|

市场调查报告书

商品编码

1721442

MEMS 感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测MEMS Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

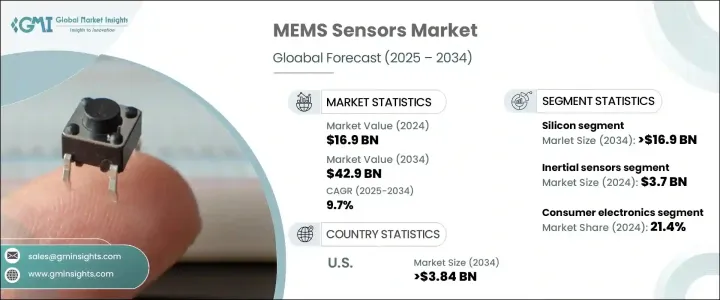

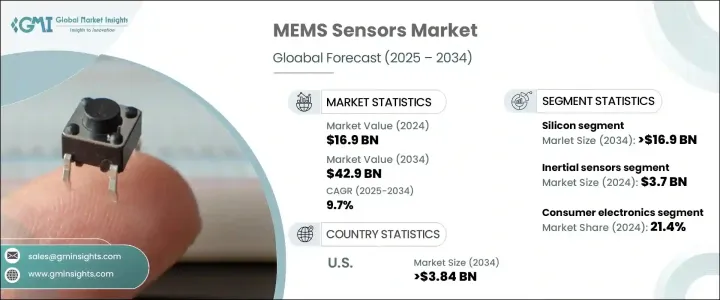

2024 年全球 MEMS 感测器市场价值为 169 亿美元,预计到 2034 年将以 9.7% 的复合年增长率成长,达到 429 亿美元。受各行各业加速采用互联技术的推动,该市场正呈现强劲发展动能。从下一代智慧型手机和智慧手錶到自动驾驶汽车和工业自动化系统,对智慧、微型感测器的需求从未如此高涨。 MEMS(微机电系统)感测器因其能够收集精确资料,同时保持低功耗和紧凑的外形而越来越受到重视。

随着消费者对更智慧、响应更快的设备的期望不断提高,製造商正在整合 MEMS 技术来提升用户体验并实现即时分析。此外,工业 4.0 的快速发展、对电动车的投资不断增长以及物联网 (IoT) 生态系统的不断扩大,正在强化 MEMS 感测器在重塑技术基础设施中的作用。全球原始设备製造商也专注于多功能感测器集成,以提高设备效率并最大限度地减少组件冗余,从而进一步推动市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 169亿美元 |

| 预测值 | 429亿美元 |

| 复合年增长率 | 9.7% |

MEMS 感测器在消费性电子产品和汽车应用中发挥越来越重要的作用。在汽车领域,对高级驾驶辅助系统 (ADAS) 和安全技术日益增长的需求推动了 MEMS 感测器的整合。这些系统依赖精确和即时的资料,随着全球汽车安全法规的收紧,MEMS 感测器确保了准确性和响应能力。在电子产品中,MEMS 感测器透过实现手势识别、运动追踪和环境监测等功能来提高设备性能,从而满足消费者对智慧、多功能设备的期望。

製造 MEMS 感测器所使用的材料包括硅、聚合物、陶瓷和金属。其中,硅继续占据主导地位,预计到 2034 年该领域将创造 169 亿美元的产值。硅与 CMOS 製造製程的兼容性,加上其卓越的机械和热稳定性,使其成为高性能应用中的首选材料。随着对轻量、耐用组件的需求不断增加,其在医疗保健、穿戴式装置和消费性电子产品领域的应用正在迅速扩大。

市场按感测器类型细分,例如惯性感测器、压力感测器、麦克风、环境感测器、光学感测器和超音波感测器。光是惯性感测器一项,2024 年的市场规模将达到 37 亿美元,应用范围涵盖工业自动化、机器人、无人机和汽车系统(包括自动驾驶汽车)。这些感测器对于运动侦测、定位和稳定至关重要,这些都是新兴智慧技术的关键要求。

美国 MEMS 感测器市场呈上升趋势,预计到 2034 年将达到 38.4 亿美元。美国的成长归因于航太、国防、医疗保健和自主系统等领域的部署不断增加。人工智慧、机器人和医疗创新的进步进一步增强了需求。罗伯特博世有限公司、意法半导体、博通公司、德州仪器和 Qorvo 公司等领导企业正专注于扩大产品线、推动研发和建立策略联盟,以加强其全球市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 消费性电子产品需求不断成长

- 汽车应用的进步

- 工业自动化和物联网的扩展

- 医疗保健和生物医学应用的成长

- 小型化和能源效率创新

- 产业陷阱与挑战

- 製造复杂性高且成本高

- 整合和标准化挑战

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按感测器类型,2021 - 2034 年

- 惯性感测器

- 压力感测器

- 麦克风

- 环境感测器

- 光学感测器

- 超音波感测器

- 其他的

第六章:市场估计与预测:按材料,2021 - 2034 年

- 硅

- 聚合物

- 陶瓷

- 金属材料

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 消费性电子产品

- 汽车

- 卫生保健

- 工业的

- 航太与国防

- 电信

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Robert Bosch GmbH

- STMicroelectronics

- Broadcom Inc.

- Texas Instruments

- Qorvo Inc.

- Goertek Inc.

- Hewlett Packard Enterprise Development LP

- TDK Corporation

- Knowles Electronics LLC

- Infineon Technologies AG

- Honeywell International

- Analog Devices Inc.

- Murata Manufacturing Co. Ltd.

- Teledyne DALSA

- Sony Semiconductor

- X-FAB Silicon Foundries

- Tower Semiconductor

- TSMC (Taiwan Semiconductor Manufacturing Company)

- United Microelectronics Corporation (UMC)

- Safran Sensing Technologies Norway AS

- MEMS Engineering Limited

- Redbud Labs

- USound

- Windfall Bio

- ZERO POINT MOTION LTD.

The Global MEMS Sensors Market was valued at USD 16.9 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 42.9 billion by 2034. The market is witnessing robust momentum, driven by the accelerating adoption of connected technologies across industries. From next-gen smartphones and smartwatches to autonomous vehicles and industrial automation systems, the demand for intelligent, miniaturized sensors has never been higher. MEMS (Micro-Electro-Mechanical Systems) sensors are gaining prominence for their ability to collect precise data while maintaining low power consumption and compact form factors.

As consumer expectations for smarter, more responsive devices continue to rise, manufacturers are integrating MEMS technology to elevate user experiences and enable real-time analytics. Additionally, the rapid evolution of Industry 4.0, growing investments in electric vehicles, and the expanding footprint of the Internet of Things (IoT) ecosystem are reinforcing the role of MEMS sensors in reshaping technological infrastructures. Global OEMs are also focusing on multi-functional sensor integration to enhance device efficiency and minimize component redundancy, further boosting market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.9 Billion |

| Forecast Value | $42.9 Billion |

| CAGR | 9.7% |

MEMS sensors play an increasingly critical role in both consumer electronics and automotive applications. In the automotive sector, the growing demand for advanced driver-assistance systems (ADAS) and safety technologies is fueling the integration of MEMS sensors. These systems rely on precise and real-time data, and MEMS sensors ensure accuracy and responsiveness as global regulations around automotive safety tighten. In electronics, MEMS sensors enhance device performance by enabling features like gesture recognition, motion tracking, and environmental monitoring, thus aligning with consumer expectations for intelligent, multifunctional gadgets.

The materials used in manufacturing MEMS sensors include silicon, polymers, ceramics, and metals. Among these, silicon continues to dominate, with the segment projected to generate USD 16.9 billion by 2034. Silicon's compatibility with CMOS fabrication processes, along with its superior mechanical and thermal stability, makes it a preferred material across high-performance applications. Its adoption is expanding rapidly in healthcare, wearables, and consumer electronics as demand for lightweight, durable components increases.

The market is segmented by sensor types such as inertial sensors, pressure sensors, microphones, environmental sensors, optical sensors, and ultrasonic sensors. Inertial sensors alone accounted for USD 3.7 billion in 2024, with applications spanning industrial automation, robotics, drones, and automotive systems, including self-driving vehicles. These sensors are vital for motion detection, orientation, and stabilization, key requirements for emerging smart technologies.

The U.S. MEMS sensors market is on an upward trajectory, projected to reach USD 3.84 billion by 2034. Growth in the U.S. is attributed to increasing deployment across aerospace, defense, healthcare, and autonomous systems. Progress in AI, robotics, and medical innovations further reinforces demand. Leading players such as Robert Bosch GmbH, STMicroelectronics, Broadcom Inc., Texas Instruments, and Qorvo Inc. are focusing on expanding product lines, advancing R&D, and forming strategic alliances to strengthen their global market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for consumer electronics

- 3.2.1.2 Advancements in automotive applications

- 3.2.1.3 Expansion of industrial automation and iot

- 3.2.1.4 Growth in healthcare and biomedical applications

- 3.2.1.5 Miniaturization and energy efficiency innovations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing complexity and costs

- 3.2.2.2 Integration and standardization challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Sensor Type, 2021 - 2034 (USD Million and Units)

- 5.1 Inertial sensors

- 5.2 Pressure sensors

- 5.3 Microphones

- 5.4 Environmental sensors

- 5.5 Optical sensors

- 5.6 Ultrasonic sensors

- 5.7 Others

Chapter 6 Market estimates & forecast, By Material, 2021 - 2034 (USD Million and Units)

- 6.1 Silicon

- 6.2 Polymers

- 6.3 Ceramics

- 6.4 Metallic materials

Chapter 7 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million and Units)

- 7.1 Consumer electronics

- 7.2 Automotive

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Aerospace & defense

- 7.6 Telecommunications

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million and Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Robert Bosch GmbH

- 9.2 STMicroelectronics

- 9.3 Broadcom Inc.

- 9.4 Texas Instruments

- 9.5 Qorvo Inc.

- 9.6 Goertek Inc.

- 9.7 Hewlett Packard Enterprise Development LP

- 9.8 TDK Corporation

- 9.9 Knowles Electronics LLC

- 9.10 Infineon Technologies AG

- 9.11 Honeywell International

- 9.12 Analog Devices Inc.

- 9.13 Murata Manufacturing Co. Ltd.

- 9.14 Teledyne DALSA

- 9.15 Sony Semiconductor

- 9.16 X-FAB Silicon Foundries

- 9.17 Tower Semiconductor

- 9.18 TSMC (Taiwan Semiconductor Manufacturing Company)

- 9.19 United Microelectronics Corporation (UMC)

- 9.20 Safran Sensing Technologies Norway AS

- 9.21 MEMS Engineering Limited

- 9.22 Redbud Labs

- 9.23 USound

- 9.24 Windfall Bio

- 9.25 ZERO POINT MOTION LTD.