|

市场调查报告书

商品编码

1444961

氢气:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Hydrogen Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

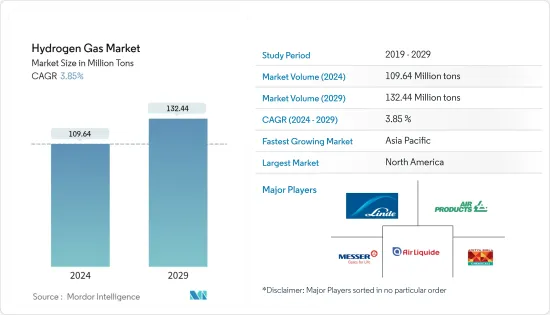

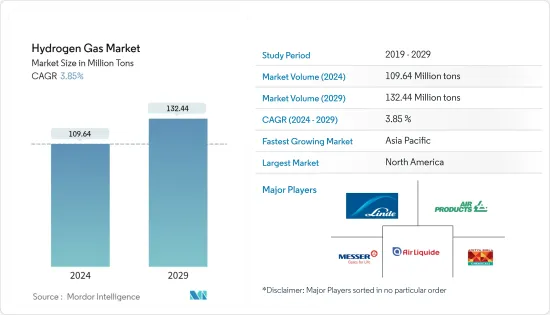

2024年氢气市场规模预估为1,0964万吨,预估至2029年将达到1,3,244万吨,预测期内(2024-2029年)复合年增长率为3.85%成长。

COVID-19 大流行对 2020 年的市场产生了负面影响。由于疫情相关的限制,氢气产量大幅下降。但2021年由于限制的放鬆和疫情情势的好转,略有成长。

主要亮点

- 从中期来看,化学工业需求的增加和炼油厂氢气使用的扩大预计将成为所研究市场的驱动因素。

- 另一方面,蓝氢和绿氢的高生产成本以及不断增加的运输和储存成本可能会阻碍市场成长。

- 太空探勘和航空的日益普及、燃料电池电动车需求的增加以及低碳经济中该行业对氢的准备程度可能会在预测期内为市场带来机会。

- 亚太地区在氢气市场上占据主导地位,并且由于中国和印度的巨大需求,预计将继续占据主导地位。

氢气市场趋势

氨产量主导市场需求

- 氨是世界各地生产的主要化学品之一。哈伯-博世工艺,也称为非生物、人工或工业固氮,用于氨的工业工业。

- Haber 哈伯法由 Fritz Haber 和 Karl Bosch 在 1900 年代初期开发,是最传统使用的同化氢气生产氨的工业製程。该过程涉及大气中的氮气和氢气在铀、锇等金属催化剂存在下在高温高压下发生化学反应。

- 哈伯-博世製程所使用的氢气通常从石化燃料原料中获得。取得氢气最常见的技术是透过天然气原料与蒸气在蒸气重组中反应来获得氢气。氢气也可以透过原油馏分的裂解和煤的部分氧化法过程来生产。

- 由于储存和运输氢气的复杂性,氨和化肥生产厂通常由整合製氢装置 (HGU)(改性)组成,这些装置使用石化燃料等化石燃料。

- 2021年全球氨产量约1.5亿吨,与前一年同期比较增加约2%。

- 2021年氨产量最高的地区是东亚,约6,460万吨。中国是全球最大的氨生产国,2021年产量约3,900万吨。

- 根据美国地质调查局的数据,美国是最大的氨生产国之一,16 家公司的 35 座设施生产了 1,400 万吨氨。

- 估计占氨市场 80% 份额的农业是氨作为化肥消费量增加的主要动力。东南亚是亚太地区主要化肥消费国,2021年中国占亚太化肥市场42.5%的份额。根据记录,亚洲对氮肥的需求极为重要,这为亚太地区工业固氮应用创造了巨大的氢气需求潜力。

- 2022年7月,巴西公司Unigel在卡马卡里工业开始建造全球最重要的绿色氢氨整合工厂。该厂初始产能为每年1万吨绿色氢气和6万吨绿色氨。该计划将耗资约1.2亿美元,预计于2023年终启动。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

亚太地区主导市场

- 亚太地区对氢气的需求庞大。该地区是成长最快的地区,预计将继续主导全球氢气需求,占氢气总需求量的 45% 以上。

- 在亚太地区,中国和印度是全球最大的需求国之一,中国透过两国的各种计划主导了全球氢气市场。

- 2022年3月,中国政府宣布了该国第一个长期氢能计划,涵盖2021年至2035年。该计划的重点是逐步发展国内氢工业并获得技术和製造能力。

- 邯郸经济技术开发区氢能装备产业丛集计划预计将利用陆域风电和电解製程生产氢气。该计划计划于 2026 年启动,生产的氢气将用于行动和家庭供暖行业。

- 张家口阳原靖西新能源基地计划将利用各种可再生资源和电解製程生产氢气。该计划计划于 2024 年启动。

- 2022年2月,印度政府宣布了新的绿氢能政策。该政策旨在帮助政府实现气候变迁目标,并透过实现2030年生产500万吨绿氢的目标,使印度成为绿氢中心。

- 印度新能源和可再生能源部表示,印度计划在未来五到七年内斥资2亿美元推广低碳氢的使用。此外,政府也要求国家石油和天然气公司在未来几年内建立七个氢试点工厂。

- 此外,中国和印度的氨产量和需求位居世界前列,最终推动了这些国家的氢气市场。

- 所有上述因素都可能在预测期内推动该地区氢市场的成长。

氢气产业概况

氢气市场趋于整合,主要参与者占据了市场需求的很大份额。市场主要企业包括(排名不分先后)Air Liquide、Linde plc、Air Products and Chemicals, Inc、Aditya Birla Chemicals、Messer SE &Co. KGaA 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 化学工业的需求不断增加

- 扩大炼油厂的氢气使用

- 抑制因素

- 蓝氢和绿氢生产成本高

- 运输和仓储成本高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(市场规模(数量))

- 发行

- 管道

- 高压长管拖车

- 圆柱

- 目的

- 氨

- 甲醇

- 精製

- 直接还原铁 (DRI)

- 燃料电池汽车(FCV)

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Aditya Birla Chemicals

- Air Liquide

- Air Products and Chemicals, Inc

- BASF SE

- Equinor ASA

- Gujarat Alkalies and Chemicals Limited

- Gulf Cryo

- Linde plc

- Lords Chloro Alkali Limited

- Matheson Tri-Gas Inc.

- Messer SE &Co. KGaA

- PAO NOVATEK

- TAIYO NIPPON SANSO CORPORATION

- Universal Industrial Gases Inc.

第七章市场机会与未来趋势

- 太空探勘和航空业的采用率增加

- 燃料电池电动车的需求不断增加

- 低碳经济中工业的氢气准备就绪

The Hydrogen Gas Market size is estimated at 109.64 Million tons in 2024, and is expected to reach 132.44 Million tons by 2029, growing at a CAGR of 3.85% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020. Due to restrictions associated with the pandemic, hydrogen gas production decreased significantly. However, with the relaxation in regulations and improvement in the pandemic situation, it slightly increased in 2021.

Key Highlights

- Over the medium term, increasing demand from the chemical Industry and expanding usage of hydrogen in refineries are likely to act as driving factors for the market studied.

- On the flip side, the high production cost of blue and green hydrogen and increased transportation and storage cost is likely to hamper the market's growth.

- Increased space exploration and aviation adoption, increasing demand for fuel cell electric vehicles, and industry readiness of hydrogen in a low carbon economy are likely to act as an opportunity for the market over the forecast period.

- The Asia-Pacific region is dominating the market for hydrogen gas and is expected to remain dominating owing to massive demand from China and India.

Hydrogen Gas Market Trends

Ammonia Production to Dominate the Market Demand

- Ammonia is one of the leading chemicals produced across the world. The industrial production of ammonia uses the Haber-Bosch process, also referred to as abiotic or artificial, or industrial nitrogen fixation.

- The Haber-Bosch process, developed by Fritz Haber and Carl Bosch in the early 1900s, is the most conventionally used industrial process for producing ammonia in assimilation with hydrogen. The process involves a chemical reaction between atmospheric nitrogen and hydrogen in the presence of a metal-based catalyst, such as Uranium, Osmium, etc., at high temperature and pressure.

- Hydrogen used in the Haber-Bosch process is typically derived from fossil fuel feedstocks. The most prevalent technique for sourcing hydrogen is the reaction of natural gas feedstocks with steam in a steam reforming unit for deriving hydrogen. Hydrogen is also produced from cracking crude oil fractions or subjecting coal to partial oxidation processes.

- Due to hydrogen gas's storage and transportation complexities, ammonia and fertilizer production plants usually comprise integrated hydrogen generation units (HGUs) (i.e., reformers) fed with fossil fuels, such as natural gas and others.

- In 2021, global ammonia production amounted to around 150 million metric tons, registering an increase of about 2% compared to the previous year.

- East Asia had the highest ammonia production in 2021, with approximately 64.6 million metric tons. China is the top ammonia producer globally, producing around 39 million metric tons in 2021.

- According to the U.S. geological survey, the United States is one of the largest ammonia producers, producing 14 million metric tons at 35 facilities belonging to 16 companies.

- The agriculture industry, with an estimated share of 80% in the ammonia market, is the primary driver of the rising ammonia consumption in fertilizers. Southeast Asia is the major fertilizer consumer in Asia-Pacific, with China representing a 42.5% share in the Asia-Pacific fertilizer market in 2021. The demand for nitrogenous fertilizers in Asia is recorded as vital, creating a huge demand potential for hydrogen gas in industrial nitrogen fixation applications.

- In July 2022, the Brazilian company Unigel began constructing the world's most significant integrated green hydrogen and ammonia plant in the Camacari Industrial Complex. The plant will have an initial production capacity of 10,000 tons per year of green hydrogen and 60,000 tons per year of green ammonia. Costing around USD 120 million, the project will come on stream by the end of 2023.

- Therefore, the above factors are expected to impact the market in the coming years significantly.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific accounts for an enormous demand for hydrogen gas. It is estimated to be the fastest-growing region and to remain at the dominant position in global hydrogen gas, accounting for more than 45% of the total demand for hydrogen gas.

- In the Asia-Pacific region, China and India are among the largest countries in the world with the highest demand, with China dominating the global market for hydrogen gas owing to various projects in the countries.

- In March 2022, the Chinese government released the country's first-ever long-term plan for hydrogen, covering the period of 2021-2035. The program is focused on a phased approach to developing a domestic hydrogen industry and mastering technologies and manufacturing capabilities.

- Hydrogen Energy Equipment Industrial Cluster Project in Handan Economic and Technological Development Zone is expected to generate hydrogen using onshore wind and electrolysis process. The project is expected to come online in 2026, and the hydrogen produced will be used in the mobility and domestic heating industries.

- Zhangjiakou Yangyuan Jingxi New Energy Base Project will generate hydrogen using various renewable sources and electrolysis processes. The project is expected to come online in 2024.

- In February 2022, the government of India announced a new green hydrogen policy. The policy aims to help the government meet its climate targets and make India a green hydrogen hub by reaching the production target of 5 million tons of green hydrogen by 2030.

- According to the Ministry of New and Renewable Energy, India will spend USD 200 million over the next five to seven years to promote the use of low-carbon hydrogen. Moreover, the government asked its state-run oil and gas companies to set up seven hydrogen pilot plants in the next few years.

- Furthermore, ammonia production and demand in China and India stand at the top globally, ultimately driving the hydrogen gas market in these countries.

- All the factors mentioned above are likely to see growth in the Hydrogen market in the region over the forecasted period.

Hydrogen Gas Industry Overview

The hydrogen gas market is consolidated, where major players hold a significant share of the market demand. Some of the major players in the market include (not in any particular order) Air Liquide, Linde plc, Air Products and Chemicals, Inc, Aditya Birla Chemicals, and Messer SE & Co. KGaA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From Chemical Industry

- 4.1.2 Expanding Usage Of Hydrogen In Refinery

- 4.2 Restraints

- 4.2.1 High Production Cost Of Blue And Green Hydrogen

- 4.2.2 High Transportation And Storage Cost

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Distribution

- 5.1.1 Pipelines

- 5.1.2 High-Pressure Tube Trailers

- 5.1.3 Cylinders

- 5.2 Application

- 5.2.1 Ammonia

- 5.2.2 Methanol

- 5.2.3 Refining

- 5.2.4 Direct Reduced Iron (DRI)

- 5.2.5 Fuel Cell Vehicles (FCV)

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aditya Birla Chemicals

- 6.4.2 Air Liquide

- 6.4.3 Air Products and Chemicals, Inc

- 6.4.4 BASF SE

- 6.4.5 Equinor ASA

- 6.4.6 Gujarat Alkalies and Chemicals Limited

- 6.4.7 Gulf Cryo

- 6.4.8 Linde plc

- 6.4.9 Lords Chloro Alkali Limited

- 6.4.10 Matheson Tri-Gas Inc.

- 6.4.11 Messer SE & Co. KGaA

- 6.4.12 PAO NOVATEK

- 6.4.13 TAIYO NIPPON SANSO CORPORATION

- 6.4.14 Universal Industrial Gases Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Adoption In Space Exploration And Aviation Industry

- 7.2 Increasing Demand For Fuel Cell Electric Vehicles

- 7.3 Industry Readiness Of Hydrogen In Low Carbon Economy