|

市场调查报告书

商品编码

1642021

DWaaS(资料仓储即服务):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Data Warehouse as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

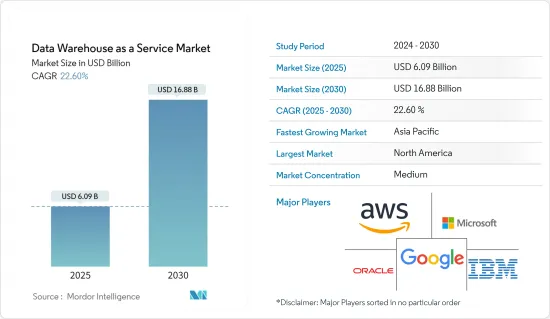

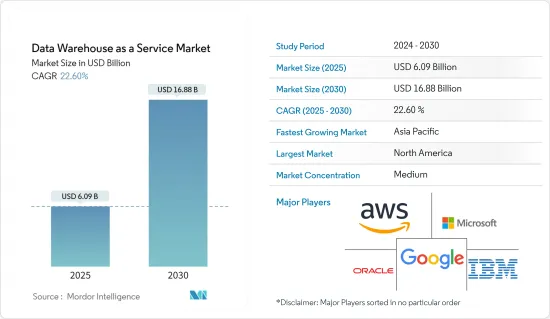

资料仓储即服务 (DWaaS) 市场规模预计在 2025 年为 60.9 亿美元,预计到 2030 年将达到 168.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 1.2%。 。

企业对了解有关业务流程、产品、客户和服务的可用资讯以抓住新商机的兴趣日益浓厚,这对市场产生了积极影响。

主要亮点

- 近年来,随着人们对资料可管理性和复杂性的日益关注,资料仓储在实际应用中引起了极大的兴趣,尤其是在金融、商业、医疗保健和其他行业。

- 预计市场需求将受到对低延迟和高速分析的不断增长的需求以及商业智慧在整个企业生态系统的企业运营中日益增长的重要性的推动。然而,由于控制和提高资料品质的复杂性日益增加,可能需要进行改进以扩大研究市场。

- 此外,包括金融服务、保险和保险业、零售和电子商务、政府和公共部门组织以及製造业在内的多个终端用户行业产生的结构化和非结构化资料量正在大幅增长,从而刺激了基于云端基础的资料资料的采用。例如,腾讯控股有限公司计划在日本开设第三个资料中心,日本对线上游戏和直播系统的云端服务需求强劲。

- 此外,资料仓储在高阶分析方面的日益普及、资料量的快速增长、法规遵从性的提高以及多重云端架构的兴起为采用云端基础的资料仓储解决方案创造了充足的机会。

- 企业使用报告、仪表板和分析工具从资料集中获取见解并监控业务绩效以支援决策。这些报告、仪表板和分析工具是资料仓储的一部分,透过有效率地储存资料并同时向多个使用者提供快速查询结果,推动新兴经济体采用资料即服务 (DWaaS)。 -as-a-Service)。

- 新冠疫情和全球实施的封锁规定影响了全球的资本投资和工业活动。在新冠疫情引发的全球经济衰退之后,资料仓储即服务 (DWaaS) 市场因疫情上半年数位转型的加速而出现成长。由于封锁规定,大多数终端用户行业(主要是製造业和汽车业)的公司都关闭了生产设施。

DWaaS(资料仓储即服务)市场的趋势

资料仓储即服务 (DWaaS) 在 BFSI 领域的使用日益增多,正在推动市场的发展。

- 银行、金融服务和保险非常有利于资料仓储即服务市场的成长,因为它们需要处理定期产生的大量客户资料。 BFSI 产业产生大量资料,因此公司需要能够自动追踪系统中储存的资讯的效能和行为的资料仓储解决方案。

- 他们还需要透过具有 BI 功能的解决方案进行分析,以製定创新的商务策略并提高整体业务效率。纽约梅隆银行、摩根士丹利、美国银行、瑞士信贷和 PNC 等银行都已开始製定业务巨量资料策略,其他银行也迅速追赶。

- 美国加州的硅谷是许多金融科技新兴企业的所在地。这有望增加贷款业务并升级零售银行机构的付款领域。这反过来将加强信用核保流程,因为公司藉助巨量资料分析向许多个人和小型企业发放贷款。

- 线上资料的数量、种类和速度的增加必然需要分析解决方案,例如社群媒体分析,以了解消费者针对相应产品和服务的购买行为。因此,保险公司越来越多地采用云端基础的资料仓储解决方案,从而推动保险产品的销售,分析与保险产品相关的客户情绪,以及社群媒体监控和分析工具。

- 此外,金融顾问公司越来越多地采用资料仓储即服务,因为它可以减轻他们不断更新内部部署软体的负担。此外,透过高速互联网连接,可以从任何地方存取资料仓储即服务 (DWaaS),从而增加了整个 BFSI 领域对资料仓储即服务 (DWaaS) 的需求。

预计北美将占据最大市场占有率

- 由于拥有技术先进的资料仓储基础设施,北美预计将占据相当大的市场占有率。美国各行各业的企业都在积极采用分析解决方案。由于对管理业务资料的需求很高且云端解决方案提供商的不断涌现,该市场被认为将由美国主导。

- 随着云端基础的资料仓储解决方案的可用性和使用变得越来越广泛,整个全部区域的云端运算市场环境也持续发生变化。几乎每个企业都在寻找能够减少搜寻资料时间并提高员工和组织效率的解决方案。这导致资料仓储即服务 (DWaaS) 的使用增加并提高了业务流程的效率。

- 此外,美国正在看到企业之间的联盟和伙伴关係范围和规模不断扩大,以支援和扩展整个资料仓储服务范围内提供者的服务。此外,提供云端服务的资料仓储供应商正在成为许多 IT 服务公司的重要合作伙伴,可在需要时提供灵活性和规模。

- 此外,行动装置和社交网路的使用等消费化趋势资料资讯资料量呈指数级增长,需要有效的储存、分析和管理方法才能在北美市场保持竞争力。

- 随着该地区的主要供应商(包括 Google LLC、Teradata Corp.、SAP SE、IBM Corp. 和 Microsoft Corp.)专注于正规化专业服务以支援资料仓储即服务(DWaaS) 市场,竞争格局正在发生变化。

资料仓储即服务 (DWaaS) 产业概述

资料仓储即服务 (DWaaS) 市场竞争激烈,由多家重要参与者组成。目前,一些参与者在市场占有率上占据主导地位。随着 Google LLC、Teradata Corp.、SAP SE、IBM Corp. 和 Microsoft Corp. 等全部区域知名企业的存在,竞争格局得到巩固。亚马逊网路服务公司 (Amazon Web Services Inc.) 是领先的供应商之一,非常重视正规化专业服务以支援资料仓储服务交付。然而,随着技术进步和产品创新,各种中型公司正在透过赢得新合约和探索新市场来扩大其在市场上的份额。

- 2022 年 6 月 – HCL Technologies 与 Amazon Web Services 合作。 AWS 使 HCL 能够提供可扩展、经济高效、安全且高效能的企业资料仓储解决方案。 Amazon Redshift 提供由最新 AI/ML 功能支援的资料主导业务洞察,从而提高 HCL Technologies 的业务效率、决策能力和上市时间。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 快速采用云端基础的解决方案并专注于即时资料分析

- BFSI 领域越来越多地使用资料仓储服务,推动市场发展

- 资料分析与商业智慧在企业管理中发挥重要作用

- 市场挑战

- 资料安全问题可能会阻碍市场成长

- 评估新冠肺炎对市场的影响

第六章 市场细分

- 按组织

- 大型企业

- 中小企业

- 按最终用户产业

- BFSI

- 政府

- 卫生保健

- 电子商务与零售

- 媒体和娱乐

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- IBM Corporation

- Microsoft Corporation

- Google LLP

- Oracle Corporation

- SAP SE

- Micro Focus International PLC

- Cloudera Inc.

- Snowflake Computing Inc.

- Pivotal Software Inc.

- Yellowbrick BV

- Teradata Corporation

- Veeva Systems Inc

第八章投资分析

第九章:市场的未来

The Data Warehouse as a Service Market size is estimated at USD 6.09 billion in 2025, and is expected to reach USD 16.88 billion by 2030, at a CAGR of 22.6% during the forecast period (2025-2030).

The growing interest of companies to understand the available information regarding business processes, products, customers, and services to grab new business opportunities is positively impacting the market.

Key Highlights

- Due to rising concerns about data manageability and increasing complexity in recent years, data warehousing has attracted significant interest in real-life applications, especially in finance, business, healthcare, and other industries.

- The market demand is anticipated to be driven by the rising demand for low latency and high-speed analytics and the expanding importance of business intelligence in enterprise management throughout the company ecosystem. However, expanding the market under study may need to be improved due to the growing complexity of controlling and enhancing data quality.

- Further, the demand for data warehouse services, especially across the cloud-based deployment, is expected to rise, owing to tremendous growth in the volume of the structured and unstructured data generated across multiple end-user industries, such as BFSI, retail and e-commerce, government, and public sector, and manufacturing industries. For instance, Tencent Holdings planned to open a third data center in Japan, where its cloud services for online games and live streaming systems are in robust demand.

- Also, the growing adoption of the data warehouse to perform advanced analytics, rapid growth in data volumes, and an increase in regulatory compliance, along with the rise of multi-cloud architecture, creates ample opportunities for adopting cloud-based data warehouse solutions.

- Enterprises are using reports, dashboards, and analytics tools to extract insights from the datasets, thereby monitoring the business performance that supports decision-making. These reports, dashboards, and analytics tools are a part of the data warehouse, which stores data efficiently and delivers query results at high speeds across multiple users simultaneously, thereby driving the adoption of the data warehouse as a service across emerging economies.

- The COVID-19 outbreak and the lockdown restriction imposed across the globe have affected capital investments and industrial activities across the world. Following the global economic recession led by COVID-19, data warehouse as a service market has seen growth due to accelerated digital transformation in the first half of the pandemic. Most enterprises operating in the end-user industries (majorly manufacturing and automotive) had shut down their production sites due to lockdown restrictions.

Data Warehouse as a Service Market Trends

Rising use of Data Warehouse services in BFSI sector to drive the market.

- Banking, financial services, and insurance are highly lucrative for growth in the Data Warehouse-as-a-Service market as it deals with massive customer data generated regularly. Due to the large amount of data generated across the BFSI sector, enterprises need data warehousing solutions to automatically track the performance and behavior of the information stored in their systems.

- Also, they require analytics to develop innovative business strategies and improve their overall operational efficiency through solutions with BI capabilities. Banks like BNY Mellon, Morgan Stanley, Bank of America, Credit Suisse, and PNC are already working on strategies around Big Data in Banking, and other banks are rapidly catching up.

- Several FinTech start-ups are coming up in Silicon Valley, California, United States. This is expected to increase the lending business and upgrade the payments domain of retail banking institutions. This, in turn, will enhance credit underwriting procedures, as firms will lend to many individuals and small businesses with the help of big data analytics.

- The rising volume, variety, and velocity of online data need analytics solutions, such as social media analytics, to understand consumer buying behavior related to its respective products and service offerings. Therefore, insurance firms are increasingly adopting cloud-based data warehousing solutions, thereby implementing social media monitoring and analytical tools to increase insurance product sales and analyze customer sentiments related to insurance products.

- Further, financial consulting companies are increasingly adopting Data Warehouse-as-a-Service to set themselves free from the burden of updating their on-premise software repeatedly. Moreover, they can access Data Warehouse-as-a-Service anywhere by having access to fast internet connectivity, which, in turn, is driving the demand for the Data Warehouse-as-a-Service market across the BFSI sector.

North America is Expected to Hold the Largest Market Share

- North America is anticipated to have a significant market share owing to the availability of technologically-advanced data warehouse infrastructure. The US organizations are higher adopters of analytics solutions across several verticals. They are considered the leading country in the market due to the significant demand for managing operational data and the increased emergence of cloud solution providers.

- The market environment for cloud computing continues to develop across the region as the availability and usage of cloud-based data warehouse solutions become more prevalent. Almost all enterprises are looking for a solution to reduce the time to search for data and improve the efficiency of both the employees and the organizations. This has increased the utilization of data warehouse-as-a-service, thereby increasing the efficiency of business processes.

- Also, the scope and scale of alliances and partnerships among enterprises in the United States are expanding to support and expand upon provider offerings across the data warehouse services space. Also, the data warehouse providers of cloud services are becoming essential partners for many IT services firms, offering them flexibility and scale whenever required.

- Moreover, the adoption of consumerization trends, such as the usage of mobile devices and social networking, is leading to an exponential rise in the volume of informational data that needs an effective way to be stored, analyzed, and managed to stay competitive among the North American market, which is further anticipated to amplify the data warehousing market growth.

- The competitive landscape is consolidated with the presence of some of the prominent players across the region, such as Google LLC, Teradata Corp., SAP SE, IBM Corp., and Microsoft Corp., who are some of the leading vendors, placing significant emphasis on the formalization of professional services to support the data warehousing-as-a-service market.

Data Warehouse as a Service Industry Overview

The Data Warehouse as a Service Market is competitive and consists of several significant players. Some of the players currently dominate the market in terms of market share. The competitive landscape is consolidated with the presence of some of the prominent players across the region, such as Google LLC, Teradata Corp., SAP SE, IBM Corp., and Microsoft Corp., Amazon Web Services Inc. are some of the leading vendors that are placing significant emphasis on the formalization of professional services to support the data warehouse services delivery. However, with technological advancement and product innovation, various mid-size companies are increasing their market presence by securing new contracts and tapping new markets.

- June 2022 - HCL Technologies partnered with Amazon Web Services. AWS allows HCL to offer scalable, cost-effective, secure, and high-performing enterprise data warehouse solutions. Amazon Redshift provides data-driven business insights enabled by modern AI/ML capabilities to improve operational efficiency, decision-making, and faster time to market to HCL Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Cloud-based Solutions and Focus on Real-time Data Analysis

- 5.1.2 Rising use of Data Warehouse services in BFSI sector to drive the market.

- 5.1.3 Data analytics and business intelligence are expected to play a major role in enterprise management.

- 5.2 Market Challenges

- 5.2.1 Concerns Over Data Security might hinder the market growth

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 Organization

- 6.1.1 Large Enterprises

- 6.1.2 Small and Medium Enterprises (SME)

- 6.2 End User Vertical

- 6.2.1 BFSI

- 6.2.2 Government

- 6.2.3 Healthcare

- 6.2.4 E-Commerce and Retail

- 6.2.5 Media and Entertainment

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 UK

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 UAE

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Google LLP

- 7.1.5 Oracle Corporation

- 7.1.6 SAP SE

- 7.1.7 Micro Focus International PLC

- 7.1.8 Cloudera Inc.

- 7.1.9 Snowflake Computing Inc.

- 7.1.10 Pivotal Software Inc.

- 7.1.11 Yellowbrick B.V

- 7.1.12 Teradata Corporation

- 7.1.13 Veeva Systems Inc