|

市场调查报告书

商品编码

1445518

木材防腐剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Wood Preservatives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

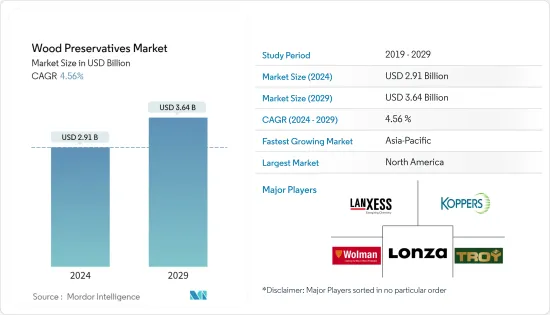

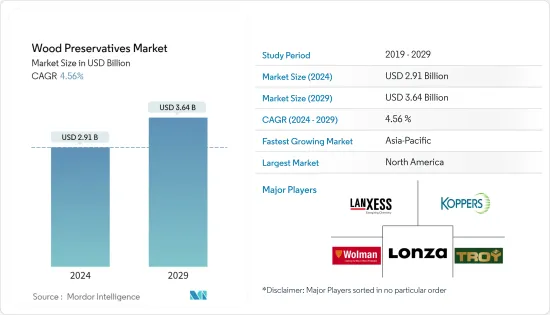

木材防腐剂市场规模预计到 2024 年为 29.1 亿美元,预计到 2029 年将达到 36.4 亿美元,在预测期内(2024-2029 年)增长 4.56%。复合年增长率为

COVID-19大流行对2020年的市场产生了轻微影响。然而,现在预计将恢復到大流行前的水平并稳定增长。

主要亮点

- 从中期来看,推动市场成长的因素将是各种应用对木材的需求不断增加以及家具产量的增加。

- 另一方面,政府对各种木材防腐剂的严格监管可能会成为市场成长的障碍。

- 环保木材防腐剂的开发可为该产业提供新的成长机会。

- 调查的市场以北美为主,其中美国和加拿大的消费量最高。

木材防腐剂市场趋势

住宅建筑业主导市场

- 木材有多种用途,包括家具、墙壁、地板、门、屋顶、橱柜、柱子、横樑和楼梯。木材防腐剂声称可以控制由真菌腐烂、腐烂、汁液污渍、霉菌或破坏木材的昆虫引起的木材劣化问题。

- 木材防腐剂包括多种化学品,例如铜基化学品、硼酸盐和杂酚油。

- 木材防腐剂用于製造住宅户外产品,如电线杆、栅栏柱、栏桿和草坪家具。它也用作结构构件和木屋等建筑。

- 胶合层压梁(复合板)在建筑物的建造中用作直梁、柱,如过梁、檩条、屋脊梁、楼板梁、系椽条、桁架等。这里主要使用木材防腐剂。

- 全球住宅计划需求的增加预计将在整个预测期内推动木材防腐剂市场的发展。中国、日本、英国和美国等国家日益增长的住宅建设活动可能会推动木材防腐剂市场的发展。

- 在中国和印度不断扩大的住宅建筑市场的推动下,亚太地区预计将出现最高的成长。预计到2030年,这两个国家的中产阶级将占全球中产阶级的43.3%以上。印度政府已将住宅消费税从 12% 降至 5%。这种退税可以扩大中产阶级住宅建设的市场。

- 此外,未来七年印度的住宅投资预计将达到约 1.3 兆美元。目前,都市区住宅缺口估计约1000万套。到 2030 年,还需要额外 2,500 万住宅来容纳该国不断增长的城市人口。

- 美国住宅的增加也是推动整个木材防腐剂市场成长的关键因素之一。根据美国人口普查局的数据,2022 年 12 月竣工的私人住宅约为 14.11 亿套(经季节已调整的年率),较 2021 年 12 月增长 6.4%(13.26 亿套)。

- 因此,基于以上几个方面,住宅领域预计将占据市场主导地位。

北美市场占据主导地位

- 由于美国、加拿大和墨西哥等国家的建设活动增加,北美地区木材防腐剂的使用量不断增加。

- 美国政府数万亿美元的基础设施法案预计将在预测期内推动美国木材防腐剂市场的发展。

- 据加拿大建筑协会称,建筑业是加拿大最大的雇主之一,为国家的经济成功做出了重大贡献。该产业占该国内生产总值(GDP)的7%。

- 在加拿大,住宅和商业领域近年来经历了稳定成长。一些最重要的建设计划已经在这个国家进行,包括 Panda 公寓、Harwood 公寓、Power 和阿德莱德公寓以及亚马逊配送中心/渥太华。

- 除了家具之外,木材防腐剂还用于地板、装饰板、胶合板、橱柜、塑合板、窗户和门。

- 作为投资加拿大计画的一部分,政府宣布计划在 2028 年投资近 1,400 亿加元用于关键基础设施开发。根据加拿大统计局的数据,萨斯喀彻尔是建筑投资最多的省份。 2022年10月建筑工程投资较2021年10月成长39.3%。 2022 年 10 月建筑工程投资为 4.45 亿美元。

- 由于上述因素和政府支持,北美地区预计将在全球市场中占据主导地位。

木材防腐剂产业概况

全球木材防腐剂市场部分分散,因为许多参与者所占的份额微不足道。主要企业包括 Koppers Performance Chemicals、Lonza Specialty Elements、LANXESS、Wolman Wood and Fire Protection GmbH 和 Troy Corporation。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 各种用途对木材的需求不断增加

- 增加家具产量

- 抑制因素

- 严格的环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 科技

- 水基技术

- 微粉化铜系统

- 铬酸砷酸铜 (CCA)

- 硼酸盐

- 其他的

- 石油基础技术

- 五氯酚

- 杂酚油

- 其他的

- 其他的

- 水基技术

- 最终用户产业

- 住宅

- 商业的

- 基础设施

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业采取的策略

- 公司简介

- Advance Agrisearch Limited

- Wolman Wood and Fire Protection GmbH

- Copper Care Wood Preservatives Inc.

- Dolphin Bay

- Rio Tinto

- Jubilant

- Koppers Performance Chemicals

- Kurt Obermeier GmbH &Co. KG

- LANXESS

- Lonza Specialty Ingredients(Bain Capital and Cinven)

- Nisus Corporation

- Changchun Wood Preservative Manufacturing Co. Ltd

- Sanyu Chemical(Shenzhen)Co. Ltd

- Remmers Gruppe AG

- TIMBERLIFE(PTY)LTD

- Troy Corporation

- Viance

- Wykamol Group Ltd

- BERKEM

- Impra Wood Protection Ltd

第七章市场机会与未来趋势

- 环保木材防腐剂的开发

The Wood Preservatives Market size is estimated at USD 2.91 billion in 2024, and is expected to reach USD 3.64 billion by 2029, growing at a CAGR of 4.56% during the forecast period (2024-2029).

The COVID-19 pandemic moderately impacted the market in 2020. However, it now returned to pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Over the medium term, the factors driving the market's growth are the increasing demand for wood in different applications and the increasing furniture production.

- On the other hand, the stringent government regulations on various wood preservatives may act as barriers to the market's growth.

- Developing eco-friendly wood preservatives will likely offer new growth opportunities to the industry.

- North America dominates the market studied, with the highest consumption recorded by the United States and Canada.

Wood Preservatives Market Trends

Residential Construction Sector to Dominate the Market

- Wood is used for many applications, such as furniture, walls, flooring, doors, roofs, cabinets, columns, beams, and staircases. Wood preservatives are those that claim to control wood degradation problems due to fungal rot or decay, sap stains, mold, or wood-destroying insects.

- Wood preservatives include various chemicals, e.g., copper-based chemicals, borates, and creosote oils.

- Wood preservatives are used to manufacture residential outdoor products, such as utility poles, fence posts, rails, and lawn furniture. They are also used during construction, including structural members and log homes.

- Glue-laminated beams (Glulam) are used as straight beams, columns such as lintels, purlins, ridge beams, floor beams, tied rafters, and trusses in the construction of buildings. Here, wood preservatives are prominently used.

- The increasing demand for residential projects worldwide is expected to drive the market for wood preservatives through the forecast period. The growing residential construction activity in countries such as China, Japan, the United Kingdom, the United States, and India will drive the wood preservatives market.

- The highest growth is expected to be registered in the Asia-Pacific region, owing to China and India's expanding housing construction markets. These two countries are expected to represent over 43.3% of the global middle class by 2030. The government of India reduced the GST taxes for housing from 12% to 5%. This tax redemption may increase the construction market for middle-class housing.

- Furthermore, India will likely witness an investment of around USD 1.3 trillion in housing over the next seven years. The current housing shortage in urban areas is estimated to be ~10 million units. An additional 25 million affordable housing units are required by 2030 to meet the country's urban population growth.

- The rising residential construction in the United States is also one of the major factors driving the overall wood preservatives market growth. According to the US Census Bureau, around 1,411 million units (seasonally adjusted annual rate) of privatelyowned housing were completed in December 2022, above by 6.4% (1,326 million units) from December 2021.

- Hence, based on the aspects above, the residential segment is expected to dominate the market.

North America to Dominate the Market

- With the growing construction activities in countries such as the United States, Canada, and Mexico, the utilization of wood preservatives is increasing in the North American region.

- A trillion-dollar infrastructure bill by the US government is expected to drive the market for wood preservatives in the United States during the forecast period.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a significant contributor to the country's economic success. The industry contributes 7% of the country's gross domestic product (GDP).

- In Canada, the residential and commercial sectors have been witnessing steady growth in the recent past. The country witnessed some of its most significant construction projects, including the Panda Condominium, the Harwood Condominium, the Power and Adelaide Condominium, and the Amazon Distribution Centre/Ottawa.

- Apart from furniture, wood preservatives are also used in flooring, decks, plywood, cabinet, particleboard, windows, and doors.

- As part of the "Investing in Canada," the government announced its plans to invest nearly USD 140 billion in significant infrastructure developments by 2028. According to Statistics Canada, Saskatchewan is the leading building construction investment province. In October 2022, investment in building construction was up 39.3% compared to October 2021. The value of building construction investments was USD 445 million in October 2022.

- The factors above, coupled with government support, are expected to make the North American region dominant in the global market.

Wood Preservatives Industry Overview

The global wood preservatives market is partially fragmented due to many players occupying insignificant shares. Some major companies are Koppers Performance Chemicals, Lonza Specialty Ingredients, LANXESS, Wolman Wood and Fire Protection GmbH, and Troy Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Wood in Different Applications

- 4.1.2 Increasing Furniture Production

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Technology

- 5.1.1 Water-based Technologies

- 5.1.1.1 Micronized Copper Systems

- 5.1.1.2 Chromated Copper Arsenate (CCA)

- 5.1.1.3 Borates

- 5.1.1.4 Other Water-based Technologies

- 5.1.2 Oil-based Technologies

- 5.1.2.1 Pentachlorophenol

- 5.1.2.2 Creosote

- 5.1.2.3 Other Oil-based Technologies

- 5.1.3 Other Technologies

- 5.1.1 Water-based Technologies

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructural

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advance Agrisearch Limited

- 6.4.2 Wolman Wood and Fire Protection GmbH

- 6.4.3 Copper Care Wood Preservatives Inc.

- 6.4.4 Dolphin Bay

- 6.4.5 Rio Tinto

- 6.4.6 Jubilant

- 6.4.7 Koppers Performance Chemicals

- 6.4.8 Kurt Obermeier GmbH & Co. KG

- 6.4.9 LANXESS

- 6.4.10 Lonza Specialty Ingredients (Bain Capital and Cinven)

- 6.4.11 Nisus Corporation

- 6.4.12 Changchun Wood Preservative Manufacturing Co. Ltd

- 6.4.13 Sanyu Chemical (Shenzhen) Co. Ltd

- 6.4.14 Remmers Gruppe AG

- 6.4.15 TIMBERLIFE (PTY) LTD

- 6.4.16 Troy Corporation

- 6.4.17 Viance

- 6.4.18 Wykamol Group Ltd

- 6.4.19 BERKEM

- 6.4.20 Impra Wood Protection Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Eco-friendly Wood Preservatives