|

市场调查报告书

商品编码

1445489

Fruit Picker:全球市场占有率分析、产业趋势与统计、成长预测(2024-2029)Global Fruit Picker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

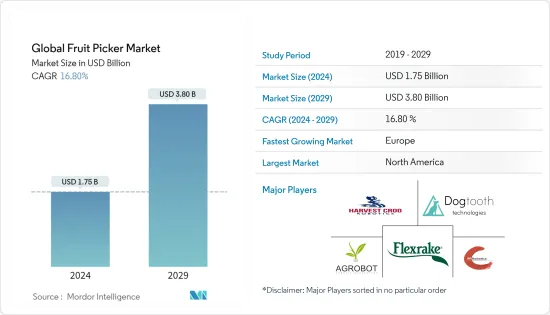

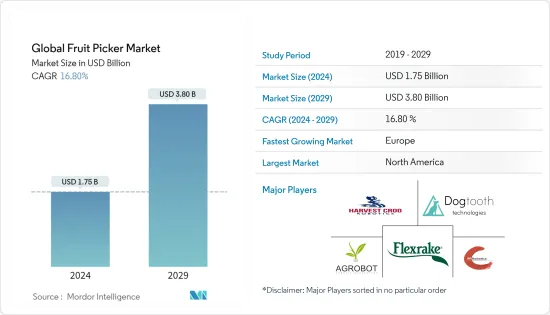

2024年全球水果采摘机市场规模预计为17.5亿美元,预计到2029年将达到38亿美元,预测期内(2024-2029年)复合年增长率为16.80%。

主要亮点

- 当水果在树上或地上腐烂时,农民每年损失 300 亿美元的销售额,两週后收穫的水果损失了 80% 的价值。农作物浪费的主要原因(有时是由于水果在树上腐烂)是全球水果采摘工人的短缺,估计到 2050 年将有 500 万工人失踪。马苏。全球7000万公顷土地上每年生产超过8亿吨水果。年市值相当于1兆美元。农民每年花费1000亿美元用于水果采摘,并僱用超过1000万短期临时工来采摘水果。即使在今天,世界上还有超过10%的水果无法收穫,相当于整个欧盟每年的水果消费量。

- 以色列新兴企业Tevel Aerobotics Technologies 开发了一款飞行自主机器人,它可以从基地台起飞,只从树上采摘成熟的水果,轻轻地将其放下来进行收穫,并在收穫期间 24/7运作。久保田向 Tevel 投资了 2000 万美元,Tevel 是飞行自主水果采摘机器人收穫领域的行业领导者。久保田将与Tebel合作,加强水果采收省力和自动化技术的开发,并推出利用这些技术的企业,为农业的省力和效率提高做出贡献。自动水果收割机预计将成为市场的未来,而该技术的实用性预计在未来几年将显着成长。

- 据热带水果网络称,约 1,200 名南太平洋水果采摘工已抵达南澳大利亚,以填补季节性农业工人的严重短缺,并为失业的当地人提供水果采摘工作。政府已联合资助700万美元用于该产业的发展。推动市场的其他因素包括农业机械化率的提高(尤其是在新兴国家)、农业人事费用的增加以及由于全球创新水果采摘机市场的增长而缩短的拖拉机更换週期。预计在预测期内将出现巨大增长。

水果采摘机市场趋势

创新水果采摘机,提高效率

- 果农正在投资创新水果采摘机,以填补草莓、蓝莓、酪梨、番茄、黄瓜和橘子等水果采摘机的短缺。由于水果采收作业具有季节性和临时性,手动水果采收面临一些挑战。例如,在英国,由于缺乏工人,2021年水果采摘工人的数量增加了一倍,达到16,000人,来自巴贝多、尼泊尔、塔吉克和肯亚等37个国家。因此,推出了各种可调节的水果采摘器,以方便手工作业。例如,推出了具有可调节工作角度和不銹钢刀片的手动水果采摘机,为果农节省了时间和精力。透过调整角度,种植者可以轻鬆地以不同角度切割水果。

- 此外,正在引入机器人水果采摘机,使用演算法来识别和定位果园和苗圃中的水果。因此,为了克服收穫水果时的各种挑战,果农正大力投资能够执行多项任务的产品和技术。这将鼓励生产商开发更多创新产品,预计在未来几年扩大市场。

- 在非洲,拉夫堡大学的研究人员创新了六种新设备,作为为期 18 个月的计划的一部分,以减少低收入和中等收入国家可回收废弃物的影响,并支持当地企业。将宝特瓶变成有用的产品。宝特瓶来自肯亚、卢安达和奈及利亚的社区,并用废弃宝特瓶製作了 3D 酪梨收穫工具。根据当地人民和企业的需求,再生塑胶被转化为专门造福这些社区的产品和工具。

- 例如,2022 年,总部位于新加坡的 Singrow 开发了水果和蔬菜生产的创新农业解决方案。该公司在其采收和授粉系统中使用机器人,利用整合人工智慧 (AI) 模型来帮助识别草莓花朵和果实。 Singrow 使用摄影机和红外线扫描仪对机器人进行编程,以检查资料库中的草莓并选择成熟的草莓。

- 机器人改变了中小型企业的游戏规则。由于新加坡缺乏大空间,小型企业使用的机器人被设计为靠近人工作并且非常容易操作。这些因素将在未来几年推动水果采摘机市场的发展。

北美引领水果采摘机市场

- 北美是全球最大的水果采摘市场。美国是北美水果采摘机市场中机器人和手动水果采摘机最大的市场之一,许多生产商正在创新新产品以扩大该地区的市场。 2021年,Advanced Farm Technologies在美国推出了TX机器人草莓收割机。该公司总部位于加州,旨在收穫种植在土壤中的草莓床,使农民能够在不改变田地设计的情况下实施该技术。柔软的食品级机械手会自动感知并采摘成熟的草莓,并可全天24小时在田间自主移动。

- 随着人口成长和粮食不安全的持续,这三种水果收穫技术和其他新的收穫技术可能会改变农民的游戏规则。农民必须采用最新的创新技术来提高营运效率、最大限度地提高产量、克服劳动力短缺并保持收益。

- 北美地区的许多小型企业正在引进新型创新水果采摘机。这些将帮助全部区域的果农透过手动和机器人水果采摘工具的进步来管理水果采摘。例如,自动水果收割设备製造商 Advanced Farm Technologies 在 Washington State AG Group 的津贴下设计了一款新的苹果收割机器人。该机器人用于在加利福尼亚州采摘草莓。它使用与该公司为其华盛顿新客户开发的相同软体、光学元件和机器人技术。

- 为了满足不断增长的粮食需求,此类智慧农业解决方案将变得越来越普遍。农业不断创新新产品和新技术,优化劳动力,同时提高食品品质和数量。这些因素将推动预测期内的市场成长。

水果采摘机行业概况

水果采摘机市场高度分散,许多大大小小的企业控制大部分市场占有率。新产品发布、合作伙伴关係和收购是世界领先公司采取的关键策略。除了创新和扩张之外,研发投资和新产品系列的开发可能是未来几年的关键策略。市场上的一些主要参与者包括 Agrobot、Dogtooth Technologies Limited、Harvest Croo、FFRobotics 和 Flexrake。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争公司之间的敌意强度

第五章市场区隔

- 动力来源

- 手动操作

- 电子化操作

- 产品类别

- 手动工具

- 可扩展水果采收机

- 伸缩式水果采摘机

- 自动工具

- 手动工具

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 市场占有率分析

- 最采用的策略

- 公司简介

- Agrobot

- Dogtooth Technologies Limited

- FFRobotics

- HARVEST CROO

- Flexrake

- Ohuhu

- Corona Tools

- OCTINION

- Peaceful Valley Farm Supply, Inc.

- Red Rooster

第七章市场机会与未来趋势

The Global Fruit Picker Market size is estimated at USD 1.75 billion in 2024, and is expected to reach USD 3.80 billion by 2029, growing at a CAGR of 16.80% during the forecast period (2024-2029).

Key Highlights

- Fruit rotting on trees or the ground costs farmers USD 30 billion in sales annually, and fruit picked two weeks later loses 80 percent of its value. A major reason for wasted produce, sometimes in fruit rotting on trees, is a global shortage of fruit pickers, estimated to grow to five million missing workers by 2050. Every year, over 800 million tons of fruits are produced on 70 million hectares worldwide, representing an annual market value of USD 1 trillion. Farmers spend annually USD 100 billion on fruit picking and recruit over 10 million temporary workers for a short period to pick their fruit. Even today, more than 10% of all fruit worldwide cannot be harvested, equivalent to the total annual consumption of fruit in the entire European Union.

- Israeli startup Tevel Aerobotics Technologies developed flying autonomous robots that take off from a base station, pick only the ripe fruit off the tree and gently lower it for collection, and can work 24/7 during the harvest period. Kubota invested USD 20 million in Tevel, an industry leader in the flying autonomous fruit-picking robot harvesting segment. Together with Tevel, Kubota will reinforce the company's development of labor-saving and automation technology for fruit picking and enable the launch of a business using these technologies that will contribute to labor-saving and efficiency improvement in farming. Automated fruit pickers are expected to be the market's future, and this technology's workability is expected to show major growth in the coming years.

- According to Tropical Fruit Network, about 1,200 South Pacific fruit pickers have arrived in South Australia to help fill critical shortages of seasonal agriculture workers to encourage unemployed locals to take up fruit picking jobs. The government jointly funded USD 7 million to develop the industry for this. Other factors driving the market are increasing farm mechanization rates, especially in developing countries, increasing farm labor costs, and shorter replacement cycles of tractors attributed to the growth of the global innovative fruit pickers market and expected to grow huge during the forecast period.

Fruit Picker Market Trends

Innovative Fruit Pickers to Improve Efficiency

- Fruit growers are investing in innovative fruit pickers to compensate for the shortage of fruit pickers for fruits, for instance, strawberries, blueberries, avocados, tomatoes, cucumbers, and mandarin oranges. Manual fruit picking will face several challenges with fruit-picking tasks' seasonal and temporary nature. For instance, in the United Kingdom, the number of fruit pickers doubled in 2021, with 16,000 who migrated from 37 countries, including Barbados, Nepal, Tajikistan, and Kenya, due to a lack of workers in the country. Therefore, various adjustable fruit pickers are being introduced to make tasks easier, even for manual tasks. For instance, manual fruit pickers with adjustable working angles and stainless blades are being introduced, saving both the fruit growers' time and energy. By adjusting the angle, the growers can easily cut the fruits at various angles.

- Moreover, robotic fruit pickers are also being introduced, which use algorithms to identify and locate fruits in orchards or nurseries. Thus, to overcome the various challenges of picking fruits, fruit growers invest significantly in products and technologies that can perform multiple activities. This will encourage the producers to develop more innovative products and is expected to grow the market in the coming years.

- In Africa, researchers from Loughborough University innovated six new devices as part of an 18-month project to reduce the impact of recyclable waste in low-middle-income countries to support local African businesses, such as farming, fishing, and construction, by transforming plastic bottles into useful products. Plastic bottles are sourced from communities in Kenya, Rwanda, and Nigeria, from which the 3D avocado harvesting tool has been created from waste plastic water bottles. Depending on the needs of local people and businesses, the reclaimed plastic is turned into a product or tool that would specifically benefit that community.

- For example, in 2022, Singapore-based Singrow developed innovative agronomic solutions for fruit and vegetable production. It used robots in its harvesting and pollination systems using an integrated artificial intelligence (AI) model to help identify the flowers and fruits of strawberries. Singrow checks strawberries with its database using its camera and infrared scanner and programs the robot to select ripe strawberries.

- Robots are game changers for small and medium businesses. Due to the lack of large space in Singapore, small and medium-sized enterprises use robots because they are designed to work close to people and are very easy to operate. These factors will boost the fruit pickers market in the coming years.

North America Leads the Fruit Picker Market

- North America is the largest fruit picker market globally. The United States is one of the largest markets for robotic and manual fruit pickers in the fruit pickers market in North America due to a large number of producers innovating new products to boost the market in the region. In 2021, Advanced Farm Technologies launched TX Robotic Strawberry Harvester in the United States, a California-based company designed to pick on soil-planted strawberry beds so farmers can implement the technology without changing their field design. It automatically senses and picks ripe strawberries with a soft, food-grade robotic gripper and can navigate fields autonomously 24 hours a day.

- These three fruit harvesting technologies and other emerging harvesting tech will likely be game changers for farmers as the population grows and food insecurity persists. It will be vital for farmers to adopt the latest, innovative technologies to improve operational efficiency, yield maximum outputs, overcome labor shortages, and remain profitable.

- Many small players in the North American region are introducing new types of innovative fruit pickers. These are helping the fruit growers across the region manage fruit picking through advancements in manual and robotic fruit-picking tools. For instance, autonomous fruit harvesting equipment maker Advanced Farm Technologies Inc. has designed new robots to pick apples, with the help of a grant from a Washington State AG Group, which is used in California for picking strawberries, and the new equipment will use some of the same software, optics, and robotics the company developed for the new customers in Washington.

- Smart agriculture solutions like this will become increasingly common to meet the rising food demand. The farming industry continues to innovate new products and technology to optimize labor while improving the quality and quantity of food. These factors are driving the market to grow during the forecasting period.

Fruit Picker Industry Overview

The fruit pickers market is highly fragmented, with many small and major players dominating most of the market share. New product launches, partnerships, and acquisitions are the major strategies the leading global companies adopt. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years. Some of the major players in the market are Agrobot, Dogtooth Technologies Limited, Harvest Croo, FFRobotics, and Flexrake.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Manually Operated

- 5.1.2 Electronically Operated

- 5.2 Product Type

- 5.2.1 Manual Tools

- 5.2.1.1 Extendable Fruit Picker

- 5.2.1.2 Telescopic Fruit Picker

- 5.2.2 Automated Tools

- 5.2.1 Manual Tools

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 UAE

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Agrobot

- 6.3.2 Dogtooth Technologies Limited

- 6.3.3 FFRobotics

- 6.3.4 HARVEST CROO

- 6.3.5 Flexrake

- 6.3.6 Ohuhu

- 6.3.7 Corona Tools

- 6.3.8 OCTINION

- 6.3.9 Peaceful Valley Farm Supply, Inc.

- 6.3.10 Red Rooster