|

市场调查报告书

商品编码

1630279

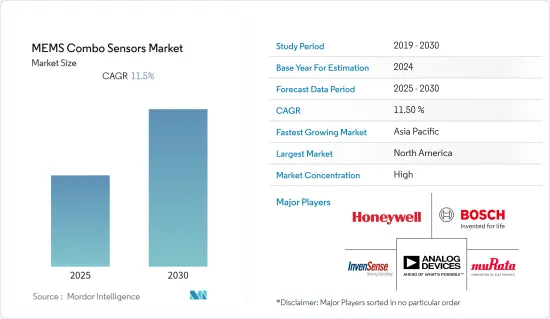

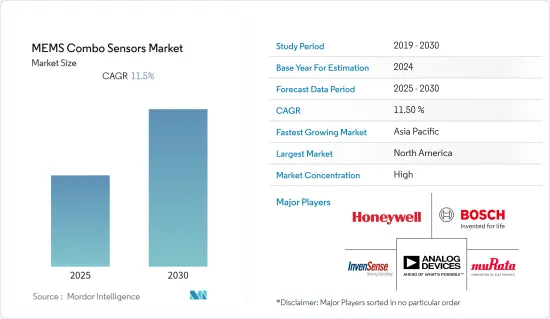

MEMS联合感应器-市场占有率分析、产业趋势/统计、成长预测 (2025-2030)MEMS Combo Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

MEMS联合感应器市场预计在预测期内复合年增长率为 11.5%

主要亮点

- 由于连网型设备的日益普及,全球对连网型穿戴式装置装置的需求正在显着增加。根据思科系统公司统计,2018年全球连网穿戴装置数量为5.93亿台,预计2022年将达到11.05亿台。因此,穿戴式装置的日益普及预计将有助于研究期间的市场成长。

- 汽车产业正在经历一场技术变革,自动驾驶汽车的采用即将到来。 ADAS(高级驾驶员辅助系统)变得越来越直觉。根据高盛预测,到 2025 年,ADAS/AV 市场预计价值 960 亿美元。因此,对 MEMS 组合感测器的需求预计将会增加。

- 全球家用电子电器市场和物联网设备的成长预计将对 MEMS联合感应器市场需求产生正面影响。根据GFU的数据,2021年全球家用电子电器产品支出为312亿欧元,较2020年成长2.5%。

- 随着科技公司在全球加速创新以对抗 COVID-19 大流行,晶片产业的 MEMS联合感应器正在经历巨大的成长。电子领域进步的背后是对超小型设备的需求。除了推出新产品外,供应商还想方设法取得更多技术进步,以满足不断变化的需求。然而,由于COVID-19大流行影响了多个全球市场,汽车、旅游和民航业都受到了不同程度的沉重打击。

- 此外,疫情改变了人们对製造业全球供应链的看法,出现了更多在地化价值链和区域化。这样做主要是为了最大限度地减少未来疫情造成的类似风险。

MEMS联合感应器市场趋势

对互联手持设备和穿戴式装置不断增长的需求推动了市场

- 近年来,微电子机械系统联合感应器因其能够使电子设备小型化和执行复杂测量以及其准确性和可靠性而受到广泛欢迎。推动 MEMS联合感应器市场的关键因素包括对工业自动化和小型消费性设备(例如穿戴式装置和物联网连接设备)的需求。

- 全球智慧型手机用户数量显着增加,穿戴式装置的需求也在增加。爱立信预计,全球智慧型手机用户数量预计将从2021年的62.59亿增加到2027年的76.9亿。智慧型手机的不断普及预计将在研究期间推动市场需求。

- 随着行动游戏的普及显着增加,用于游戏目的的手持设备的日益普及预计也将推动 MEMS联合感应器市场。根据DeviceAtlas的数据,2021年全球行动游戏支出为980亿美元,较2020年成长13%。

- 此外,由于全球健康意识趋势和健康资料追踪应用的采用,人们对穿戴式装置的兴趣日益增加,预计将推动 MEMS联合感应器市场的发展。据思科系统公司称,到 2022 年,全球将有 11 亿台连网穿戴装置。

北美占有很大的市场份额

- 由于对紧凑型系统和设备的需求不断增长,北美预计将成为 MEMS联合感应器市场的重要股东。该地区在研发领域投入巨资,并积极采用新技术进步。智慧型手机等家用电子电器的日益小型化以及将先进功能整合到创新的可穿戴技术中,正在为该地区创造可观的收益铺平道路。

- 此外,鑑于智慧电子、物联网和汽车产业在全球市场占有率,该地区预计将成为采用 ADAS 车辆和自动驾驶交通解决方案的先驱之一。根据Car of the Future预测,2021年美国ADAS产量将达1,845万辆。

- 根据国际能源总署 (IEA) 的数据,美国插电式电动车销量将从 2020 年的 34 万辆增至 2021 年的 607,600 辆,成长近一倍。总体而言,该国的汽车产业也在持续成长,促进了该地区MEMS市场的成长,特别是汽车产业。此外,政府推动电动车发展的措施预计也将促进该地区的成长。例如,2021年11月,美国政府制定了一个雄心勃勃的目标,即到2030年让50%的新车实现电动化,并承诺部署50万个充电站以增强客户信心。

- 此外,有关乘客安全的严格政府法规以及不断发展的汽车和航太工业正在推动北美 MEMS联合感应器市场的发展。资讯科技 (IT) 的进步以及物联网在製造业、工业和汽车等广泛应用中的日益普及,为该地区的业务运营带来了新的维度。

MEMS联合感应器产业概览

随着市场领导透过多样化的产品系列和产品开发占上风,MEMS联合感应器市场正在走向整合。任何製造商的创新能力都取决于其在研发方面的投入。该行业是资本密集型行业,为新进入者设置了进入障碍。主要参与企业包括 Honeywell International, Inc.、Bosch Sensortec GmbH、Analog Devices, Inc.、Murata Manufacturing 和 InvenSense, Inc.。

- 2022 年 1 月 - TDK 推出 InvenSense ICM-45xxx SmartMotion 超高性能 (UHP) 6 轴 MEMS动作感测器系列。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 对手持和穿戴式装置的需求增加

- ADAS 和自动驾驶解决方案在汽车产业的采用

- 互动游戏的成长

- 市场限制因素

- MEMS 总体成本增加

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

第五章市场区隔

- 按类型

- 移动联合感应器

- 环境联合感应器

- 光学联合感应器

- 其他感测器类型

- 按最终用户

- 航太/国防

- 车

- 家用电子电器

- 用水和污水管理

- 石油和天然气

- 饮食

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争状况

- 公司简介

- Honeywell International, Inc.

- Bosch Sensortec GmbH

- Analog Devices, Inc.

- Murata Manufacturing Co., Ltd.

- InvenSense, Inc.

- Panasonic Corporation

- KIONIX, Inc.

- MEMSIC, Inc.

- Microchip Technology, Inc.

- NXP Semiconductors

- Safran Colibrys SA

- STMicroelectronics NV

第七章 投资分析

第八章 市场机会及未来趋势

The MEMS Combo Sensors Market is expected to register a CAGR of 11.5% during the forecast period.

Key Highlights

- The global demand for connected wearable devices is significantly increased owing to the rising popularity of connected devices. According to CISCO Systems, the global number of connected wearable devices stood at 593 million during fiscal 2018 and is expected to reach 1105 million by 2022. Thus, increasing the adoption of wearable devices is expected to contribute to market growth throughout the study period.

- The automotive industry is moving towards a technological shift and is on the verge of adopting autonomous vehicles. Advanced Driver Assistance Systems are increasingly becoming intuitive. According to Goldman Sachs, the ADAS/AV market is expected to be USD 96 billion by 2025. This, in turn, is anticipated to bolster the demand for the MEMS combo sensors.

- The growing global consumer electronics market and IoT devices are expected to positively influence the demand for the MEMS combo sensors market. According to GFU, the expenditure on consumer electronics products worldwide stood at 31.2 billion euros in 2021, an increase of 2.5% compared to 2020.

- The MEMS combo sensors in the chip industry have witnessed immense growth as technology companies globally accelerated innovation in the fight against the COVID-19 pandemic. The need for tiny devices is behind advances in the areas of electronics. Alongside introducing new products, vendors are navigating more ways of technological advancement to address the evolving demand. However, since the COVID-19 pandemic impacted multiple global markets, the automotive, mobility, and civil aviation industries have suffered drastically yet differently.

- Moreover, the pandemic has changed the perception of the global supply chain in manufacturing, where more localized value chains and regionalization have come into the picture. These are primarily done to minimize similar future risks posed by the pandemic.

MEMS Combo Sensors Market Trends

Growing Demand for Connected Handheld and Wearable Devices to Drive the Market

- Microelectromechanical system combo sensors have gained significant traction over recent years due to advantages, such as accuracy and reliability, in addition to the scope for making smaller electronic devices and the ability to provide a combination of measurements. Among the significant factors driving the MEMS combo sensors market are industrial automation and the demand for miniaturized consumer devices, such as wearables, IoT-connected devices, and others.

- The number of smartphone users is increasing significantly across the globe, and the demand for wearable devices is also growing. According to Ericsson, worldwide smartphone subscriptions are expected to increase from 6,259 million in 2021 to 7,690 million in 2027. This increasing adoption of smartphones is expected to propel market demand over the study period.

- The increasing popularity of handheld devices for gaming purposes is also projected to drive the market for MEMS combo sensors, and the popularity of mobile gaming is increasing significantly. According to DeviceAtlas, worldwide spending on mobile gaming stood at USD 98 billion in 2021, a 13% increase from 2020.

- Additionally, the growing inclination towards wearable devices owing to the global trend of health-conscious lifestyles and the adoption of health data tracking applications is expected to drive the MEMS combo sensors market. According to CISCO Systems, 1.1 billion connected wearable devices will be globally by 2022.

North America to Hold Significant Share of the Market

- North America is expected to be a significant shareholder in the MEMS combo sensors market, owing to the increasing demand for compact systems and devices. The region is an active adopter of new technological advancements with significant investments in the R&D sector. The growing drive to reduce the size of consumer electronics, like smartphones, and integrate advanced features in innovative wearable technology has paved the path for generating significant revenue in the region.

- Furthermore, owing to its significant global market share of smart electronic devices, IoT, and the Automotive industry, the region is expected to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Car of the Future, the US ADAS unit production volume stood at 18.45 million in 2021.

- According to the International Energy Agency (IEA), the sales of plug-in electric light vehicles in the United States nearly doubled from 340,000 units in 2020 to 607,600 units in 2021. At an overall level, the automotive sector in the country has also been growing, contributing to the growth of the MEMS market, especially in the automotive industry, in the region. Further, government initiatives to boost electric vehicles are expected to contribute to the region's growth. For instance, In November 2021, the US government set an ambitious 50% electrified target for new automobiles by 2030, backed up by the declaration of the implementation of 500 000 charge sites to boost customer trust.

- In addition, stringent governmental regulations regarding passenger safety and the growing automotive and aerospace industries drive the market for MEMS combo sensors in North America. The advancements in information technology (IT) and the increased adoption of IoT across a wide range of manufacturing, industrial, and automotive applications have added a new dimension to conducting business operations in the region.

MEMS Combo Sensors Industry Overview

The MEMS combo sensors market is moving towards consolidation as market leaders are banking on diverse product portfolios and product development to gain an edge. Any player's innovation capabilities are dependent on investment in research and development. The industry is capital intensive and poses an entry barrier to new entrants. Key players are Honeywell International, Inc., Bosch Sensortec GmbH, Analog Devices, Inc., Murata Manufacturing Co., Ltd., and InvenSense, Inc., among others.

- January 2022 - TDK launched the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors which finds applications in equipment that require negligible gyro drift.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Handheld & Wearable Devices

- 4.2.2 Adoption of ADAS and Self Driving Solutions in Automotive Industry

- 4.2.3 Growth in Interactive Gaming

- 4.3 Market Restraints

- 4.3.1 Increase in Overall Cost of MEMS

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Movement Combo Sensor

- 5.1.2 Environment Combo Sensor

- 5.1.3 Optical Combo Sensor

- 5.1.4 Other Sensor Type

- 5.2 By End User

- 5.2.1 Aerospace & Defense

- 5.2.2 Automotive

- 5.2.3 Consumer Electronics

- 5.2.4 Water and Wastewater Management

- 5.2.5 Oil and Gas

- 5.2.6 Food and Beverage

- 5.2.7 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International, Inc.

- 6.1.2 Bosch Sensortec GmbH

- 6.1.3 Analog Devices, Inc.

- 6.1.4 Murata Manufacturing Co., Ltd.

- 6.1.5 InvenSense, Inc.

- 6.1.6 Panasonic Corporation

- 6.1.7 KIONIX, Inc.

- 6.1.8 MEMSIC, Inc.

- 6.1.9 Microchip Technology, Inc.

- 6.1.10 NXP Semiconductors

- 6.1.11 Safran Colibrys SA

- 6.1.12 STMicroelectronics NV