|

市场调查报告书

商品编码

1445633

数位体验平台:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Digital Experience Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

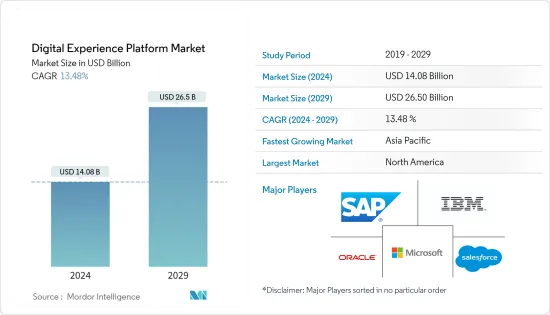

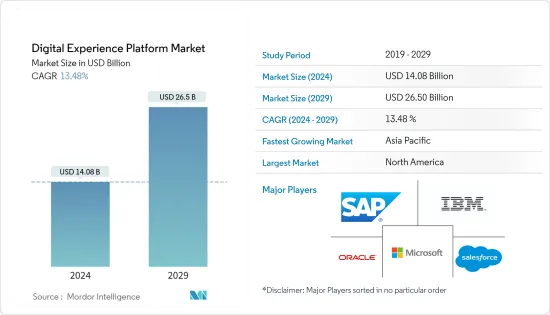

数位体验平台市场规模预计到 2024 年为 140.8 亿美元,预计到 2029 年将达到 265 亿美元,预测期内(2024-2029 年)复合年增长率为 13.48%。

越来越多的公司製定以客户为中心的策略,以提供卓越的客户互动,预计将推动市场成长。

主要亮点

- 此外,负责人越来越多地采用数位体验平台 (DXP),使他们能够透过多种数位装置接触客户并促进交叉销售和提升销售。 DXP 让使用者可以跨各种数位管道创建和提供最佳化的、统一的使用者体验。

- 此外,DXP 收集和分析客户购买行为以及整合来自多个接触点的客户资料以创建统一视图的能力也是推动市场成长的关键因素。此外,透过整合人工智慧、巨量资料和机器学习 (ML) 等新兴技术,关键解决方案供应商现在可以跨多个应用程式升级其 DX。

- 此外,组织使用 DXP 来了解客户的即时需求并透过各种数位管道提供相关内容。此外,数位体验平台还提供额外的优势,例如客户活动监控、高级分析功能以及与现有框架的无缝整合。主要市场参与者进一步专注于透过投资人工智慧(AI)、机器学习(ML)和巨量资料分析等先进技术来改善其数位平台,以推动市场成长。

- 然而,快速发展的 DXP 技术、与传统业务流程和基础设施的整合问题,以及不愿升级到以客户为中心的行销和传播策略,构成了阻碍 DXP 市场成长的重大挑战。我是。此外,作为 DXP 的一部分,需要经验丰富的员工来管理多个解决方案,这是小型企业和新兴企业的主要关注点。

- COVID-19感染疾病证明了 IT 和数位转型的重要性,组织必须抓住这个机会加速转型。企业变得越来越数位化,与客户的互动越来越多地透过萤幕而不是面对面进行。该公司的倡议可能会推动市场成长。

数位体验平台市场趋势

云端采用推动市场成长

- 由于对云端基础的DXP快速部署能力的支援不断增加以及对实体基础设施的投资减少,预计云端基础的市场部分在预测期内将占据最高的复合年增长率。

- 各种企业都喜欢云端服务,因为云端服务有许多优势。例如,中小型企业(SME)使用云端模型,可以降低硬体设定和功耗等初始IT成本,并且需要更少的实体空间。大型企业可以透过在云端网路上託管多个应用程式来享受云端服务的好处,从而简化应用程式管理。

- 云端部署模型为客户提供基于使用的服务模型,其中包括计量型功能。此外,云端部署也为企业带来了许多好处,包括无需维护伺服器基础架构、更快的效能、回应能力、更好的协作和更高的敏捷性。

- 此外,云端基础的DXP 允许企业从各种装置(包括笔记型电脑、智慧型手机和桌上型电脑)存取该平台,并根据客户的购买行为、偏好和过去的交易提供客製化内容。

亚太地区将经历最高的成长

- 由于云端运算、人工智慧 (AI) 和分析等新兴技术的普及,预计该地区将在预测期内实现最高成长。此外,中国和印度等新兴经济体正在迅速采用最尖端科技,预计也将有助于该地区 DXP 市场的成长。

- 例如,支援 Boundless Digital Invention 的数位体验平台 (DXP) 供应商 Optimizely 宣布其内容管理、商务和个人化解决方案现已在 Microsoft Azure Marketplace 上提供。此网路商店提供可与 Azure 搭配使用的应用程式和服务。 Optimizely 客户受益于高效能、可靠的 Azure 云端平台以及简化的部署和管理。 Optimizely DXP 提供由人工智慧 (AI) 以及 Azure 的可扩展性、可靠性、效能和安全优势提供支援的广泛个人化功能。

- 印度和中国等新兴国家的消费者偏好不断提高以及网路和行动购物应用程式的普及,正在推动区域市场中运营的公司更多地采用 DXP。

- 线上零售的快速成长正在增加该地区对 DXP 的需求。此外,印度、中国、新加坡、日本和韩国等国家的资讯技术支援服务 (ITES) 和软体公司的建立也有望促进 DXP 的经济高效实施。

数位体验平台产业概况

数位体验平台市场高度分散,全球有许多公司。主要公司有 IBM、微软、Adobe、Acquia 和 SAP。市场参与企业利用合作伙伴关係、合资企业和其他方法来扩大其影响力和影响力,并增加市场占有率。市场上一些最重要的发展包括:

- 2022 年 4 月 - Oracle 宣布推出名为 Oracle ME 的完整员工体验平台,以协助组织提高员工敬业度并确保员工成功。 Oracle ME 是Oracle 融合云端人力资本管理(HCM) 的一个元件,让人力资源和业务领导者能够透过创造更具协作性和信任度的工作环境来提高人才留任率并吸引员工。您可以透过指导完成复杂的任务并简化沟通来提高生产力整个组织。

- 2022 年 3 月 - Adobe 宣布大幅扩展其合作伙伴生态系统。这为技术、解决方案合作伙伴和开发人员创造了新的机会,可以加快内容速度和无缝客户旅程,同时为数百万人提供更个人化的体验。技术合作伙伴关係为 Adobe Experience Cloud 带来了新功能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 越来越多地采用云端基础的解决方案

- 巨量资料分析需求不断成长

- 市场挑战

- 与传统业务流程和基础设施的整合问题

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代产品的威胁

- 竞争公司之间的敌意强度

- 评估 COVID-19感染疾病对数位体验平台市场的影响

第五章市场区隔

- 成分

- 平台

- 服务

- 安装类型

- 本地

- 云

- 使用者

- 零售

- 资讯科技和电信

- BFSI

- 卫生保健

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Adobe Inc.

- Oracle Corporation

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Salesforce, Inc.

- OpenText Corporation

- SDL PLC

- Sitecore

- Acquia

第七章 投资分析

第八章市场机会及未来趋势

The Digital Experience Platform Market size is estimated at USD 14.08 billion in 2024, and is expected to reach USD 26.5 billion by 2029, growing at a CAGR of 13.48% during the forecast period (2024-2029).

Companies' growing inclination to develop customer-centric strategies to deliver superior customer interaction is expected to drive market growth.

Key Highlights

- Furthermore, marketers' increasing adoption of Digital Experience Platforms (DXPs) has enabled them to reach customers across multiple digital devices and promote cross-selling and upselling. Users can use DXP to create and deliver optimized, integrated user experiences across various digital channels.

- Moreover, the ability of DXPs to collect and analyze customer purchasing behavior and unify customer data obtained from multiple touchpoints to create a centralized view is another important factor driving the market growth. Furthermore, incorporating emerging technologies such as AI, big data, and Machine Learning (ML) has enabled critical solution providers to upgrade their DXs across multiple applications.

- Furthermore, organizations use DXP to understand their customers' immediate needs and deliver relevant content via various digital channels. Furthermore, digital experience platforms provide additional benefits, such as client activity monitoring, advanced analytical capability, and seamless integration with the existing framework. Key market players are further focusing on improving their digital platforms by investing in advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics, driving the market growth.

- However, rapidly evolving DXP technologies, integration issues with legacy business processes and infrastructure, and a reluctance to upgrade to customer-oriented marketing and communication strategies are significant challenges impeding DXP market growth. Furthermore, the need for an experienced workforce to manage multiple solutions as part of DXPs is a substantial concern for SMEs and startups.

- The Covid-19 pandemic has demonstrated the importance of IT and digital transformation, and organizations should seize this opportunity to accelerate the transition. Companies are becoming more digital, with more customer interactions occurring not in person but through a screen. The company's efforts are likely to fuel market growth.

Digital Experience Platform Market Trends

On Cloud Deployment to Drive the Market Growth

- Due to the growing preference for cloud-based DXPs' rapid deployment capability and lower investments in physical infrastructure, the cloud-based segment of the market will account for the highest CAGR during the forecast period.

- Various businesses prefer cloud services because of their numerous advantages. For example, Small and Medium Enterprises (SMEs) use the cloud model, which reduces initial IT costs such as hardware setup and power consumption, and requires less physical space. Large enterprises can benefit from cloud services because they can host multiple applications in the cloud network, simplifying application management.

- The cloud deployment model provides customers with a usage-based service model that includes a pay-per-use facility. Furthermore, cloud deployment offers numerous advantages for businesses, such as faster performance, responsiveness, improved collaboration, and greater agility, without needing to maintain a server infrastructure.

- Furthermore, cloud-based DXPs have enabled businesses to access the platform from various devices, including laptops, smartphones, and desktop computers, to deliver customized content based on customer purchasing behavior, preferences, and historical transactions.

Asia-Pacific to Witness Highest Growth

- Owing to the widespread adoption of emerging technologies such as cloud computing, Artificial Intelligence (AI), and analytics, the region is expected to experience the highest growth during the forecast period. Furthermore, the presence of developing economies such as China and India, which are rapidly implementing cutting-edge technology, is expected to contribute to the region's DXP market growth.

- For instance, Optimizely, a digital experience platform (DXP) provider that enables Boundless Digital Invention has announced that its content management, commerce, and personalization solutions are available on the Microsoft Azure Marketplace. This online store offers applications and services for use on Azure. Customers of Optimizely can now benefit from the productive and trusted Azure cloud platform with streamlined deployment and management. Optimizely, DXP provides extensive personalization features powered by artificial intelligence (AI) and benefits from Azure's scalability, reliability, performance, and security.

- Companies operating in the regional market are further fueling the adoption of DXPs due to growing consumer preference and the widespread adoption of web and mobile shopping applications in developing countries such as India and China.

- The rapid growth of online retailing is fueling the demand for DXPs in the region. Furthermore, the well-established presence of Information Technology Enabled Services (ITES) and software companies in countries like India, China, Singapore, Japan, and South Korea are also anticipated to facilitate the cost-effective deployment of DXPs.

Digital Experience Platform Industry Overview

The market for Digital Experience Platforms is highly fragmented, with numerous players worldwide. The major players are IBM, Microsoft, Adobe, Acquia, and SAP. Market participants use partnerships, joint ventures, and other methods to increase their market share through increased coverage and presence. Some of the market's most significant developments include:

- April 2022- Oracle has announced a complete employee experience platform called Oracle ME to assist organizations in increasing employee engagement and ensuring employee success. Oracle ME, a component of Oracle Fusion Cloud Human Capital Management (HCM), enables HR and business leaders to improve talent retention by creating a more supportive and trusted work environment, increase productivity by guiding employees through complex tasks, and streamline communications across the organization.

- March 2022 - Adobe announced a significant expansion of its partner ecosystem, creating new opportunities for its technology, solution partners, and developers to deliver more personalized experiences to millions of people while accelerating content velocity and seamless customer journeys. Technology partnerships bring new capabilities to adobe experience cloud.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Deployment of Cloud-Based Solutions

- 4.2.2 Rising Demand for big Data Analytics

- 4.3 Market Challenges

- 4.3.1 Integration Issues with Legacy Business Processes and Infrastructure

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porters Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Digital Experience Platform Market

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 Deployment Type

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 End Users

- 5.3.1 Retail

- 5.3.2 IT and Telecom

- 5.3.3 BFSI

- 5.3.4 Healthcare

- 5.3.5 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Adobe Inc.

- 6.1.2 Oracle Corporation

- 6.1.3 SAP SE

- 6.1.4 IBM Corporation

- 6.1.5 Microsoft Corporation

- 6.1.6 Salesforce, Inc.

- 6.1.7 OpenText Corporation

- 6.1.8 SDL PLC

- 6.1.9 Sitecore

- 6.1.10 Acquia