|

市场调查报告书

商品编码

1690207

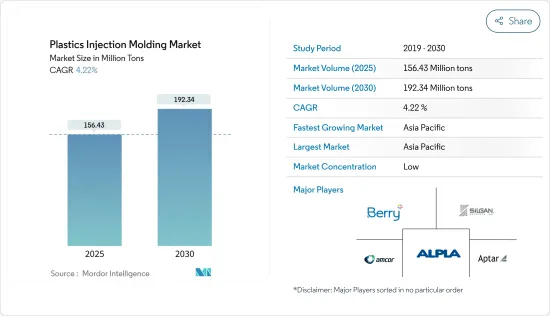

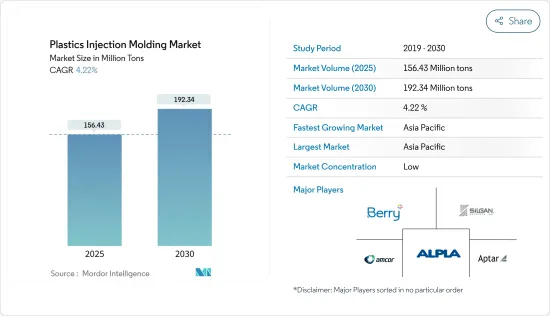

塑胶射出成型:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Plastics Injection Molding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计 2025 年塑胶射出成型市场规模将达到 615 万吨,预计到 2030 年将达到 754 万吨,预测期内(2025-2030 年)的复合年增长率为 4.18%。

在新冠疫情期间,射出成型需求有所下降,但所研究的市场已稳定恢復,达到疫情前的活动水准。

关键亮点

- 推动射出成型市场需求的关键因素是汽车应用的使用增加以及包装产业的需求增加。此外,预计消费品和电子产品需求的成长将进一步刺激这项需求。

- 然而,进入射出成型市场的高初始成本以及 3D 列印等替代和新兴技术的大力采用预计将阻碍市场成长。

- 另一方面,向轻量化和电动车製造的转变以及医疗领域的新应用可能会为塑胶射出成型市场的成长带来丰厚的机会。

- 亚太地区占据全球塑胶射出成型市场主导地位,其中中国、印度和日本等国家占最大消费量。

塑胶射出成型市场趋势

包装领域占据市场主导地位

- 塑胶射出成型提供了许多解决方案,从散装包装到薄壁容器和瓶子形状。这些解决方案广泛应用于各个终端用户产业的包装用途。

- 塑胶成型不仅能提供多功能的包装解决方案,还能减少塑胶消费量,被证明是经济和生态的理想选择。

- 世界各地的包装产业正在快速发展和扩张。根据包装和加工技术研究所(PMMI)发布的报告,2021年全球包装产业总价值达422亿美元。

- 这种成长主要得益于人口成长、对永续性关注、新兴经济体可支配收入的增加、新兴经济体零售业的成长以及对智慧包装解决方案的需求的不断增长。

- 例如,日本是全球最大、成长最快的电子商务市场之一,排名第三。预计到 2023 年,该国的收益将达到约 2,322 亿美元,2023-2028 年的复合年增长率为 11.23%。预计该国电子商务行业的成长将推动对包装解决方案的需求。

- 同样,美国也是零售业的主要企业。全球十大零售公司中有五家总部位于美国。根据美国软包装协会的数据,软包装是美国第二大包装领域,约有20%的市场占有率。

- 此外,由于消费者对包装食品和餐饮的需求不断增长,以及新冠疫情后餐厅外带的增加,到 2025 年,该国食品和饮料行业的收益可能达到 250 亿美元。截至 2021 年,该产业价值约为 210 亿美元,其中食品包装占所有软包装应用的 50% 以上。

- 因此,由于上述因素,预计包装领域对塑胶射出成型的需求将激增。

亚太地区占市场主导地位

- 由于中国、印度、日本和韩国等新兴经济体,预计亚太地区将在预测期内主导全球塑胶射出成型市场。

- 中国是亚太地区主要经济体之一。预计未来几年该国的包装产业将实现强劲成长,到 2025 年的复合年增长率将达到 6.8% 左右。预计包装产业的成长将推动对塑胶射出成型的需求。

- 同样,中国汽车产业在2022年儘管面临新冠疫情频传、半导体晶片短缺、地缘政治紧张局势导致供应链中断等诸多障碍,但仍实现了成长。

- 根据中国工业协会统计,2019年,我国汽车产销分别完成2,702.1万辆及2,686.4万辆,与前一年同期比较分别成长3.4%及2.1%。汽车产业对塑胶射出成型的日益普及可能会在预测期内推动研究市场的需求。

- 此外,国内住宅建筑业的成长预计将推动塑胶射出成型的需求。印度政府在 2022-23 年联邦预算中为「总理安居计画」拨款 4,800 亿印度卢比(64.4 亿美元),重申了实施「全民住宅」计画的承诺,该计画旨在 2022-23 年为都市区贫困阶级建造 8,000 万套经济适用住宅。

- 过去几年,亚太地区的电子产业稳步成长,其中中国、印度和日本引领市场竞争。日本电子情报技术产业协会(JEITA)发布的报告显示,2021年日本电子产业总产值较上年增加近10%。

- 因此,由于上述因素,预计亚太地区将在预测期内主导全球塑胶射出成型市场。

塑胶射出成型行业概况

塑胶射出成型市场细分化,主要企业的市场占有率较小。市场上的主要企业包括 Berry Global Inc.、AptarGroup, Inc.、Silgan Holdings Inc.、Amcor PLC 和 ALPLA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业需求不断成长

- 消费品和电子产品需求旺盛

- 在汽车应用中的使用日益增多

- 限制因素

- 进入成本高且存在替代技术

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 原料类型

- 聚丙烯

- 丙烯腈丁二烯苯乙烯(ABS)

- 聚苯乙烯

- 聚乙烯

- 聚氯乙烯(PVC)

- 聚碳酸酯

- 聚酰胺

- 其他的

- 应用

- 包装

- 建筑与施工

- 消费品

- 电子产品

- 汽车与运输

- 医疗保健

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- ALPLA

- Amcor PLC

- AptarGroup Inc.(CSP Technologies)

- BERICAP

- Berry Global Inc.

- EVCO Plastics

- HTI Plastics

- IAC Group

- Magna International

- Quantum Plastics

- Silgan Holdings Inc.

- The Rodon Group

第七章 市场机会与未来趋势

- 轻型汽车和电动车的采用

- 医疗领域的新应用

The Plastics Injection Molding Market size is estimated at 6.15 million tons in 2025, and is expected to reach 7.54 million tons by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Although there was a dip in demand for injection molding during the COVID-19 pandemic, the studied market steadily recovered and reached pre-pandemic activity levels.

Key Highlights

- The major factors driving the demand for injection molding in the market are the increasing usage in automotive applications and the growing demand from the packaging industry. Additionally, increased consumer goods and electronics demand is anticipated to strengthen this demand further.

- However, the high initial costs associated with entering the injection molding market and the strong prevalence of alternative and emerging technologies like 3D printing are expected to hinder the market growth.

- On the flip side, the shift towards manufacturing lightweight and electrified vehicles and the emerging applications in the healthcare sector could open up lucrative opportunities for the growth of the plastics injection molding market.

- The Asia-Pacific region dominated the plastics injection molding market worldwide, with the largest consumption from countries such as China, India, and Japan.

Plastics Injection Molding Market Trends

Packaging Segment to Dominate the Market

- Plastic injection molding offers many solutions, from high-volume packaging to thin-wall containers and bottle molds. These solutions are extensively used in packaging purposes across various end-user industries.

- Besides providing versatile packaging solutions, plastic molding reduces plastic consumption, proving an ideal choice for economical and ecological reasons.

- The packaging industry across the globe is evolving and expanding at a rapid pace. According to a report published by the Association for Packaging and Processing Technologies (PMMI), the total value of the global packaging industry reached USD 42.2 billion in 2021.

- The growth was majorly led by the increasing population, growing sustainability concerns, rising disposable income in developing nations, growing retail sector in emerging economies, and increasing demand for smart packaging solutions.

- For instance, Japan stands in the 3rd position globally as one of the largest and fastest-growing e-commerce markets. The country is anticipated to generate revenue of around USD 232.20 billion by 2023 and is expected to grow at an average annual growth rate of 11.23% between 2023-28. The growing e-commerce sector in the nation is anticipated to strengthen the demand for packaging solutions.

- Similarly, the United States is the foremost company in the retail industry. Out of the top 10 largest retail companies in the world, five of them are based out of the United States. According to the Flexible Packaging Association of the United States, flexible packaging is the second-largest packaging segment in the country, with around 20% share in the market.

- Additionally, with the growing consumerism for packaged food and beverages in the country and the rise in restaurant takeaways in the aftermath of the COVID-19 pandemic, the revenue from the food and beverage industry could reach USD 25 billion by 2025. As of 2021, the industry is valued at around USD 21 billion, with food packaging accounting for over 50% of the total flexible packaging applications.

- Thus, owing to the factors above, the demand for plastic injection molding is anticipated to rise sharply in the packaging segment.

Asia-Pacific Region to Dominate the Market

- Due to emerging economies like China, India, Japan, and South Korea, the Asia-Pacific region is expected to dominate the global plastics injection molding market during the forecast period.

- China is one of the leading economies in the Asia-Pacific region. The packaging industry in the country is anticipated to register strong growth figures in the coming years, registering a CAGR of around 6.8% by 2025. The growth of the packaging industry is anticipated to augment the nation's demand for plastic injection molding.

- Similarly, China's automotive industry experienced growth in 2022, despite facing many obstacles, including the reoccurrence of frequent COVID-19 outbreaks, semiconductor chip shortages, and geopolitical tensions resulting in supply chain disruptions.

- According to China's Association of Automobile Manufacturers, the country recorded production and sales figures of 27.021 million and 26.864 million, respectively, an increase of 3.4% and 2.1% compared to the previous year. The growing adoption of plastic injection molding in the automotive industry could drive demand for the studied market during the forecast period.

- Additionally, demand for plastic injection molding is anticipated to be strengthened by the growing residential construction sector in the country. The Indian government, in its Union Budget 2022-23, allocated INR 48,000 crores (USD 6.44 billion) for its 'PM Aawas Yojana' scheme, reiterating its commitment to implementing 'Housing for All' which aims to build 80,00,000 affordable housing units for the urban and rural poor in FY 2022-23.

- The Asia-Pacific's electronic sector witnessed steady growth in the last several years, with China, India, and Japan leading the market race. According to the report published by the Japan Electronics and Information Technology Industries Association (JEITA), in 2021, the total production value of the electronics industry in Japan showcased a rise of nearly 10% from the previous year.

- Thus, the factors mentioned above indicate the Asia-Pacific region is set to dominate the global plastics injection molding market., during the forecast period.

Plastics Injection Molding Industry Overview

The plastics injection molding market is fragmented, with the top players accounting for a marginal market share. Some of the key companies in the market include Berry Global Inc, AptarGroup, Inc., Silgan Holdings Inc., Amcor PLC, and ALPLA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Packaging Industry

- 4.1.2 Favorable Demand from Consumer Goods and Electronics

- 4.1.3 Increasing Usage in Automotive Applications

- 4.2 Restraints

- 4.2.1 High Entry Cost and Presence of Alternative Technologies

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material Type

- 5.1.1 Polypropylene

- 5.1.2 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.3 Polystyrene

- 5.1.4 Polyethylene

- 5.1.5 Polyvinyl Chloride (PVC)

- 5.1.6 Polycarbonate

- 5.1.7 Polyamide

- 5.1.8 Other Raw Materials

- 5.2 Applications

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Consumer Goods

- 5.2.4 Electronics

- 5.2.5 Automotive and Transportation

- 5.2.6 Healthcare

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALPLA

- 6.4.2 Amcor PLC

- 6.4.3 AptarGroup Inc. (CSP Technologies)

- 6.4.4 BERICAP

- 6.4.5 Berry Global Inc.

- 6.4.6 EVCO Plastics

- 6.4.7 HTI Plastics

- 6.4.8 IAC Group

- 6.4.9 Magna International

- 6.4.10 Quantum Plastics

- 6.4.11 Silgan Holdings Inc.

- 6.4.12 The Rodon Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Lightweight Vehicles and Electric Vehicles

- 7.2 Emerging Applications in the Healthcare Sector