splunk Inc., BMC Software Inc., and Sumo Logic Inc., amongst others. The ability to continually innovate its products and services allowed them to gain a competitive advantage over other players in the market. These players can attain a more significant market footprint through strategic partnerships, mergers & acquisitions, and research and development activities.

- November 2022- Aprecomm, a provider of network intelligence, unveiled their AIOps solution for Edgecore ecCloud controllers, the Aprecomm Virtual Wireless Expert. According to a release, all users of Edgecore Wi-Fi 6 access points can increase network performance due to the Edgecore Wi-Fi AIOps solution that the two firms jointly introduced.

- June 2022- The HCL Technologies DRYiCE introduced DRYiCE IntelliOps (IntelliOps), a solution that addresses an enterprise's full-stack AIOps and workflow observability demands. Businesses have made significant investments in sophisticated digital efforts to modernize their IT environment and strive to meet consumer expectations for constantly available digital services. However, a few obstacles still need to be overcome.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for AI-based services in IT operations

- 5.1.2 Increasing end-to-end business application assurance and uptime

- 5.2 Market Restraints

- 5.2.1 Increasing number of changes in IT operations

- 5.3 Market Opportunities and Key Developments

- 5.3.1 SMEs Moving Towards Cloud Infrastructure

- 5.3.2 Government Initiatives For AI Adoption in Various Countries

- 5.4 AIOps Tools Released in Past Two Years and Key AIOps Platform Capabilities To be Considered

- 5.5 Application of AIOps across various Use Cases Over the Life Cycle of an Application

- 5.6 Evolution of AIOps Stages and Use Cases

6 KEY APPLICATION LANDSCAPE

- 6.1 Root Cause Analysis

- 6.2 Network Availability and Optimization

- 6.3 Problem Assignment

- 6.4 Anomaly Detection and Cybersecurity

- 6.5 Improved Storage Management

7 MARKET SEGMENTATION

- 7.1 Organization Type

- 7.1.1 Small and Medium Enterprises

- 7.1.2 Large Enterprise

- 7.2 Deployment

- 7.2.1 On-Premise

- 7.2.2 Cloud/SaaS

- 7.3 End-User Industry

- 7.3.1 Media and Entertainment

- 7.3.2 IT and Telecom

- 7.3.3 Retail

- 7.3.4 Healthcare

- 7.3.5 BFSI

- 7.3.6 Other End-User Industries

- 7.4 Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia Pacific

- 7.4.4 Latin America

- 7.4.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Bigpanda Inc.

- 8.1.2 BMC Software Inc.

- 8.1.3 Broadcom Inc

- 8.1.4 Elasticsearch B.V

- 8.1.5 IBM Corporation

- 8.1.6 Logz.Io (Logshero Ltd.)

- 8.1.7 Loom Systems Ltd. (Service Now Inc)

- 8.1.8 Moogsoft Inc.

- 8.1.9 Splunk Inc

- 8.1.10 Appdynamics LLC (Cisco Systems Inc)

- 8.1.11 Dynatrace LLC

- 8.1.12 Extrahop Networks Inc.

- 8.1.13 New Relic Inc.

- 8.1.14 Resolve Systems LLC

- 8.1.15 Stackstate BV