|

市场调查报告书

商品编码

1687813

乙炔:市场占有率分析、产业趋势与成长预测(2025-2030 年)Acetylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

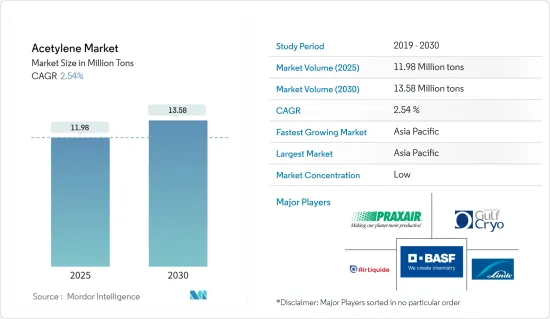

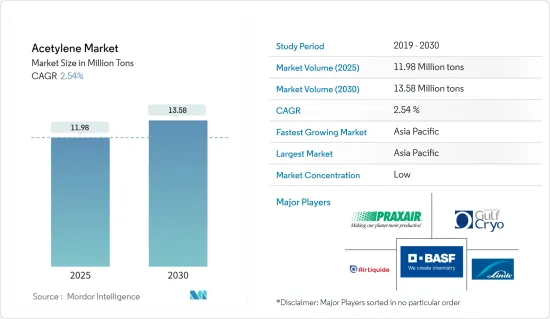

预计2025年乙炔市场规模为1,198万吨,2030年将达1,358万吨,预测期(2025-2030年)复合年增长率为2.54%。

受新冠疫情影响,乙炔市场遭遇挫折。全球封锁和严格的政府监管导致大面积製造工厂关闭。不过,预计市场将在 2021 年復苏,并在未来几年内实现显着成长。

主要亮点

- 短期内,金属加工产业的需求不断增长和化学工业的需求不断增长是推动研究市场需求的主要因素。

- 然而,由于乙炔的有害影响以及焊接和切割应用中乙炔的替代方案而製定的严格的环境法规预计会阻碍市场的成长。

- 然而,乙炔气体在各类科学研究中的应用可望为调查市场带来新的机会。

- 预计亚太地区将主导全球整体市场,其中中国和印度的需求占大部分市场份额。

乙炔市场趋势

金属加工领域可望主导市场

- 乙炔是一种高度易燃的气体,在各种金属加工过程中至关重要。其独特的特性使其成为许多工业应用的首选燃料气体。

- 乙炔主要用于氧乙炔切割、热处理和焊接。此外,化学加工产业使用大量乙炔作为原料合成乙醛、乙酸和乙酸酐等有机化合物。

- 乙炔由于具有三键结构,所以其燃烧温度是所有气体中最高的。乙炔与氧气燃烧时,火焰温度为3090°C,释放出54.8 kJ/公升的能量。这种高火焰温度使得乙炔成为切割、焊接、锡焊和硬焊等金属加工作业的必需品。

- 此类金属加工应用服务于各种终端用户产业,包括汽车、航太、金属加工、製药和玻璃。

- 根据世界钢铁协会(Worldsteel)的资料,2023年12月全球粗钢产量为1.357亿吨,较11月下降6.3%。截至 2024 年 7 月,产量恢復至 1.528 亿吨(Mt),较 2023 年 7 月下降 4.7%。虽然这些数字凸显了该产业面临的挑战,但随着新兴经济体活性化基础建设计划力度,钢铁需求预计将会復苏。

- 根据安巴图尔工业区製造商协会(AIEMA)的报告,印度工具机产业预计2023年将年增与前一年同期比较%。 AIEMA预测未来三年工具机产业将成长12-17%。这种成长将扩大对金属加工应用的需求并推动市场扩张。

- 此外,中国和美国等国家的钢铁生产能力增强,正在促进全球钢铁产量,进一步推动对金属加工应用的需求并支持市场成长。

- 根据世界钢铁协会统计,日本2024年7月钢铁产量为7.1吨,较去年同期下降3.8%。累计产量49.8吨,较去年同期下降2.8%。

- 美国是世界第四大粗钢生产国,据报告,2024 年 7 月粗钢产量为 690 万吨,小幅增加 2.1%。不过,根据世界钢铁协会的数据显示,今年全年钢铁总产量为 4,690 万吨,下降了 1.8%。

- 正如美国製造技术 (AMT)美国製造技术订单报告所强调的,2023 年 12 月工具机新订单激增。製造商将在金属切割和金属成型/製造机械上投资 4.9103 亿美元,较 2023 年 11 月成长 21.7%,较 2022 年 12 月成长 11.9%。 2024 年 2 月製造技术(工具机)订单达 3.433 亿美元,比 2024 年 1 月成长 2.1%。此外,2024 年 2 月製造技术(工具机)订单达到 3.433 亿美元,比 2024 年 1 月成长 2.1%。

- 预计2024年7月德国钢铁产量为310万吨,成长4.8%。根据世界钢铁协会的资料,德国全年产量达2,250万吨,大幅增加4.5%。

- 巴西2024年7月产量为3.1吨,成长11.6%。世界钢铁协会报告称,巴西全年产量为 1,940 万吨,成长 3.3%。

- 由于乙炔在金属加工中的使用不断增加,预计预测期内乙炔市场将会成长。

亚太地区可望主导市场

- 预计亚太地区将引领乙炔市场并成为预测期内成长最快的地区。这种快速成长的主要动力是对金属加工和化学原料等多种应用的需求不断增长,主要是在中国、印度、韩国、日本和东南亚国家。

- 乙炔在氯乙烯单体、丙烯腈、醋酸乙烯酯、乙烯基醚、乙醛、1,2-二氯乙烷、1,4-丁炔二醇、丙烯酸酯、聚乙炔和聚二乙炔等基本化学物质的生产中起着至关重要的作用。考虑到亚太地区是化学工业最大的市场,乙炔市场潜力巨大。

- 中国是世界化学加工中心,主导全球化学品生产。随着全球对各种化学品的需求不断增加,预计预测期内该产业对乙酸等中间体的需求将大幅增加。

- 中国不仅是化工领域的领导者,也是成长最快的市场之一。中国扮演重要角色,VCI(德国化学工业协会)的资料显示,2023年中国将占全球石化出口的12.8%。

- 中国是世界上最大的钢铁生产国之一,也正在转向更环保的钢铁生产方式。 2024年7月中国钢铁产量下降9.0%至8,290万吨。根据世界钢铁协会的数据,累计产量为 6.137 亿吨,较 2023 年下降 2.2%。

- 根据印度投资局的资料,化学品和化学产品(不包括药品和化肥)的出口占 2022-23 年出口总额的 10.5%,低于 2021-22 年的 11.7%。截至 2023 年 12 月,该产业对 2023-24 财年出口总额的贡献率为 10%。

- 根据BigMint预测,到2024/2025财政年度结束(截至2025年3月),印度的钢铁产量预计将与前一年同期比较增近6%,达到1.52亿吨。预计该预测产量大部分将来自使用高炉的钢厂。

- 此外,经济综合观察站(OEC)的资料显示,韩国有机化学品出口大幅成长。 2023年5月至2024年5月,出口额激增7,660万美元,从17.3亿美元成长至18.1亿美元,成长4.42%。这一成长凸显了该行业日益增长的重要性,并为市场需求的成长奠定了基础。

- 此外,马来西亚统计局(DOSM)报告称,2024年5月,马来西亚化学品和化学产品出口年增0.8%至63.1亿令吉(约13.4亿美元)。这一增长表明马来西亚整体贸易下滑已经触底。 2024 年 5 月化学品整体出口年增 7.3% 至 1,282 亿林吉特(约 272.2 亿美元),进口成长 13.8% 至 1,181 亿林吉特(约 250.8 亿美元)。化工产业的强劲成长预计将推动市场对乙炔的需求。

- 随着该地区工业的快速发展,预计未来几年乙炔市场将大幅成长。

乙炔产业概况

乙炔市场较为分散。主要参与者(不分先后顺序)包括BASF SE、Praxair Technology Inc.、Gulf Cryo、Linde PLC 和 Air Liquide。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 金属加工产业的需求不断增加

- 化工产业需求增加

- 其他驱动因素

- 限制因素

- 乙炔的有害影响导致严格的环境法规

- 焊接和切割应用中乙炔的替代品

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 应用

- 金工

- 化学原料

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Air Liquide

- Air Products And Chemicals Inc.

- Asia Technical Gas Co Pte Ltd.

- Axcel Gases

- BASF SE

- Butler Gas Products

- Denka Company Limited

- Gruppo SIAD

- Gulf Cryo

- Jinhong Gas Co. Ltd.

- Koatsu Gas Kogyo Co. Ltd.

- Linde PLC

- Nippon Sanso Holdings Corporation

- NOL Group

- Pune Air Products

- TOHO ACETYLENE Co.

- Transform Materials

第七章 市场机会与未来趋势

- 乙炔气在各类科学研究的应用

- 其他机会

The Acetylene Market size is estimated at 11.98 million tons in 2025, and is expected to reach 13.58 million tons by 2030, at a CAGR of 2.54% during the forecast period (2025-2030).

The acetylene market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, growing demand from the metalworking industry and increasing demand from the chemical sector are the major factors driving the demand for the market studied.

- However, stringent environmental regulations due to the harmful effects of acetylene and alternatives of acetylene in welding and cutting applications are expected to hinder the market's growth.

- Nevertheless, the application of acetylene gas for various scientific research is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Acetylene Market Trends

Metalworking Segment is Expected to Dominate the Market

- Acetylene, a highly flammable gas, is pivotal in various metalworking processes. Its distinct properties render it an optimal fuel gas for numerous industrial applications.

- Primarily, acetylene is utilized in oxyacetylene cutting, heat treating, and welding. Additionally, the chemical processing industry employs bulk acetylene as a raw material to synthesize organic compounds like acetaldehyde, acetic acid, and acetic anhydride.

- Acetylene's triple-bond structure grants it the highest flame temperature among gases. When combusted with oxygen, acetylene reaches a flame temperature of 3090°C (5594°F), releasing an energy of 54.8 kJ/liter. This elevated flame temperature is what makes acetylene indispensable for metalworking tasks such as cutting, welding, soldering, and brazing.

- These metalworking applications find utility across diverse end-user industries, including automotive, aerospace, metal fabrication, pharmaceuticals, and glass.

- As per the data from the World Steel Association (worldsteel), global crude steel production was 135.7 million tonnes (Mt) in December 2023, down 6.3% from November. By July 2024, production rebounded to 152.8 million tonnes (Mt), though this was a 4.7% dip from July 2023. These figures highlight the industry's challenges, but with emerging economies ramping up infrastructure projects, a steel demand recovery is anticipated.

- As reported by the Ambattur Industrial Estate Manufacturers Association (AIEMA), India's machine tools industry was estimated to grew by 14-15% in 2023 compared to the previous year. Looking ahead, AIEMA forecasts a growth rate of 12-17% for the machine tools sector over the next three years. Such growth is set to amplify the demand for metalworking applications, subsequently propelling the market's expansion.

- Additionally, enhanced steel production capacities in countries like China and the United States have bolstered global steel output, further driving the demand for metalworking applications and supporting the market's growth.

- As per the World Steel Association, Japan's steel production in July 2024 stood at 7.1 Mt, marking a 3.8% decline from the same month in 2023. Year-to-date figures show a production of 49.8 Mt, reflecting a 2.8% year-on-year drop.

- The United States, ranked as the fourth-largest producer of crude steel globally, reported a production of 6.9 Mt in July 2024, witnessing a modest increase of 2.1%. However, the year-to-date production figures were at 46.9 Mt, indicating a decline of 1.8%, as per the World Steel Association.

- As highlighted in the United States Manufacturing Technology Orders report by AMT-the Association For Manufacturing Technology-December 2023 saw a surge in new machine tool orders. Manufacturers invested USD 491.03 million in metal-cutting and metal-forming/fabricating machinery, reflecting a 21.7% rise from November 2023 and an 11.9% increase from December 2022. In February 2024, orders for manufacturing technology (machine tools) reached USD 343.3 million, marking a 2.1% uptick from January 2024. Furthermore, in February 2024, manufacturing technology (machine tools) orders reached USD 343.3 million, indicating an increase of 2.1% compared to January 2024.

- Germany's steel production in July 2024 was estimated at 3.1 Mt, showcasing a 4.8% increase. Year-to-date, Germany's production reached 22.5 Mt, marking a notable 4.5% rise, according to World Steel Association data.

- Brazil led with the most significant growth, producing 3.1 Mt in July 2024, an impressive 11.6% increase. Year-to-date, Brazil's production stood at 19.4 Mt, up by 3.3%, as reported by the World Steel Association.

- Given the rising applications of acetylene in metalworking, the market for acetylene is set to witness growth over the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is poised to lead the acetylene market, emerging as the region with the fastest growth during the forecast period. This surge is primarily fueled by rising demands in diverse applications, including metalworking and as a chemical raw material, particularly in nations like China, India, South Korea, Japan, and several Southeast Asian countries.

- Acetylene plays a pivotal role in producing essential chemicals, including vinyl chloride monomer, acrylonitrile, vinyl acetate, vinyl ether, acetaldehyde, 1,2-dichloroethane, 1,4-butynediol, acrylate esters, polyacetylene, and polydiacetylene. Given that Asia-Pacific boasts the largest market for the chemical industry, there's vast potential for the acetylene market to flourish.

- China, a global chemical processing hub, dominates worldwide chemical production. As global demand for various chemicals rises, this sector's need for intermediates, such as acetic acid, is projected to see a significant uptick during the forecast period.

- China stands out not only as the largest player in the chemical arena but also as one of its fastest-growing markets. Data from VCI (Association of the Chemical Industry e.V.) highlights China's significant role, with the nation accounting for 12.8% of global petrochemical exports in 2023.

- China, the world's leading iron and steel producer, is also pivoting towards eco-friendly steel production methods. While serving both domestic and international markets, China's steel output saw a 9.0% decline in July 2024, totaling 82.9 million tonnes (Mt). Year-to-date figures indicate a production of 613.7 Mt, marking a 2.2% drop from 2023, as per the World Steel Association.

- Data from Invest India highlights that exports of chemicals and chemical products (excluding pharmaceuticals and fertilizers) accounted for 10.5% of total exports in 2022-23, down from 11.7% in 2021-22. As of December 2023, this segment contributed 10% to total exports for the 2023-24 fiscal year.

- According to BigMint, India's steel production is projected to grow by nearly 6% year-on-year, reaching 152 million tons by the close of FY2024/2025 (ending March 2025). The bulk of this projected output is anticipated to stem from steel mills utilizing blast furnaces.

- Furthermore, data from the Observatory of Economic Complexity (OEC) highlights a significant rise in South Korea's organic chemical exports. From May 2023 to May 2024, exports jumped by USD 76.6 million, a 4.42% increase from USD 1.73 billion to USD 1.81 billion. This growth underscores the sector's rising prominence and sets the stage for increased market demand.

- Additionally, the Department of Statistics Malaysia (DOSM) reports that Malaysia's chemical and chemical product exports grew by 0.8% year-on-year to MYR 6.31 billion (~USD 1.34 billion) in May 2024. This growth comes as signs indicate a bottoming out of the nation's overall trade weakness. Overall chemicals exports surged by 7.3% year-on-year to MYR 128.2 billion (~USD 27.22 billion) in May 2024, while imports rose by 13.8% to MYR 118.1 billion (~USD 25.08 billion). Such robust growth in the chemical sector is set to bolster demand in the acetylene market.

- Given the burgeoning industries in the region, the acetylene market is poised for significant growth in the coming years.

Acetylene Industry Overview

The acetylene market is fragmented in nature. The major players (not in any particular order) include BASF SE, Praxair Technology Inc., Gulf Cryo, Linde PLC, and Air Liquide, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Metalworking Industry

- 4.1.2 Increasing Demand from the Chemical Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Due to the Harmful Effects of Acetylene

- 4.2.2 Alternatives of Acetylene in Welding And Cutting Applications

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Metal Working

- 5.1.2 Chemical Raw Materials

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Qatar

- 5.2.5.3 United Arab Emirates

- 5.2.5.4 Nigeria

- 5.2.5.5 Egypt

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products And Chemicals Inc.

- 6.4.3 Asia Technical Gas Co Pte Ltd.

- 6.4.4 Axcel Gases

- 6.4.5 BASF SE

- 6.4.6 Butler Gas Products

- 6.4.7 Denka Company Limited

- 6.4.8 Gruppo SIAD

- 6.4.9 Gulf Cryo

- 6.4.10 Jinhong Gas Co. Ltd.

- 6.4.11 Koatsu Gas Kogyo Co. Ltd.

- 6.4.12 Linde PLC

- 6.4.13 Nippon Sanso Holdings Corporation

- 6.4.14 NOL Group

- 6.4.15 Pune Air Products

- 6.4.16 TOHO ACETYLENE Co.

- 6.4.17 Transform Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Application of Acetylene Gas for Various Scientific Research

- 7.2 Other Opportunities