|

市场调查报告书

商品编码

1444960

石墨电极:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Graphite Electrode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

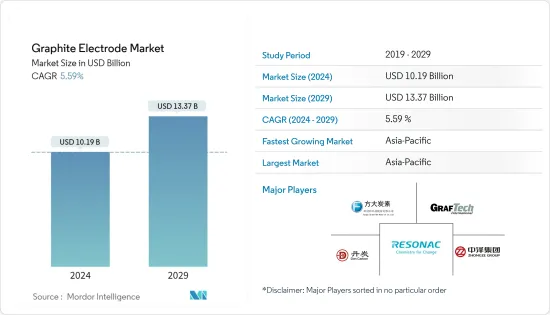

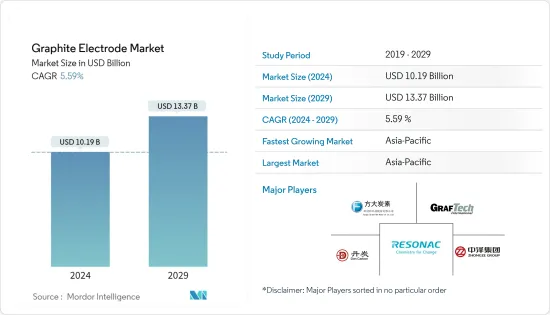

石墨电极市场规模预计到2024年为101.9亿美元,预计到2029年将达到133.7亿美元,预测期内(2024-2029年)复合年增长率为5.59%。

2020年,市场受到COVID-19爆发的负面影响。然而,随着主要终端用户产业恢復运营,2021年出现显着復苏。

主要亮点

- 短期内,新兴国家钢铁产量的强劲成长以及中国废钢供应量的增加预计将推动市场成长。

- 另一方面,针状焦价格上涨可能会阻碍所研究市场的成长。

- 中国透过电弧炉(EAF)技术增加钢铁产量预计将成为未来几年市场的机会。

- 由于中国的强劲需求,预计亚太地区将主导市场。

石墨电极市场趋势

电炉领域占据市场主导地位

- 电弧炉 (EAF) 透过熔化废铁、DRI(直接还原铁)、HBI(用 DRI 压缩的热煤球)或固体生铁来生产钢。在电弧炉製程中,电力提供熔化原料所需的动力。

- 石墨电极主要用于熔化电弧炉(EAF)炼钢过程中的废钢。电极由石墨製成,可以承受高温。在 EAF 中,电极尖端可达到 3,000°F,这是太阳表面温度的一半。电极尺寸范围为直径 75 毫米至 750 毫米、长度 2,800 毫米。炼钢厂和炼钢厂的电弧炉(EAF)通常分别使用UHP电极(通常为350毫米或以上)和HP和UHP电极(通常为400毫米或以下)。

- 近期石墨电极价格上涨,增加了电炉製造成本。截至2022年2月16日,我国石墨电极均价较年初上涨5.17%,较去年同期上涨44.48%。

- 在中国,电炉钢约占总市场份额的10%。然而,由于国内废钢供应量的增加以及政府支持废钢使用的政策,预计情况将会改变。由于这些因素,电炉应用中使用的石墨电极的需求预计在预测期内稳定增长。

- 下游石墨电极钢厂处于恢復状态。石墨电极较往年供不应求。随着钢厂重启,需求预计将增加。

- 根据世界钢铁协会的数据,2023 年 2 月 63 个国家的粗钢产量为 1.424 亿吨。 2023年2月,中东粗钢产量为350万吨。与 2022 年同期相比,成长了 11.5%。

- 因此,强劲的需求、有限的供应和高成本预计将在预测期内提高石墨电极价格。

中国将主导亚太地区

- 中国决策机构大力支持电炉炼钢技术,努力减少碳排放,实现国内钢铁业的永续性。

- 在世界范围内,中国石墨电极消费量和产能均占最大份额。目前,中国有40多家官方石墨电极製造商,还有30家新参与企业在过去几年将其他耐火材料产品与电极一起推向市场。

- 2022年3月,新余钢铁100吨电炉计划动工。新厂预计钢水产能为100万吨/年。

- 中国的石墨电极製造商始终致力于透过进口或国内采购来获取高品质的针状焦,同时确保技术提高品质。中国电极製造商也专注于生产尺寸超过700毫米的UHP级石墨电极。

- 今年7月7日,中国的经济规划机构国家发展和改革委员会(国家发改委)公布了国家资源循环利用产业规划,以加速发展低碳循环经济。该计画包括2025年钢铁业废钢使用量达到3.2亿吨的目标。

- 展望未来10年,预计电炉钢占全球钢铁产量的比重将从2020年的30%达到40%,2030年我国电炉钢占比将由10%左右上升至10%左右%,预计将达到全国的25% 。据 Fastmarket 钢铁调查团队称,

- 因此,上述因素将导致预测期内中国研究市场的成长。

石墨电极产业概况

石墨电极市场部分整合。主要企业包括(排名不分先后)GrafTech International、Resonac Holdings Corporation、方大炭新材料、中泽集团、丹炭。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 炼钢电炉技术需求旺盛

- 中国废钢供应量增加

- 抑制因素

- 针状焦价格飙升

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

- 各国钢铁产能

第五章市场区隔(数量和金额方面的市场规模)

- 电极等级

- 高功率(UHP)

- 高功率(小功率)

- 正常输出(RP)

- 目的

- 电炉

- 碱性氧气炉

- 有色金属应用

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)分析

- 主要企业采取的策略

- 公司简介

- Dan Carbon

- EPM Group

- Fangda Carbon New Material Co., Ltd.

- GrafTech International

- Graphite India Limited

- HEG Limited

- Kaifeng Pingmei New Carbon Materials Technology Co., Ltd.

- Nantong Yangzi Carbon Co. Ltd.

- Nippon Carbon Co Ltd.

- Resonac Holdings Corporation

- SANGRAF International

- SEC CARBON, LIMITED

- Tokai Carbon Co., Ltd.

- ZHONGZE GROUP

第七章市场机会与未来趋势

- 中国透过电炉技术提高钢铁产量

The Graphite Electrode Market size is estimated at USD 10.19 billion in 2024, and is expected to reach USD 13.37 billion by 2029, growing at a CAGR of 5.59% during the forecast period (2024-2029).

The market was affected negatively by the COVID-19 outbreak in 2020. However, with the resumption of operations in major end-user industries, it recovered significantly in 2021.

Key Highlights

- In the short term, the strong growth in steel production in emerging countries and the rising availability of steel scrap in China are expected to drive the market's growth.

- On the flip side, soaring prices of needle coke are likely to hinder the growth of the studied market.

- The rising production of steel through electric arc furnace (EAF) technology in China is expected to act as an opportunity for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market due to strong demand from China.

Graphite Electrode Market Trends

The Electric Arc Furnace Segment to Dominate the Market

- An electric arc furnace (EAF) melts steel scrap, DRI (directly reduced iron), HBI (hot briquetted iron, which is compacted DRI), or pig iron in solid form to produce steel. On the EAF route, electricity provides the required power to melt the feedstock.

- Graphite electrodes are primarily used in the electric arc furnace (EAF) steelmaking process to melt steel scrap. Electrodes are made of graphite due to their ability to withstand high temperatures. In EAF, the tip of the electrode can reach 3,000º F, which is half the temperature of the sun's surface. The size of electrodes varies widely, from 75 mm to as large as 750 mm in diameter and up to 2,800 mm in length. Electric arc furnaces (EAF) in steel mills and iron and steel foundries commonly use UHP electrodes (usually 350 mm and larger) and HP and UHP electrodes (typically 400 mm and smaller), respectively.

- The recent price surge for graphite electrodes has boosted EAF mills' costs. As of February 16, 2022, the average price of the graphite electrode in China was up by 5.17% from the beginning of the year and 44.48% from the same period last year.

- In China, EAF steel accounts for around 10% of the overall share. However, the situation is expected to change due to the growing availability of steel scrap in the country and the government's policies supporting the use of steel scrap. Due to such factors, the demand for graphite electrodes used for EAF applications is expected to increase steadily during the forecast period.

- The downstream graphite electrode steel plants are in a recovery state. The graphite electrode stock is insufficient compared to previous years. With the resumption of steel plants, demand is expected to increase.

- According to the World Steel Association, the production of crude steel for 63 countries in the month of February 2023 was 142.4 million metric tons (Mt). In February 2023, the Middle East produced 3.5 million metric tons of crude steel. This was up by 11.5% as compared to the same period in 2022.

- As a result, there will be a rise in the price of graphite electrodes during the forecast period due to favorable demand, limited supply, and high cost.

China to Dominate the Asia-Pacific Region

- The decision-making bodies in China have strongly supported EAF steelmaking technologies in their efforts to decrease carbon emissions and achieve sustainability in the nation's steel industry.

- China holds the largest share in terms of consumption and production capacity of graphite electrodes in the global scenario. At present, there are more than 40 official graphite electrode producers in China, with 30 new entrants that have added other refractory products, along with electrodes, to the market in the past 2-3 years.

- In March 2022, Xinyu Steel started constructing its 100-metric-ton EAF project. The new mill is expected to have a liquid steelmaking capacity of 1 million metric tons annually.

- Chinese graphite electrode producers are constantly trying to procure quality needle coke via imports or domestic procurement while securing technology for quality improvement. Chinese electrode manufacturers are also focusing on producing more UHP-grade graphite electrodes with sizes larger than 700 mm.

- The National Development and Reform Commission (NDRC), China's economic planning body, published a plan for the country's resource recycling industry on July 7 this year to accelerate the development of a low-carbon circular economy. The plan included a goal for scrap usage in the steel sector to reach 320 million tons in 2025.

- Looking into the next decade, the share taken by EAF steel is estimated to reach 40% of global steel output, against 30% in 2020, with EAF steel in China at 25% of the country's total in 2030, compared with around 10% last year, according to Fastmarkets' steel research team.

- Hence, the above factors will lead to the growth of the studied market in China over the forecast period.

Graphite Electrode Industry Overview

The graphite electrode market is partially consolidated. Some of the key players (not in any particular order) include GrafTech International, Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd., Zhongze Group, and Dan Carbon among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand For EAF Technology For Steelmaking

- 4.1.2 Rising Availability Of Steel Scrap In China

- 4.2 Restraints

- 4.2.1 Soaring Prices Of Needle Coke

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Steel Production Capacity by Country

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Electrode Grade

- 5.1.1 Ultra High Power (UHP)

- 5.1.2 High Power (SHP)

- 5.1.3 Regular Power (RP)

- 5.2 Application

- 5.2.1 Electric Arc Furnace

- 5.2.2 Basic Oxygen Furnace

- 5.2.3 Non-steel Application

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Dan Carbon

- 6.4.2 EPM Group

- 6.4.3 Fangda Carbon New Material Co., Ltd.

- 6.4.4 GrafTech International

- 6.4.5 Graphite India Limited

- 6.4.6 HEG Limited

- 6.4.7 Kaifeng Pingmei New Carbon Materials Technology Co., Ltd.

- 6.4.8 Nantong Yangzi Carbon Co. Ltd.

- 6.4.9 Nippon Carbon Co Ltd.

- 6.4.10 Resonac Holdings Corporation

- 6.4.11 SANGRAF International

- 6.4.12 SEC CARBON, LIMITED

- 6.4.13 Tokai Carbon Co., Ltd.

- 6.4.14 ZHONGZE GROUP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Production of Steel through EAF Technology in China