|

市场调查报告书

商品编码

1445401

MEMS 压力感测器:市场占有率分析、行业趋势和统计、成长预测(2024-2029 年)MEMS Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

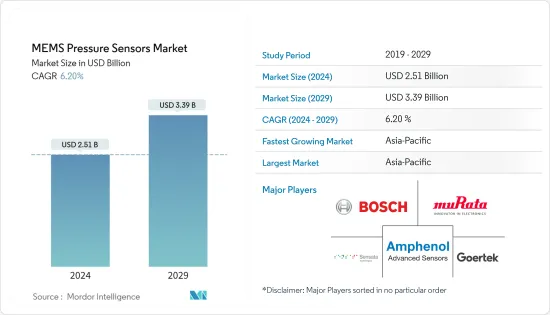

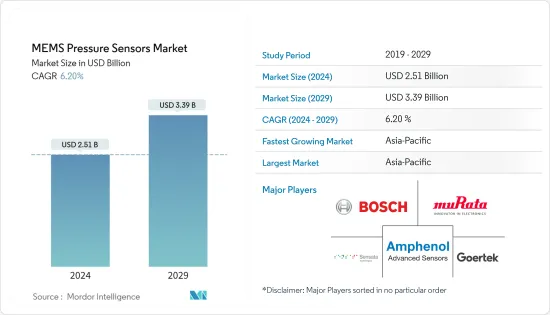

MEMS压力感测器市场规模预计到2024年为25.1亿美元,预计到2029年将达到33.9亿美元,在预测期内(2024-2029年)增长6.20%。复合年增长率为

全部区域的工业自动化和小型消费性设备(例如穿戴式装置和物联网连接设备)的需求是推动 MEMS 压力感测器市场的关键因素。

主要亮点

- MEMS感测器由于其精度和可靠性等优势,以及小型电子设备的製造范围,在过去几年受到了极大的关注,在各个领域越来越受欢迎。全部区域的工业自动化和小型消费性设备(例如穿戴式装置和物联网连接设备)的需求是推动 MEMS 压力感测器市场的关键因素。

- 此外,汽车产业目前正在经历一场以提高安全性、舒适性和娱乐性为重点的技术转型,为 MEMS 压力感测器提供了充足的机会。自动驾驶汽车、无人机和 AR/VR 设备等新兴感测器密集型应用进一步增加了对 MEMS 压力感测器的需求。

- 此外,MEMS 技术可实现小型化、经济高效且可靠的感测器,其中一些感测器可承受高温和恶劣环境,从而扩大了半导体装置的范围。 MEMS 装置的多样性及其製造所涉及的不同技术导致了从设计到测试的复杂但永续的供应链。

- 介面在基于感测器的系统设计中引起最严重的问题。连接到感测器介面的多个障碍物使设计和製造变得复杂。虽然允许零件在不同的实现之间分离和重复使用是非常有价值的,但它足以使设计和製造变得困难。事实上,在 Fierce Electronics 最近一项关于感测器设计的调查中,超过三分之一的受访者表示,将感测器纳入他们的计划是最困难的问题。预计这将对市场成长构成挑战。

- 此外,2020年和2021年,COVID-19大流行袭击了MEMS压力感测器市场,导致MEMS压力感测器略有下降。然而,所研究的市场在 COVID-19感染疾病后可能会成长。放鬆管制导致消费者主要在配备 MEMS 压力感测器的物联网设备上做出支出决定。

MEMS压力感测器市场趋势

市场驱动的自动化与工业 4.0 的出现

- 支援智慧工业的MEMS的主要特点是精度、可靠性和寿命。在工业4.0中,MEMS感测器可应用于需要振动、温度、压力、声音和声学分析的早期故障检测和预测维修系统系统,从而促进其在自动化和工业4.0应用中的使用。

- 随着工业4.0和物联网(IoT)的引入为製造业带来重大变革,企业越来越多地利用技术透过自动化来补充和增强人力,减少流程故障造成的工伤。采用灵活和创造性的策略来推进我们的业务。由于互联设备和感测器的普及以及 M2M通讯的加速,製造业产生的资料点数量不断增加。

- 此外,各行业也越来越多地采用自动化,也大大增加了人们对工业机器人的兴趣。国际机器人联合会(IFR)预计,2020年全球工业机器人出货达到约38.4万台,较2019年略有成长。预计未来几年工业机器人出货将快速成长,甚至可能超过2018年的高峰。全球约有 422,000 台工业机器人出货。预计2024年全球工业机器人出货将达51.8万台。

- 工业机器人越来越多地应用于各个行业。儘管高度自动化的电子机械产业仍然是机电机械最大的市场之一,但电气和电子产业在 2020 年引入了最多的工业机器人。工业机器人的增加也将增加全球对 MEMS 压力感测器的需求。

- 此外,据思科称,到 2022 年,支援物联网应用的机器对机器 (M2M) 连接预计将占全球 285 亿台连网装置的一半以上。世界各地的製造商也意识到,下一代机器人和自动化技术是在生产力、品质、安全和成本指标方面升级製造业的革命性机会。此外,机器人自动化支出的与前一年同期比较主要扩大了研究市场的范围。

亚太地区维持主要市场占有率

- 亚太地区被称为製造地,并且正在快速成长。汽车产业需要更多的安全法规。由于智慧型手机、智慧型装置和电器产品中 MEMS 压力感测器的普及,消费性电子产业预计将主导区域 MEMS 压力感测器市场。

- 此外,亚太地区的汽车工业是世界上最大的汽车工业之一,在过去的几十年中从一个由政府控制的小型产业发展成为由大型跨国公司控制的产业。韩国是起亚汽车、现代汽车、雷诺等大公司的所在地,预计汽车需求将稳定成长。汽车产业的成长预计将增加该地区对 MEMS 压力感测器的需求。

- MEMS 压力感测器广泛应用于汽车产业,目前汽车产业正在经历技术转型,其主要目标是提高安全性、舒适性和娱乐性。这些感测器(如 MEMS)由于尺寸小而在汽车行业中需求量很大,这是普及的主要驱动力。

- 由于汽车产业在压力感测器市场中占据很大一部分,因此该地区在未来几年将带来巨大的机会。 MEMS压力感测器的采用预计也将受到联网汽车概念的不断扩大和中国有关车辆安全的法规的影响。

- 未来几年,技术的不断发展、物联网的大规模采用以及与产品相关的政府法规预计都将促进压力感测器市场的成长。然而,由于监管障碍较高,压力感测器市场可能面临额外的挑战。

MEMS压力感测器产业概况

MEMS 压力感测器市场由许多能够进行后向整合和向前整合的大型供应商组成,展现出巨大的产生收入能力。市场相对整合,供应商正在增加研发支出,以获得相对于其他公司的技术力和竞争优势。市场上的供应商竞争的是技术和质量,而不是价格。市场上竞争公司之间的敌对激烈程度相当高,预计未来几年将进一步加剧。

- 2022 年 7 月 - Bosch Sensor Tech 宣布其 Edge Impulse 机器学习平台现在支援 Arduino NiclaSense ME 微控制器上的感测器。根据该公司的公告,首款 Arduino Pro 产品是与 Bosch Sensortec 合作创建的,Bosch Sensortec 的感测器利用 BMP390 压力感测器提供多种高精度资料收集和分析方法。

- 2022 年 2 月 -电子机械系统 (MEMS) 製造商意法半导体发布第三代 MEMS 感测器。新感测器将进一步显着提高消费性行动装置、智慧工业、医疗保健和零售业的性能和功能。经销商很快就能购买采用 2.8mm x 2.8mm x 1.95mm 7 接脚 LGA 封装的 LPS28DFW 压力感知器和采用 2.0mm x 2.0mm x 0.73mm 10 接脚 LGA 封装的 LPS22DF 压力感知器。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌意强度

- 产业价值链分析

- 技术简介

- 评估 COVID-19感染疾病对市场的影响

- 聚对二甲苯在 MEMS 压力感测器中的使用概述

第五章市场动态

- 市场驱动因素

- 自动化和工业 4.0 的出现

- 对感测器密集型应用的需求不断增长

- 市场限制因素

- 多个介面的复杂性

第六章市场区隔

- 按用途

- 医疗保健

- 车

- 产业

- 航太和国防

- 家用电器

- 按类型

- 硅压敏电阻

- 硅电容

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争形势

- 公司简介

- Bosch Sensortec GmbH

- Murata Manufacturing Co. Ltd

- Amphenol Advanced Sensors(Amphenol Corporation)

- Sensata Technologies Inc.

- Goertek INC.

- STMicroelectronics NV

- Omron Corporation

- Alps Alpine Co. Ltd

- Infineon Technologies AG

- TE Connectivity Ltd

- NXP Semiconductors NV(Freescale)

- InvenSense Inc.(TDK Corporation)

- ROHM Co. Ltd

- Honeywell International Inc.

- Melexis

- Vendor Ranking for the Top 5 Vendors Across the End-user Verticals

- 2021年排名前15的供应商市场占有率

第八章投资分析

第9章市场的未来

The MEMS Pressure Sensors Market size is estimated at USD 2.51 billion in 2024, and is expected to reach USD 3.39 billion by 2029, growing at a CAGR of 6.20% during the forecast period (2024-2029).

Industrial automation and demand for miniaturized consumer devices across regions, such as wearables and IoT-connected devices, are among the significant factors driving the MEMS pressure sensors market.

Key Highlights

- MEMS sensors are gaining popularity across sectors, due to their advantages, such as accuracy and reliability, in addition to the scope for making smaller electronic devices, which have gained significant traction in the past few years. Industrial automation and demand for miniaturized consumer devices across regions, such as wearables and IoT-connected devices, are among the crucial factors driving the MEMS pressure sensors market.

- Also, The automotive industry, which is presently undergoing a technology transition with a significant focus on increasing safety, comfort, and entertainment, provides ample opportunities for MEMS pressure sensors. Emerging sensor-rich applications, such as autonomous vehicles, drones, and AR/VR equipment, further accelerate the need for MEMS pressure sensors.

- In addition, MEMS technologies have enabled miniaturized, cost-effective, and reliable sensors, some of which can withstand high temperatures and harsh environments, expanding the scope of semiconductor devices. Such diversity in MEMS devices and the different technologies involved in their manufacture have led to a complex but sustainable supply chain, from design to testing.

- The interfaces are a source of some of the most severe issues in the design of sensor-based systems. The multiple obstacles connected with sensor interfaces are enough to make design and manufacture complicated. While invaluable for decoupling parts and allowing reuse across different implementations, they are enough to make design and manufacturing difficult. Indeed, more than a third of respondents in a recent Fierce Electronics study on sensor design said that incorporating sensors into a plan is their most demanding issue. This is expected to challenge the market's growth.

- Moreover, the COVID-19 pandemic hurt the MEMS pressure sensors market in 2020 and 2021, which resulted in a slight drop in the MEMS pressure sensors. However, the market studied is likely to grow after the COVID-19 pandemic; the ease of restrictions attracted consumers to make spending decisions on IoT-enabled devices, which mostly come with MEMS pressure sensors.

MEMS Pressure Sensors Market Trends

Emergence of Automation and Industry 4.0 to Drive the Market

- MEMS's key features to support the smart industry are accuracy, reliability, and longevity. For Industry 4.0, MEMS sensors can be applied in early-failure-detection and predictive-maintenance systems where vibration, temperature, pressure, sound, and acoustics analyses are needed, thus, driving its usage in automation and Industry 4.0 applications.

- Massive changes in the manufacturing industry brought by Industry 4.0 and the adoption of IoT demand that businesses adopt flexible and creative strategies to advance production with technologies that complement and augment human labor with automation and lower industrial accidents brought on by process failure. There has been an increase in the number of data points generated in the manufacturing sector as a result of the widespread adoption of connected devices and sensors and the facilitation of M2M communication.

- In addition, the increased adoption of automation across a variety of industries has significantly increased interest in industrial robotics. The International Federation of Robotics (IFR) estimates that industrial robot shipments worldwide reached about 384,000 in 2020, only slightly up from 2019. Industrial robot shipments are anticipated to rise sharply in the years to come, possibly even exceeding the peak year of 2018, when about 422,000 industrial robots were shipped globally. Global shipments of industrial robots are predicted to reach 518,000 units in 2024.

- Industrial robots can be used in a growing number of industries for a variety of tasks. The electrical and electronic industries installed the most industrial robots in 2020, despite the highly automated auto industry continuing to be one of the largest markets for electro-mechanical machines. Such a rise in industrial robots would also boost the demand for MEMS pressure sensors globally.

- Additionally, According to Cisco, by 2022, machine-to-machine (M2M) connections that support IoT applications are expected to account for over half of the world's 28.5 billion connected devices. Manufacturers worldwide also understand that the next generation of robotics and automation technologies is a revolutionary opportunity to upgrade manufacturing in terms of productivity, quality, safety, and cost metrics. Also, increased year-on-year robotic automation expenditure mainly expands the scope of the studied market.

Asia Pacific to Hold Major Market Share

- Asia-Pacific is a well-known manufacturing hub and rapidly growing. There is a need for more safety regulations in the automotive industry. Due to the widespread use of MEMS pressure sensors in smartphones, smart devices, and home electronics, the consumer electronics segment is predicted to dominate the regional MEMS pressure sensor market.

- Additionally, Asia pacific automotive industry is among the largest worldwide, growing from a small government-controlled sector to one controlled by large multinational enterprises over the past few decades. South Korea is home to major players like Kia, Hyundai, and Renault, and it is expected to witness steady growth in the demand for automobiles. Such growth in automobiles will increase demand for MEMS pressure sensors in the region.

- MEMS pressure sensors have a variety of applications in the automotive industry, which is currently undergoing a technological transformation with the primary goal of enhancing safety, comfort, and entertainment. These sensors, like MEMS, are in high demand in the automotive industry due to their small size, which is a key driver of their widespread adoption.

- Since the automotive sector accounts for a sizable portion of the pressure sensor market, the region presents an excellent opportunity over the coming years. The adoption of MEMS pressure sensors is also anticipated to be influenced by the expanding idea of connected cars and Chinese regulations regarding automotive safety.

- In the upcoming years, expanding technological development, IoT adoption on a large scale, pro-product government regulations, and more will all contribute to the growth of the pressure sensors market. However, the market for pressure sensors may face additional challenges due to high regulatory barriers.

MEMS Pressure Sensors Industry Overview

The MEMS pressure sensor market comprises many large-scale vendors capable of both backward and forward integration and commands significant revenue generation capabilities. The market is relatively consolidated, and vendors are increasingly spending on R&D to gain technological capabilities and a competitive edge over other companies. The vendors in the market are competing on technology and quality but not on price. The intensity of competitive rivalry in the market is moderately high and is expected to increase over the coming years.

- July 2022 - Bosch Sensortec announced that Edge Impulse's machine-learning platform supports its sensors on the Arduino NiclaSense ME microcontroller. According to the company's announcement, the first Arduino Pro product was created in association with Bosch Sensortec, in which sensors offered by Bosch Sensortec offer numerous high-accuracy data collection and analysis methods by utilizing the pressure sensor BMP390.

- February 2022 - STMicroelectronics manufacturer of micro-electro-mechanical systems (MEMS), is releasing its third generation of MEMS sensors. The new sensors offer the next jump in performance and features for consumer mobile devices, intelligent industries, healthcare, and retail. Distributors will soon be able to purchase the LPS28DFW pressure sensor in a 2.8mm x 2.8mm x 1.95mm 7-lead LGA and the LPS22DF pressure sensor in a 2.0mm x 2.0mm x 0.73mm 10-lead LGA package.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Assessment of Impact of COVID-19 on the Market

- 4.6 Overview of the Use of Parylene in the MEMS Pressure Sensors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Automation and Industry 4.0

- 5.1.2 Increasing Demand for Sensor-rich Applications

- 5.2 Market Restraints

- 5.2.1 Complexity Regarding Multiple Interface

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Medical

- 6.1.2 Automotive

- 6.1.3 Industrial

- 6.1.4 Aerospace and Defense

- 6.1.5 Consumer Electronics

- 6.2 By Type

- 6.2.1 Silicon Piezoresistive

- 6.2.2 Silicon Capacitive

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bosch Sensortec GmbH

- 7.1.2 Murata Manufacturing Co. Ltd

- 7.1.3 Amphenol Advanced Sensors (Amphenol Corporation)

- 7.1.4 Sensata Technologies Inc.

- 7.1.5 Goertek INC.

- 7.1.6 STMicroelectronics NV

- 7.1.7 Omron Corporation

- 7.1.8 Alps Alpine Co. Ltd

- 7.1.9 Infineon Technologies AG

- 7.1.10 TE Connectivity Ltd

- 7.1.11 NXP Semiconductors NV (Freescale)

- 7.1.12 InvenSense Inc. (TDK Corporation)

- 7.1.13 ROHM Co. Ltd

- 7.1.14 Honeywell International Inc.

- 7.1.15 Melexis

- 7.2 Vendor Ranking for the Top 5 Vendors Across the End-user Verticals

- 7.3 Vendor Market Share for the Top 15 Vendors in 2021