|

市场调查报告书

商品编码

1643213

楼梯升降机 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Stair Lift - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

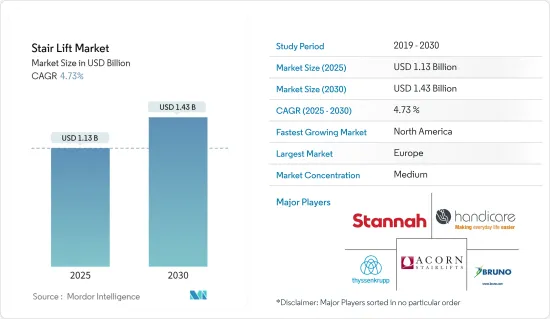

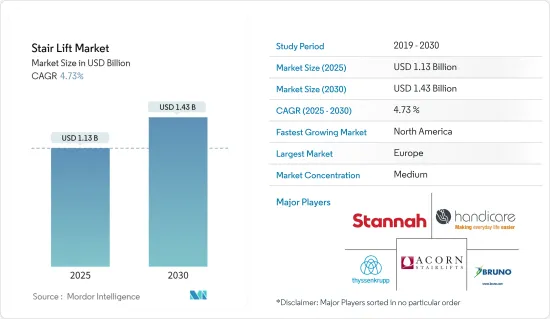

2025 年楼梯升降机市场规模预计为 11.3 亿美元,预计到 2030 年将达到 14.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.73%。

人口老化以及流动性、安全性等方面的挑战等因素推动了过去几年楼梯升降机市场的成长。

关键亮点

- 根据《世界人口展望2022》发布的报告,预计全球65岁及以上人口占总人口的比例将从2022年的10%上升至2050年的16%。这意味着到2050年,全球65岁及以上人口数量预计将是5岁以下儿童数量的两倍,几乎等于12岁以下儿童的数量。这意味着这个年龄层的人更有可能出现行动不便的问题并需要帮助。

- 此外,根据世界卫生组织 (WHO) 2022 年的数据,目前估计有 13 亿人(约占世界人口的 16%)患有严重残疾。每天约有 7500 万人依靠轮椅上班。这些案例限制了残障人士获得医疗中心、职场和教育机构等服务的机会,增加了他们的依赖性。

- 此外,医疗机构中老年人和残障人士对楼梯升降机的需求的主要原因之一是他们无法安全地走动。此外,僱用看护者的额外费用对许多老年人来说是难以负担的。这些案例正在推动非住宅领域的市场成长。

- 市场上的商贩正在利用技术进步来帮助残障人士和老年人过上独立的生活。我们看到现代辅助器具的发布量正在增加,包括带有集成轮椅支撑的楼梯升降机和适合任何自订楼梯配置的弯曲楼梯升降机。此外,市场上的一些参与企业报告该产品的利润增加。

- 此外,在 COVID-19 疫情期间,最终用户不太可能负担购买楼梯升降机的大量前期资金。 Handicare Group 等全球供应商已采取多项措施适应情势,做出必要的调整,包括大幅削减成本和降低生产能力。

楼梯升降椅的市场趋势

市场区隔预计将以住宅市场为主

- 在市场区隔方面,住宅市场预计将占据主要市场占有率。这主要是因为他们拥有卓越的产品,使老年人能够在自己的家中保持独立。此外,楼梯升降机可以灵活地安装在几乎任何楼梯上,这也推动了市场的成长。

- 与站立式楼梯升降机相比,坐式楼梯升降机更具成本效益,而且患有骨关节炎、膝关节骨性关节炎等肌肉骨骼问题的最终用户数量不断增加,因此住宅领域对坐式楼梯升降机的需求大幅增长。例如,根据世界卫生组织(WHO)的数据,全球约有17.1亿人患有肌肉骨骼疾病,约占全球人口的21%。这进而促进了市场的成长。

- 此外,世界卫生组织将骨关节炎列为已开发国家十大最严重慢性疾病之一。骨关节炎是一种与老龄化相关的退化性关节疾病,多年来对膝盖、臀部、手指和下脊椎等关节造成持续的压力。据估计,全世界 60 岁以上的老年人中,9.6% 的男性和 18% 的女性患有症状性骨关节炎,80% 的患者活动受限,25% 的患者难以进行日常生活活动。

- 此外,疾病预防控制中心预测,未来几年美国人口老化和医生诊断的关节炎的盛行率将会增加。预计到 2040 年,超过 7,840 万 18 岁及以上的成年人将被诊断出患有关节炎,3,460 万人将报告活动受限。预计世界其他已开发国家也将出现类似的趋势。

- 与最近爆发的全球大流行的 COVID-19 类似,由于病毒对老年人的危害性,政府机构要求人们在居住地进行自我隔离,并特别关注老年人。此外,医疗机构缺乏容纳病毒受害者的基础设施,这进一步增加了对楼梯升降机等家庭无障碍解决方案的需求。

- 此外,在疫情过后,Merits Heal 和 Harmar 等市场上的供应商面临着对具有美观设计的楼梯升降机的需求,这些设计要与最终用户的室内装饰相匹配。然而,医疗保险和保险资金的缺乏预计会阻碍市场成长。

欧洲占有较大市场占有率

- 由于人口平均年龄不断增加、政府机构对老年人问题的关注以及人口流动等因素,欧洲占据了相当大的市场占有率。此外,该地区还有 EPSA 等组织,以确保产品符合使用者要求和法规。

- 2022年,法国政府宣布了「Ma Prime Adapt」政府计画。 「Ma Prime Adapt」致力于透过安装楼梯升降机或加宽门框以方便轮椅通行,让老年人和残障人士更容易地重建自己的家,以保持自由并避免跌倒。

- 2022 年 7 月,得益于超过 600 万英镑(约 723 万美元)的投资,Platinum Stairlifts 位于西约克郡的新製造工厂开始运作。铸造园区是一座占地 58,000 平方英尺的专用建筑,位于该区的道尔顿巷,具有将製造能力提高一倍的潜力。该公司目前每年向英国、欧洲、北美和澳洲的合作伙伴网路供应超过 10,000 台楼梯升降机。然而,新工厂的推出将为进一步扩张铺平道路。

楼梯升降椅产业概况

楼梯升降机市场相当分散,主要供应商包括蒂森克虏伯电梯技术公司、Handicare Group、Stannah Lifts Holdings Ltd. 等。为了进一步扩大基本客群和占领市场占有率,供应商正在利用策略合作计画和收购作为竞争优势来增强其产品线。

- 2022 年 3 月-Mobility Stairlifts 宣布将在英国各地推出楼梯升降机拆除服务。该公司表示,其专业技术人员可以拆除包括 Stannah、Thyssen Krupp、Acorn 和 Brooks 等品牌在内的五年或五年以下的楼梯升降机。该公司进一步表示,该服务将安排经验丰富的技术人员到达现场并在 60 分钟内拆除直线和曲线楼梯升降机,以最大限度地减少对居民的不便。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场区隔

- 轨道定位

- 直线

- 曲线

- 使用者导向

- 就座

- 常设

- 融合的

- 地点

- 室内的

- 户外的

- 应用

- 住宅

- 医疗

- 政府

- 休閒娱乐

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Thyssenkrupp Elevator AG

- Handicare Group AB

- Bruno Independent Living Aids, Inc.

- Stannah Lifts Holdings Ltd

- Acorn Stairlifts, Inc.

- Mobility Stairlift Ltd

- Candor Care Limited

- Acme Home Elevator

- Ameriglide, Inc.

- Garaventa (Canada) Ltd

- Bespoke Stairlifts Limited

- American Elevator Company Inc

- Artico Group Ltd

第七章 市场机会与未来趋势

The Stair Lift Market size is estimated at USD 1.13 billion in 2025, and is expected to reach USD 1.43 billion by 2030, at a CAGR of 4.73% during the forecast period (2025-2030).

The factors such as the aging population, accompanied by challenges such as mobility, and safety, have been driving the stairlift market's growth in the past few years.

Key Highlights

- According to the report published by World population prospects in 2022, The global population share of people aged 65 years or above is projected to increase from 10% in 2022 to 16% in 2050, which means people aged 65 years or over worldwide are projected to be twice more than the number of children under age five and about the same as the number of children under age 12 by 2050. So, this age group is more likely to have issues with mobility and would require assistance.

- Also, the World Health Organization (WHO) in 2022, an estimated 1.3 billion people - about 16% of the global population - currently experience significant disability. Around 75 million people rely on a wheelchair for their daily commute. These instances limit the disabled population's access to services such as healthcare centers, work, and educational institutions while increasing their dependency.

- Further, one of the primary drivers for the demand for stairlifts by elderly and disabled people living in healthcare facilities remains their inability to move safely, as professional caregivers cannot be expected to be available around the clock. Furthermore, added cost expense in hiring caregivers is beyond the financial reach of many seniors. This instance drives the growth of the market in non-residential sectors.

- Vendors in the market are leveraging technological advancements to help the disabled and aged population lead self-reliant lives. There has been an increase in the launch of modern aids like stairlift with integrated wheelchair support and curved stairlift that works into any custom stairway structure, among others. A few players in the market have also reported profit gains for the same.

- Moreover, amidst the COVID-19 pandemic, the end-user are likely be unable to spend many upfront costs on stairlifts. Global vendors such as the Handicare group are taking several measures to adapt to the situation by making necessary adjustments such as substantial cost reduction and decreased production capacity.

Stair Lift Market Trends

Residential facilities is expected to s Segment to Hold Major Market Share

- The residential segment is expected to maintain a significant market share, majorly owing to the preeminence of the elderly population towards products that would allow them to remain self-sustaining in their houses. Also, the flexibility of stairlifts installed on almost any staircase elevates the market's growth.

- There is considerable demand for the seated stairlift within the residential segment major due to its cost-effectiveness as compared to stand stairlift counterpart and end-users growing musculoskeletal problems such as Osteoarthritis, Knee Problems, among others. For instance, according to the World Health Organization, approximately 1.71 billion people have musculoskeletal conditions worldwide, around 21% of the global population. Therefore it is thereby leveraging the growth of the market.

- Moreover, the WHO categorizes Osteoarthritis as one of the ten most disabling chronic diseases in developed countries. It is a degenerative joint disease associated with aging that affects joints, including knees, hips, fingers, and low spine continually stressed throughout the years. It estimates that worldwide, 9.6% of men and 18% of women over 60 years suffer from symptomatic Osteoarthritis, with 80% of the patients having limitations in movement and 25% unable to perform daily life activities.

- Further CDC suggests that the aging of the US population and the prevalence of doctor-diagnosed arthritis is predicted to rise in the forthcoming years. It is also estimated that by 2040, over 78.4 million adults aged 18 years and older will be diagnosed with arthritis, and 34.6 million adults will report activity limitations. A similar trend is expected to be followed by other developed nations worldwide.

- As with the recent outbreak of global pandemic COVID 19 and government bodies demanding people for self-isolation at their residence with particular emphasis on the elderly population due to critically of the virus on the aging population. Also, with medical facilities running out of infrastructure to accommodate the victims of the virus further elevates the demand for home accessibility solutions such as stairlift.

- Furthermore, Vendors in the market, such as Merits Heal, and Harmar post covid situation, are encountering demand for esthetically engaging design stairlifts that fit in end-users decor. However, the lack of funding through Medicare and insurance policies is expected to hinder the market's growth.

Europe to Hold Major Market Share

- The European region holds a considerable market share owing to factors such as the increase in the population's average age, government bodies' concern towards the issues faced by the elderly, and the impaired mobility population. Additionally, the region also has the presence of organizations such as EPSA that ensure the products meet the user's requirements and regulations.

- In 2022, the French Government announced its plan for the "Ma Prime Adapt" government scheme, where "Ma Prime Adapt" strives to make it easier for older people or those with disabilities to renovate their homes to maintain their freedom and avoid falls by installing a stair lift or widening a doorframe to allow wheelchair access.

- In July 2022, with an investment of over GBP 6 million (~USD 7.23 million), Platinum Stairlifts began operating from its new West Yorkshire manufacturing facility. Foundry Park is a purpose-built 58,000 sq ft building located in the district on Dalton Lane, which has the potential to double manufacturing output. The company currently supplies over 10,000 stairlifts a year to a network of partners across the UK, Europe, North America, and Australia. But the launch of the new site will pave the way for greater expansion.

Stair Lift Industry Overview

The Stair Lift market is moderately fragmented, with major vendors including ThyssenKrupp Elevator Technology, Handicare Group, and Stannah Lifts Holdings Ltd. The vendors are enhancing the product line by leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to expand their customer base further and gain market share.

- March 2022 - Mobility Stairlifts announced the launch of stairlift removal services across the UK. According to the company, the expert technicians of the organization can remove stairlifts by brands such as Stannah, Thyssen Krupp, Acorn, and Brooks, provided they are under five years old. In addition, the company stated that the experienced technicians arrive at the site to remove straight and curved stairlifts and take less than 60 minutes to minimize the inconvenience to the residents through this service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Rail Orientation

- 5.1.1 Straight

- 5.1.2 Curved

- 5.2 User Orientation

- 5.2.1 Seated

- 5.2.2 Standing

- 5.2.3 Integrated

- 5.3 Installation

- 5.3.1 Indoor

- 5.3.2 Outdoor

- 5.4 Application

- 5.4.1 Residential

- 5.4.2 Healthcare

- 5.4.3 Government

- 5.4.4 Leisure & Entertainment

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 South America

- 5.5.5 Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thyssenkrupp Elevator AG

- 6.2.2 Handicare Group AB

- 6.2.3 Bruno Independent Living Aids, Inc.

- 6.2.4 Stannah Lifts Holdings Ltd

- 6.2.5 Acorn Stairlifts, Inc.

- 6.2.6 Mobility Stairlift Ltd

- 6.2.7 Candor Care Limited

- 6.2.8 Acme Home Elevator

- 6.2.9 Ameriglide, Inc.

- 6.2.10 Garaventa (Canada) Ltd

- 6.2.11 Bespoke Stairlifts Limited

- 6.2.12 American Elevator Company Inc

- 6.2.13 Artico Group Ltd