|

市场调查报告书

商品编码

1445470

酒柜:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Wine Cooler - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

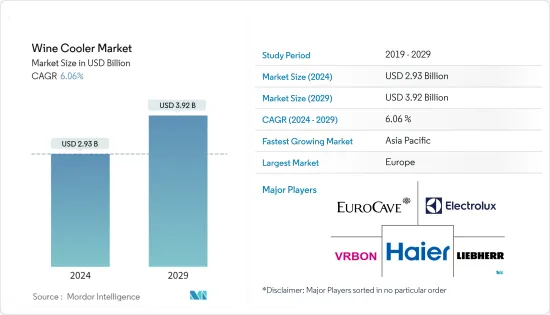

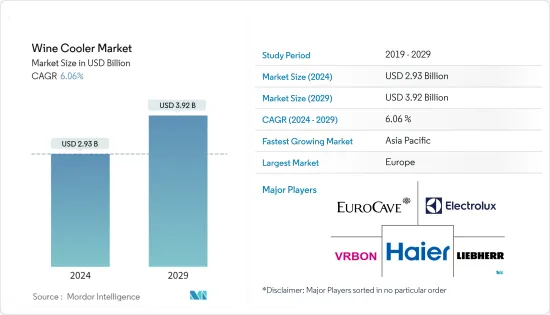

酒柜市场规模预计到 2024 年为 29.3 亿美元,预计到 2029 年将达到 39.2 亿美元,预测期内(2024-2029 年)复合年增长率为 6.06%。

在最佳温度下储存葡萄酒的概念对于成功的陈酿过程至关重要。葡萄酒冰箱或冷藏箱有助于让您的葡萄酒长期饮用并改善葡萄酒的味道。这是预测期内市场成长的完美驱动因素。全球葡萄酒消费量的增加是推动产品需求的主要因素之一。在英国、英国、西班牙、义大利、南非和加拿大等国家,美国越来越受欢迎,尤其是在年轻消费者中,需求预计将进一步增加。

消费者在夏季对一杯优质葡萄酒的偏好增加,这表明不同类型的葡萄酒在世界各地的饮食文化中越来越受欢迎。除了葡萄酒产品的健康益处和优质化之外,由于风味创新和全球更复杂的分销网络,葡萄酒需求的成长预计将推动酒柜市场的发展。此外,市场参与者正在推出采用尖端技术的酒柜,推动市场发展。例如,2021 年 8 月,Signature Kitchen Suite 宣布推出其葡萄酒冰箱系列专用的创新 Wine Cave 技术。新推出的产品具有减少振动和温度波动、限制光照和优化湿度的特点,可保护藏品免受葡萄酒中最有害的成分影响。

酒柜市场趋势

全球市场葡萄酒零售额成长

世界主要国家酒精饮料尤其是葡萄酒的零售额不断增长,这也是酒柜和冰箱市场的关键驱动力。例如,根据葡萄酒研究所的数据,去年美国葡萄酒零售额约为784亿美元,高于去年的668亿美元。由于越来越多的消费者更喜欢购买酒瓶供内部消费,因此预计在预测期内对酒柜的需求将会出现波动。此外,在高端厨房设置的趋势下,消费者不仅在家中,而且在自己的厨房中引入高科技电器,酒柜是消费者的理想选择之一。

此外,大量的城市人口鼓励使用酒柜来储存葡萄酒。智慧酒柜产品的使用在全球范围内不断增加,增加了对高端产品的需求。根据人口研究所预测,2022年部分地区都市化北美为-83%,拉丁美洲和加勒比海地区为-81%,欧洲为-75%。随着都市化程度的不断提高,世界各地的人们接触到的葡萄酒种类越来越多,进一步鼓励消费者购买葡萄酒供自己消费,从而推动市场成长。

欧洲和北美引领市场

从地区来看,欧洲和北美近年来已成为葡萄酒的主要消费地区,并且随着这两个地区的葡萄酒和其他酒精饮料的内部消费量不断增加,酒柜市场在这些地区是最大的。 。然而,就产量而言,中国领先全球市场,与其他国家相比,生产的酒柜和冰箱最多,其次是美国。根据《Wines of Great Britain》发布的行业报告显示,2021年英国葡萄酒市场按销售管道分類的销售份额为:英国酒窖(38%)、酒庄网站(19%)、交易零售(14%) 、独立(12%)、出口(4%)及其他零售通路(13%)。

此外,根据加拿大统计局的数据,2021年加拿大葡萄酒市场达到80.1775亿加元,比前一年的收益(2020年为78.4953亿加元)有所增长。因此,酒柜的需求量逐年增加。随着全部区域各个零售通路的葡萄酒市场的成长,这一数字也成比例地成长。

酒柜业概况

酒柜市场高度分散,涉及世界领先的电子製造商以及几家专门生产酒柜的公司。主要市场参与者包括海尔集团、深圳万邦电子有限公司、伊莱克斯、利勃海尔和 Eurocave SAS。大多数商业公司都将技术进步作为其关键策略之一。研究市场中最常使用的策略包括产品创新和合作关係。市场上的公司推出了具有尖端技术的产品,以吸引更多的客户并与市场上的其他参与者竞争。 2021年2月,海尔欧洲旗下品牌Hoover和Candy推出了全新酒柜系列。新产品包括五款 Hoover 型号和三款 Candy 型号,据称它们整合了最新技术,可最大限度地利用空间并使葡萄酒保持最佳状态。所有产品均配有烟色玻璃门,可阻挡有害的紫外线,保持恆定的内部温度,并允许瓶子在使用者设定的各种温度下储存。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 类型

- 自主型

- 檯面

- 内建

- 科技

- 压缩机底座

- 热电底座

- 分销管道

- 线下通路

- 线上管道

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 主要企业采取的策略

- 市场占有率分析

- 公司简介

- Dunavox Kft.

- The Legacy Companies(Avanti Products Inc)

- Haier Group Corporation

- Shenzhen VRBON Electrical Appliance Co., Ltd.

- Investor AB(Electrolux AB)

- Eurocave SAS

- La Sommeliere Int. SAS

- Liebherr

- Caple

- LG Corporation

- Equator Advanced Appliances

第七章市场机会与未来趋势

The Wine Cooler Market size is estimated at USD 2.93 billion in 2024, and is expected to reach USD 3.92 billion by 2029, growing at a CAGR of 6.06% during the forecast period (2024-2029).

The concept of keeping wine stored at the optimum temperature is essential in allowing the aging process to take place successfully. A wine fridge or cooler helps keep the wine drinkable for a much longer period and improves the taste of wine, which is an optimal driving reason for helping the market to grow in the forecast period. Increasing consumption of wine across the world is one of the main factors fueling product demand. The rising popularity of wine in countries such as the United States, the United Kingdom, Spain, Italy, South Africa, and Canada, especially among young consumers, is projected to further fuel the demand.

Growing indulgence of consumers toward a glass of fine wine in summer indicates the rising popularity of various variants of wine in dietary cultures across several parts of the world. The wine cooler market is likely to be driven by the increasing demand for wine due to its health benefits and premiumization of wine products, coupled with flavor innovation and a more advanced distribution network globally. Furthermore, the players in the market have been launching wine coolers with cutting-edge technologies, in turn propelling the market. For instance, in August 2021, Signature Kitchen Suite announced the launch of a revolutionary Wine Cave technology, which is exclusive to the wine refrigerator lineup offered by the company. The newly launched product featured a reduction of vibration and temperature variations, restriction to light exposure, and optimizing humidity, shielding collections from wine's most detrimental components.

Wine Cooler Market Trends

Rising Retail Sales of Wine Across the Global Market

The retail sales of alcoholic beverages, especially wines, are on the rise across major countries worldwide, which is also a key driving agent for the wine coolers and refrigerators market. For instance, according to the Wine Institute, the retail sales of wine in the United States amounted to approximately USD 78.4 billion last year, which was higher than the previous year's sales, amounting to USD 66.8 billion. Since more consumers prefer to buy their wine bottles for in-house consumption, the demand for the wine cooler is expected to drift in the forecast period. Moreover, in the trend of luxury kitchen setup where consumers are seeking to incorporate high technological appliances for their kitchen as well as households, a wine cooler is one ideal choice for the consumers.

Furthermore, the presence of a large base of urban population has been aiding the usage of wine coolers for wine storage. The rising usage of smart wine cooler products across the world is boosting the demand for high-end products. According to the Population Reference Bureau, in 2022, the degree of urbanization in some regions was: North America - 83%, Latin America and the Caribbean - 81%, and Europe - 75%. With the rise in urbanization, the global population is exposed to a wide range of wines, further encouraging consumers to buy wines for in-house consumption, in turn propelling the growth of the market.

Europe and North America Leading the Market

As per the regions, Europe and North America have been the primary consumers of wines over recent years, owing to the increasing in-house consumption of wines and other alcoholic beverages in both regions, the wine cooler market is estimated the largest in the regions. However, by production, China led the way for the global market accounting for the largest wine cooler and refrigerator production as compared to any other country followed by the United States. According to the industry report published by "Wines of Great Britain", in 2021 the sales share of the wine market in the United Kingdom by sales channel was United Kingdom cellar door (38%), winery websites (19%), on-trade (14%), Indies (12%), exports (4%), and other retail channels (13%).

Additionally, according to Statistics Canada, the wine market in Canada amounted to CAD 8,017.75 million in the year 2021 which was higher as compared to the revenue generated in the previous year i.e. CAD 7,849.53 million in 2020. Hence, the demand for wine coolers has been increasing proportionally with the growth of the wine market across various retail channels throughout the region.

Wine Cooler Industry Overview

The wine cooler market is largely fragmented with the involvement of leading electronic appliance manufacturers of the world, along with a few companies specialized in manufacturing wine coolers. The key market players include Haier Group, Shenzhen VRBON Electronic Appliance Co., Electrolux AB, Liebherr, and Eurocave SAS. Most companies engaged in business are focusing on technological advancements as one of their leading strategies. The most commonly used strategies in the market studied include product innovations and partnerships. The companies in the market have been launching products with cutting-edge technologies to attract more customers and compete with the other players in the market. In February 2021, Hoover and Candy, brands of Haier Europe, introduced new wine cooler collections. The new products, which include five Hoover and three Candy models, are said to integrate the latest technology to maximize space and keep the wine in the optimum state. All products have smoked glass doors to keep harmful UV rays out and help maintain a consistent interior temperature, and they can store bottles at a variety of temperatures determined by the user.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Free-Standing

- 5.1.2 Counter Top

- 5.1.3 Built-In

- 5.2 Technology

- 5.2.1 Compressor-based

- 5.2.2 Thermoelectic-based

- 5.3 Distribution Channel

- 5.3.1 Offline Channel

- 5.3.2 Online Channel

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Dunavox Kft.

- 6.3.2 The Legacy Companies (Avanti Products Inc)

- 6.3.3 Haier Group Corporation

- 6.3.4 Shenzhen VRBON Electrical Appliance Co., Ltd.

- 6.3.5 Investor AB (Electrolux AB)

- 6.3.6 Eurocave SAS

- 6.3.7 La Sommeliere Int. SAS

- 6.3.8 Liebherr

- 6.3.9 Caple

- 6.3.10 LG Corporation

- 6.3.11 Equator Advanced Appliances