|

市场调查报告书

商品编码

1645053

欧洲葡萄酒冷却器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Wine Coolers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

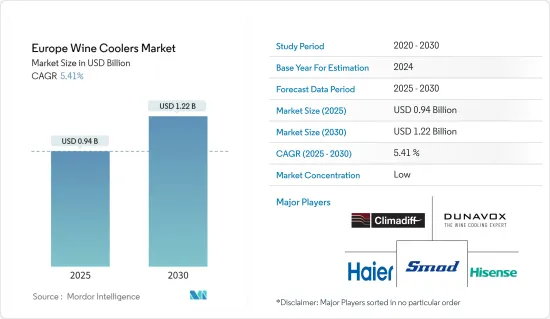

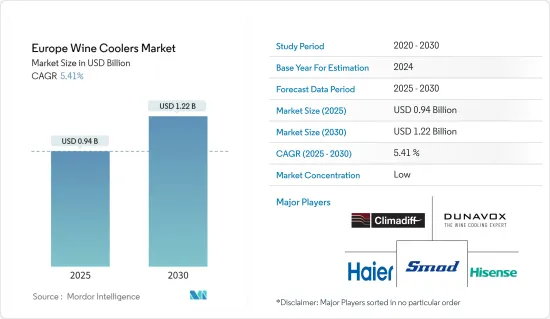

预计 2025 年欧洲葡萄酒冷却器市场规模为 9.4 亿美元,到 2030 年将达到 12.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.41%。

儘管自新冠疫情以来,欧洲的人均葡萄酒消费量一直在下降,但仍在持续增长,而且这种消费量的增加对葡萄酒柜的销售产生了正外部影响。自新冠疫情爆发以来,随着欧洲酒店入住率的提高,游客的葡萄酒消费量也在增加,为商业性领域的葡萄酒柜销售创造了机会。

随着新冠疫情后欧洲人均葡萄酒销量和总销量持续增长,以及其在户外消费中的份额不断上升,与住宅领域相比,商业领域已成为未来一段时间内葡萄酒冷却器的主要需求领域。

技术创新将智慧冷却器推向市场,彻底改变了葡萄酒冷却器产业。由于其具有 Wi-Fi 连接的智慧功能,您可以透过智慧型手机存取葡萄酒冷却器,以设定温度、检查库存并在冷却器内储存葡萄酒。越来越多的网路零售商和电子商务营运商将葡萄酒柜作为销售商品,丰富了销售管道并增加了製造商的市场收益。此外,欧洲都市化进程加快,人均收入增加,从而导致葡萄酒消费量增加,推动了住宅和商业场所对葡萄酒冷却器的需求。

欧洲葡萄酒冷却器市场趋势

商业部门销售额成长

葡萄酒销售份额不断增加,而住宅销售份额却不断减少。出于这个原因,商业领域正在推动葡萄酒冷却器的市场需求。在欧洲酒精饮料总销量中,葡萄酒占了约 40% 的份额,因此葡萄酒冷却器成为市场的关键组成部分。博洛尼亚、布拉格、瓦伦西亚和利兹是欧洲地区每百万居民酒吧数量最多的老牌城市,在商业领域对葡萄酒冷却器的需求方面也处于领先地位。南欧的葡萄酒柜市场规模比北欧更大,由于新冠疫情之后酒店和旅游业务的扩张,该地区的需求预计将进一步增加。

法国领先葡萄酒冷却器销售

法国是欧洲最大的葡萄酒消费国,也是该地区葡萄酒柜销售成长最快的国家。在法国的饮料领域,酒精饮料约占销售额的50%,该国的酒精消费人口正稳定增加。葡萄酒约占法国酒精饮料的55%,使法国成为该地区葡萄酒冷却器销量最大的销售国。由于这些趋势,越来越多的葡萄酒冷却器製造商正在扩大在该地区的销售和业务。法国都市化很高,超过80%,这导致商业和住宅环境中的葡萄酒消费量增加,为法国的葡萄酒柜销售创造了积极的外部因素。

欧洲葡萄酒冷却器产业概况

欧洲葡萄酒冷却器市场部分分散,越来越多的参与者进入市场,希望利用现有的市场空白。 Wi-Fi 技术的智慧特性和多种尺寸的可用性使其在商业和住宅领域得到应用。欧洲葡萄酒柜市场现有的参与者包括Climadiff、Dunavox、Smad、海尔和海信。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 欧洲葡萄酒消费量不断成长

- 城市人口在葡萄酒冷却器上的支出增加

- 市场限制

- 欧洲家电价格上涨

- 大部分市占率集中在都市区

- 市场机会

- 客製化和 Wi-Fi 葡萄酒柜的需求不断增长

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 欧洲葡萄酒冷却器市场的技术创新

- COVID-19 市场影响

第五章 市场区隔

- 按类型

- 独立式

- 檯面

- 内建

- 依技术分类

- 压缩机类型

- 热电

- 按销售管道

- 在线的

- 离线

- 按国家

- 德国

- 法国

- 英国

- 其他欧洲国家

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Climadiff

- Dunavox

- Smad

- Haier

- Hisense

- Arte Vino

- Avintage

- Dometic

- Swisscave

- EXPO*

第七章 未来市场趋势

第八章 免责声明及发布者

The Europe Wine Coolers Market size is estimated at USD 0.94 billion in 2025, and is expected to reach USD 1.22 billion by 2030, at a CAGR of 5.41% during the forecast period (2025-2030).

Per capita, wine consumption in Europe observed a continuous increase after a declining trend post-COVID-19; this rise in consumption of wine generated a positive externality for the sales of wine coolers. Rising users of hotels in Europe post covid are leading to an increasing consumption of wine by tourists and an opportunistic market for Wine cooler sales in the commercial segments.

The post-COVID-19 average revenue per capita and total revenue of wine in Europe observed a continuous increase, with the rising share in out-of-home consumption leading to the commercial segment emerging as a major demand segment for wine coolers over the coming period in comparison to residential space.

With technological innovations launch of smart coolers in the market is revolutionizing the wine cooler industry. Through smart features of wi-fi connectivity, the wine coolers can be accessed through smartphones and can be used for setting the temperature or checking the stock and storage of wine in the cooler. The rising number of online retailers and e-commerce players are offering wine coolers as their sales product, resulting in the diversification of sales channels and an increasing market revenue for manufacturers. In addition, the rising share of urbanization in Europe, existing with increasing per capita income and wine consumption, is resulting in residential and commercial segments increasing their demand for wine coolers.

Europe Wine Coolers Market Trends

Rising Sales in Commercial segment

The revenue share of wine had observed a continuous increase with a declining revenue share from the residential segment. This is leading to the commercial segments raising the market demand for wine coolers. In the total revenue of Europe, alcoholic drinks wine exists with a major share of around 40%, making wine coolers an important component of the market. Bologna, Prague, Valencia, and Leeds are among some of the existing cities in the European region with the largest number of bars per million population, making them the leading cities in the region for the demand for wine coolers by commercial segment. Southern Europe exists as a significantly larger market for wine coolers in comparison to Northern Europe, and with expanding hotels and tourism business post-COVID-19, the demand is expected to increase further in the region.

France Leading in Sales of Wine Cooler

France exists as the European country with the largest consumption of wine making it the fastest-growing country for sales of wine coolers in the region. In the beverage segment of France, alcoholic drinks have a share of around 50% in sales, with a continuous rise in the population consuming alcohol in the country. Among the alcoholic drinks in France, wine exists with a share of around 55% with a sales revenue making it a leading country for sales of wine coolers in the region. These trends are leading to an increasing number of wine cooler manufacturer expanding their sales and business in the region. Rising urbanization in France, existing at more than 80%, is leading to an increase in wine consumption in the commercial as well as residential segments and creating a positive externality for sales of wine coolers in France.

Europe Wine Coolers Industry Overview

Europe's wine coolers market is partially fragmented, with a rising number of players entering the market to reap the existing market gap. Smart features of wi-fi technology and the availability of different sizes are leading to their adoption in the commercial as well as residential segments. Some of the existing players europe wine cooler market are Climadiff, Dunavox, Smad, Haier, and Hisense.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Consumption of Wine in Europe

- 4.2.2 Increasing Spending on Wine Coolers by Urban Population

- 4.3 Market Restraints

- 4.3.1 Rising Price of Home Appliances in Europe

- 4.3.2 Major Market Share of Market Restricted to Urban Cities

- 4.4 Market Opportunities

- 4.4.1 Increasing demand for Customized and Wi-Fi Enabled Wine Coolers

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Europe Wine Coolers Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Free Standing

- 5.1.2 Counter-top

- 5.1.3 Built-in

- 5.2 By Technology

- 5.2.1 Compressor Based

- 5.2.2 Thermoelectric Based

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Rest of the Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profile

- 6.2.1 Climadiff

- 6.2.2 Dunavox

- 6.2.3 Smad

- 6.2.4 Haier

- 6.2.5 Hisense

- 6.2.6 Arte Vino

- 6.2.7 Avintage

- 6.2.8 Dometic

- 6.2.9 Swisscave

- 6.2.10 EXPO*